1.7 Accounting Principles, Concepts and Assumptions

The Financial Accounting Standards Board (F.A.S.B.) is an independent, nonprofit organization that sets the standards for financial accounting and reporting, including generally accepted accounting principles (G.A.A.P.), for both public- and private-sector businesses in the United States.

GAAP are the concepts, standards, and rules that guide the preparation and presentation of financial statements. If US accounting rules are followed, the accounting rules are called US GAAP. International accounting rules are called International Financial Reporting Standards (I.F.R.S.). Publicly traded companies (those that offer their shares for sale on exchanges in the United States) have the reporting of their financial operations regulated by the Securities and Exchange Commission (S.E.C.).

The SEC is an independent federal agency that is charged with protecting the interests of investors, regulating stock markets, and ensuring companies adhere to GAAP requirements. By having proper accounting standards such as US GAAP or IFRS, information presented publicly is considered comparable and reliable. As a result, financial statement users are more informed when making decisions. The SEC not only enforces the accounting rules but also delegates the process of setting standards for US GAAP to the FASB.

Some companies that operate on a global scale may be able to report their financial statements using IFRS. The SEC regulates the financial reporting of companies selling their shares in the United States, whether US GAAP or IFRS are used. The basics of accounting discussed in this chapter are the same under either set of guidelines.

The Conceptual Framework

The FASB uses a conceptual framework, which is a set of concepts that guide financial reporting. These concepts can help ensure information is comparable and reliable to stakeholders. Guidance may be given on how to report transactions, measurement requirements, and application on financial statements, among other things.1

The conceptual framework sets the basis for accounting standards set by rule-making bodies that govern how the financial statements are prepared. Here are a few of the principles, assumptions, and concepts that provide guidance in developing GAAP.

Revenue Recognition Principle

The revenue recognition principle directs a company to recognize revenue in the period in which it is earned; revenue is not considered earned until a product or service has been provided. This means the period of time in which you performed the service or gave the customer the product is the period in which revenue is recognized.

There also does not have to be a correlation between when cash is collected and when revenue is recognized. A customer may not pay for the service on the day it was provided. Even though the customer has not yet paid cash, there is a reasonable expectation that the customer will pay in the future. Since the company has provided the service, it would recognize the revenue as earned, even though cash has yet to be collected.

For example, Lynn Sanders owns a small printing company, Printing Plus. She completed a print job for a customer on August 10. The customer did not pay cash for the service at that time and was billed for the service, paying at a later date. When should Lynn recognize the revenue, on August 10 or at the later payment date? Lynn should record revenue as earned on August 10. She provided the service to the customer, and there is a reasonable expectation that the customer will pay at the later date.

Expense Recognition (Matching) Principle

The expense recognition principle (also referred to as the matching principle) states that we must match expenses with associated revenues in the period in which the revenues were earned. A mismatch in expenses and revenues could be an understated net income in one period with an overstated net income in another period. There would be no reliability in statements if expenses were recorded separately from the revenues generated.

For example, if Lynn earned printing revenue in April, then any associated expenses to the revenue generation (such as paying an employee) should be recorded on the same income statement. The employee worked for Lynn in April, helping her earn revenue in April, so Lynn must match the expense with the revenue by showing both on the April income statement.

Cost Principle

The cost principle, also known as the historical cost principle, states that virtually everything the company owns or controls (assets) must be recorded at its value at the date of acquisition. For most assets, this value is easy to determine as it is the price agreed to when buying the asset from the vendor. There are some exceptions to this rule, but always apply the cost principle unless FASB has specifically stated that a different valuation method should be used in a given circumstance.

The primary exceptions to this historical cost treatment, at this time, are financial instruments, such as stocks and bonds, which might be recorded at their fair market value. This is called mark-to-market accounting or fair value accounting and is more advanced than the general basic concepts underlying the introduction to basic accounting concepts; therefore, it is addressed in more advanced accounting courses.

Once an asset is recorded on the books, the value of that asset must remain at its historical cost, even if its value in the market changes. For example, Lynn Sanders purchases a piece of equipment for $40,000. She believes this is a bargain and perceives the value to be more at $60,000 in the current market. Even though Lynn feels the equipment is worth $60,000, she may only record the cost she paid for the equipment of $40,000.

Full Disclosure Principle

The full disclosure principle states that a business must report any business activities that could affect what is reported on the financial statements. These activities could be nonfinancial in nature or be supplemental details not readily available on the main financial statement. Some examples of this include any pending litigation, acquisition information, methods used to calculate certain figures, or stock options. These disclosures are usually recorded in footnotes on the statements, or in addenda to the statements.

Separate Entity Concept

The separate entity concept prescribes that a business may only report activities on financial statements that are specifically related to company operations, not those activities that affect the owner personally. This concept is called the separate entity concept because the business is considered an entity separate and apart from its owner(s).

For example, Lynn Sanders purchases two cars; one is used for personal use only, and the other is used for business use only. According to the separate entity concept, Lynn may record the purchase of the car used by the company in the company’s accounting records, but not the car for personal use.

