Buy-sell Arrangements

Buy-sell arrangements are agreements between owners of a business that allow the owners to control who gets the ownership interest when an owner leaves. For corporations, the buy-sell allows shareholders to control the stock outstanding by restricting its transfer. (Transfer restrictions are placed in red on the stock certificate.)

I use the term “arrangements” rather than “agreements” to indicate that buy-sell provisions can be within a company governing document, such as an LLC Operating Agreement, or it can be a stand-alone Shareholders’ Agreement for corporate entities. Regardless, of the house where these provisions live, they pretty much look the same, and are agreements between the owners of the business.

Picture it: Cassidy, Brenda, Deidre and Akeem own an LLC. Each is instrumental to the success of the business as they have a different knowledge base. They would not like to bring in another owner – ever. Deidre unexpectedly dies and their LLC ownership interest passes to their spouse. Now what? Cassidy, Brenda and Akeem are stuck with Deidre’s spouse as an owner and that is not what they want. What if Deidre’s spouse does not want to own a part of the LLC and would rather be bought out? How does this occur? When does it occur? Who ensures a fair buy-out price? What if Deidre’s spouse does want to be an active owner but Cassidy, Brenda and Akeem do not want that?

This small hypo highlights one reason why owners should have a buy-sell arrangement set up from the beginning. Boiling this down, the main reasons that business owners enter into buy-sell arrangements are to:

- Create liquidity for an owner who departs due to certain triggering events

- Create liquidity for the family of a deceased owner (so that they are not stuck with an illiquid ownership interest)

- Provide a valuation method for a departing owner’s interest

- Establish a value for the business for federal estate/gift tax purposes

- Facilitate a smooth transition of management and control for the remaining owners

- Keep an ownership interest away from undesirable owners

Attorneys need to be vigilant when it comes to advising clients of the importance of setting up a buy-sell arrangement when the company is first organized. Often clients do not see the immediacy and would rather put these sorts of things off so they can conserve time and money for more immediate needs. Often, I would tell clients that LLC Operating Agreements and the buy-sell provisions are important to avoid fighting later. Why would the client want to spend time building a business only to have the lack of an agreement cause it to crumble later?

Buy-sell arrangements may be amended from time to time. 💡 Think about what kind of scenarios will require an amendment.

Triggering Events

Certain events trigger the use of the buy-sell provisions. The events that trigger the use of the buy-sell provisions are outlined within the document. 💡 How many different triggering events do you see in the hypo from our last section?

Commonly used triggering events are:

- Death

- Disability

- Retirement (set retirement age?)

- Termination of Employment (voluntary and involuntary)

- Sales or gifts to Third Parties

- Bankruptcy (transfer to a third party)

- Divorce (transfer to an ex-spouse)

- Deadlock

- Time

One of the main reasons to have a buy-sell arrangement is so the owners can ensure they do not end up with a co-owner that they do not want. Providing that a buy out needs to occur upon certain of the triggering events is important. How do we parse this out? A decision must be made as to which events result in a mandatory purchase and which trigger a right of first refusal or an option to purchase. In my experience, most agreements treat death and disability as mandatory purchase events because the deceased or disabled owner is no longer in a position to negotiate with their co-owners. Retirement at the stated retirement age is also considered a mandatory purchase. The other triggering events can go either way but often the arrangements are set up to give the remaining owners a right of first refusal to match a third party offer or an option to purchase under the price and terms set forth in the buy-sell provisions.

Divorce is a typical triggering event. How can a buy-sell help in divorce situations? Example: Owner is getting divorced and needs to split the assets. The ownership interest is an asset and will need to be valued. The buy-sell can help with the valuation of their interest. Further the other owners will want to be sure that they are not put into a situation where they own a company with an owner’s ex-spouse, so they will want to preserve the ability to buy back that ownership interest.

💡 How do “deadlock” and “time” work as triggering events?

Valuation

A good buy-sell arrangement not only describes when an interest will be sold but for how much as well. There are several different ways that businesses compute a value for their company, and therefore assign a value to an ownership interest. However, it is not one-size-fits-all and you (and the owners) may need to be creative. Always keep in mind that whatever method is chosen, it has to be a fair value.

