2.3 Purchases of Merchandise- Perpetual System

The following example transactions and subsequent journal entries for merchandise purchases are recognized using a perpetual inventory system. The periodic inventory system recognition of these example transactions and corresponding journal entries will be studied in more advanced accounting courses.

Basic Analysis of Purchase Transaction Journal Entries

To better illustrate merchandising activities, let’s follow California Business Solutions (CBS), a retailer providing electronic hardware packages to meet small business needs. Each electronics hardware package (see Figure 2.33) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine.

CBS purchases each electronic product from a manufacturer. The following are the per-item purchase prices from the manufacturer.

Cash and Credit Purchase Transaction Journal Entries

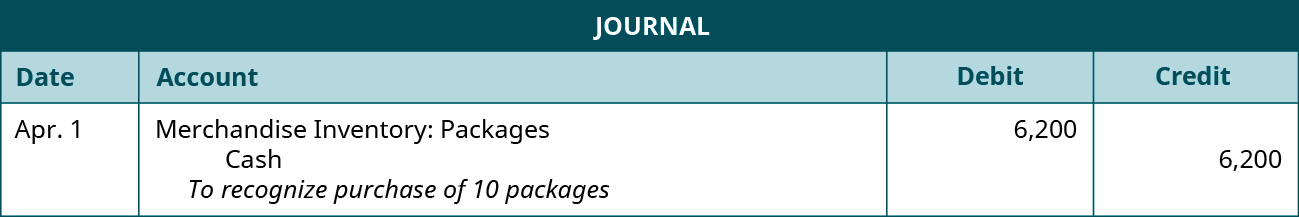

On April 1, CBS purchases 10 electronic hardware packages at a cost of $620 each. CBS has enough cash-on-hand to pay immediately with cash. The following entry occurs.

Merchandise Inventory-Packages increases (debit) for 6,200 ($620 × 10), and Cash decreases (credit) because the company paid with cash. It is important to distinguish each inventory item type to better track inventory needs.

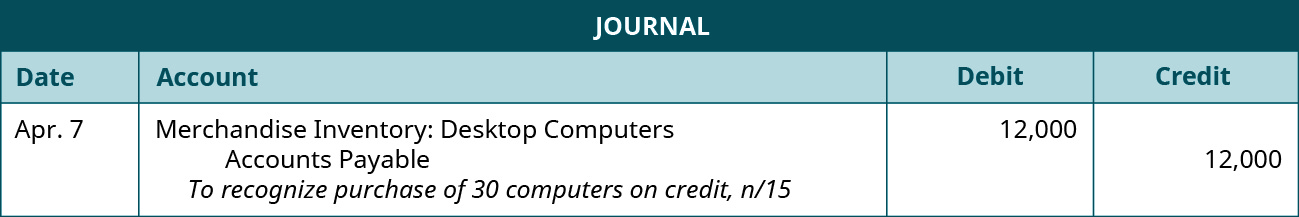

On April 7, CBS purchases 30 desktop computers on credit at a cost of $400 each. The credit terms are n/15 with an invoice date of April 7. The following entry occurs.

Merchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 × 30). Since the computers were purchased on credit by CBS, Accounts Payable increases (credit).

On April 17, CBS makes full payment on the amount due from the April 7 purchase. The following entry occurs.

Accounts Payable decreases (debit), and Cash decreases (credit) for the full amount owed. The credit terms were n/15, which is net due in 15 days. No discount was offered with this transaction. Thus the full payment of $12,000 occurs.

Purchase Discount Transaction Journal Entries

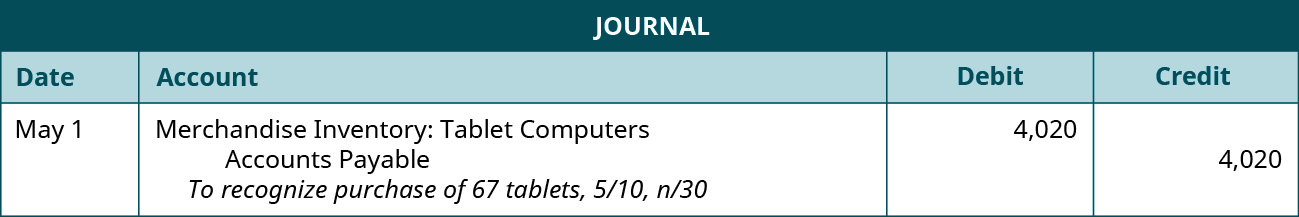

On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit. The payment terms are 5/10, n/30, and the invoice is dated May 1. The following entry occurs.

