13 Money and Banking

From: OpenStax Macroeconomics (http://cnx.org/content/col12190/), Chapter 14.1

10.1 Defining money by its functions

Money for the sake of money is not an end in itself. You cannot eat dollar bills or wear your bank account. Ultimately, the usefulness of money rests in exchanging it for goods or services. As the American writer and humorist Ambrose Bierce (1842–1914) wrote in 1911, money is a “blessing that is of no advantage to us excepting when we part with it.” Money is what people regularly use when purchasing or selling goods and services, and thus both buyers and sellers must widely accept money. This concept of money is intentionally flexible, because money has taken a wide variety of forms in different cultures.

Barter and the Double Coincidence of Wants

To understand the usefulness of money, we must consider what the world would be like without money. How would people exchange goods and services? Economies without money typically engage in the barter system. Barter—literally trading one good or service for another—is highly inefficient for trying to coordinate the trades in a modern advanced economy. In an economy without money, an exchange between two people would involve a double coincidence of wants, a situation in which two people each want some good or service that the other person can provide. For example, if an accountant wants a pair of shoes, this accountant must find someone who has a pair of shoes in the correct size and who is willing to exchange the shoes for some hours of accounting services. Such a trade is likely to be difficult to arrange. Think about the complexity of such trades in a modern economy, with its extensive division of labor that involves thousands upon thousands of different jobs and goods.

Another problem with the barter system is that it does not allow us to easily enter into future contracts for purchasing many goods and services. For example, if the goods are perishable it may be difficult to exchange them for other goods in the future. Imagine a farmer wanting to buy a tractor in six months using a fresh crop of strawberries. Additionally, while the barter system might work adequately in small economies, it will keep these economies from growing. The time that individuals would otherwise spend producing goods and services and enjoying leisure time they spend bartering.

Functions of Money

Money solves the problems that the barter system creates. (We will get to its definition soon.) First, money serves as a medium of exchange, which means that money acts as an intermediary between the buyer and the seller. Instead of exchanging accounting services for shoes, the accountant now exchanges accounting services for money. The accountant then uses this money to buy shoes. To serve as a medium of exchange, people must widely accept money as a method of payment in the markets for goods, labor, and financial capital.

Second, money must serve as a store of value. In a barter system, we saw the example of the shoemaker trading shoes for accounting services. However, she risks having her shoes go out of style, especially if she keeps them in a warehouse for future use—their value will decrease with each season. Shoes are not a good store of value. Holding money is a much easier way of storing value. You know that you do not need to spend it immediately because it will still hold its value the next day, or the next year. This function of money does not require that money is a perfect store of value. In an economy with inflation, money loses some buying power each year, but it remains money.

Third, money serves as a unit of account, which means that it is the ruler by which we measure values. For example, an accountant may charge $100 to file your tax return. That $100 can purchase two pair of shoes at $50 a pair. Money acts as a common denominator, an accounting method that simplifies thinking about trade-offs.

Finally, another function of money is that it must serve as a standard of deferred payment. This means that if money is usable today to make purchases, it must also be acceptable to make purchases today that the purchaser will pay in the future. Loans and future agreements are stated in monetary terms and the standard of deferred payment is what allows us to buy goods and services today and pay in the future. Thus, money serves all of these functions— it is a medium of exchange, store of value, unit of account, and standard of deferred payment.

Commodity versus Fiat Money

Money has taken a wide variety of forms in different cultures. People have used gold, silver, cowrie shells, cigarettes, and even cocoa beans as money. Although we use these items as commodity money, they also have a value from use as something other than money. For example, people have used gold throughout the ages as money although today we do not use it as money but rather value it for its other attributes. Gold is a good conductor of electricity and the electronics and aerospace industry use it. Other industries use gold too, such as to manufacture energy efficient reflective glass for skyscrapers and is used in the medical industry as well. Of course, gold also has value because of its beauty and malleability in creating jewelry.

As commodity money, gold has historically served its purpose as a medium of exchange, a store of value, and as a unit of account. Commodity-backed currencies are dollar bills or other currencies with values backed up by gold or other commodities held at a bank. During much of its history, gold and silver backed the money supply in the United States. Interestingly, antique dollars dated as late as 1957, have “Silver Certificate” printed over the portrait of George Washington. This meant that the holder could take the bill to the appropriate bank and exchange it for a dollar’s worth of silver.

