73 14.1 Introduction

Learning Objectives

After studying this section you should be able to do the following:

- Understand the extent of Google’s rapid rise and its size and influence when compared with others in the media industry.

- Recognize the shift away from traditional advertising media to Internet advertising.

- Gain insight into the uniqueness and appeal of Google’s corporate culture.

Google has been called a one-trick pony (Li, 2009), but as tricks go, it’s got an exquisite one. Google’s “trick” is matchmaking—pairing Internet surfers with advertisers and taking a cut along the way. This cut is substantial—about $23 billion in 2009. In fact, as Wired’s Steve Levy puts it, Google’s matchmaking capabilities may represent “the most successful business idea in history” (Levy, 2009). For perspective, consider that as a ten-year-old firm, and one that had been public for less than five years, Google had already grown to earn more annual advertising dollars than any U.S. media company. No television network, no magazine group, no newspaper chain brings in more ad bucks than Google. And none is more profitable. While Google’s stated mission is “to organize the world’s information and make it universally accessible and useful,” advertising drives profits and lets the firm offer most of its services for free.

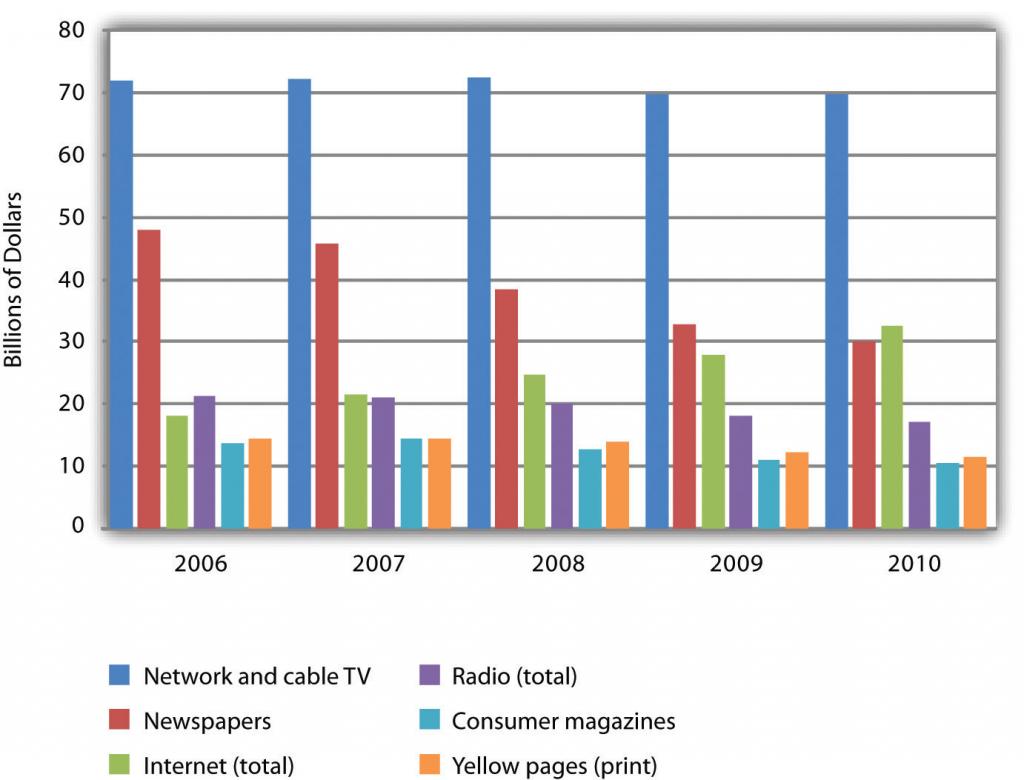

Figure 14.1 U.S. Advertising Spending (by selected media)

Online advertising represents the only advertising category trending with positive growth. Figures for 2009 and beyond are estimates.

Data retrieved via eMarketer.com.

