Wage and Hour Laws

In the U.S. we have employee wage laws at the city, state, and federal levels. Before we talk about the specifics of any one particular law, it’s important to note that an employee is entitled to follow whichever wage laws provide them the highest wage. For instance, where the state minimum wage is lower or higher than the FLSA wage requirement, the employee is entitled to the higher of the two.

Minimum Wage – FLSA

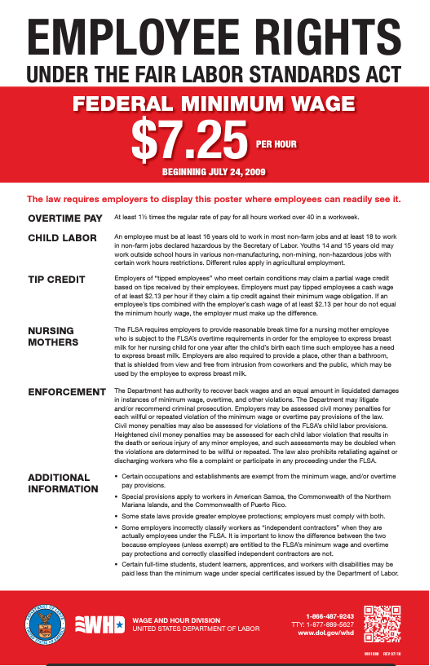

The FLSA became effective in 1938 during the Roosevelt administration. Its goal was to protect workers from exploitation prevalent in the industrial revolution. It provides basic pay standards for employees, such as minimum wage, overtime pay, and child labor standards. The Wage and Hour Division (“WHD”) of the Department of Labor administers and enforces the FLSA with respect to private employers. Employers are required to hang informational posters to educate employees about applicable wage laws. These posters, in several languages, are available on the DoL website for free. You should advise your client that they do not need to, and should not, purchase such posters.

The FLSA minimum wage is $7.25/hour (as of 1/29/22). We have seen bills introduced to amend the FLSA to increase the minimum wage, but they have not passed as of this writing.

The FLSA minimum wage is $7.25/hour (as of 1/29/22). We have seen bills introduced to amend the FLSA to increase the minimum wage, but they have not passed as of this writing.

Who is covered by the FLSA? Businesses can be subject to the FLSA in three different ways:

Enterprise Coverage: Gross annual revenues of at least $500,000 with at least two employees who handle goods in interstate commerce. This threshold pretty much guarantees that any business with at least two employees that meets the revenue threshold will be required to comply with FLSA because interstate commerce includes using anything that was made out-of-state, e.g. paper, pens, office furniture, etc. Note that if a business has several locations that do similar work (related activities, common control, common business purpose), then they will all be considered as part of the same enterprise for purposes of determining whether the business meets the $500,000 threshold. Organizing each location as a separate entity or with their own EINs does not change this aggregation. Well, what if a business owner has four businesses that meet the related activities, common control, and common business test but one of them only has $50,000 in annual revenue? If the aggregate meets the $500,000 threshold, then all employees at all of the businesses (including the smaller one), will be subject to the FLSA.

Individual coverage: If an employee’s work or job duties involve them in interstate commerce (work that crosses state lines). For example, sending an email that goes out of state or processing a credit card transaction. Individually covered employees are subject to FLSA protection; those that are not will not be.

Named enterprise coverage: There are certain businesses that the FLSA specifically lists to be subject to its requirements, regardless of the size of the business, e.g., hospitals, schools, government agencies.

If a business meets one of the above types of coverage, then it must compensate employees with at least the minimum wage, comply with the overtime rules, child labor rules, and posting of legal information and rights.