Some agreements will use a fixed price that is subject to periodic revaluations and provide for an appraisal if the owners cannot agree on a revaluation, or if they simply fail to amend their agreement to take into account a revaluation. You can imagine that business owners don’t really think about amending their documents every year or two, so if this method is being used, you will want to be the one to reach out to check as to revaluations.

Most valuations are formulaic and based on either book value, adjusted book value, multiple of earnings, fair market value (appraisal) or a customized formula. Some are completely unique to the business. As I said earlier, the goal is to achieve a fair valuation.

Book Value

A company’s “book value” is easily located on its Balance Sheet. Book value is total assets minus total liabilities. It’s easily computed with simple first grade math, and it requires no appraisal. However, while its simplicity is alluring, it may not always be the best way to value the company. The assets on the balance sheet are listed at cost less depreciation so they may not reflect the true fair market value of the assets. Additionally, if a company has any goodwill, that will not be taken into consideration.

Startups are well positioned to use book value at the beginning. Their assets are new and have not yet depreciated; and they have no goodwill because they are just starting. For many startup clients, I advised using book value as their buy-sell valuation method initially with an anticipated change of valuation method after we revisit in 2-3 years.

Adjusted Book Value

This valuation method starts with the company’s book value and then adjusts it upward or downward to reflect the current fair market value of tangible assets (real estate, equipment, inventory, etc.) An appraiser will need to be used to determine the fmv of these assets.

Multiple of Earnings

When valuing a company based on a multiple of its earnings, we start with the Statement of Operations (or Statement of Income) rather than the Balance Sheet. Here the business value is calculated by multiplying earnings by a multiplier. Often the earnings used are an average over a certain number of years, say 3-5 years. Additionally, they can be weighted to emphasize the business’ most recent earnings. (Weighting captures the earnings trend.) An appraiser or the company’s accountant is best positioned to develop the appropriate earnings multiplier. They are also best positioned to make adjustments to the earnings – things that may have affected earnings numbers but don’t reflect the true earnings of the company e.g., excessive salaries, nonrecurring expenses, etc.

Fair Market Value

This is the fairest of all of the valuations. Hire an appraiser and figure out what the true value of the business is based on fmv of assets, current liabilities, earnings, etc. As a matter of fact, many appraisers will look at the company from all three of the aforementioned methods and then tweak it to make it more accurate. Perhaps they will determine that a combination of the methods work best. It’s costly. Appraisers are not cheap.

Customized Formula

From time to time, you represent a business that is unique and to use one of the aforementioned valuations may not provide the best value. Or, simply, the owners want to create their own formula. Maybe they use book value then add an arbitrary percentage (+15%) to accommodate for goodwill and any appreciation in the company’s assets. Going this route saves on the costs of an appraiser.

Perhaps it makes more sense to start with an industry comparable company valuation and then tweak from there. Drafting such a method can be difficult but it is doable. Be sure to define what the “industry” is and also what “comparable” means.

💡 What is the fairest way to value a business that has recurring income through contracts? Say we represent a company that has little in the way of tangible assets and it sells a service that someone contracts for by the year. So, a 2-year contract will cost the customer $50/month. How can we value this company? What must be taken into account?

Types of Buy-outs

There are different ways in which to implement a buy-out and there are tax considerations associated with each. When drafting the buy-sell provisions one of the following must be chosen:

- Redemption (entity)

- Cross-purchase

- Hybrid

Let’s remember our hypo:

Cassidy, Brenda, Deidre and Akeem own an LLC. Each is instrumental to the success of the business as they have a different knowledge base. They would not like to bring in another owner – ever. Deidre unexpectedly dies. Say they each own 25% of the business before Deidre dies and they each have a basis in their ownership interest of $10,000. The ownership interest is worth $15,000 when Deidre dies.