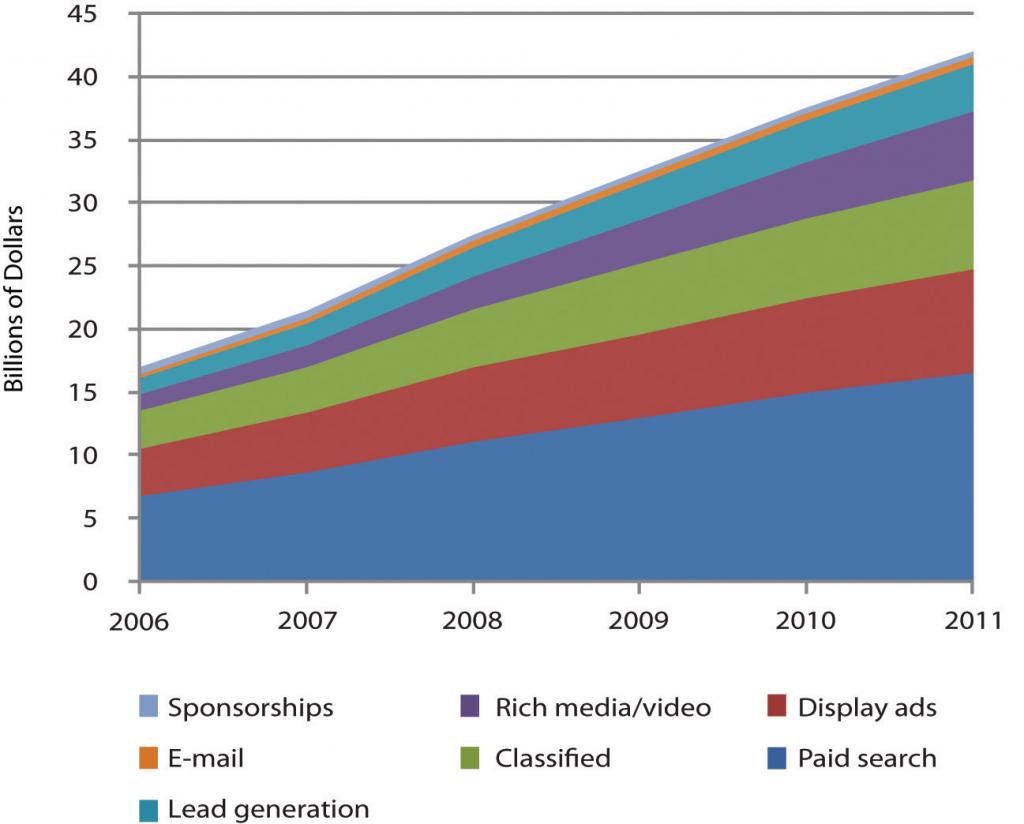

Figure 14.2 U.S. Online Ad Spending (by format)

Search captures the most online ad dollars, and Google dominates search advertising. Figures for 2009 and beyond are estimates.

Data retrieved via eMarketer.com.

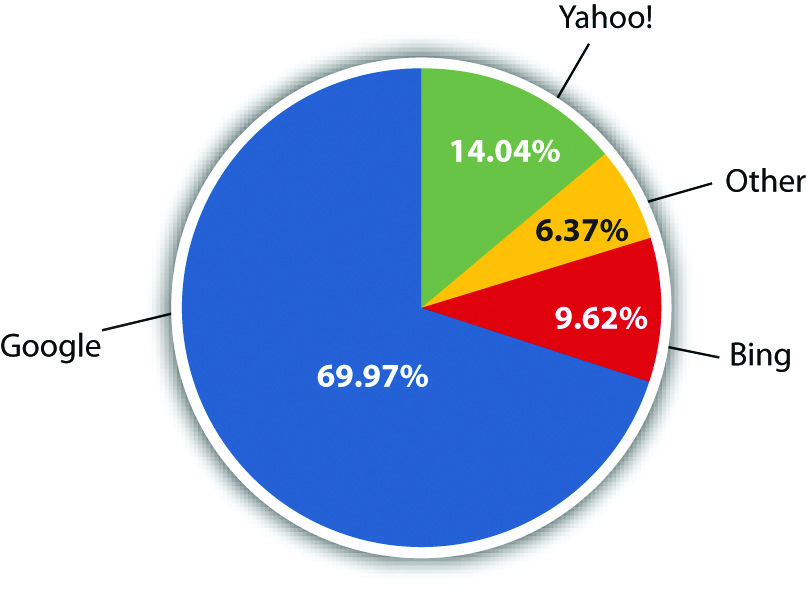

As more people spend more time online, advertisers are shifting spending away from old channels to the Internet; and Google is swallowing the lion’s share of this funds transfer (Pontin, 2009). By some estimates Google has 76 percent of the search advertising business (Sherman, 2009). Add to that Google’s lucrative AdSense network that serves ads to sites ranging from small time bloggers to the New York Times, plus markets served by Google’s acquisition of display ad leader DoubleClick, and the firm controls in the neighborhood of 70 percent of all online advertising dollars (Baker, 2008). Google has the world’s strongest brand (Rao, 2009) (its name is a verb—just Google it). It is regularly voted among the best firms to work for in America (twice topping Fortune’s list). While rivals continue to innovate (see Note 14.85 “Search: Google Rules, but It Ain’t Over”) through Q1 2009, Google continues to dominate the search market.