As economies grew and became more global in nature, the use of commodity monies became more cumbersome. Countries moved towards the use of fiat money. Fiat money has no intrinsic value, but is declared by a government to be a country’s legal tender. The United States’ paper money, for example, carries the statement: “THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE.” In other words, by government decree, if you owe a debt, then legally speaking, you can pay that debt with the U.S. currency, even though it is not backed by a commodity. The only backing of our money is universal faith and trust that the currency has value, and nothing more.

10.2 Measuring money: Currency, m1, and m2

From: From: OpenStax Macroeconomics (http://cnx.org/content/col12190/), Chapter 14.2

Cash in your pocket certainly serves as money; however, what about checks or credit cards? Are they money, too?Rather than trying to state a single way of measuring money, economists offer broader definitions of money based on liquidity. Liquidity refers to how quickly you can use a financial asset to buy a good or service. For example, cash is very liquid. You can use your $10 bill easily to buy a hamburger at lunchtime. However, $10 that you have in your savings account is not so easy to use. You must go to the bank or ATM machine and withdraw that cash to buy your lunch. Thus, $10 in your savings account is less liquid.

The Federal Reserve Bank, which is the central bank of the United States, is a bank regulator and is responsible for monetary policy and defines money according to its liquidity. There are two definitions of money: M1 and M2 money supply. M1 money supply includes those monies that are very liquid such as cash, checkable (demand) deposits, and traveler’s checks M2 money supply is less liquid in nature and includes M1 plus savings and time deposits, certificates of deposits, and money market funds.

M1 money supply includes coins and currency in circulation—the coins and bills that circulate in an economy that the U.S. Treasury does not hold at the Federal Reserve Bank, or in bank vaults. Closely related to currency are checkable deposits, also known as demand deposits. These are the amounts held in checking accounts. They are called demand deposits or checkable deposits because the banking institution must give the deposit holder his money “on demand” when the customer writes a check or uses a debit card. These items together—currency, and checking accounts in banks—comprise the definition of money known as M1, which the Federal Reserve System measures daily.

A broader definition of money, M2 includes everything in M1 but also adds other types of deposits. For example, M2 includes savings deposits in banks, which are bank accounts on which you cannot write a check directly, but from which you can easily withdraw the money at an automatic teller machine or bank. Many banks and other financial institutions also offer a chance to invest in money market funds, where they pool together the deposits of many individual investors and invest them in a safe way, such as short-term government bonds. Another ingredient of M2 are the relatively small (that is, less than about $100,000) certificates of deposit (CDs) or time deposits, which are accounts that the depositor has committed to leaving in the bank for a certain period of time, ranging from a few months to a few years, in exchange for a higher interest rate. In short, all these types of M2 are money that you can withdraw and spend, but which require a greater effort to do so than the items in M1.

The Federal Reserve System is responsible for tracking the amounts of M1 and M2 and prepares a weekly release of information about the money supply. To provide an idea of what these amounts sound like, according to the Federal Reserve Bank’s measure of the U.S. money stock, as of February 10, 2020, M1 in the United States was $4.0 trillion, while M2 was $15.5 trillion. Table 10.1 provides a breakdown of the portion of each type of money that comprised M1 and M2 in January 2020, as provided by the Federal Reserve Bank.

| Components of M1 in the US (as of 02/10/20) (SA) | $ billions |

| Currency | 1,723.2 |

| Demand Deposits | 1,627.9 |

| Other Checking | 677.3 |

| Total M1 | 4,028.4 |

| Components of M2 in the US (January 2020)(SA) | |

| M1 Money Supply | 4,028.4 |

| Savings Accounts | 9,948.5 |

| Time Deposits | 583.5 |

| Individual Money Market Mutual Fund Balances | 994.8 |

| Total M2 | 15,551.2 |

The lines separating M1 and M2 can become a little blurry. Sometimes businesses do not treat elements of M1 alike. For example, some businesses will not accept personal checks for large amounts, but will accept traveler’s checks or cash. Changes in banking practices and technology have made the savings accounts in M2 more similar to the checking accounts in M1. For example, some savings accounts will allow depositors to write checks, use automatic teller machines, and pay bills over the internet, which has made it easier to access savings accounts. As with many other economic terms and statistics, the important point is to know the strengths and limitations of the various definitions of money, not to believe that such definitions are as clear-cut to economists as, say, the definition of nitrogen is to chemists.

