Chapter 14.1 – Absolute and Comparative Advantage

By the end of this section, you will be able to:

- Define absolute advantage, comparative advantage, and opportunity costs

- Explain the gains of trade created when a country specializes

The American statesman Benjamin Franklin (1706–1790) once wrote: “No nation was ever ruined by trade.” Many economists would express their attitudes toward international trade in an even more positive manner. The evidence that international trade confers overall benefits on economies is pretty strong. Trade has accompanied economic growth in the United States and around the world. Many of the national economies that have shown the most rapid growth in the last several decades—for example, Japan, South Korea, China, and India—have done so by dramatically orienting their economies toward international trade. There is no modern example of a country that has shut itself off from world trade and yet prospered. To understand the benefits of trade, or why we trade in the first place, we need to understand the concepts of comparative and absolute advantage.In 1817, David Ricardo, a businessman, economist, and member of the British Parliament, wrote a treatise called On the Principles of Political Economy and Taxation. In this treatise, Ricardo argued that specialization and free trade benefit all trading partners, even those that may be relatively inefficient. To see what he meant, we must be able to distinguish between absolute and comparative advantage.

A country has an absolute advantage over another country in producing a good if it uses fewer resources to produce that good. Absolute advantage can be the result of a country’s natural endowment. For example, extracting oil in Saudi Arabia is pretty much just a matter of “drilling a hole.” Producing oil in other countries can require considerable exploration and costly technologies for drilling and extraction—if they have any oil at all. The United States has some of the richest farmland in the world, making it easier to grow corn and wheat than in many other countries. Guatemala and Colombia have climates especially suited for growing coffee. Chile and Zambia have some of the world’s richest copper mines. As some have argued, “geography is destiny.” Chile will provide copper and Guatemala will produce coffee, and they will trade. When each country has a product others need and it can produce it with fewer resources in one country than in another, then it is easy to imagine all parties benefitting from trade. However, thinking about trade just in terms of geography and absolute advantage is incomplete. Trade really occurs because of comparative advantage.

Recall from the chapter Choice in a World of Scarcity that a country has a comparative advantage when it can produce a good at a lower cost in terms of other goods. The question each country or company should be asking when it trades is this: “What do we give up to produce this good?” It should be no surprise that the concept of comparative advantage is based on this idea of opportunity cost from Choice in a World of Scarcity. For example, if Zambia focuses its resources on producing copper, it cannot use its labor, land and financial resources to produce other goods such as corn. As a result, Zambia gives up the opportunity to produce corn. How do we quantify the cost in terms of other goods? Simplify the problem and assume that Zambia just needs labor to produce copper and corn. The companies that produce either copper or corn tell you that it takes two hours to mine a ton of copper and one hour to harvest a bushel of corn. This means the opportunity cost of producing a ton of copper is two bushels of corn. The next section develops absolute and comparative advantage in greater detail and relates them to trade.

A Numerical Example of Absolute and Comparative Advantage

Consider a hypothetical world with two countries, Saudi Arabia and the United States, and two products, oil and corn. Further assume that consumers in both countries desire both these goods. These goods are homogeneous, meaning that consumers/producers cannot differentiate between corn or oil from either country. There is only one resource available in both countries, labor hours. Saudi Arabia can produce oil with fewer resources, while the United States can produce corn with fewer resources. Table 14.1 illustrates the advantages of the two countries, expressed in terms of how many hours it takes to produce one unit of each good.

| Country | Oil (hours per barrel) | Corn (hours per bushel) |

|---|---|---|

| Saudi Arabia | 1 | 4 |

| United States | 2 | 1 |

Table 14.1 How Many Hours It Takes to Produce Oil and Corn (Source: https://openstax.org/books/principles-microeconomics-2e/pages/1-introduction)(CC BY 4.0)

In Table 14.1, Saudi Arabia has an absolute advantage in producing oil because it only takes an hour to produce a barrel of oil compared to two hours in the United States. The United States has an absolute advantage in producing corn.

