Closing the Business

If your client cannot find a buyer, or they just want/need to close the business, there are procedures that must be followed. There are also numerous considerations. First, think about the customers. Will you be referring them to someone else? Have you notified your employees?

Governmental Compliance

State Government

Pennsylvania’s Business One-Stop Shop will create a customized business checklist for you and your client. As you can see, the site provides various checklists. Our focus is on the last choice—closing the business.

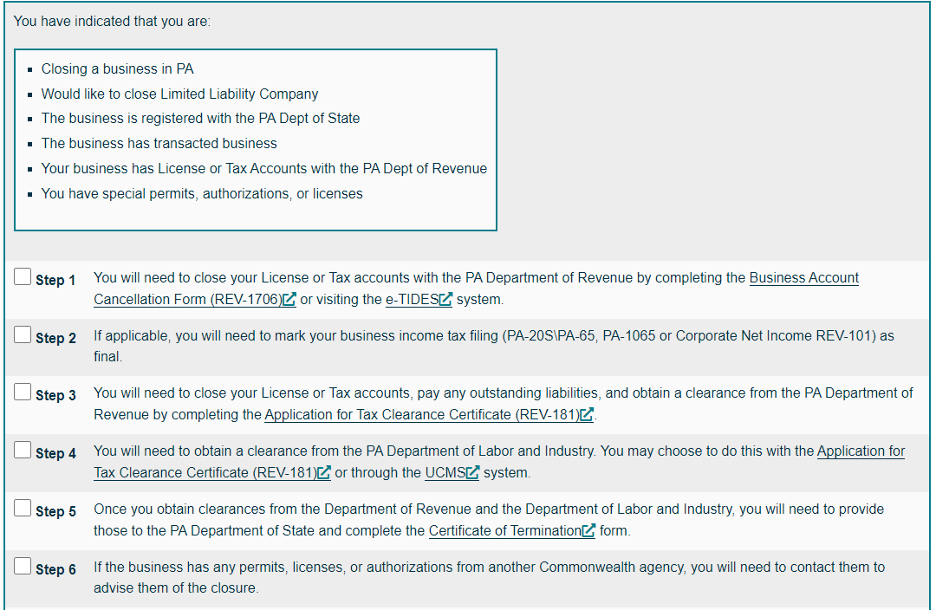

Here is what comes out:

As you can see, it is pretty helpful and provides useful links. It seems to me that the Dissolution form is missing. This needs to be filed when the company is ready to start closing down. After the dissolution form is filed, it is time to wind up the business. “Dissolution” signifies the beginning of the end for unincorporated associations such as partnerships and limited liability companies. The end itself is labeled “termination.” See 15 Pa.C.S. § 8872(f).

Federal Government

Federally, you will need to file the client’s final income tax form. Usually, there is a box that needs to be checked that indicates it is the final one.

After employees receive their final paychecks, our client has to make their final tax deposits and report the employment taxes. If this is overlooked, the business owner could be subject to the trust fund recovery penalty. On Forms 941 and 940, there is a box indicating this is the final return.

If the client had a 401(k) or other retirement plan, there are steps that need to be taken to terminate it. Note that when a 401(k) plan terminates, all plan participants will become 100% vested in employer contributions.

Remind the client that W-2s and any Form 1099s will need to be taken care of.

Ultimately, close the IRS business account and cancel the EIN.

One extra word of advice is to recommend that the client saves all paperwork for at least 4 years.

Miscellany

- If the business had any assets, it is time to sell them off. This can be done piecemeal and does not need to be done like a big asset sale. For instance, excess inventory could be sold to a competitor. A truck could be sold to anyone who wants to buy it.

- If the business had creditors, it is time to pay them.

- Close the bank accounts.

- Cancel insurance.

- Check any contracts for termination clauses.

💡Put yourself in the place of a business owner who is closing down. What other loose ends need to be taken care of?