Conservatism

This concept is important when valuing a transaction for which the dollar value cannot be as clearly determined, as when using the cost principle. Conservatism states that if there is uncertainty in a potential financial estimate, a company should err on the side of caution and report the most conservative amount. This would mean that any uncertain or estimated expenses/losses should be recorded, but uncertain or estimated revenues/gains should not. This understates net income, therefore reducing profit. This gives stakeholders a more reliable view of the company’s financial position and does not overstate income.

Monetary Measurement Concept

In order to record a transaction, we need a system of monetary measurement, or a monetary unit by which to value the transaction. In the United States, this monetary unit is the US dollar. Without a dollar amount, it would be impossible to record information in the financial records. It also would leave stakeholders unable to make financial decisions, because there is no comparability measurement between companies. This concept ignores any change in the purchasing power of the dollar due to inflation.

Going Concern Assumption

The going concern assumption assumes a business will continue to operate in the foreseeable future. A common time frame might be twelve months. However, one should presume the business is doing well enough to continue operations unless there is evidence to the contrary. For example, a business might have certain expenses that are paid off (or reduced) over several time periods. If the business will stay operational in the foreseeable future, the company can continue to recognize these long-term expenses over several time periods. Some red flags that a business may no longer be a going concern are defaults on loans or a sequence of losses.

Time Period Assumption

The time period assumption states that a company can present useful information in shorter time periods, such as years, quarters, or months. The information is broken into time frames to make comparisons and evaluations easier. The information will be timely and current and will give a meaningful picture of how the company is operating.

For example, a school year is broken down into semesters or quarters. After each semester or quarter, your grade point average (GPA) is updated with new information on your performance in classes you completed. This gives you timely grading information with which to make decisions about your schooling.

A potential or existing investor wants timely information by which to measure the performance of the company, and to help decide whether to invest. Because of the time period assumption, we need to be sure to recognize revenues and expenses in the proper period. This might mean allocating costs over more than one accounting or reporting period.

The use of the principles, assumptions, and concepts in relation to the preparation of financial statements is better understood when looking at the full accounting cycle and its relation to the detailed process required to record business activities (Figure 1.10).

CONCEPTS IN PRACTICE

Tax Cuts and Jobs Act

In 2017, the US government enacted the Tax Cuts and Jobs Act. As a result, financial stakeholders needed to resolve several issues surrounding the standards from GAAP principles and the FASB. The issues were as follows: “Current Generally Accepted Accounting Principles (GAAP) requires that deferred tax liabilities and assets be adjusted for the effect of a change in tax laws or rates,” and “implementation issues related to the Tax Cuts and Jobs Act and income tax reporting.”2

In response, the FASB issued updated guidance on both issues. You can explore these revised guidelines at the FASB website.

Accounting Principles and Assumptions Regulating Revenue Recognition

Revenue and expense recognition timing is critical to transparent financial presentation. GAAP governs recognition for publicly traded companies. Even though GAAP is required only for public companies, to display their financial position most accurately, private companies should manage their financial accounting using its rules. Two principles governed by GAAP are the revenue recognition principle and the matching principle. Both the revenue recognition principle and the matching principle give specific direction on revenue and expense reporting.

The revenue recognition principle, which states that companies must recognize revenue in the period in which it is earned, instructs companies to recognize revenue when a four-step process is completed. This may not necessarily be when cash is collected. Revenue can be recognized when all of the following criteria have been met:

- There is credible evidence that an arrangement exists.

- Goods have been delivered or services have been performed.

- The selling price or fee to the buyer is fixed or can be reasonably determined.

- There is reasonable assurance that the amount owed to the seller is collectible.

The accrual accounting method aligns with this principle, and it records transactions related to revenue earnings as they occur, not when cash is collected. The revenue recognition principle may be updated periodically to reflect more current rules for reporting.

For example, a landscaping company signs a $600 contract with a customer to provide landscaping services for the next six months (assume the landscaping workload is distributed evenly throughout the six months). The customer sets up an in-house credit line with the company, to be paid in full at the end of the six months. The landscaping company records revenue earnings each month and provides service as planned. To align with the revenue recognition principle, the landscaping company will record one month of revenue ($100) each month as earned; they provided service for that month, even though the customer has not yet paid cash for the service.

Let’s say that the landscaping company also sells gardening equipment. It sells a package of gardening equipment to a customer who pays on credit. The landscaping company will recognize revenue immediately, given that they provided the customer with the gardening equipment (product), even though the customer has not yet paid cash for the product.

Accrual accounting also incorporates the matching principle (otherwise known as the expense recognition principle), which instructs companies to record expenses related to revenue generation in the period in which they are incurred. The principle also requires that any expense not directly related to revenues be reported in an appropriate manner. For example, assume that a company paid $6,000 in annual real estate taxes. The principle has determined that costs cannot effectively be allocated based on an individual month’s sales; instead, it treats the expense as a period cost. In this case, it is going to record 1/12 of the annual expense as a monthly period cost. Overall, the “matching” of expenses to revenues projects a more accurate representation of company financials. When this matching is not possible, then the expenses will be treated as period costs.

