9 Monopolistic Competition

9.1 an Introduction to monopolistic competition

Monopolistic competition involves many firms competing against each other, but selling products that are distinctive in some way. Examples include stores that sell different styles of clothing; restaurants or grocery stores that sell a variety of food; and even products like golf balls or beer that may be at least somewhat similar but differ in public perception because of advertising and brand names. There are over 600,000 restaurants in the United States. When products are distinctive, each firm has a mini-monopoly on its particular style or flavor or brand name. However, firms producing such products must also compete with other styles and flavors and brand names.

Differentiated Products

A firm can try to make its products different from those of its competitors in several ways: physical aspects of the product, location from which it sells the product, intangible aspects of the product, and perceptions of the product. We call products that are distinctive in one of these ways differentiated products.

Physical aspects of a product include all the phrases you hear in advertisements: unbreakable bottle, nonstick surface, freezer-to-microwave, non-shrink, extra spicy, newly redesigned for your comfort. A firm’s location can also create a difference between producers. For example, a gas station located at a heavily traveled intersection can probably sell more gas, because more cars drive by that corner. A supplier to an automobile manufacturer may find that it is an advantage to locate close to the car factory.

Intangible aspects can differentiate a product, too. Some intangible aspects may be promises like a guarantee of satisfaction or money back, a reputation for high quality, services like free delivery, or offering a loan to purchase the product. Finally, product differentiation may occur in the minds of buyers. For example, many people could not tell the difference in taste between common varieties of ketchup or mayonnaise if they were blindfolded but, because of past habits and advertising, they have strong preferences for certain brands. Advertising can play a role in shaping these intangible preferences.

The concept of differentiated products is closely related to the degree of variety that is available. If everyone in the economy wore only blue jeans, ate only white bread, and drank only tap water, then the markets for clothing, food, and drink would be much closer to perfectly competitive. The variety of styles, flavors, locations, and characteristics creates product differentiation and monopolistic competition.

The Oxymoron

An oxymoron is defined by Google Dictionary as: “a figure of speech in which apparently contradictory terms appear in conjunction.” This explains the term monopolistic competition well. A monopoly is defined as a situation where one firm controls the market for some good. Competition refers to a situation where firms battle with other firms for customers and sales. How can we put these two words together?

Monopolistic competition refers to a situation where firms have a monopoly on their own product but they must compete in that market sector. For example, McDonald’s holds a monopoly on the Big Mac hamburger, but must compete with other fast food restaurants for both hamburger and fast food sales.

The Demand in the Market Structures

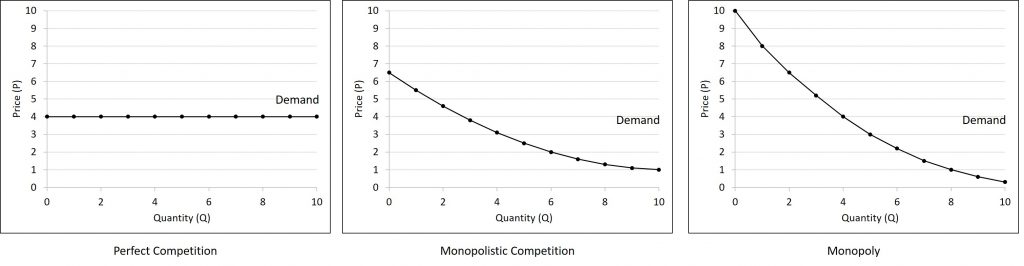

A monopolistically competitive firm perceives a demand for its goods that is an intermediate case between monopoly and competition. Figure 9.1 offers a reminder that the demand curve that a perfectly competitive firm faces is perfectly elastic or flat, because the perfectly competitive firm can sell any quantity it wishes at the prevailing market price. In contrast, the demand curve, as faced by a monopolist, is the market demand curve, since a monopolist is the only firm in the market, and hence is downward sloping.

The demand curve as a monopolistic competitor faces is not flat, but rather downward-sloping, which means that the monopolistic competitor can raise its price without losing all of its customers or lower the price and gain more customers. Since there are substitutes, the demand curve facing a monopolistically competitive firm is more elastic than that of a monopoly where there are no close substitutes. If a monopolist raises its price, some consumers will choose not to purchase its product—but they will then need to buy a completely different product. However, when a monopolistic competitor raises its price, some consumers will choose not to purchase the product at all, but others will choose to buy a similar product from another firm. If a monopolistic competitor raises its price, it will not lose as many customers as would a perfectly competitive firm, but it will lose more customers than would a monopoly that raised its prices.