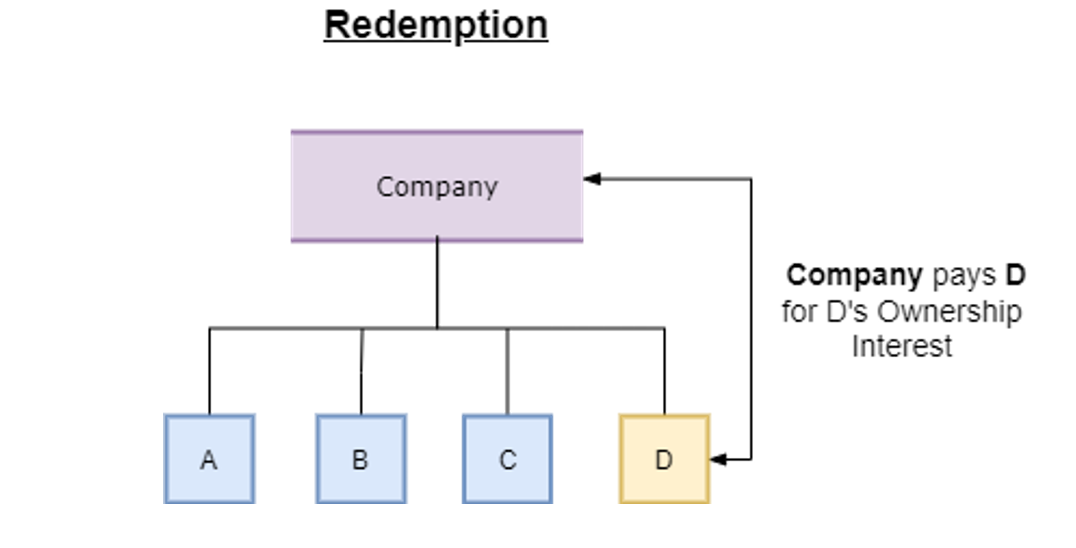

Redemption

In a redemption, the company buys back the departing owner’s interest. It’s the simplest of the buy-out forms.

If the company pays the prior owner in installments with interest accruing, the interest will be a deductible business expense to the company.

The departing owner will have capital gain or loss on their investment if the buy-out causes a complete termination of the owner’s interest.* One exception is if the departing owner has died, their ownership interest gets a “stepped up basis” to the fair market value of the ownership interest on the date of death resulting in no capital gains or loss.

The company does not have a tax consequence when buying back the ownership.

*Note, there are family attribution rules that apply here. So, if certain members of a departing owner’s family also own an interest, then a departing owner cannot completely terminate – this means that gains/losses will be ordinary instead of capital.

Apply the hypo:

The LLC buys back Deidre’s shares for $15,000. Deidre’s estate receives the $15,000. Deidre’s estate gets a stepped up basis in the shares to $15,000 so there is no gain or loss. Easy enough. 💡 What percentage of the business do Cassidy, Brenda and Akeem now own? What basis do each have in their ownership interest before and after Deidre’s ownership interest is purchased?

Cross- Purchase

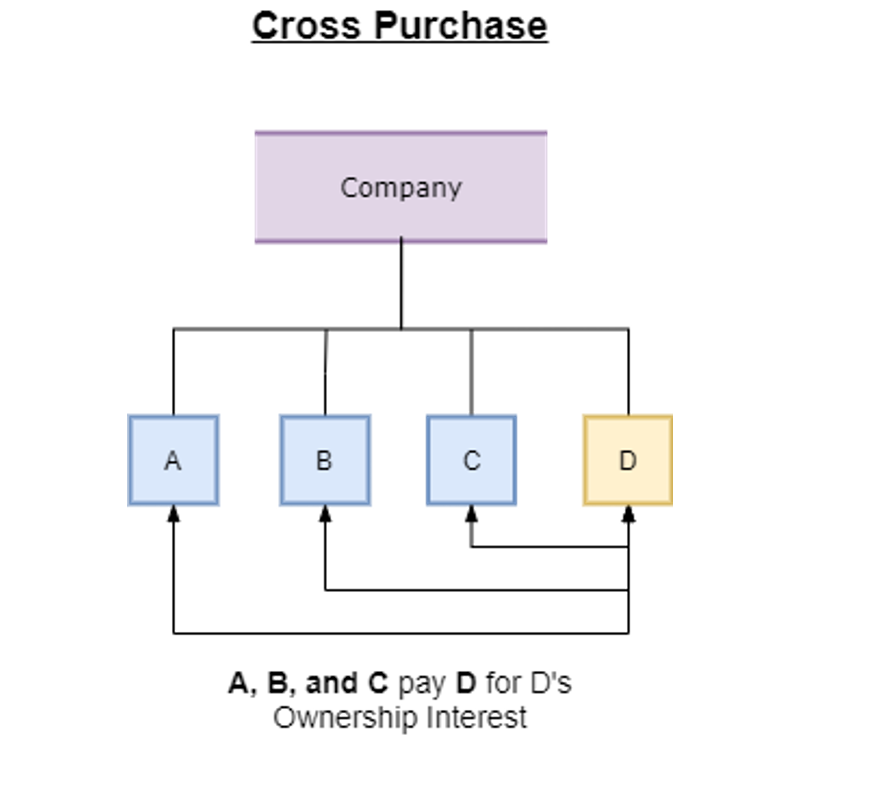

In a cross-purchase arrangement, the other owners (not the company) buy out the departing owner’s interest.

