Chapter 12 – Analyzing and Managing Food & Beverage Expense

Learning Objectives:

- Determine the cost of food sold and the cost of food consumed (or used) and explain the difference between the two

- Describe and calculate the impact of free or reduced-cost employee meals and transfers on the cost of food sold calculations

- Calculate the food cost percentage – Cost of Food Sold / Food Sales or Cost of Food Portion/Menu Price

- Explain how errors in inventory will affect the cost of food used or sold calculations

- Calculate an operational efficiency ratio

- Explain the meaning of the operational efficiency ratio

- Identify acceptable and unacceptable variances in food cost

Key Terms:

- Food & Beverage Cost of Goods Sold

- Food & Beverage Cost of Goods Consumed (used)

- Beginning Inventory

- Ending Inventory

- Credits and transfers

- Food to beverage or beverage to food

- Standard food & beverage cost

- Attainable food & beverage cost

- Direct purchases

- Requisition voucher

- Adjustments

- Operational efficiency ratio

- Variance

Introduction

The effective manager has to manage and control all the various operating expenses in a foodservice operation. In the end, the goal is typically to make a profit. Food and beverage expenses combined are one of the largest expense categories for foodservice operations. One of the key figures needed each month (or even more often) is the cost of goods sold. The food & beverage cost of goods sold is the dollar amount spent on items actually used to provide the menu items sold to the guests. The amount may significantly differ from the total spent on food purchase since:

- Items purchased in bulk are not entirely used during the accounting period (refer to the section on inventory)

- Items are consumed but not always sold to guests (employee meals, complimentary meals served for promotion purposes, etc.)

The food & beverage cost of goods sold (usually referred to as Food & Beverage Cost in the industry) is expressed as both a dollar amount and a percentage of food & beverage revenues.

Determining Actual Food Expenses

Food & beverage inventory revisited

From an accounting and financial standpoint, a restaurant inventory is the dollar value of the food and beverage items that are held in storage. While in storage, the inventoried items are not considered a cost until used or sold. Just like cash, food and beverage inventory is a company asset. Unlike cash, however, inventory values may decrease since food and beverage items are perishable and subject to spoilage and theft.

Holding inventory has the potential to incur significant expenditures including operating expenses (such as spoilage, obsolescence, theft, and facility expenses) and capital investments (such as the construction of the premises and refrigeration equipment.) Additionally, operations immobilizing too much cash in inventory could eventually need to borrow money to pay for other expenses.

Accordingly, managers need to implement stringent inventory management systems to protect the value of their inventory with procedures that avoid over-ordering (cash spending) and spoilage, including security measures for accessing the premises, proper requisition procedures for removing inventoried products, and adequate rotation of perishable items.

Components of food and beverage cost calculations

Beginning Inventory

The beginning inventory is the dollar value of the food and beverage items held in storage at the beginning of an accounting period.

Ending Inventory

The ending inventory is the dollar value of the food and beverage items held in storage at the end of an accounting period. The ending inventory of a particular period becomes the beginning inventory of the next accounting period. Example: In cases where a company implements monthly accounting periods, the November 30th ending inventory becomes the December 1st beginning inventory.

Purchases

Purchases sum up the dollar value of all food and beverage items acquired during the accounting period. These include direct purchases, which are usually fresh products that are delivered and used on a daily basis, or par items, products that are held in storage, or items such as salt, sugar, flour that are ordered cyclically to maintain a permanent minimum amount in inventory.

Credits and Transfers

Credits and transfers are inventory items that are not directly used to generate sales.

- Credits: Some inventoried food and beverage products are not used to produce items that generate sales. One example is when hotels and restaurants provide employees with free or heavily discounted meals.

- Transfers in or out: Multi-unit operations such as restaurant chains or hotels with several restaurants, bars, or other foodservice operations, such as catering, may move inventory items from one unit to another based on the needs or particular sales patterns of the various outlets. “Transfers in” are additions to purchases for the receiving outlet while the issuing outlet would account for the inventory reduction as a “transfer out.”