Where does “plastic money” like debit cards, credit cards, and smart money fit into this picture? A debit card, like a check, is an instruction to the user’s bank to transfer money directly and immediately from your bank account to the seller. It is important to note that in our definition of money, it is checkable deposits that are money, not the paper check or the debit card. Although you can make a purchase with a credit card, the financial institution does not consider it money but rather a short term loan from the credit card company to you. When you make a credit card purchase, the credit card company immediately transfers money from its checking account to the seller, and at the end of the month, the credit card company sends you a bill for what you have charged that month. Until you pay the credit card bill, you have effectively borrowed money from the credit card company. With a smart card, you can store a certain value of money on the card and then use the card to make purchases. Some “smart cards” used for specific purposes, like long-distance phone calls or making purchases at a campus bookstore and cafeteria, are not really all that smart, because you can only use them for certain purchases or in certain places.

In short, credit cards, debit cards, and smart cards are different ways to move money when you make a purchase. However, having more credit cards or debit cards does not change the quantity of money in the economy, any more than printing more checks increases the amount of money in your checking account.

One key message underlying this discussion of M1 and M2 is that money in a modern economy is not just paper bills and coins. Instead, money is closely linked to bank accounts. The banking system largely conducts macroeconomic policies concerning money. The next section explains how banks function and how a nation’s banking system has the power to create money.

10.3 The role of banks

From: From: OpenStax Macroeconomics (http://cnx.org/content/col12190/), Chapter 14.3

Somebody once asked the late bank robber named Willie Sutton why he robbed banks. He answered: “That’s where the money is.” While this may have been true at one time, from the perspective of modern economists, Sutton is both right and wrong. He is wrong because the overwhelming majority of money in the economy is not in the form of currency sitting in vaults or drawers at banks, waiting for a robber to appear. Most money is in the form of bank accounts, which exist only as electronic records on computers. From a broader perspective, however, the bank robber was more right than he may have known. Banking is intimately interconnected with money and consequently, with the broader economy.

Banks make it far easier for a complex economy to carry out the extraordinary range of transactions that occur in goods, labor, and financial capital markets. Imagine for a moment what the economy would be like if everybody had to make all payments in cash. When shopping for a large purchase or going on vacation you might need to carry hundreds of dollars in a pocket or purse. Even small businesses would need stockpiles of cash to pay workers and to purchase supplies. A bank allows people and businesses to store this money in either a checking account or savings account, for example, and then withdraw this money as needed through the use of a direct withdrawal, writing a check, or using a debit card.