Merchandise Inventory-Tablet Computers increases (debit) in the amount of $4,020 (67 × $60). Accounts Payable also increases (credit) but the credit terms are a little different than the previous example. These credit terms include a discount opportunity (5/10), meaning, CBS has 10 days from the invoice date to pay on their account to receive a 5% discount on their purchase.

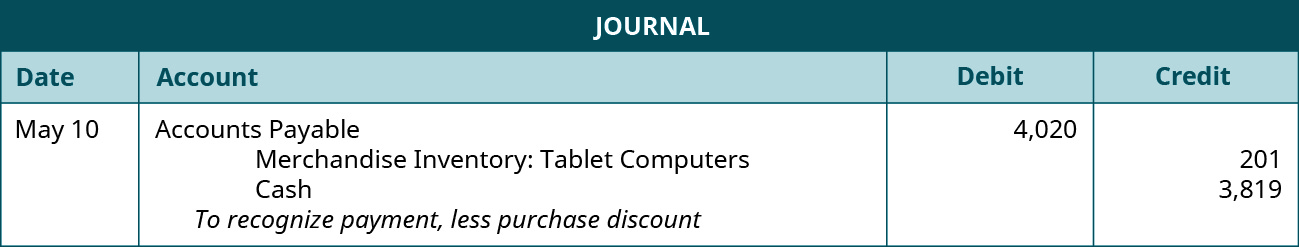

On May 10, CBS pays their account in full. The following entry occurs.

Accounts Payable decreases (debit) for the original amount owed of $4,020 before any discounts are taken. Since CBS paid on May 10, they made the 10-day window and thus received a discount of 5%. Cash decreases (credit) for the amount owed, less the discount. Merchandise Inventory-Tablet Computers decreases (credit) for the amount of the discount ($4,020 × 5%). Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost.

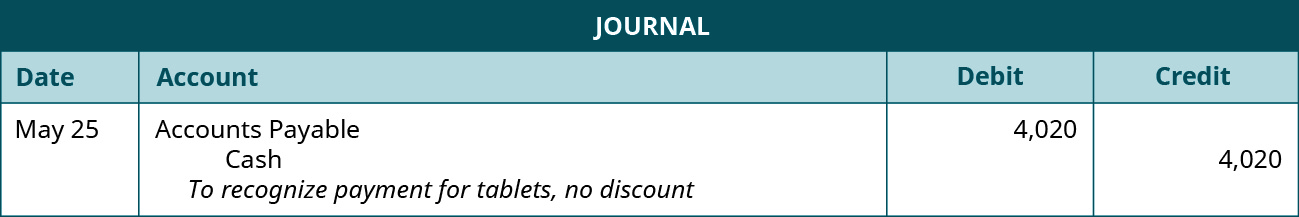

Let’s take the same example purchase with the same credit terms, but now CBS paid their account on May 25. The following entry would occur instead.

Accounts Payable decreases (debit) and Cash decreases (credit) for $4,020. The company paid on their account outside of the discount window but within the total allotted timeframe for payment. CBS does not receive a discount in this case but does pay in full and on time.