At a glance, the demand curves that a monopoly and a monopolistic competitor face look similar—that is, they both slope down. However, the underlying economic meaning of these perceived demand curves is different, because a monopolist faces the market demand curve and a monopolistic competitor does not. Rather, a monopolistically competitive firm’s demand curve is but one of many firms that make up the “before” market demand curve.

9.2 Market considerations for monopolistically competitive firms

Profit Maximization in Monopolistic Competition

The monopolistically competitive firm decides on its profit-maximizing quantity and price in much the same way as a monopolist. A monopolistic competitor, like a monopolist, faces a downward-sloping demand curve, and so it will choose some combination of price and quantity along its perceived demand curve. For the sake of time, we will not repeat the process since it is strikingly similar to problems we have already done so far.

Although the process by which a monopolistic competitor makes decisions about quantity and price is similar to the way in which a monopolist makes such decisions, two differences are worth remembering. First, although both a monopolist and a monopolistic competitor face downward-sloping demand curves, the monopolist’s perceived demand curve is the market demand curve, while the perceived demand curve for a monopolistic competitor is based on the extent of its product differentiation and how many competitors it faces. Second, a monopolist is surrounded by barriers to entry and need not fear entry, but a monopolistic competitor who earns profits must expect the entry of firms with similar, but differentiated, products.

Entry and Exit

If one monopolistic competitor earns positive economic profits, other firms will be tempted to enter the market. A gas station with a great location must worry that other gas stations might open across the street or down the road—and perhaps the new gas stations will sell coffee or have a carwash or some other attraction to lure customers. A successful restaurant with a unique barbecue sauce must be concerned that other restaurants will try to copy the sauce or offer their own unique recipes. A laundry detergent with a great reputation for quality must take note that other competitors may seek to build their own reputations.

The entry of other firms into the same general market (like gas, restaurants, or detergent) shifts the demand curve that a monopolistically competitive firm faces. As more firms enter the market, the quantity demanded at a given price for any particular firm will decline, and the firm’s perceived demand curve will shift to the left. As a firm’s perceived demand curve shifts to the left, its marginal revenue curve will shift to the left, too. The shift in marginal revenue will change the profit-maximizing quantity that the firm chooses to produce, since marginal revenue will then equal marginal cost at a lower quantity.

As long as the firm is earning positive economic profits, new competitors will continue to enter the market, reducing the original firm’s demand and marginal revenue curves. When price is equal to average cost, economic profits are zero. Thus, although a monopolistically competitive firm may earn positive economic profits in the short term, the process of new entry will drive down economic profits to zero in the long run. Remember that zero economic profit is not equivalent to zero accounting profit. A zero economic profit means the firm’s accounting profit is equal to what its resources could earn in their next best use. We can also have the reverse situation, where a monopolistically competitive firm is originally losing money. The adjustment to long-run equilibrium is analogous to the previous example. The economic losses lead to firms exiting, which will result in increased demand for this particular firm, and consequently lower losses. Firms exit up to the point where there are no more losses in this market, for example when the demand curve touches the average cost curve.

Monopolistic competitors can make an economic profit or loss in the short run, but in the long run, entry and exit will drive these firms toward a zero economic profit outcome. However, the zero economic profit outcome in monopolistic competition looks different from the zero economic profit outcome in perfect competition in several ways relating both to efficiency and to variety in the market.

Monopolistic Competition and Efficiency

The long-term result of entry and exit in a perfectly competitive market is that all firms end up selling at the price level determined by the lowest point on the average cost curve. This outcome is why perfect competition displays productive efficiency: goods are produced at the lowest possible average cost. However, in monopolistic competition, the end result of entry and exit is that firms end up with a price that lies on the downward-sloping portion of the average cost curve, not at the very bottom of the AC curve. Thus, monopolistic competition will not be productively efficient.

