Using 401(k) Retirement Money for Seed Funding

When shifting from employee to entrepreneur, one may consider using retirement savings accumulated in their (former) employer’s 401(k) Plan. After all, an entrepreneur needs startup money, and this could be the trick. There are some options here, but I will explain how the 401(k) plan works first.

How a 401(k) Plan Works

An employer can establish a 401(k) plan for its employees. One 401(k) plan applies to the entire universe of employees. In other words, it is the same plan for all. I emphasize this because sometimes students think that you can negotiate the terms of your 401(k) plan when you are negotiating your employment contract. You cannot do this. A 401(k) plan is pre-approved by the IRS to be tax-qualified which is a benefit to an employer as well as an employee. These plans are full of detailed provisions and therefore very lengthy. I’ve drafted them. Usually, they are upwards of 80 pages long. You will be relieved to know that we will not cover 80 pages of information here. As a matter of fact, I will not elaborate on what it takes for a 401(k) plan to be tax-qualified, but I will tell you what it means to an employee when it is.

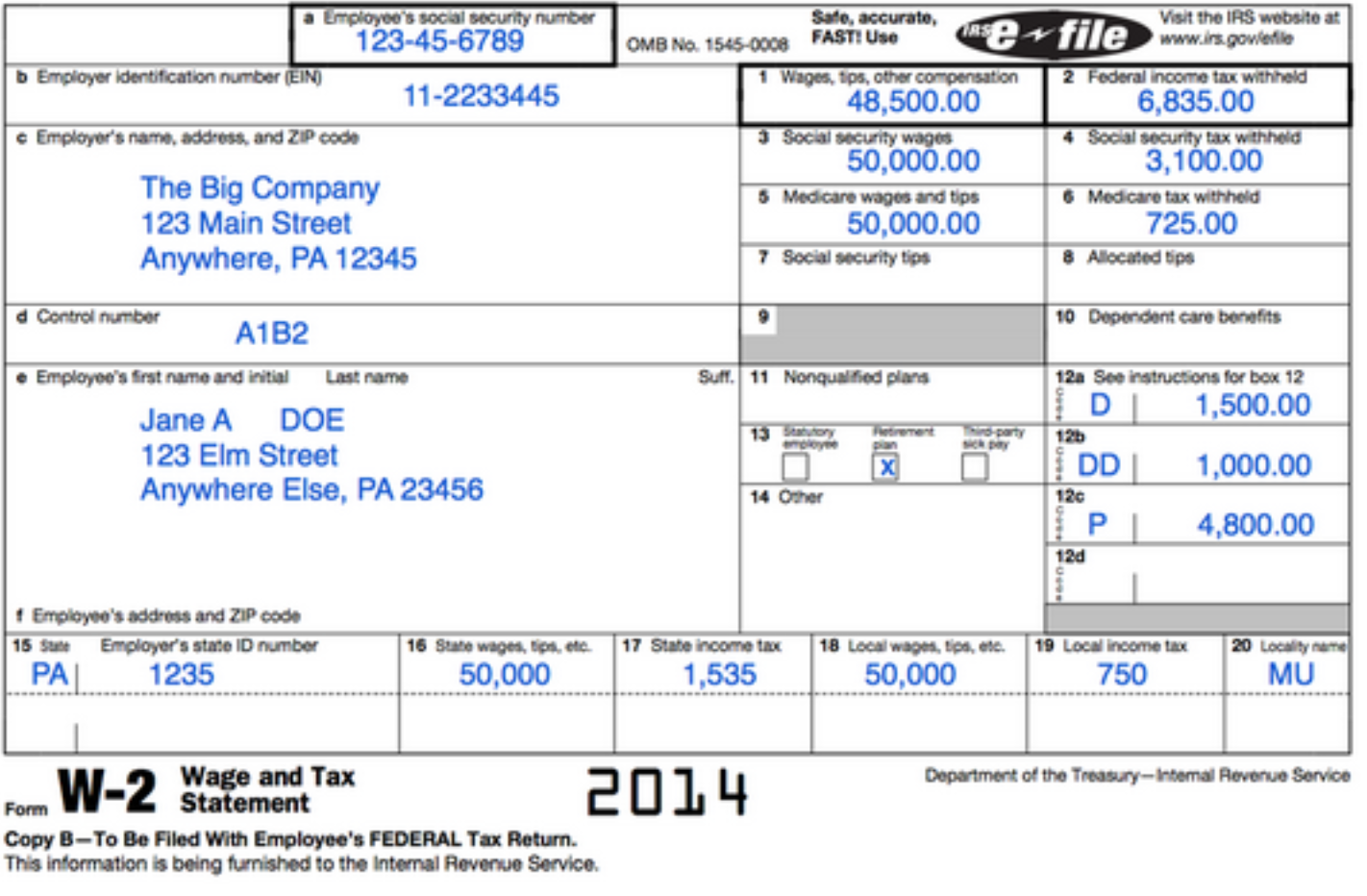

When a retirement plan is tax-qualified under 401(k), an employee can contribute a portion of their salary to it without paying federal income taxes on it at the time it is earned. So, if an employee has a $50,000 annual salary and seeks to contribute $1,500 into the company 401(k) plan on a pre-tax basis, this means that there will be no federal income tax currently paid on that $1,500. Said another way, when the employee does their tax return, they will not include that $1,500 in their income. The W-2 that the employee receives for the year will show $48,500 in the Box 1 Wages, not $50,000. You can see in the example below that the $1,500 missing from Box 1 Wages is shown in box 12a with a D demarcation indicating that the money is in a 401(k) plan.