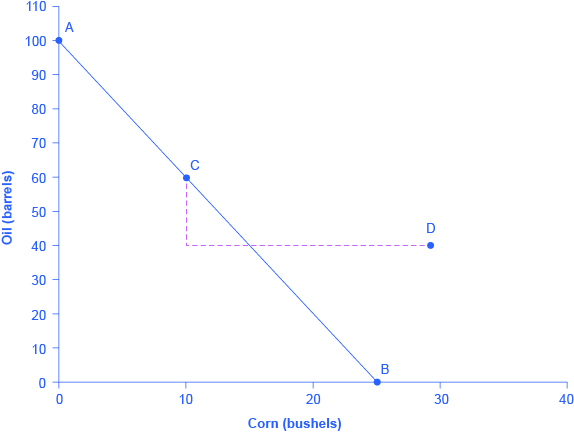

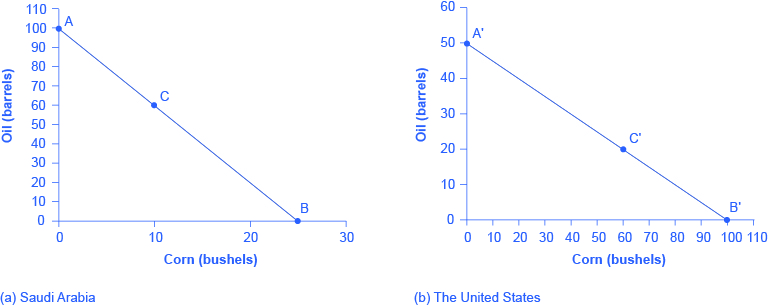

To simplify, let’s say that Saudi Arabia and the United States each have 100 worker hours (see Table 14.2). Figure 14.1 illustrates what each country is capable of producing on its own using a production possibility frontier (PPF) graph. Recall from Choice in a World of Scarcity that the production possibilities frontier shows the maximum amount that each country can produce given its limited resources, in this case workers, and its level of technology.

| Country | Oil Production using 100 worker hours (barrels) | Corn Production using 100 worker hours (bushels) | |

|---|---|---|---|

| Saudi Arabia | 100 | or | 25 |

| United States | 50 | or | 100 |

Table 14.2 Production Possibilities before Trade (Source: https://openstax.org/books/principles-microeconomics-2e/pages/1-introduction)(CC BY 4.0)

Arguably Saudi and U.S. consumers desire both oil and corn to live. Let’s say that before trade occurs, both countries produce and consume at point C or C'. Thus, before trade, the Saudi Arabian economy will devote 60 worker hours to produce oil, as Table 14.3 shows. Given the information in Table 14.1, this choice implies that it produces/consumes 60 barrels of oil. With the remaining 40 worker hours, since it needs four hours to produce a bushel of corn, it can produce only 10 bushels. To be at point C', the U.S. economy devotes 40 worker hours to produce 20 barrels of oil and it can allocate the remaining worker hours to produce 60 bushels of corn.

| Country | Oil Production (barrels) | Corn Production (bushels) |

|---|---|---|

| Saudi Arabia (C) | 60 | 10 |

| United States (C') | 20 | 60 |

| Total World Production | 80 | 70 |

Table 14.3 Production before Trade (Source: https://openstax.org/books/principles-microeconomics-2e/pages/1-introduction)(CC BY 4.0)

The slope of the production possibility frontier illustrates the opportunity cost of producing oil in terms of corn. Using all its resources, the United States can produce 50 barrels of oil or 100 bushels of corn; therefore, the opportunity cost of one barrel of oil is two bushels of corn—or the slope is 1/2. Thus, in the U.S. production possibility frontier graph, every increase in oil production of one barrel implies a decrease of two bushels of corn. Saudi Arabia can produce 100 barrels of oil or 25 bushels of corn. The opportunity cost of producing one barrel of oil is the loss of 1/4 of a bushel of corn that Saudi workers could otherwise have produced. In terms of corn, notice that Saudi Arabia gives up the least to produce a barrel of oil. Table 14.4 summarizes these calculations.

| Country | Opportunity cost of one unit — Oil (in terms of corn) | Opportunity cost of one unit — Corn (in terms of oil) |

|---|---|---|

| Saudi Arabia | ¼ | 4 |

| United States | 2 | ½ |

Table 14.4 Opportunity Cost and Comparative Advantage (Source: https://openstax.org/books/principles-microeconomics-2e/pages/1-introduction)(CC BY 4.0)

Again recall that we defined comparative advantage as the opportunity cost of producing goods. Since Saudi Arabia gives up the least to produce a barrel of oil, (14 < 2 in Table 14.4) it has a comparative advantage in oil production. The United States gives up the least to produce a bushel of corn, so it has a comparative advantage in corn production.

In this example, there is symmetry between absolute and comparative advantage. Saudi Arabia needs fewer worker hours to produce oil (absolute advantage, see Table 14.1), and also gives up the least in terms of other goods to produce oil (comparative advantage, see Table 14.4). Such symmetry is not always the case, as we will show after we have discussed gains from trade fully, but first, read the following Clear It Up feature to make sure you understand why the PPF line in the graphs is straight.