In a perfectly competitive market, each firm produces at a quantity where price is set equal to marginal cost, both in the short and long run. This outcome is why perfect competition displays allocative efficiency: the social benefits of additional production, as measured by the marginal benefit, which is the same as the price, equal the marginal costs to society of that production. In a monopolistically competitive market, the rule for maximizing profit is to set MR = MC—and price is higher than marginal revenue, not equal to it because the demand curve is downward sloping. When P > MC, which is the outcome in a monopolistically competitive market, the benefits to society of providing additional quantity, as measured by the price that people are willing to pay, exceed the marginal costs to society of producing those units. A monopolistically competitive firm does not produce more, which means that society loses the net benefit of those extra units. This is the same argument we made about monopoly, but in this case the allocative inefficiency will be smaller. Thus, a monopolistically competitive industry will produce a lower quantity of a good and charge a higher price for it than would a perfectly competitive industry.

9.3 Advertising

From: Wikipedia: Advertising

Theory of Advertising

Advertising is a marketing communication that employs an openly sponsored, non-personal message to promote or sell a product, service or idea.[1]:465 Sponsors of advertising are typically businesses wishing to promote their products or services. Advertising is differentiated from public relations in that an advertiser pays for and has control over the message. It differs from personal selling in that the message is non-personal, i.e., not directed to a particular individual.[1]:661,672 Advertising is communicated through various mass media,[2] including traditional media such as newspapers, magazines, television, radio, outdoor advertising or direct mail; and new media such as search results, blogs, social media, websites or text messages. The actual presentation of the message in a medium is referred to as an advertisement, or “ad” or advert for short.

Commercial ads often seek to generate increased consumption of their products or services through “branding“, which associates a product name or image with certain qualities in the minds of consumers. On the other hand, ads that intend to elicit an immediate sale are known as direct-response advertising. Non-commercial entities that advertise more than consumer products or services include political parties, interest groups, religious organizations and governmental agencies. Non-profit organizations may use free modes of persuasion, such as a public service announcement. Advertising may also help to reassure employees or shareholders that a company is viable or successful.

Modern advertising originated with the techniques introduced with tobacco advertising in the 1920s, most significantly with the campaigns of Edward Bernays, considered the founder of modern, “Madison Avenue” advertising.[3][4]

Worldwide spending on advertising in 2015 amounted to an estimated US$529.43 billion.[5] Advertising’s projected distribution for 2017 was 40.4% on TV, 33.3% on digital, 9% on newspapers, 6.9% on magazines, 5.8% on outdoor and 4.3% on radio.[6] Internationally, the largest (“Big Five”) advertising-agency groups are Dentsu, Interpublic, Omnicom, Publicis, and WPP.[7]

In Latin, advertere means “to turn towards”.[8]

Sales promotions are another way to advertise. Sales promotions are double purposed because they are used to gather information about what type of customers one draws in and where they are, and to jump start sales. Sales promotions include things like contests and games, sweepstakes, product giveaways, samples coupons, loyalty programs, and discounts. The ultimate goal of sales promotions is to stimulate potential customers to action.[92]

Criticism of Advertising

While advertising can be seen as necessary for economic growth,[27] it is not without social costs. Unsolicited commercial e-mail and other forms of spam have become so prevalent as to have become a major nuisance to users of these services, as well as being a financial burden on internet service providers.[93] Advertising is increasingly invading public spaces, such as schools, which some critics argue is a form of child exploitation.[94] This increasing difficulty in limiting exposure to specific audiences can result in negative backlash for advertisers.[95] In tandem with these criticisms, the advertising industry has seen low approval rates in surveys and negative cultural portrayals.[96]

One of the most controversial criticisms of advertisement in the present day is that of the predominance of advertising of foods high in sugar, fat, and salt specifically to children. Critics claim that food advertisements targeting children are exploitive and are not sufficiently balanced with proper nutritional education to help children understand the consequences of their food choices. Additionally, children may not understand that they are being sold something, and are therefore more impressionable.[97] Michelle Obama has criticized large food companies for advertising unhealthy foods largely towards children and has requested that food companies either limit their advertising to children or advertise foods that are more in line with dietary guidelines.[98] The other criticisms include the change that are brought by those advertisements on the society and also the deceiving ads that are aired and published by the corporations. Cosmetic and health industry are the ones which exploited the highest and created reasons of concern.[99]