Aside from an employee’s contributions, an employer may also contribute to the 401(k) plan on the employee’s behalf. If this occurs, the employee will not currently pay tax on that contribution. (This is a simplified and brief overview of 401(k) plans. It is nowhere near a thorough discussion, but it will suffice for our needs in this Unit.) I touch on 401(k) plans in Unit 17 as well.

Ultimately, when the employee retires, and they start taking distributions from the 401(k) plan, they will then be taxed on the money that was contributed and any interest or dividends that it accumulated.

Opportunities to Withdraw 401(k) Plan Money for Starting Up

When representing an entrepreneur, you may be asked if they can use 401(k) plan money to help fund their start-up. When leaving an employer, an employee has to decide whether to keep the 401(k) money with the former employer or move it elsewhere (typically rolling it over to a new employer’s plan or into an IRA). The employer or its plan may have a deadline on this decision so it is important to help the entrepreneur determine if they will be leaving the money where it is or utilizing one of the options below.

There are tax consequences for taking the money out of a 401(k) plan before one retires or reaches age 59 1/2. If an employee withdraws from the company 401(k) plan, the money will be taxed in the tax year that the withdrawal took place. Additionally, one will pay a hefty 10% early withdrawal penalty on the amount withdrawn. And, if your client has done this and failed to put it on their tax return (and therefore paid the tax on the money withdrawn) they will be charged interest on the tax deficiency. An entrepreneur can cash out the value of their holdings in the 401(k) plan but as stated herein, there are tax consequences for doing so. As such, I would consider this a last resort.

However, some 401(k) plans allow an employee to borrow or take a loan from the plan. The typical plan provision will allow for a $50,000 loan (or half the vested amount, whichever is less). The loan term is typically five years and when you pay interest, you are paying it back to your plan account, so it is yours. Of note, if you return the funds before 60 days, you incur no penalty.