Other Adjustments

Food to beverage or beverage to food: Food and beverage costs are usually presented separately in addition to the overall Food and Beverage Cost of Sales (F&B Cost). Food recipes routinely call for alcohol such as wine or brandy (beverage to food), while cocktails often include food items such as olives, or lemons, or come with a side of peanuts (food to beverage). Food to beverage is credited (subtracted from) the food cost and imputed (added to) to the beverage cost. Beverage to food credit similarly reduces the beverage cost and increases the food cost.

Additional adjustments include credits for returned products or discounts and price adjustments from the purveyor/supplier.

Food & Beverage Cost of Goods Consumed vs. Cost of Goods Sold

Food & Beverage Cost of Goods Sold is the cost that is directly attributable to the production of food and beverage items that were sold to guests. As previously mentioned, this differs from the Cost of Goods Consumed, which includes the cost of products that were used to produce items that were not associated with corresponding sales.

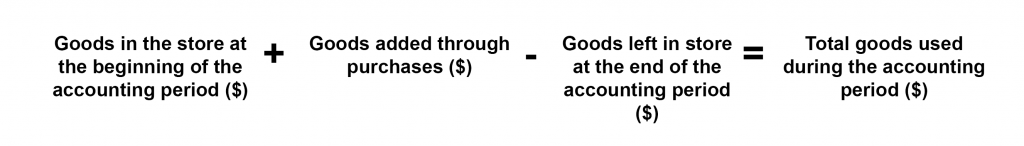

The following formula determines the Food & Beverage Cost of Goods Consumed:

- Beginning Inventory + Purchases – Ending Inventory = Cost of Goods Consumed

Long description:

An equation at the top that adds "Purchases" to "Beginning Inventory" and subtracts it from "Ending Inventory" which totals the "Cost of Goods Consumed". Below the equation is an example equation that adds "Goods in the store at the beginning of the accounting period" and Goods added through purchases and subtracts "Goods left in the store at the end of the accounting period" to get the "Total goods used during the accounting period".

End long description.

The formula for Food & Beverage Cost of Goods Sold removes the components of Cost of Goods Consumed that are not directly associated with sales.

Beginning Inventory ($)

+ Purchases ($)

+ Transfers In ($)

- Transfers Out ($)

= Cost of Goods Available for sale ($) - Ending Inventory ($) - Employee meals ($) = Cost of Goods Sold ($)

Some operations allow managers and marketing personnel to offer complimentary meals. The Cost of Goods sold is further adjusted by deducting the corresponding costs that are subsequently imputed to the relevant accounts, such as administrative or marketing.

Inventory issues

Ending Inventory is a credit to food and beverage cost (i.e. it is subtracted from the overall cost of sales}. The higher the ending inventory amount, the lower the food and beverage cost. This creates a temptation to overstate the inventory value (known as “inventory padding”) for employees, such as managers or chefs, whose bonus and often job preservation, depend on the F&B cost figure. Several methods may be used to unethically overstate inventory values such as:

- Creating false entries (non-existing products);

- Manipulating numbers (quantity, prices);

- Valuing spoiled or past due products that should be discarded;

- Counting off-menu products that are in storage but not likely to be used ever again;

- Moving products from one outlet to another in order to inflate inventory figures.

Food & Beverage Cost of Goods Sold Percentage (%)

Food and beverage costs are usually expressed in percentage of sales (revenue) when evaluating performance or setting up goals in a budget since sales and cost dollar amounts fluctuate significantly. For the same reason, food cost percentages allow managers to compare numbers over time and benchmark their performances against industry standards and comparable operations.

- Food Cost Percentage (%) = Cost of food sold ($) divided by Food Sales $

- Beverage Cost Percentage (%) = Cost of beverage sold ($) divided by Beverage Sales $

- F&B Cost Percentage (%) = Cost of Food and Beverage sold ($) divided by Food & Beverage Sales $

Accordingly, restaurant profit and loss statements display both the dollar amount and percentage of sales of the food and beverage costs from an operation.