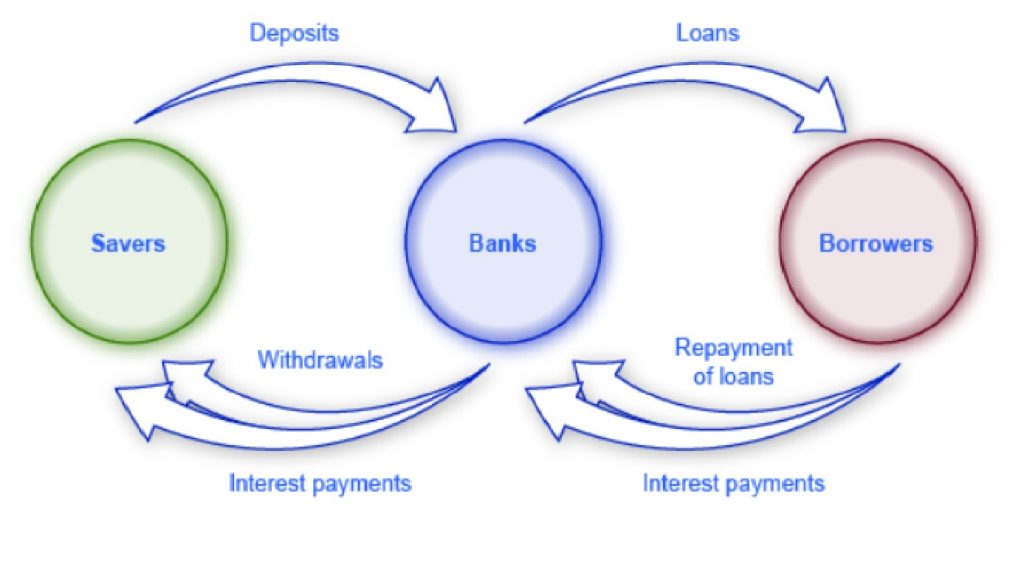

Banks are a critical intermediary in what we call the payment system, which helps an economy exchange goods and services for money or other financial assets. Also, those with extra money that they would like to save can store their money in a bank rather than look for an individual who is willing to borrow it from them and then repay them at a later date. Those who want to borrow money can go directly to a bank rather than trying to find someone to lend them cash. Transaction costs are the costs associated with finding a lender or a borrower for this money. Thus, banks lower transactions costs and act as financial intermediaries—they bring savers and borrowers together. Along with making transactions much safer and easier, banks also play a key role in creating money.

Banks as Financial Intermediaries

An “intermediary” is one who stands between two other parties. Banks are a financial intermediary—that is, an institution that operates between a saver who deposits money in a bank and a borrower who receives a loan from that bank. Financial intermediaries include other institutions in the financial market such as insurance companies and pension funds, but we will not include them in this discussion because they are not depository institutions, which are institutions that accept money deposits and then use these to make loans. All the deposited funds mingle in one big pool, which the financial institution then lends. Figure 10.1 illustrates the position of banks as financial intermediaries, with deposits flowing into a bank and loans flowing out. Of course, when banks make loans to firms, the banks will try to funnel financial capital to healthy businesses that have good prospects for repaying the loans, not to firms that are suffering losses and may be unable to repay.

A Bank’s Balance Sheet

A balance sheet is an accounting tool that lists assets and liabilities. An asset is something of value that you own and you can use to produce something. For example, you can use the cash you own to pay your tuition. If you own a home, this is also an asset. A liability is a debt or something you owe. Many people borrow money to buy homes. In this case, a home is the asset, but the mortgage is the liability. The net worth is the asset value minus how much is owed (the liability). A bank’s balance sheet operates in much the same way. A bank’s net worth as bank capital. We also refer to a bank has assets such as cash held in its vaults, monies that the bank holds at the Federal Reserve bank (called “reserves”), loans that it makes to customers, and bonds.

Table 10.2 illustrates a hypothetical and simplified balance sheet for the Safe and Secure Bank. Because of the two-column format of the balance sheet, with the T-shape formed by the vertical line down the middle and the horizontal line under “Assets” and “Liabilities,” we sometimes call it a T-account.

| Assets | Liabilities + Net Worth | ||

| Loans | $5 million | Deposits | $10 million |

| US Government Securities (USGS) | $4 million | ||

| Reserves | $2 million | Net Worth | $1 million |

The “T” in a T-account separates the assets of a firm, on the left, from its liabilities, on the right. All firms use T-accounts, though most are much more complex. For a bank, the assets are the financial instruments that either the bank is holding (its reserves) or those instruments where other parties owe money to the bank—like loans made by the bank and U.S. Government Securities, such as U.S. treasury bonds purchased by the bank. Liabilities are what the bank owes to others. Specifically, the bank owes any deposits made in the bank to those who have made them. The net worth of the bank is the total assets minus total liabilities. Net worth is included on the liabilities side to have the T account balance to zero. For a healthy business, net worth will be positive. For a bankrupt firm, net worth will be negative. In either case, on a bank’s T-account, assets will always equal liabilities plus net worth.

When bank customers deposit money into a checking account, savings account, or a certificate of deposit, the bank views these deposits as liabilities. After all, the bank owes these deposits to its customers, when the customers wish to withdraw their money. In the example in Table 10.2, the Safe and Secure Bank holds $10 million in deposits.