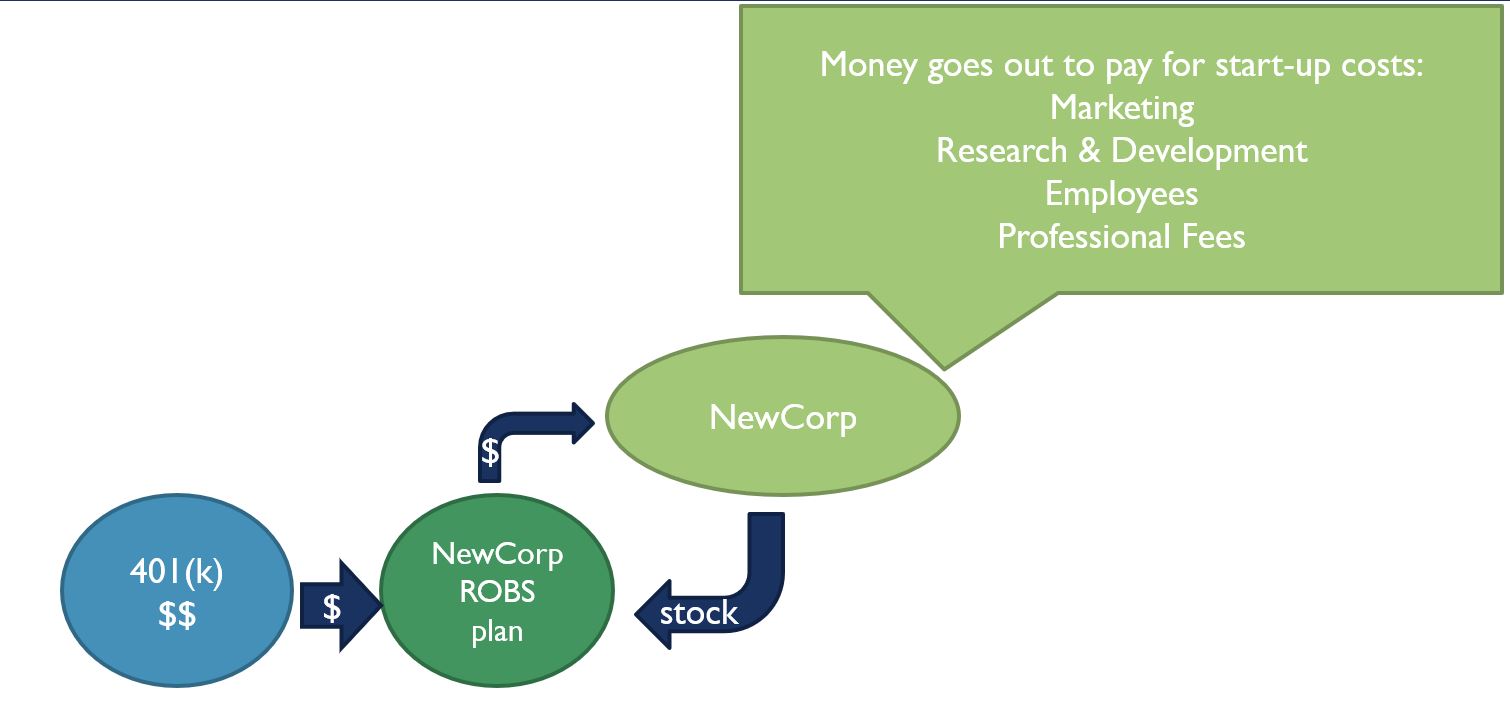

Another opportunity for using one’s 401(k) plan money is to do a rollover through a ROBS plan. ROBS is a way in which entrepreneurs can use their retirement funds to pay for new business startup expenses. What happens is this: An entrepreneur starts a C Corporation (if an entrepreneur is going to do ROBS, there is no choice of entity – it must be a C Corp) and then rolls the former 401(k) plan money into a newly formed ROBS retirement plan. The 401(k) funds are rolled over into the ROBS plan and the ROBS plan then uses the money to buy stock in the new C Corp. The money from the company’s “sale” of the stock to the ROBS retirement plan is now in the C Corp coffers and can be used for expenses. If done correctly, there will be no immediate tax consequences – no income tax, no penalty. The good news is that if the business fails, the entrepreneur does not have to repay the funds. The bad news is the entrepreneur has just lost or spent their retirement savings. If the business fails, the entrepreneur loses all. More bad news, the IRS closely scrutinizes these situations and warns that “promoters aggressively market ROBS arrangements to prospective business owners.”

📖 Review this IRS info sheet.💡 What do you need to keep in mind if you file for an IRS determination letter on behalf of the entrepreneur? Remember Unit 2?