Purchase Returns and Allowances Transaction Journal Entries

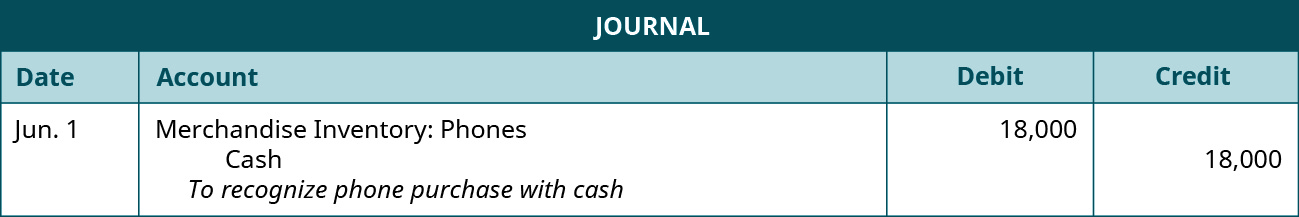

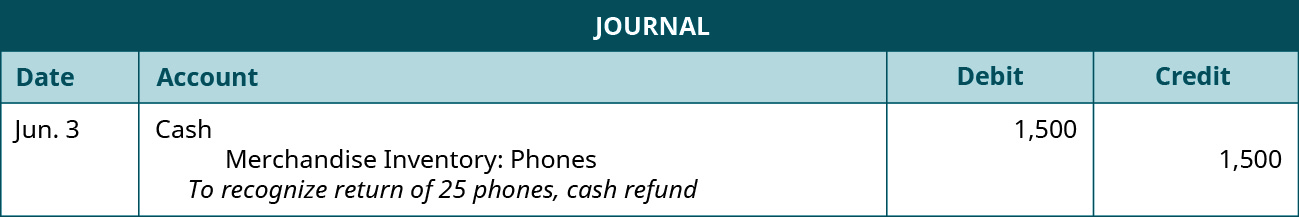

On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. The following entries occur with the purchase and subsequent return.

Both Merchandise Inventory-Phones increases (debit) and Cash decreases (credit) by $18,000 ($60 × 300).

Since CBS already paid in full for their purchase, a full cash refund is issued. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier.

On June 8, CBS discovers that 60 more phones from the June 1 purchase are slightly damaged. CBS decides to keep the phones but receives a purchase allowance from the manufacturer of $8 per phone. The following entry occurs for the allowance.

Since CBS already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $480 (60 × $8). This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise is less valuable than before the damage discovery.

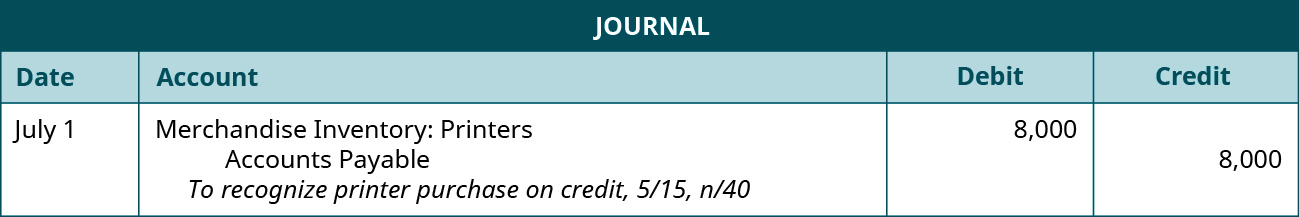

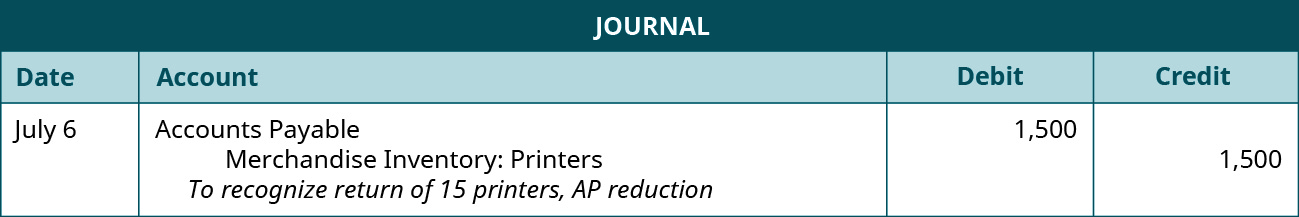

CBS purchases 80 units of the 4-in-1 desktop printers at a cost of $100 each on July 1 on credit. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund. The following entries show the purchase and subsequent return.