CLEAR IT UP

Can a production possibility frontier be straight?

When you first met the production possibility frontier (PPF) in the chapter on Choice in a World of Scarcity we drew it with an outward-bending shape. This shape illustrated that as we transferred inputs from producing one good to another—like from education to health services—there were increasing opportunity costs. In the examples in this chapter, we draw the PPFs as straight lines, which means that opportunity costs are constant. When we transfer a marginal unit of labor away from growing corn and toward producing oil, the decline in the quantity of corn and the increase in the quantity of oil is always the same. In reality this is possible only if the contribution of additional workers to output did not change as the scale of production changed. The linear production possibilities frontier is a less realistic model, but a straight line simplifies calculations. It also illustrates economic themes like absolute and comparative advantage just as clearly.

Gains from Trade

Consider the trading positions of the United States and Saudi Arabia after they have specialized and traded. Before trade, Saudi Arabia produces/consumes 60 barrels of oil and 10 bushels of corn. The United States produces/consumes 20 barrels of oil and 60 bushels of corn. Given their current production levels, if the United States can trade an amount of corn fewer than 60 bushels and receives in exchange an amount of oil greater than 20 barrels, it will gain from trade. With trade, the United States can consume more of both goods than it did without specialization and trade. (Recall that the chapter Welcome to Economics! defined specialization as it applies to workers and firms. Economists also use specialization to describe the occurrence when a country shifts resources to focus on producing a good that offers comparative advantage.) Similarly, if Saudi Arabia can trade an amount of oil less than 60 barrels and receive in exchange an amount of corn greater than 10 bushels, it will have more of both goods than it did before specialization and trade. Table 14.5 illustrates the range of trades that would benefit both sides.

| The U.S. economy, after specialization, will benefit if it: | The Saudi Arabian economy, after specialization, will benefit if it: |

|---|---|

| Exports no more than 60 bushels of corn | Imports at least 10 bushels of corn |

| Imports at least 20 barrels of oil | Exports less than 60 barrels of oil |

Table 14.5 The Range of Trades That Benefit Both the United States and Saudi Arabia (Source: https://openstax.org/books/principles-microeconomics-2e/pages/1-introduction)(CC BY 4.0)

The underlying reason why trade benefits both sides is rooted in the concept of opportunity cost, as the following Clear It Up feature explains. If Saudi Arabia wishes to expand domestic production of corn in a world without international trade, then based on its opportunity costs it must give up four barrels of oil for every one additional bushel of corn. If Saudi Arabia could find a way to give up less than four barrels of oil for an additional bushel of corn (or equivalently, to receive more than one bushel of corn for four barrels of oil), it would be better off.

CLEAR IT UP

What are the opportunity costs and gains from trade?

The range of trades that will benefit each country is based on the country’s opportunity cost of producing each good. The United States can produce 100 bushels of corn or 50 barrels of oil. For the United States, the opportunity cost of producing one barrel of oil is two bushels of corn. If we divide the numbers above by 50, we get the same ratio: one barrel of oil is equivalent to two bushels of corn, or ([latex]\frac{100}{50}=2\;and\;\frac{50}{50}=1[/latex]). In a trade with Saudi Arabia, if the United States is going to give up 100 bushels of corn in exports, it must import at least 50 barrels of oil to be just as well off. Clearly, to gain from trade it needs to be able to gain more than a half barrel of oil for its bushel of corn—or why trade at all?

Recall that David Ricardo argued that if each country specializes in its comparative advantage, it will benefit from trade, and total global output will increase. How can we show gains from trade as a result of comparative advantage and specialization? Table 14.6 shows the output assuming that each country specializes in its comparative advantage and produces no other good. This is 100% specialization. Specialization leads to an increase in total world production. (Compare the total world production in Table 14.3 to that in Table 14.6.)

| Country | Quantity produced after 100% specialization — Oil (barrels) | Quantity produced after 100% specialization — Corn (bushels) |

|---|---|---|

| Saudi Arabia | 100 | 0 |

| United States | 0 | 100 |

| Total World Production | 100 | 100 |

Table 14.6 How Specialization Expands Output (Source: https://openstax.org/books/principles-microeconomics-2e/pages/1-introduction)(CC BY 4.0)

What if we did not have complete specialization, as in Table 14.6? Would there still be gains from trade? Consider another example, such as when the United States and Saudi Arabia start at C and C', respectively, as Figure 14.2 shows. Consider what occurs when trade is allowed and the United States exports 20 bushels of corn to Saudi Arabia in exchange for 20 barrels of oil.