Restaurant X Y Z Statement of Income: Fiscal Year 2018

Covers served: 56,346

Seat Turnover per Day Open: 1.54

Average Check (Combined F & B): $28.01

Restaurant X Y Z Statement of Income

| Sales and Costs | Amount in dollars | Percentage |

|---|---|---|

| Food Sales | $1,213,966.46 | 76.9% |

| Beverage Sales | $364,189.94 | 23.1% |

| Totals | $1,578,156.40 | 100.0% |

| Cost of food | $473,447.91 | 39.0% |

| Cost of beverages | $80, 123.65 | 22.0% |

| Total cost of sales | $553,571.56 | 35.1% |

| Gross Profit | $1,024,584.84 | 64.9% |

Example of Statement of Income

Food Cost: $473,447.91 / $1,213,966.46 = 39.0%

Beverage Cost: $80,123.65 / $364,189.94 = 22.0%

Food & Beverage Cost: $553,571.56 / $1,578,156.40 = 35.1%

Full Service Restaurants Statement of Income and Expenses: average check per person under $15

| Sales or Costs | Amount per Seat: Lower Quartile | Amount per Seat: Median | Amount per Seat: Upper Quartile | Ratio to Total Sales: Lower Quartile | Ratio to Total Sales: Median | Ratio to Total Sales: Upper Quartile |

|---|---|---|---|---|---|---|

| Food Sales | $4,906 | $7,698 | $11,071 | 75.6% | 90.9% | 100.0% |

| Beverage Sales | 556 | 1,716 | 3,199 | 0.0 | 9.1 | 24.4 |

| Total Sales | 6,034 | 8,827 | 12,718 | 100.0 | 100.0 | 100.0 |

| Food Costs | 1,567 | 2,704 | 3,491 | 29.8 | 33.6 | 38.0 |

| Beverage Costs | 161 | 480 | 876 | 24.4 | 29.0 | 33.5 |

| Total Cost of Sales | 1,981 | 2,901 | 4,122 | 29.2 | 32.2 | 37.2 |

| Gross Profit | 3,967 | 5,824 | 8,897 | 62.8 | 67.8 | 70.8 |

Statement of Income and Expenses

The National Restaurant Association publishes an Industry Operations Report that allows restaurant operators to benchmark their performances.

Monitoring and Controlling Food & Beverage Cost

Best practices require restaurant managers to (1) monitor food & beverage costs at regular intervals (daily or weekly), and (2) benchmark the actual cost against the standard or attainable cost, which is an “ideal” figure derived from the standardized recipes.

Restaurants and other types of foodservice operations produce a periodic food cost report that usually includes the following:

-

- Direct Purchases: The amount for the ingredients, mostly fresh products that are delivered and directly transformed every day. The person in charge of purchasing the products (usually the chef or foodservice director) would fill-out a “market list” and place the order a day or two in advance. The market list (or the invoice if provided with the delivery) serves as the supporting document for direct purchases. Much of this documentation is likely managed using computer systems.

- Well managed operations require that a requisition voucher be filled out for every item removed from storage.

- Likewise, each adjustment (employee and complimentary meals, transfers in or out, etc.) must be documented, again likely documented in the back of the house computer system.

The following is an example of a simple cumulative daily food cost report:

Cumulative Daily Food Cost Report

| Date | Directs | Stores | Adjustments Added to Cost | Adjustments Subtracted from Cost | Total Cost Today | Total Cost to Date | Total Sales Today | Total Sales to Date | Food Cost Percentage Today | Food Cost Percentage to Date |

|---|---|---|---|---|---|---|---|---|---|---|

| Feb 1 | $254.20 | $977.30 | $57.20 | $255.30 | $1,033.40 | $1,033.40 | $2,778.00 | $2,778.00 | 37,199% | 37,199% |

| Feb 2 | $326.70 | $944.10 | $86.20 | $253.40 | $1,103.60 | $2,137.00 | $2,919.20 | $5,697.20 | 37.805% | 37.510% |

| Feb 3 | $262.50 | $1,040.40 | $88.60 | $177.80 | $1,213.70 | $3,350.70 | $3,056.95 | $8,754.125 | 39.703% | 38.276% |

| Feb 4 | $256.35 | $965.30 | $120.00 | $220.00 | $1,121.65 | $4,472.35 | $3,094.20 | $11,848.35 | 36.250% | 37.747% |

| Feb 5 | $218.75 | $944.55 | $90.00 | $170.00 | $1,083.30 | $5,555.65 | $3,427.35 | $15,275.70 | 31.608% | 36.369% |