Note that the minimum wage for federal contractors increased to $15/hour (eff. Jan. 30, 2022) via the Raise the Wage Act. “[W]hile the $15 minimum wage will apply to construction workers, it will also apply to child care, health care, and building and other services workers employed on federal contracts. About 54% of the workers impacted by this minimum wage increase are women, and about 25% are workers of color. All of the workers who benefit from our minimum wage final rule will get an average raise of $5,228 per year” (Quote in the DoL’s blog, post by Jessica Looman). This new rule applies to not only new contracts but also to extensions or renewals of existing contracts and to the exercise of options within existing contracts. This means that the federal government could exercise an option in an existing contract to make it subject to the $15/hour rule. If you are interested in which contracts are covered and which were exempted/carved out, take a look at the rule. Lawsuits seeking exemption have already started. See, Amanda Pompuro, Judge refuses to exempt Colorado river guides from new $15 federal minimum wage, Missoula Current (Jan. 25, 2022).

Minimum Wage – States

Some states have more generous minimum wage laws; some states have no minimum wage laws showing deference to the FLSA. Look here at the State minimum wage rates as of January 1, 2022. While some states have scheduled incremental increases to reach a $15/hour minimum wage, California already has it for companies with 26 or more employees ($14 for companies with 25 or fewer employees).

Minimum Wage – Cities

New York City is a good example of a city that is proactive regarding those who work within city limits. The minimum wage for businesses in NYC, regardless of business size, is $15/hour.

Overtime – FLSA

Another part of the FLSA has to do with overtime pay. Overtime pay is 1.5 times regular pay and must be paid when an employee works more than 40 hours per week. An employer can set its pay week however it would like but it cannot switch it around. 💡Think about a certain type of business and whether it would make sense for them to deviate from a calendar week for its payroll/workweek.

There is no rule that says that you must pay people hourly, but unless the employee is exempt, you still must look at the number of hours they worked to see if they are working beyond 40 hours per week. For instance, a shuttle service was paying drivers a flat rate without regard to the number of hours they were actually working. Turns out that drivers were working 45-60 hour weeks. The company was ultimately found liable for $742,000 in back wages.

Another issue arises when employers do not count the hours of work properly. Here, an auto repair shop did not accurately calculate the hours worked and also did not include commissions earned when calculating whether overtime pay was due. The result was $79,505 in back wages for 72 workers.

AND if a company asks its workers to waive their right to overtime, and then does not pay them FLSA overtime pay, they will be in violation. “Investigators with the U.S. Department of Labor’s Wage and Hour Division found Alii Security Systems Inc. of Honolulu established a ‘voluntary program’ that offered guards more work hours if they waived their right to overtime and accepted straight-time pay for all hours worked. The division determined the company intentionally violated the Fair Labor Standards Act’s overtime laws, which requires that most employees be paid overtime pay when they work more than 40 hours in a workweek. The division identified $739,886 in back wages and an equal amount in liquidated damages owed to the workers, and assessed $60,000 in civil money penalties for the willful nature of violations.” See the news release.

Remember independent contractors are not protected by the FLSA and therefore not entitled to overtime pay. Therefore, if a company misclassifies its workers as independent contractors, it would be liable if it violated the overtime laws.

Surely there are exemptions from these overtime laws. What if the business pays the employee a salary? Many business owners and managers mistakenly believe that if an employee is salaried, they are automatically exempt from overtime pay. That thinking is over-inclusive and as attorneys, we need to pay attention to the intricacies of the overtime exemptions. So let’s look at the white-collar worker exemption which looks at any employee “employed in a bona fide executive, administrative, or professional capacity.” There are three tests that must be met for the employer to be able to exclude an employee from overtime pay:

- Salary Basis Test – The employee must be paid on a salary or fee basis (not hourly) and that salary cannot be reduceable due to variations in the quality or quantity (hours) of the work performed.

- Standard Salary Level Test – The employee must be paid a certain minimum level of salary (as of 2020 this level is $684/week or $35,568/year).

- Duties Test – The employee’s job duties must primarily involve executive, administrative, or professional duties.

There is also a special category that exempts “highly compensated employees” if their total annual compensation exceeds $107,432 and they customarily and regularly perform at least one of the exempt duties or responsibilities of an executive, administrative, or professional employee.

Computer (IT) professionals can be either paid a salary within the same amounts in #2 above or can be paid by the hour as long as it is at least $27.63/hour.