Both Merchandise Inventory-Printers increases (debit) and Accounts Payable increases (credit) by $8,000 ($100 × 80).

Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $1,500 (15 × $100). The purchase was on credit and the return occurred before payment, thus decreasing Accounts Payable. Merchandise Inventory decreases due to the return of the merchandise back to the manufacturer.

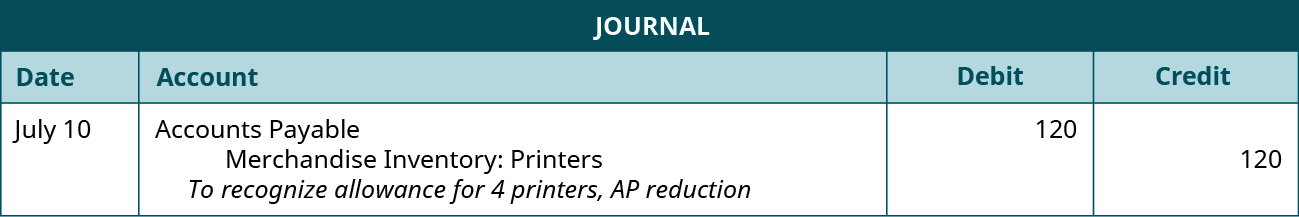

On July 10, CBS discovers that 4 more printers from the July 1 purchase are slightly damaged but decides to keep them, with the manufacturer issuing an allowance of $30 per printer. The following entry recognizes the allowance.

Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $120 (4 × $30). The purchase was on credit and the allowance occurred before payment, thus decreasing Accounts Payable. Merchandise Inventory decreases due to the loss in value of the merchandise.

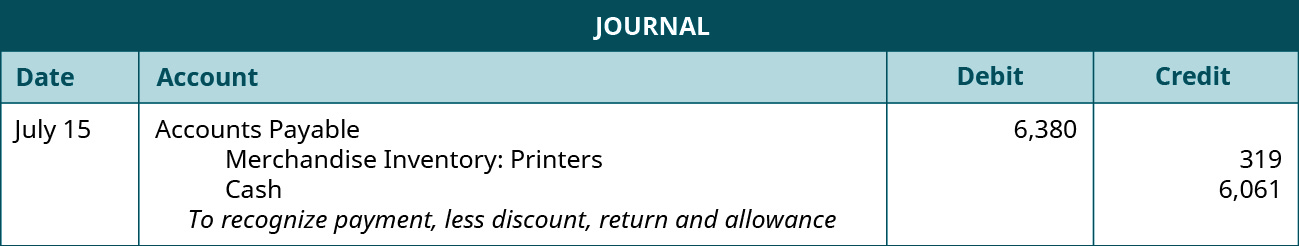

On July 15, CBS pays their account in full, less purchase returns and allowances. The following payment entry occurs.

Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 – $1,500 – $120). Since CBS paid on July 15, they made the 15-day window, thus receiving a discount of 5%. Cash decreases (credit) for the amount owed, less the discount. Merchandise Inventory-Printers decreases (credit) for the amount of the discount ($6,380 × 5%). Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost.