A simple Cumulative Daily Food Cost Report

In larger operations, the report can break the products down by category:

Daily Cumulative Cost Report

| Date | Vegetable | Fruits | Dairy | Bakery | Total Directs | Beef and Veal | Poultry | Seafood | Pork | Duck |

|---|---|---|---|---|---|---|---|---|---|---|

| Feb 1 | $118.30 | $51.40 | $49.75 | $34.75 | $254.20 | $455.30 | $65.30 | $358.45 | $22.30 | $20.75 |

| Feb 2 | $178.15 | $67.80 | $65.15 | $15.60 | $326.70 | $494.30 | $77.20 | $234.60 | $32.00 | $21.00 |

| Feb 3 | $176.30 | $2320 | $34.30 | $28.70 | $262.50 | $474.10 | $75.20 | $329.70 | $40.30 | $30.45 |

| Feb 4 | $166.35 | $46.80 | $33.20 | $10.00 | $256.35 | $419.75 | $65.30 | $320.60 | $43.20 | $23.65 |

| Feb 5 | $117.10 | $28.75 | $44.20 | $28.70 | $218.75 | $425.80 | $130.00 | $211.50 | $92.25 | $85.00 |

A Simple Daily Cumulative Cost Report broken down by categories.

Standard, or “attainable “Cost

A “standardized recipe” detailing ingredient quantity, unit cost and cooking procedures (discussed earlier in the chapter on Standardized Recipes) is written for each menu item. The standardized recipes summarize the forecasted cost per portion of a particular menu item.

As a result, food and beverage operations determine a standard or attainable dollar food cost by (1) multiplying the number items sold (from a sales report) by the cost from the relevant standardized recipes. They then sum up the costs of all the items sold. Once again, this would be calculated on a daily, weekly and/or monthly basis by a computer system.

Standardized Recipe

| Ingredient | Cost per Portion | Sales Report (portions sold) |

Standard Cost |

|---|---|---|---|

| Chicken | $3.20 | 25 | $80.00 ($3.20 X 25) |

| Fish | $5.50 | 40 | $220.00 ($5.50 X 40) |

| Lasagna | $2.70 | 15 | $40.50 ($2.70 X 15) |

The Standard Food Cost is obtained by adding the fourth column, Standard Cost, which equals $340.50.

The Standard Food Cost is obtained by adding the fourth column, Standard Cost, which equals $340.50.

The standard cost assumes that the kitchen staff is able to produce a recipe using the exact amounts of ingredients listed in the standardized recipes. This is often not the case since ingredients may vary (shape, unit size, weight) and mistakes occur (inaccurate yields, peeling waste, cutting technique, burned or dropped ingredients…). Standard costs primarily serve to determine purchasing volumes, minimum recommended menu prices, and as a benchmark to measure the difference between the actual and the ideal (theoretically perfect) costs.

Operational Efficiency

Operational efficiency is a measure of the extent to which the actual and standard (Ideal) costs differ. It is expressed as the ratio of Actual Cost to Standard Cost:

Actual F&B Cost ($) divided by Standard F&B Cost ($) = Operational Efficiency Ratio (%)

$391.60 divided by $340.50 times 100 = 115%

In this case, actual exceeds the standard cost by 15%, prompting a management team to conduct a thorough investigation.

An operational efficiency ratio below 100% (actual is less than standard) could be interpreted as a positive performance. Such is the case for example when market prices for products drop. However, this could also result from the use of inferior products or smaller portion sizes, which could negatively affect customer perception and endanger the operation.