Loans are the first category of bank assets in Table 10.2. Say that a family takes out a 30-year mortgage loan to purchase a house, which means that the borrower will repay the loan over the next 30 years. This loan is clearly an asset from the bank’s perspective, because the borrower has a legal obligation to make payments to the bank over time. However, in practical terms, how can we measure the value of the mortgage loan that the borrower is paying over 30 years in the present? One way of measuring the value of something—whether a loan or anything else—is by estimating what another party in the market is willing to pay for it. Many banks issue home loans, and charge various handling and processing fees for doing so, but then sell the loans to other banks or financial institutions who collect the loan payments. We call the market where financial institutions make loans to borrowers the primary loan market, while the market in which financial institutions buy and sell these loans is the secondary loan market.

One key factor that affects what financial institutions are willing to pay for a loan, when they buy it in the secondary loan market, is the perceived riskiness of the loan: that is, given the borrower’s characteristics, such as income level and whether the local economy is performing strongly, what proportion of loans of this type will the borrower repay? The greater the risk that a borrower will not repay loan, the less that any financial institution will pay to acquire the loan. Another key factor is to compare the interest rate the financial institution charged on the original loan with the current interest rate in the economy. If the original loan requires the borrower to pay a low interest rate, but current interest rates are relatively high, then a financial institution will pay less to acquire the loan. In contrast, if the original loan requires the borrower to pay a high interest rate, while current interest rates are relatively low, then a financial institution will pay more to acquire the loan. For the Safe and Secure Bank in this example, the total value of its loans if they sold them to other financial institutions in the secondary market is $5 million.

The second category of bank asset is bonds, which are a common mechanism for borrowing, used by the federal and local government, and also private companies, and nonprofit organizations. A bank takes some of the money it has received in deposits and uses the money to buy bonds—typically bonds issued that the U.S. government issues. Government bonds are low-risk because the government is virtually certain to pay off the bond, albeit at a low rate of interest. These bonds are an asset for banks in the same way that loans are an asset: The bank will receive a stream of payments in the future. In our example, the Safe and Secure Bank holds bonds worth a total value of $4 million.

The final entry under assets is reserves, which is money that the bank keeps on hand, and that it does not lend or invest in bonds—and thus does not lead to interest payments. The Federal Reserve requires that banks keep a certain percentage of depositors’ money on “reserve,” which means either in their vaults or at the Federal Reserve Bank. We call this a reserve requirement. (Monetary Policy and Bank Regulation will explain how the level of these required reserves are one policy tool that governments have to influence bank behavior.) Additionally, banks may also want to keep a certain amount of reserves on hand in excess of what is required. The Safe and Secure Bank is holding $2 million in reserves.

We define net worth of a bank as its total assets minus its total liabilities. For the Safe and Secure Bank in Table 10.2, net worth is equal to $1 million; that is, $11 million in assets minus $10 million in liabilities. For a financially healthy bank, the net worth will be positive. If a bank has negative net worth and depositors tried to withdraw their money, the bank would not be able to give all depositors their money.

How Banks Go Bankrupt

A bank that is bankrupt will have a negative net worth, meaning its assets will be worth less than its liabilities. How can this happen? Again, looking at the balance sheet helps to explain.

A well-run bank will assume that a small percentage of borrowers will not repay their loans on time, or at all, and factor these missing payments into its planning. Remember, the calculations of the banks’ expenses every year include a factor for loans that borrowers do not repay, and the value of a bank’s loans on its balance sheet assumes a certain level of riskiness because some customers will not repay loans. Even if a bank expects a certain number of loan defaults, it will suffer if the number of loan defaults is much greater than expected, as can happen during a recession. For example, if the Safe and Secure Bank in Table 10.2 experienced a wave of unexpected defaults, so that its loans declined in value from $5 million to $3 million, then the assets of the Safe and Secure Bank would decline so that the bank had negative net worth.

The risk of an unexpectedly high level of loan defaults can be especially difficult for banks because a bank’s liabilities, namely it customers’ deposits. Customers can withdraw funds quickly but many of the bank’s assets like loans and bonds will only be repaid over years or even decades. This asset-liability time mismatch—the ability for customers to withdraw bank’s liabilities in the short term while customers repay its assets in the long term—can cause severe problems for a bank. For example, imagine a bank that has loaned a substantial amount of money at a certain interest rate, but then sees interest rates rise substantially. The bank can find itself in a precarious situation. If it does not raise the interest rate it pays to depositors, then deposits will flow to other institutions that offer the higher interest rates that are now prevailing. However, if the bank raises the interest rates that it pays to depositors, it may end up in a situation where it is paying a higher interest rate to depositors than it is collecting from those past loans that it at lower interest rates. Clearly, the bank cannot survive in the long term if it is paying out more in interest to depositors than it is receiving from borrowers.