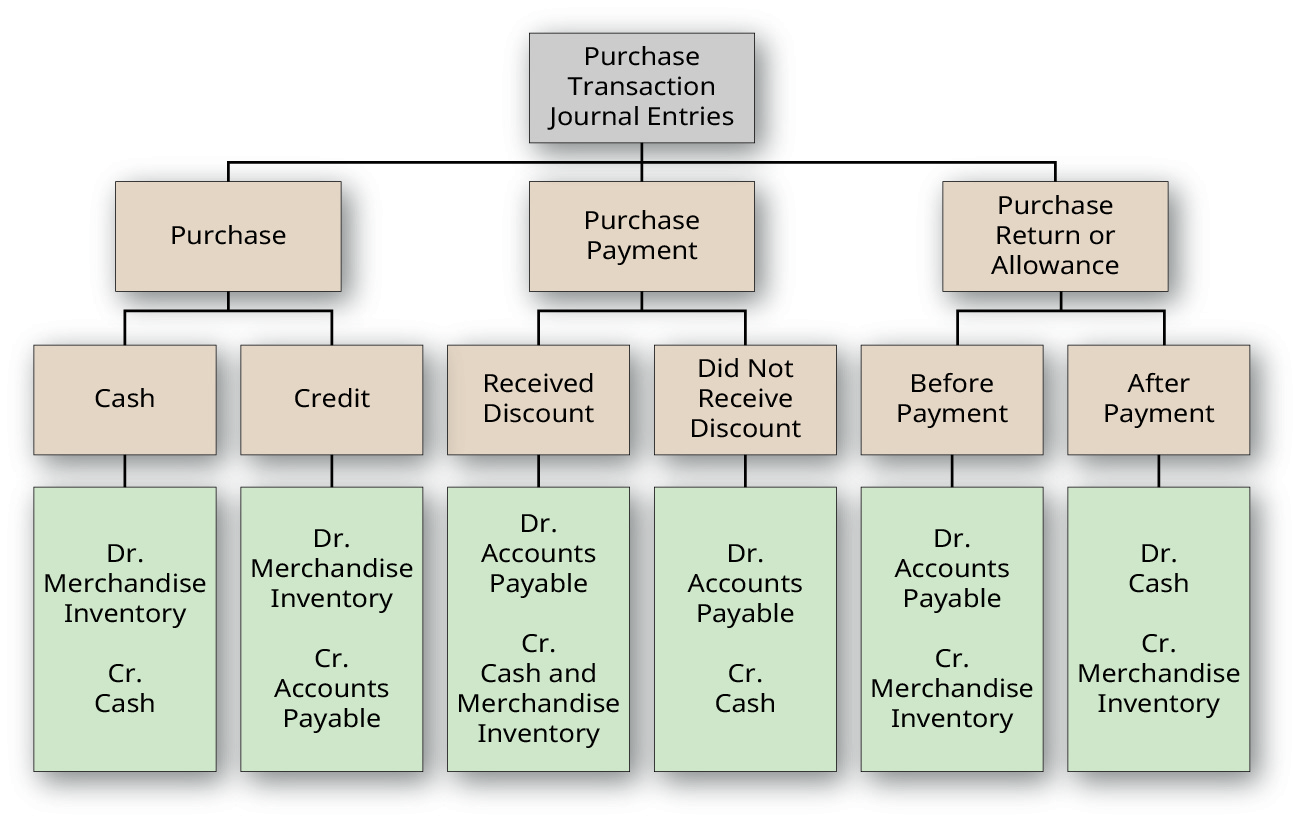

Summary of Purchase Transaction Journal Entries

The chart in Figure 2.48 represents the journal entry requirements based on various merchandising purchase transactions using the perpetual inventory system.

Note that Figure 2.48 considers an environment in which inventory physical counts and matching books records align. This is not always the case given concerns with shrinkage (theft), damages, or obsolete merchandise. In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books.

YOUR TURN! For each of the following transactions, click on the correct entry:

Long Descriptions

Journal entries starting with Purchase Transaction Journal Entries at the top, followed by Purchase, Purchase Payment, and Purchase Return or Allowance on the second tier, then Cash, Credit, Received Discount, Did not Receive Discount, Before Payment, and After Payment on the third tier, and Dr. Merchandise Inventory Cr. Cash; Dr. Merchandise Inventory Cr. Accounts Payable; Dr. Accounts Payable Cr. Cash and Merchandise Inventory; Dr. Accounts Payable Cr. Cash; Dr. Accounts Payable Cr. Merchandise Inventory; and Dr. Cash Cr. Merchandise Inventory on the bottom tier. Return

Journal entry for December 3 shows a debit to Merchandise Inventory for $500 and a credit to Accounts Payable for $500 with the note “to recognize inventory purchase, 2 / 10, n / 30.” December 6 entries show a debit to Accounts Payable for $150 and a credit to Merchandise Inventory for $150 with the note “to recognize inventory return.” December 9 entries show a debit to Accounts Payable for $350, a credit to Merchandise Inventory for $7, and a credit to Cash for $343 with the note “to recognize payment, less discount and return.” Return