Sales employees are not required to have a minimum salary.

While our main goal is to advise clients, certainly we would like to know how we, as law professionals, fit within these rules right? 📖 Read 29 CFR § 541.304. Are we exempt from the overtime laws?

As practitioners, we will have to be knowledgeable in the state laws that apply to our clients as well. Sometimes the state aligns well with the FLSA, sometimes they are more generous.

Investigations – FLSA

If employees file complaints with the WHD of the Department of Labor, the WHD may choose to conduct an investigation looking into an employer’s compensation practices. The WHD also selects certain types of business or industries, specifically low-wage industries, to investigate compensation practices. A WHD investigator will review how employers pay their employees and ask to see records, such as payroll and time records. The purpose of these investigations is to determine whether employers have properly classified employees as exempt or non-exempt and whether minimum wage and overtime obligations are met.

Child Labor – FLSA

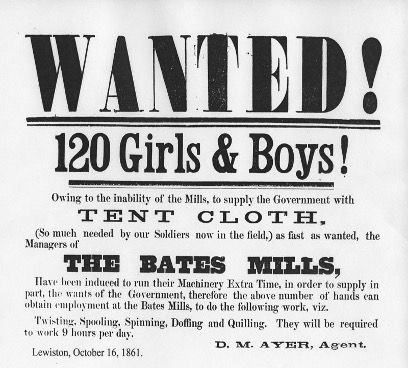

Often we think that child labor laws are not really being violated any more. We aren’t the same society that was hiring children to work in sewing factories, right? Well let’s see… how about some headlines:

Often we think that child labor laws are not really being violated any more. We aren’t the same society that was hiring children to work in sewing factories, right? Well let’s see… how about some headlines:

Jordan Valinsky, CNN Business, Chipotle cited with 13,253 child labor law violations in Massachusetts.

[PA] Labor & Industry Helps Return $3.5 Million to Workers Wronged by Employers in 2021 (In 2021, the bureau issued fines to more than 100 entities and collected $3.1 million in child labor fines that were deposited into the general fund.)

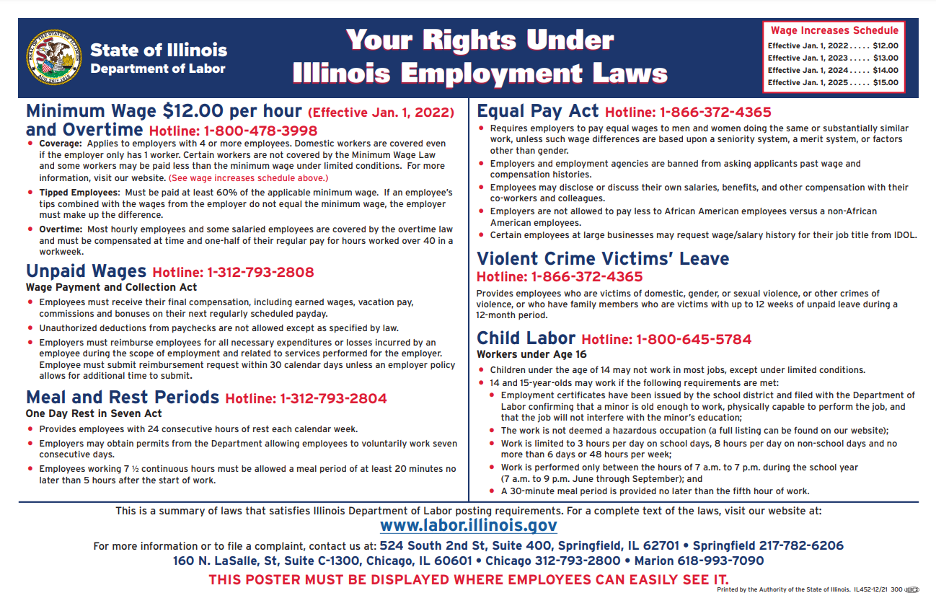

Child labor laws were created to “protect the educational opportunities of youth and prohibit their employment in jobs that are detrimental to their health and safety.” It’s an important policy to protect young people and their well-being. Yet we see evidence that these laws are still being violated. Here is a poster for Illinois employers to display in a common area at their workplace that clearly outlines the state’s child labor law and other employment laws.

