Barriers

Women and people of color traditionally receive less money in funding than their white-male counterparts. 💡 Think about ways you can help to change this!

Women

VCs have allocated less than 3% of capital to businesses with female founders and evidence suggests that gender bias still accounts for up to 35% of this funding gap. While improvements are being made on this front, more than 80% of deals still go to male-only founder teams.

“Because average deal size is smaller for firms with female founders than for those with male-only founders, the share of total capital allocated to female-founded firms is smaller than deal share. There have been no meaningful changes to female-founded only share of capital invested… Firms with only male founders received 88% of VC capital in 2019.” Source: Pitchbook Female Founders Dashboard, Guzman & Kacpercyzk, 2019.

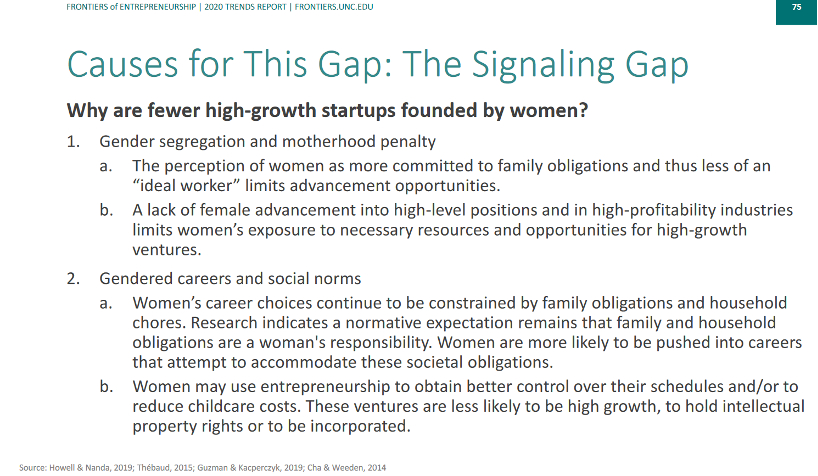

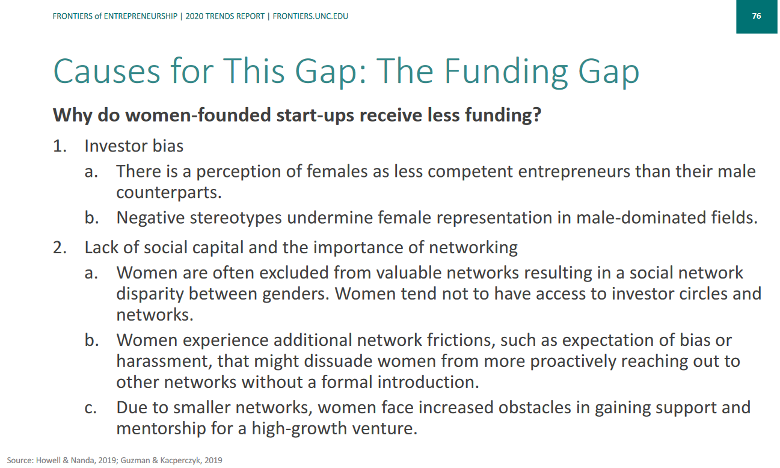

Causes for this gap, as cited in the Frontiers in Entrepreneurship: 2020 Trends in Entrepreneurship Full Report :

People of Color

The lack of VC funding for minority entrepreneurs is in part from underrepresentation in VC firms. Many of the above causes for the gaps stated for women are the same for people of color.

🎧 Listen to this excellent podcast: Business Scholarship Podcast where Professor Jennings interviews Professor Carlos Berdejó on his latest scholarly work: Financing Minority Entrepreneurship. I recommend reading the article in its entirety when time permits.

You read this article by James Norman earlier in the semester, but it warrants another read within our capital raising context.

“Because Black and brown entrepreneurs continue to be the engine of employment in Black and brown communities, an equitable recovery requires us to rewrite how capital and access to capital work. To do so, capital decision-makers need to be knowledgeable about the history and root causes of the country’s racial wealth gaps. And, we need to explore new ways of investing in fund managers of color.” Philip Gaskin and Demetric Duckett, Ewing Marion Kauffman Foundation, “Leveraging Entrepreneurship to Close Racial Wealth Gaps,” October 20, 2020. 📖 Read the Gaskin and Duckett article.