1.16 Post-Closing Trial Balance

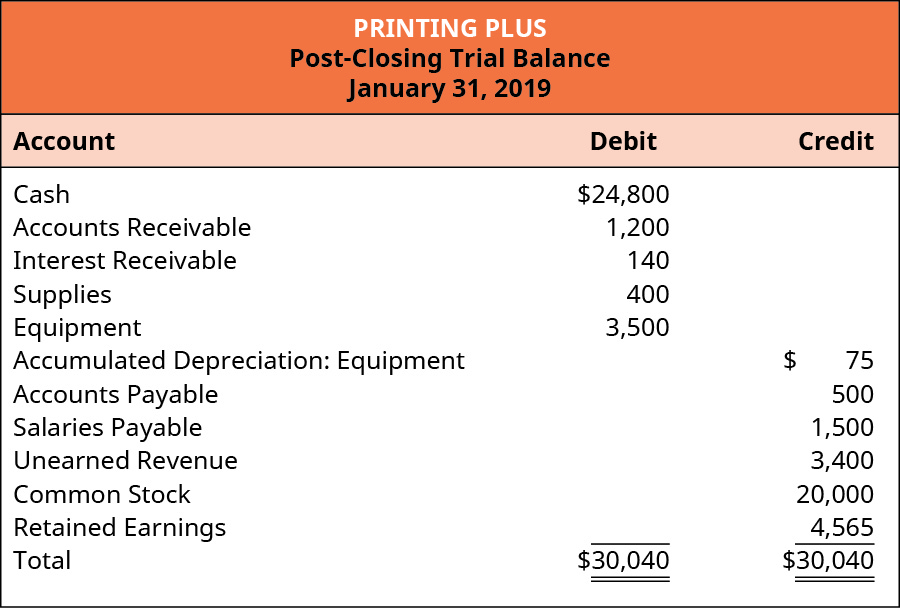

The ninth, and typically final, step of the process is to prepare a post-closing trial balance. The word “post” in this instance means “after.” You are preparing a trial balance after the closing entries are complete.

Like all trial balances, the post-closing trial balance has the job of verifying that the debit and credit totals are equal. The post-closing trial balance has one additional job that the other trial balances do not have. The post-closing trial balance is also used to double-check that the only accounts with balances after the closing entries are permanent accounts. If there are any temporary accounts on this trial balance, you would know that there was an error in the closing process. This error must be fixed before starting the new period.

The process of preparing the post-closing trial balance is the same as you have done when preparing the unadjusted trial balance and adjusted trial balance. Only permanent account balances should appear on the post-closing trial balance. These balances in post-closing T-accounts are transferred over to either the debit or credit column on the post-closing trial balance. When all accounts have been recorded, total each column and verify the columns equal each other.

The post-closing trial balance for Printing Plus is shown in Figure 1.32.

Notice that only permanent accounts are included. All temporary accounts with zero balances were left out of this statement. Unlike previous trial balances, the retained earnings figure is included, which was obtained through the closing process.

At this point, the accounting cycle is complete, and the company can begin a new cycle in the next period. In essence, the company’s business is always in operation, while the accounting cycle utilizes the cutoff of month-end to provide financial information to assist and review the operations.

It is worth mentioning that there is one step in the process that a company may or may not include, step 10, reversing entries. Reversing entries reverse an adjusting entry made in a prior period at the start of a new period. We do not cover reversing entries in this chapter, but you might approach the subject in future accounting courses.

Now that we have completed the accounting cycle, let’s take a look at another way the adjusted trial balance assists users of information with financial decision-making.

CONCEPTS IN PRACTICE

The Importance of Understanding How to Complete the Accounting Cycle

Many students who enroll in an introductory accounting course do not plan to become accountants. They will work in a variety of jobs in the business field, including managers, sales, and finance. In a real company, most of the mundane work is done by computers. Accounting software can perform such tasks as posting the journal entries recorded, preparing trial balances, and preparing financial statements. Students often ask why they need to do all of these steps by hand in their introductory class, particularly if they are never going to be an accountant. It is very important to understand that no matter what your position, if you work in business you need to be able to read financial statements, interpret them, and know how to use that information to better your business. If you have never followed the full process from beginning to end, you will never understand how one of your decisions can impact the final numbers that appear on your financial statements. You will not understand how your decisions can affect the outcome of your company.

As mentioned previously, once you understand the effect your decisions will have on the bottom line on your income statement and the balances in your balance sheet, you can use accounting software to do all of the mundane, repetitive steps and use your time to evaluate the company based on what the financial statements show. Your stockholders, creditors, and other outside professionals will use your financial statements to evaluate your performance. If you evaluate your numbers as often as monthly, you will be able to identify your strengths and weaknesses before any outsiders see them and make any necessary changes to your plan in the following month.

Long Description

Printing Plus, Post-Closing Trial Balance, January 31, 2019. Account Title, Debit or Credit. Cash $24,800 debit. Accounts Receivable 1,200 debit. Interest Receivable 140 debit. Supplies 400 debit. Equipment 3,500 debit. Accumulated Depreciation: Equipment $75 credit. Accounts Payable 500 credit. Salaries Payable 1,500 credit. Unearned Revenue 3,400 credit. Common Stock 20,000 credit. Retained Earnings 4,565 credit. Total 30,040 debit, 30,040 credit. Return

Media Attributions

- Post Closing Trial Balance © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license