For example, when the landscaping company sells the gardening equipment, there are costs associated with that sale, such as the costs of materials purchased or shipping charges. The cost is reported in the same period as revenue associated with the sale. There cannot be a mismatch in reporting expenses and revenues; otherwise, financial statements are presented unfairly to stakeholders. Misreporting has a significant impact on company stakeholders. If the company delayed reporting revenues until a future period, net income would be understated in the current period. If expenses were delayed until a future period, net income would be overstated.

CONCEPTS IN PRACTICE

Gift Card Revenue Recognition

Gift cards have become an essential part of revenue generation and growth for many businesses. Although they are practical for consumers and low cost to businesses, navigating revenue recognition guidelines can be difficult. Gift cards with expiration dates require that revenue recognition be delayed until customer use or expiration. However, most gift cards now have no expiration date. So, when do you recognize revenue?

Companies may need to provide an estimation of projected gift card revenue and usage during a period based on past experience or industry standards. There are a few rules governing reporting. If the company determines that a portion of all of the issued gift cards will never be used, they may write this off to income. In some states, if a gift card remains unused, in part or in full, the unused portion of the card is transferred to the state government. It is considered unclaimed property for the customer, meaning that the company cannot keep these funds as revenue because, in this case, they have reverted to the state government.

Long Description

Hierarchical group of boxes representing the organizations that create generally accepted accounting principles (GAAP) and the principles, conventions, assumptions, and concepts that support GAAP. The top box is labeled SEC (enforces GAAP). The box below that is labeled FASB (sets GAAP). The box below that is labeled GAAP Accounting Standards. Below that are four boxes labeled left to right: Expense Recognition Principle; Full Disclosure Principle; Conservatism Convention; Going Concern Assumption. Below that are five boxes labeled left to right: Revenue Recognition Principle; Cost Principle; Separate Entity Concept; Monetary Measurement Concept; Time Period Assumption. Return

Footnotes

1 Financial Accounting Standards Board. “The Conceptual Framework.” http://www.fasb.org/jsp/FASB/Page/BridgePage&cid=1176168367774

2 Financial Accounting Standards Board (FASB). “Accounting for the Tax Cuts and Jobs Act.” https://www.fasb.org/taxcutsjobsact#section_1

Media Attributions

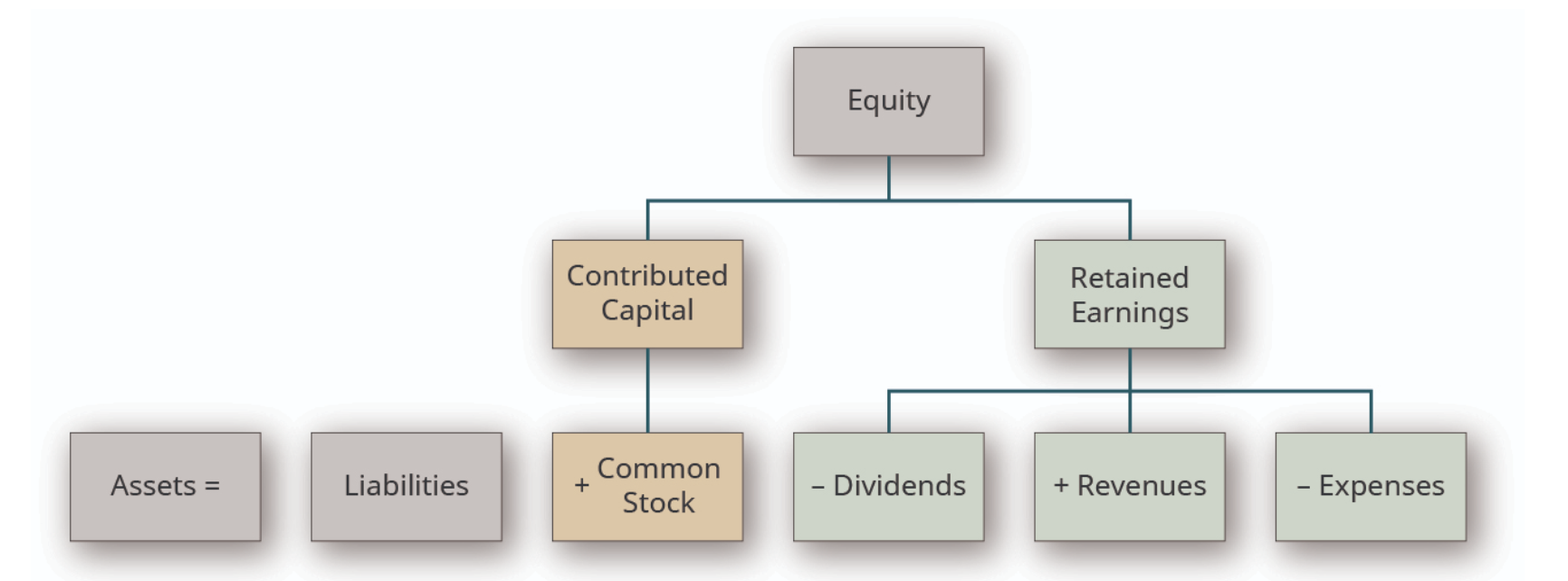

- Expanded Accounting Equation © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license