When an owner buys an interest, they receive more basis in their holdings. For instance, if you buy stock in ABC Corp for $1,000. Your basis is your cost, $1,000. If you buy more for another $1,000, you’ve invested more into the asset (stock) so you now have a basis of $1,000 (old basis) + $1,000 (new purchase basis) = $2,000.

So, keeping in mind the above, what happens in a cross-purchase is the owners invest more in their overall ownership interest by buying the departing owner’s interest.

Back to the hypo:

Cassidy, Brenda and Akeem each buy back half of Deidre’s interest, $5,000 each. If they each had a basis of $10,000 to begin with and now they are each investing another $5,000, their basis for their ownership interest is now $15,000. 💡 What percentage of the company do they each own?

Compare this to the Redemption scenario. 💡 What percentage does each own in both scenarios?

Now let’s say that Akeem wants to sell his entire interest in the LLC to Marsha for $20,000.

Redemption: Akeem will have $20,000 – $10,000 (basis) = $10,000 gain

Cross-purchase: Akeem will have $20,000 – $15,000 (basis) = $5,000 gain

💡 I assume you realize that an advantage of the cross-purchase is lower gain, but what is the disadvantage?

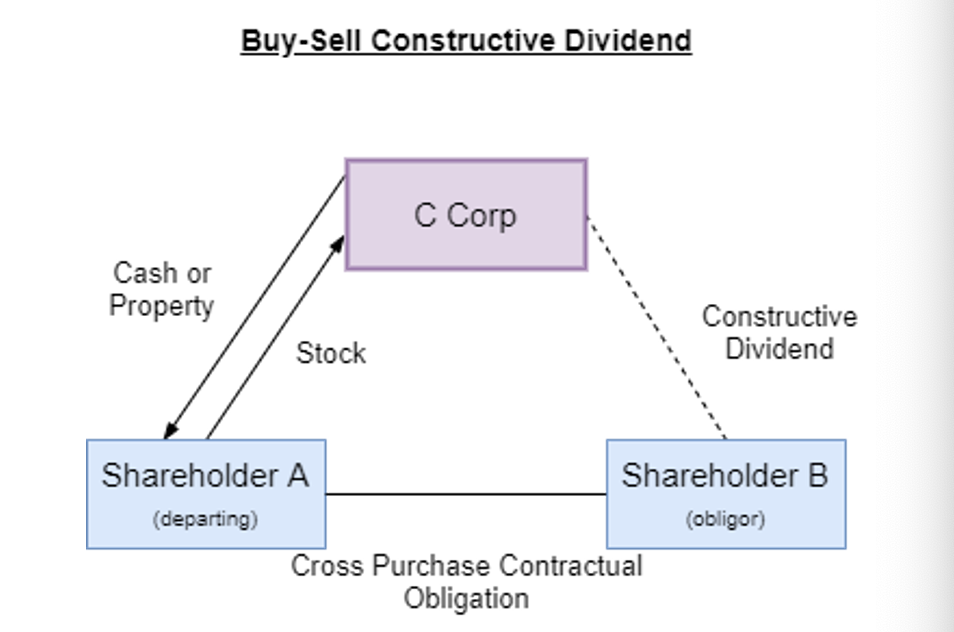

Beware of the Constructive Dividend: I want to highlight a potential tax issue that C Corp shareholders can encounter when there is a cross-purchase arrangement. As stated above, in a cross-purchase arrangement, the shareholders are obligated to buy out the departing shareholder.

If the Corporation pays the departing shareholder on behalf of the shareholders who are obligated to pay them, the shareholders are receiving a constructive dividend. This is because from a tax perspective, it is no different than the Corporation giving the shareholders a dividend and them using that money to pay the departing shareholder.