Wall Street has rewarded this success. The firm’s market capitalization (market cap), the value of the firm calculated by multiplying its share price by the number of shares, makes Google the most valuable media company on the planet. By early 2009, Google’s market cap was greater than that of News Corp (which includes Fox, MySpace, and the Wall Street Journal), Disney (including ABC, ESPN, theme parks, and Pixar), Time Warner (Fortune, Time, Sports Illustrated, CNN, and Warner Bros.), Viacom (MTV, VH1, and Nickelodeon), CBS, and the New York Times—combined! Not bad for a business started by two twenty-something computer science graduate students. By 2007 that duo, Sergey Brin and Larry Page, were billionaires, tying for fifth on the Forbes 400 list of wealthiest Americans.

Genius Geeks and Plum Perks

Brin and Page have built a talent magnet. At the Googleplex, the firm’s Mountain View, California headquarters, geeks are lavished with perks that include on-site laundry, massage, carwash, bicycle repair, free haircuts, state of the art gyms, and Wi-Fi equipped shuttles that ferry employees between Silicon Valley and the San Francisco Bay area. The Googleplex is also pretty green. The facility gets 30 percent of its energy from solar cells, representing the largest corporate installation of its kind (Weldon, 2007).

The firm’s quirky tech-centric culture is evident everywhere. A T-Rex skeleton looms near the volleyball court. Hanging from the lobby ceiling is a replica of SpaceShipOne, the first commercial space vehicle. And visitors to the bathroom will find “testing on the toilet,” coding problems or other brainteasers to keep gray matter humming while seated on one of the firm’s $800 remote-controlled Japanese commodes. Staff also enjoy an A-list lecture series attracting luminaries ranging from celebrities to heads of state.

And of course there’s the food—all of it free. The firm’s founders felt that no employee should be more than 100 feet away from nourishment, and a tour around Google offices will find espresso bars, snack nooks, and fully stocked beverage refrigerators galore. There are eleven gourmet cafeterias on-site, the most famous being “Charlie’s Place,” first run by the former executive chef for the Grateful Dead.

CEO Eric Schmidt says the goal of all this is “to strip away everything that gets in our employees’ way” (Wolgemuth, 2008). And the perks, culture, and sense of mission have allowed the firm to assemble one of the most impressive rosters of technical talent anywhere. The Googleplex is like a well-fed Manhattan project, and employee ranks include a gaggle of geniuses that helped invent critical technologies such as the Macintosh user interface, the python programming language, the XML standard, and even the protocols that underlie the Internet itself.

Engineers find Google a particularly attractive place to work, in part due to a corporate policy of offering “20 percent time,” the ability to work the equivalent of one day a week on new projects that interest them. It’s a policy that has fueled innovation. Google Vice President Marissa Mayer (who herself regularly ranks among Fortune’s most powerful women in business) has stated that roughly half of Google products got their start in 20 percent time (Casnocha, 2009).

Studying Google gives us an idea of how quickly technology-fueled market disruptions can happen, and how deeply these disruptions penetrate various industries. We’ll also study the underlying technologies that power search, online advertising, and customer profiling. We’ll explore issues of strategy, privacy, fraud, and discuss other opportunities and challenges the firm faces going forward.

Key Takeaways

- Online advertising represents the only advertising category trending with positive growth.

- Google dominates Internet search volume and controls the lion’s share of the Internet search advertising business and online advertising dollars. The firm also earns more total advertising revenue than any other firm, online or off.

- Google’s market cap makes it the most valuable media company in the world; it has been rated as having the world’s strongest brand.

Questions and Exercises

- List the reasons why Google has been considered a particularly attractive firm to work for. Are all of these associated with perks?

- Market capitalization and market share change frequently. Investigate Google’s current market cap and compare it with other media companies. Do patterns suggested in this case continue to hold? Why or why not?

- Search industry numbers presented are through March 2010. Research online to find out the most current Google versus Bing versus Yahoo! market share. Does Google’s position seem secure to you? Why or why not?

1Adapted from Experian Hitwise, “Top Search Engine Volume, All Categories, 4 Weeks Ending March 27, 2010.”

References

Baker, L., “Google Now Controls 69% of Online Advertising Market,” Search Engine Journal, March 31, 2008.

Casnocha, B., “Success on the Side,” The American: The Journal of the American Enterprise Institute, April 24, 2009.

Levy, S., “The Secrets of Googlenomics,” Wired, June 2009.

Li, C., “Why Google’s One-Trick Pony Struggles to Learn New Tricks,” Harvard Business Publishing, May 2009.

Pontin, J., “But Who’s Counting?” Technology Review, March/April 2009.

Rao, L., “Guess Which Brand Is Now Worth $100 Billion?” TechCrunch, April 30, 2009.

Sherman, C., “Report: Google Leads U.S. Search Advertising Market With 76% Market Share,” Search Engine Land, January 20, 2009.

Weldon, D., “Google’s Power Play,” EnergyDigital, August 30, 2007.

Wolgemuth, L., “Forget the Recession, I Want a Better Chair,” U.S. News and World Report, April 28, 2008.