How can banks protect themselves against an unexpectedly high rate of loan defaults and against the risk of an asset-liability time mismatch? One strategy is for a bank to diversify its loans, which means lending to a variety of customers. For example, suppose a bank specialized in lending to a niche market—say, making a high proportion of its loans to construction companies that build offices in one downtown area. If that one area suffers an unexpected economic downturn, the bank will suffer large losses. However, if a bank loans both to consumers who are buying homes and cars and also to a wide range of firms in many industries and geographic areas, the bank is less exposed to risk. When a bank diversifies its loans, those categories of borrowers who have an unexpectedly large number of defaults will tend to be balanced out, according to random chance, by other borrowers who have an unexpectedly low number of defaults. Thus, diversification of loans can help banks to keep a positive net worth. However, if a widespread recession occurs that touches many industries and geographic areas, diversification will not help.

Along with diversifying their loans, banks have several other strategies to reduce the risk of an unexpectedly large number of loan defaults. For example, banks can sell some of the loans they make in the secondary loan market, as we described earlier, and instead hold a greater share of assets in the form of government bonds or reserves. Nevertheless, in a lengthy recession, most banks will see their net worth decline because customers will not repay a higher share of loans in tough economic times.

10.4 How banks create money

From: From: OpenStax Macroeconomics (http://cnx.org/content/col12190/), Chapter 14.4

Money Creation by a Single Bank

Banks and money are intertwined. It is not just that most money is in the form of bank accounts. The banking system can literally create money through the process of making loans. Let’s see how. Start with a hypothetical bank called Singleton Bank. The bank has $10 million in deposits. The T-account balance sheet for Singleton Bank, when it holds all of the deposits in its vaults, is in Table 10.3. At this stage, Singleton Bank is simply storing money for depositors and is using these deposits to make loans. In this simplified example, Singleton Bank cannot earn any interest income from these loans and cannot pay its depositors an interest rate either.

| Assets | Liabilities + Net Worth | ||

| Reserves | $10 million | Deposits | $10 million |

| Net Worth | $0 |

The Federal Reserve requires Singleton Bank to keep $1 million on reserve (10% of total deposits). It will loan out the remaining $9 million. By loaning out the $9 million and charging interest, it will be able to make interest payments to depositors and earn interest income for Singleton Bank (for now, we will keep it simple and not put interest income on the balance sheet). Instead of becoming just a storage place for deposits, Singleton Bank can become a financial intermediary between savers and borrowers.

This change in business plan alters Singleton Bank’s balance sheet, as Table 10.4 shows. Singleton’s assets have changed. It now has $1 million in reserves and a loan to Hank’s Auto Supply of $9 million. The bank still has $10 million in deposits.

| Assets | Liabilities + Net Worth | ||

| Reserves | $1 million | Deposits | $10 million |

| Loans | $9 million | Net Worth | $0 |

Singleton Bank lends $9 million to Hank’s Auto Supply. The bank records this loan by making an entry on the balance sheet to indicate that it has made a loan. This loan is an asset, because it will generate interest income for the bank. Of course, the loan officer will not allow let Hank to walk out of the bank with $9 million in cash. The bank issues Hank’s Auto Supply a cashier’s check for the $9 million. Hank deposits the loan in his regular checking account with First National. The deposits at First National rise by $9 million and its reserves also rise by $9 million, as Table 10.5 shows. First National must hold 10% of additional deposits as required reserves but is free to loan out the rest.

| Assets | Liabilities + Net Worth | ||

| Reserves | $9 million | Deposits | $9 million |

| Net Worth | $0 |

Making loans that are deposited into a demand deposit account increases the M1 money supply. Remember the definition of M1 includes checkable (demand) deposits, which one can easily use as a medium of exchange to buy goods and services. Notice that the money supply is now $19 million: $10 million in deposits in Singleton bank and$9 million in deposits at First National. Obviously as Hank’s Auto Supply writes checks to pay its bills the deposits will draw down. However, the bigger picture is that a bank must hold enough money in reserves to meet its liabilities.