Variance Analysis

Cost variance (the difference between the standard and actual cost) results from differences in purchasing price, expected versus actual yields, quantity used, and/or changes in menu mix. The foodservice manager is responsible for defining the acceptable amount of variance and understanding its origin given the fact that waste and price variations are inevitable.

As a rule of thumb, a 10% variance may be acceptable. However, no established guideline exits for defining the “right” degree of variance. It depends on the nature of the operation and the value of the food product. Think of the cost difference between something like beef tenderloin and cucumbers. Foodservice operations using convenience food products such are pre-cut and pre-portioned ingredients should experience little variances, while operations working with fresh products have to manage AP/EP yields (As-Purchased/Edible Portion), preparation procedures and thus incur more cost variability.

The following table summarizes the most common sources of cost variances.

| Potentially Unmanageable Reasons | Potentially Manageable Reasons |

|---|---|

| - Significant increases in costs paid for food

- Shift of guest preferences to higher food cost menu selections - Storage losses (for example, refrigerator/freezer breakdown requiring stored food to be destroyed) - Shift to more convenience foods in efforts to reduce labor costs |

- Revenue theft (higher food cost %)

- Failure to properly follow procedures for effective purchasing, storing, issuing and production of food products - Improper/inaccurate procedures to calculate actual food costs - Ineffective selling techniques resulting in sales of higher food cost items (with a lower contribution margin) - Portion control issues |

Variance and Inventory Control

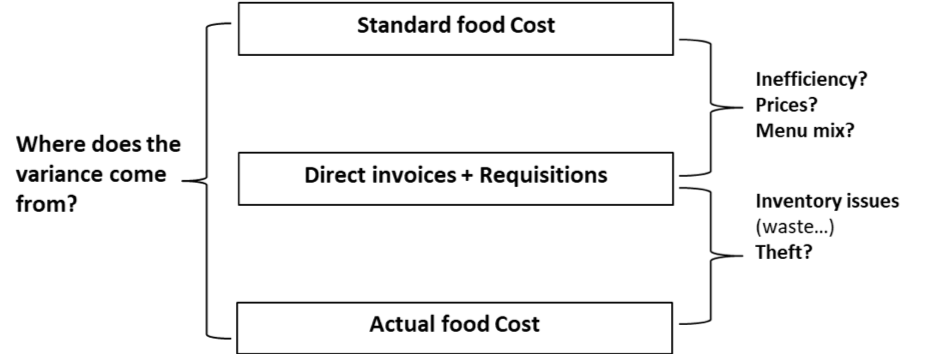

Analyzing the variances between the three methods used to calculate food and beverage costs provides initial clues as to whether cost problems originate from efficiency or other loss issues such as inventory mismanagement or theft.

Long description:

A box labeled “Standard food Cost” is at the top. Below that is a box labeled “Direct invoices and Requisitions”. On the bottom is a box labeled “Actual food cost”. On the left is the question “Where does the variance come from?” and is linked to the top and bottom boxes. On the right are 2 pieces of text. The first is “Inefficiency? Prices? Menu mix?” and is linked to the top 2 boxes. The second is “Inventory issues (waste…) Theft?” and is linked to the bottom 2 boxes.

End long description.

What’s a Manager to Do?

Managing and controlling food and beverage expenses involves collecting lots of data related to the foodservice operation. Then that data has to be analyzed on a daily, weekly, monthly, and yearly basis. Issues and problems are identified through this analysis, then the effective manager works to find solutions that bring costs “in line” with revenue. It’s a constantly changing and challenging, but rewarding task.

Review Questions

- What is the difference between cost of food consumed (or used) and cost of food sold?

- Why does offering free employee meals or complimentary meals or drinks affect the cost of food and beverage sold (and the resulting food and beverage cost percentage?

- How will an error in the physical inventory or inventory value affect an operation’s food cost percentage?

- Why would a foodservice manager want to calculate an operational efficiency ratio?

- How does variance analysis help a foodservice manager better manage food and beverage expenses?

- How should a foodservice manager determine if a variance is acceptable or unacceptable?