Sources of Capital

There are several ways an entrepreneur can obtain seed capital:

- Bootstrapping (personal savings)

- Borrowing

- Friends and family loans

- Banks

- Credit cards

- Online microlenders and web-based lenders

- Investors

- Friends and family

- Venture Capital

- Angels

- Other companies (suppliers, customers, etc.)

- Grants

Bootstrapping & Borrowing

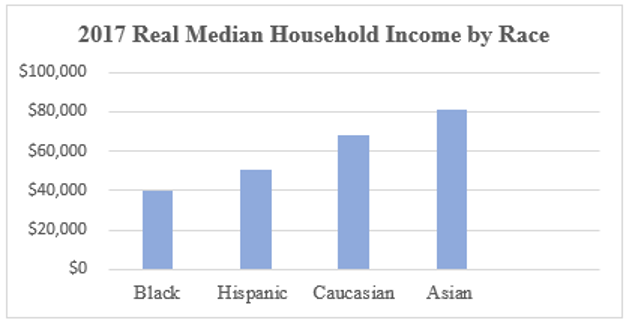

Often entrepreneurs fund or partially fund their business themselves. This money can come from savings, credit cards, from selling personal assets, or as we discussed in Unit 5, from a 401(k) plan with a previous employer. Bootstrapping is difficult on many entrepreneurs but with Black entrepreneurs it may be more difficult. The average Black household income in the United States is $40,258 (the lowest of all races). U.S. Census Bureau

These statistics impact a Black entrepreneur’s ability to borrow or obtain funding from friends and families as well. 📖 Read this short essay written by Rachel Tunney and Professor Prince for a race and equal protection presentation given in November, 2020: REP Capitalism – Black Entrepreneurs 2020.

Using a credit card is a rough way to start a business. The interest rates are too high and for some, their credit is poor, so access to credit cards can be next to impossible (unless it carries a very high interest rate). Turning to microlenders and web-based lenders is a good idea. Some of these lenders will invest in any kind of company or entrepreneurial endeavor (Paypal for example) and others have specific criteria or specialties. Take EnrichHer for instance. EnrichHer was started by Dickinson Law Inside Entrepreneurship Law blog September 2020 Entrepreneur of the Month, Dr. Roshawnna Novellus for investment in women and underrepresented entrepreneurs.

I refer clients to the SBA site as a complement to my advice. The SBA provides helpful advice on raising capital including loans and grants. The SBA even backs loans for businesses who are unsuccessful at securing a traditional business loan. This is legwork that your client can do but we need to understand the processes as well.