The rest the bank loans out. In this example so far, bank lending has expanded the money supply by $9 million. Now, First National must hold only 10% as required reserves ($900,000) but can lend out the other 90% ($8.1 million) in a loan to Jack’s Chevy Dealership as Table 10.6 shows.

| Assets | Liabilities + Net Worth | ||

| Reserves | $8.1 million | Deposits | $9 million |

| Loans | $900,000 | Net Worth | $0 |

If Jack’s deposits the loan in its checking account at Second National, the money supply just increased by an additional $8.1 million, as Table 10.7 shows. This could then be turned into another loan.

| Assets | Liabilities + Net Worth | ||

| Reserves | $8.1 million | Deposits | $8.1 million |

| Net Worth | $0 |

How is this money creation possible? It is possible because there are multiple banks in the financial system, they are required to hold only a fraction of their deposits, and loans end up deposited in other banks, which increases deposits and, in essence, the money supply.

The Money Multiplier and a Multi-Bank System

In a system with multiple banks, Singleton Bank deposited the initial excess reserve amount that it decided to lend to Hank’s Auto Supply into First National Bank, which is free to loan out $8.1 million. If all banks loan out their excess reserves, the money supply will expand. In a multi-bank system, institutions determine the amount of money that the system can create by using the money multiplier. This tells us by how many times a loan will be “multiplied” as it is spent in the economy and then re-deposited in other banks.

Fortunately, a formula exists for calculating the total of these many rounds of lending in a banking system. The money multiplier formula is:

Multiplier = 1/Reserve Requirement

We then multiply the money multiplier by the change in excess reserves to determine the total amount of M1 money supply created in the banking system.

For example, in the earlier example, we had a banking system with a 10% reserve requirement that received a $10 million deposit. After an “infinite” number of rounds of loans and deposits, the total deposits in the banking system will be

Change in Deposits = (1/0.1)($10 million) = (10)($10 million) = $100 million.

This means that the money supply increased by $90 million. This is because the $10 million was initially held by someone, but then deposited. That deposit “created” $90 million more in deposits.

Cautions about the Money Multiplier

The money multiplier will depend on the proportion of reserves that the Federal Reserve Band requires banks to hold. Additionally, a bank can also choose to hold extra reserves. Banks may decide to vary how much they hold in reserves for two reasons: macroeconomic conditions and government rules. When an economy is in recession, banks are likely to hold a higher proportion of reserves because they fear that customers are less likely to repay loans when the economy is slow. The Federal Reserve may also raise or lower the required reserves held by banks as a policy move to affect the quantity of money in an economy.

The process of how banks create money shows how the quantity of money in an economy is closely linked to the quantity of lending or credit in the economy. All the money in the economy, except for the original reserves, is a result of bank loans that institutions repeatedly re-deposit and loan.

Finally, the money multiplier depends on people re-depositing the money that they receive in the banking system. If people instead store their cash in safe-deposit boxes or in shoeboxes hidden in their closets, then banks cannot recirculate the money in the form of loans. Central banks have an incentive to assure that bank deposits are safe because if people worry that they may lose their bank deposits, they may start holding more money in cash, instead of depositing it in banks, and the quantity of loans in an economy will decline. Low-income countries have what economists sometimes refer to as “mattress savings,” or money that people are hiding in their homes because they do not trust banks. When mattress savings in an economy are substantial, banks cannot lend out those funds and the money multiplier cannot operate as effectively. The overall quantity of money and loans in such an economy will decline.

Money and Banks – Benefits and Dangers

Money and banks are marvelous social inventions that help a modern economy to function. Compared with the alternative of barter, money makes market exchanges vastly easier in goods, labor, and financial markets. Banking makes money still more effective in facilitating exchanges in goods and labor markets. Moreover, the process of banks making loans in financial capital markets is intimately tied to the creation of money.

However, the extraordinary economic gains that are possible through money and banking also suggest some possible corresponding dangers. If banks are not working well, it sets off a decline in convenience and safety of transactions throughout the economy. If the banks are under financial stress, because of a widespread decline in the value of their assets, loans may become far less available, which can deal a crushing blow to sectors of the economy that depend on borrowed money like business investment, home construction, and car manufacturing. The 2008–2009 Great Recession illustrated this pattern.