Why Worker Classification Matters

The following explanation is excerpted from Samantha J. Prince, The AB5 Experiment – Should States Adopt California’s Worker Classification Law?, forthcoming 11 Am. U. Bus. L. Rev. 43, 49–51 (2022) with footnotes provided in the sources portion of this unit. 📖 You may find the full article of interest.

The United States has been classifying workers as either “employees” or “independent contractors” since 1857. A worker’s classification has economic, social, and legal importance. Those who are considered employees qualify for benefits and have certain legal protections that independent contractors do not. The effects of being classified as an employee include, among other things, discrimination protection, tax, economic, labor (right to class certification, right to organize, wage/hour benefits, worker’s compensation, unemployment compensation), fiduciary duties, and tort liability. For instance, employees are protected from discrimination but independent contractors are not; employees have taxes withheld from their paycheck and their employer pays half of their social security and medicare taxes, but since independent contractors do not have “employers” they must remit their own taxes and pay their social security and medicare taxes in their entirety; employees have a right to organize and be part of a class in court cases, whereas independent contractors do not; employees, unless they are exempt, are protected by minimum wage and hour laws – independent contractors do not have these protections; employees owe their employers fiduciary duties, independent contractors do not, and an employee’s tortious acts can cause its employer to be liable through respondeat superior for those acts, but this is not true for independent contractors (save for some select circumstances). Also, employment-related benefits such as participation in an employer’s 401(k) plan, health insurance and other benefits exist for employees (and often on a tax-free basis) but if independent contractors want those benefits, they have to set them up, and pay for them, themselves. Independent contractors are not covered by an employer’s worker’s compensation insurance and are not generally entitled to unemployment compensation.

It is cheaper economically for companies to hire independent contractors. This is true for numerous reasons. One, the company won’t have to pay half of the worker’s social security and medicare taxes. That is an approximate 8-9% of pay savings! Further, if one is an independent contractor, the company does not have to include them for purposes of benefits such as healthcare, retirement, etc. Further, there is less chance of respondeat superior liability if the worker is an independent contractor. 💡 Can you think of other reasons why a hiring company may not want to classify workers as employees?

Here is an example from The Public Cost of Low-Wage Jobs in the US Construction Industry.

Professor Mark Erlich calls construction “the original gig economy,” noting that while independent contractors comprise 7% of the national workforce, around 20% of all independent contractors are construction workers. A significant portion of these workers are misclassified. State-level studies have found misclassification rates in construction of almost 15% in New York and 30% in Virginia. In 2011 an estimated 19% of California construction workers who were independent contractors were misclassified; these workers earned only 67 cents for every dollar earned by comparable workers with employee status. An investigation by McClatchy news found that more than a third of construction workers in Southern states were misclassified. The reason for the excessive use of independent contractors and the high levels of misclassification is obvious. Around one-third of labor costs can be eliminated by classifying workers as independent contractors; employers do not have to pay unemployment insurance, Social Security, Medicare, or workers’ compensation premiums.

…

The low wages and exploitative practices in the construction industry that cause profound hardship for many workers and their families also cost the public. When employers misclassify their workers or pay them under the table, they are defunding and defrauding government programs, including workers’ compensation, Social Security, and Medicare. Ormiston et al. (2020) conservatively estimate that fraud in the construction industry yields Social Security and Medicare shortfalls of between $1.36 and $4.28 billion annually; federal income tax losses of $319 million to $1.26 billion; and state income tax revenue losses of $160 to $552 million. Overall, misclassification is estimated to cost state and federal coffers at least $3,000 annually for every worker that is misclassified. The lack of both employer-provided insurance and access to workers’ compensation leaves many construction workers unprotected and uninsured. And, as found in this analysis, low-road employment practices cause above-average utilization of safety net programs by construction working families.

📖 Read Misclassification in Construction: The Original Gig Economy, which is referenced in the above excerpt.

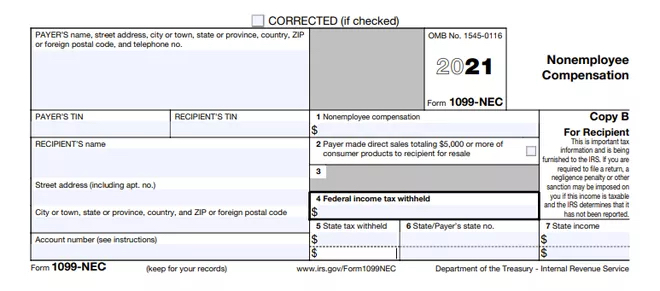

When workers work and get paid, they will owe taxes to the IRS and other taxing authorities on their income. Employees have taxes withheld by their employers and are issued a W-2 that will show how much income they earned and how much they’ve paid in taxes. Alternatively, an independent contractor does not have taxes withheld and will receive a Form 1099-NEC instead of a W-2 to show the amount paid to them. Form 1099-NEC was new as of tax year 2021 and replaces the former use of Form 1099-MISC for nonemployee compensation. (Form 1099-MISC still has other uses so it has not become entirely obsolete, but it will no longer be used for nonemployee compensation.) Note that there is a spot for federal income tax withheld, however, there is no requirement that taxes be withheld and most companies do not withhold taxes for their independent contractors.