As you can see there are numerous rules that indeed are designed to limit the hours that children work so as not to interfere with their education and safety concerns.

As you can see there are numerous rules that indeed are designed to limit the hours that children work so as not to interfere with their education and safety concerns.

Notably, Pennsylvania’s child labor laws remained unchanged from 1915 until 2012. In 2012, the Pennsylvania Child Labor Act was enacted, repealing the 1915 act. The law prohibits children under the age of 14 from working (with some exceptions). Anyone under age 18 must have a 30-minute break after 5 consecutive hours of work and they cannot work more than 6 consecutive days. A work permit is required and parental permission with an acknowledgment of duties and hours of employment is also required. PA also adopted the rule from the FLSA that children cannot work in hazardous occupations.

In PA, children who are 15 and under may not work before 7:00 am or after 7:00 pm, except that during school vacation periods they can work until 9:00 pm. They may not work more than 3 hours on a school day or more than 8 hours on a day when there is no school. They may not work more than 18 hours during a regular school week or more than 40 hours when school is not in session. There can be no “youth peddling,” which means they cannot engage in the sale of goods or services or hold signs or merchandise in order to attract potential customers unless the minors are stationed directly in front of the employer’s place of business (this is permissible as volunteers for non-profits).

If children are 16 or 17 they have less stringent rules. They may not work more than 28 hours during a regular school week. They may not work before 6:00 am or after midnight except until 1:00 am on Fridays and Saturdays or on days preceding a vacation during a school year. During school vacation, they may work up to 10 hours in a single day and up to 48 hours per week. If the child is not enrolled in school, there is no hourly limitation.

There are some exceptions to the above, like for volunteer firefighters in training and newspaper delivery people.

The FLSA contains child labor provisions that many states refer to or base their laws on. If your client is in the agricultural business, the rules could be different. Children under 14 are limited as to what they can do and the FLSA provides a list. Some things on the list include: babysitting on a casual basis, delivering newspapers, acting, performing, working as “a homeworker gathering evergreens and making wreaths,” working for a business owned entirely by the child’s parents as long as it is not in mining, manufacturing or hazardous.

As you may expect, the FLSA outlines what is hazardous. Some occupations that are deemed hazardous are:

- Manufacturing or storing of explosives

- Driving a motor vehicle or working as an outside helper on a motor vehicle

- Mining

- Forest fire fighting and prevention

- Logging and sawmilling

- Using power-driven woodworking machines

- Exposure to radioactivity

- Using power-driven metal forming, punching, and shearing machines

- Using power-driven bakery machines

- Using balers, compactors, and power-driven paper products machines

- Manufacturing bricks, tile, and related products

- Using power-driven circular saws, band saws, etc.

- Working in wrecking, demo, and shipbreaking operations

- Roofing

- Trenching or excavating

Children 14-15 may work:

- 3 hours on a school day;

- 18 hours in a school week;

- 8 hours on a non-school day;

- 40 hours in a non-school week; and

- between 7 a.m. and 7 p.m., except from June 1 through Labor Day, when nighttime work hours are extended to 9 p.m.

Notably, the FLSA does not require work permits like Pennsylvania does. It also does not limit the number of hours or times of day that workers 16 years of age and older may legally work.

Jon Hyman, What Should You Do When the DOL Shows Up at Your Door?, Ohio Employer Law Blog (Dec. 7, 2022), https://www.ohioemployerlawblog.com/2022/12/what-should-you-do-when-dol-shows-up-at.html.

Fact Sheet #44: Visits to Employers, Wage and Hour Division: United States Department of Labor (Rev. Jan. 2015), https://www.dol.gov/agencies/whd/fact-sheets/44-flsa-visits-to-employers#:~:text=In%20addition%20to%20complaints%2C%20WHD,such%20as%20growth%20or%20decline.