We want to avoid creating a situation in which the IRS will deem what we are doing as a constructive dividend. Remember that dividends are money received by a shareholder and dividends are taxed – dividend distributions represent the “double taxation” feature of C Corps. Advise clients not to do this, or if there is concern, utilize a hybrid approach instead of a pure cross-purchase.

Hybrid

Wouldn’t it be better to be able to decide later when the time comes, as opposed to at the beginning of the business’s life? In comes the hybrid approach! In the hybrid model (some call it a ‘wait and see’ model), the decision as to who is buying the interest does not get addressed until a triggering event occurs.

When drafting, you have to give either the company or the owners the ability to choose whether they would like to buy the departing owner’s interest first. For instance, give the option to the company to buy out the departing owner first (redemption) and if the company doesn’t want to, then the obligation falls on the remaining owners (cross-purchase) – usually pro rata. The hybrid approach is clearly the most flexible and the option that I utilized most when practicing.

Where does the money come from to buy out the departing owner? This will be addressed in “Funding the Buy-out.”

Payment Terms

A buy-sell arrangement needs to set forth the terms of payment. When will the payment(s) occur? The departing owner will want payment as soon as possible but whether that is practical for the business depends on its cash flow and ability to pay it at the time. Usually, payments are made quarterly and over a period of years. Also, there is usually a down payment that is paid before the installments. This should all be set forth in the buy-sell provisions.

An interest rate must apply. (Maybe based on the applicable federal rate to avoid any evasion issues.)

Draft a promissory note from the company to the departing owner setting forth the face amount of the loan, the interest rate, the payment amount, and the number of installments. I also recommend providing for the ability to pre-pay without penalty.

Another drafting point: See if the owners will agree that a promissory note will be subordinate to any future bank financing. This will make it easier for the company to secure financing in the future as needed.

💡 What can the company offer as security for the promissory note?

In addition to security, what else might a departing owner want as assurance that the company can pay in the future? Consider including operating restrictions on the company to keep the remaining owners from siphoning off profits to the detriment of the departing owner: excessive increases in the compensation paid to the remaining owners and their family members, a sale of all or substantially all of the business’s assets, merging or consolidating the business with another company, incurring debt beyond certain limits, and changes in the business’ voting control.

Funding the Buy-out

Here are the most common ways to fund a buy-sell:

- Funds come from business assets/operating profits

- Funds come from a bank loan

- Pay in installments

- Life insurance

A potential issue with getting a loan is that the departing owner may have been a key person and therefore the bank may have less faith in the company with them gone.

Life insurance is a common way to pay for the buy-out. If the buy-sell agreement is funded with life insurance, the company or the co-owners purchase life insurance policies on the lives of each co-owner. When the buy-sell is triggered, the life insurance funds can be tapped to pay the departing owner out. In the case of death, the proceeds are paid quickly so that the company can buy the deceased owner’s share without impacting its cash flow.

It is much simpler to do a redemption agreement if life insurance is going to be used because the company only has to buy one policy for each owner. Whereas in a cross-purchase the owners have to buy policies on each other. Think about a situation where you have 5 owners. Each owner has to buy a policy for the other 4 owners. That is 20 policies that have to be purchased. If the company does the purchasing, it only has to buy 5.

There are tax implications when it comes to life insurance and proceeds. However, if the company follows certain notice and consent requirements, the proceeds can be tax-free. See Section 101(j) of the IRC. Including such consent requirements into the buy-sell portion of the LLC Operating Agreement (or Shareholders’ Agreement) before the insurance policies are purchased is important. Sample language:

Pursuant to Internal Revenue Code Section 101(j), Owners are on notice that:

- The Company intends to apply for life insurance on Owner’s Life.

- The maximum face amount for which Owner could be insured at the time the policy is issued is ____________.

- The Company will be a direct or indirect beneficiary of proceeds payable on death of Owner.

It is a good idea to ask the Owners to each sign an acknowledgment such as this sample:

Owner acknowledges the Company purchasing life insurance on Owner’s life, as stated within section __ of the LLC Operating Agreement. The life insurance policy will remain in effect after the Owner terminates employment with the Company. The Company is a direct or indirect beneficiary of any death proceeds payable.

____________________

Owner Signature/Date