1.9 The Adjustment Process

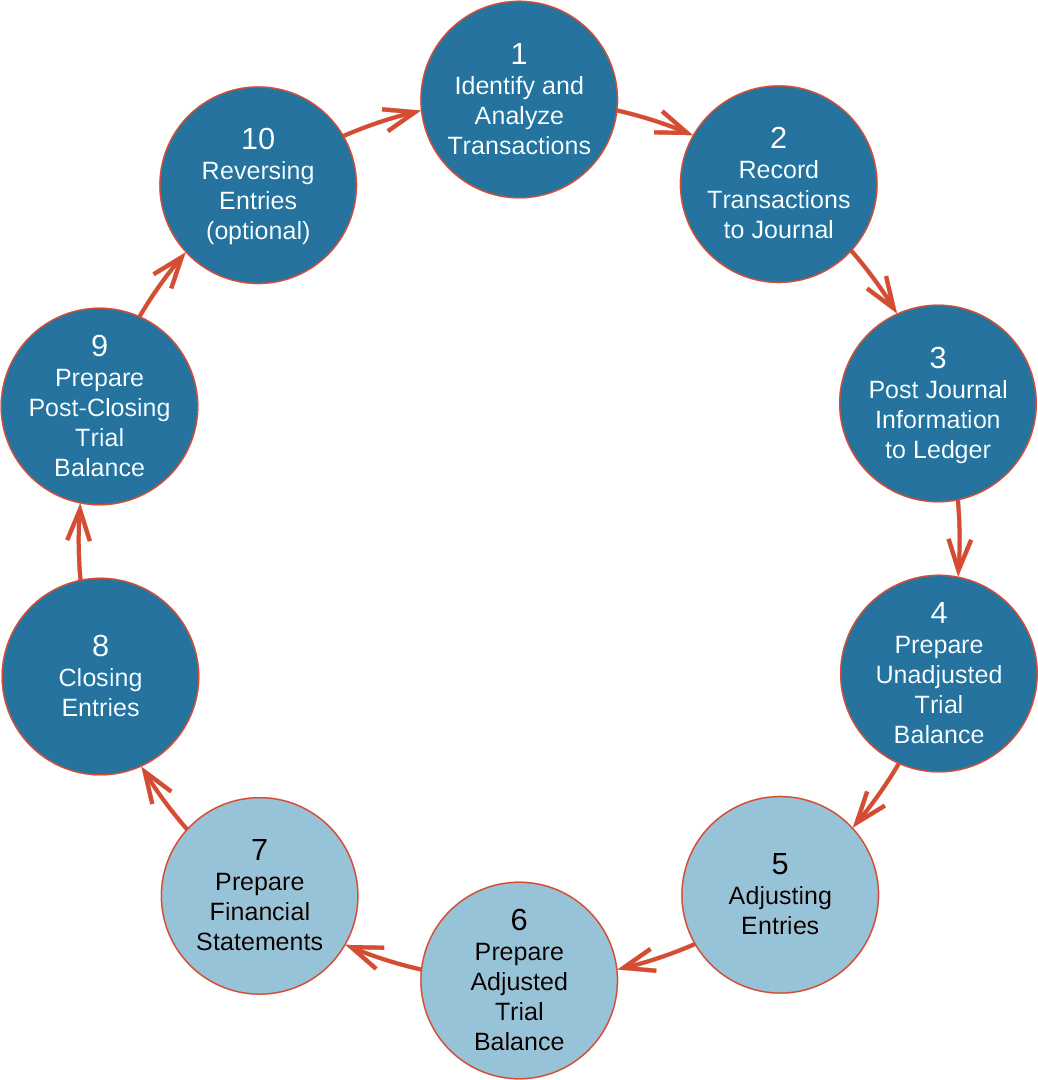

Following the steps of analyzing transactions, recording entries, posting to ledgers and creating the trial balance the accounting cycle continues with steps 5-7 of the accounting cycle.

In this segment, we review steps 5, 6, and 7 in the accounting cycle: record adjusting entries, prepare an adjusted trial balance, and prepare financial statements.

As we progress through these steps, you learn why the trial balance in this phase of the accounting cycle is referred to as an “adjusted” trial balance. We also discuss the purpose of adjusting entries and the accounting concepts supporting their need. One of the first concepts we discuss is accrual accounting.

Accrual Accounting

Public companies reporting their financial positions use either US generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), as allowed under the Securities and Exchange Commission (SEC) regulations. Also, companies, public or private, using US GAAP or IFRS prepare their financial statements using the rules of accrual accounting. Recall that accrual basis accounting prescribes that revenues and expenses must be recorded in the accounting period in which they were earned or incurred, no matter when cash receipts or payments occur. It is because of accrual accounting that we have the revenue recognition principle and the expense recognition principle (also known as the matching principle).

The accrual method is considered to better match revenues and expenses and standardizes reporting information for comparability purposes. Having comparable information is important to external users of information trying to make investment or lending decisions, and to internal users trying to make decisions about company performance, budgeting, and growth strategies.

Some nonpublic companies may choose to use cash basis accounting rather than accrual basis accounting to report financial information. Recall that cash basis accounting is a method of accounting in which transactions are not recorded in the financial statements until there is an exchange of cash. Cash basis accounting sometimes delays or accelerates revenue and expense reporting until cash receipts or outlays occur. With this method, cash flows are used to measure business performance in a given period and can be simpler to track than accrual basis accounting.

There are several other accounting methods or concepts that accountants will sometimes apply. The first is modified accrual accounting, which is commonly used in governmental accounting and merges accrual basis and cash basis accounting. The second is tax basis accounting that is used in establishing the tax effects of transactions in determining the tax liability of an organization.

One fundamental concept to consider related to the accounting cycle—and to accrual accounting in particular—is the idea of the accounting period.

The Accounting Period

As we discussed, accrual accounting requires companies to report revenues and expenses in the accounting period in which they were earned or incurred. An accounting period breaks down company financial information into specific time spans, and can cover a month, a quarter, a half-year, or a full year. Public companies governed by GAAP are required to present quarterly (three-month) accounting period financial statements called 10-Qs. However, most public and private companies keep monthly, quarterly, and yearly (annual) period information. This is useful to users needing up-to-date financial data to make decisions about company investment and growth. When the company keeps yearly information, the year could be based on a fiscal or calendar year. This is explained shortly.

The Fiscal Year and the Calendar Year

A company may choose its yearly reporting period to be based on a calendar or fiscal year. If a company uses a calendar year, it is reporting financial data from January 1 to December 31 of a specific year. This may be useful for businesses needing to coincide with a traditional yearly tax schedule. It can also be easier to track for some businesses without formal reconciliation practices, and for small businesses.

A fiscal year is a twelve-month reporting cycle that can begin in any month and records financial data for that consecutive twelve-month period. For example, a business may choose its fiscal year to begin on April 1, 2019, and end on March 31, 2020. This can be common practice for corporations and may best reflect the operational flow of revenues and expenses for a particular business. In addition to annual reporting, companies often need or choose to report financial statement information in interim periods.

Interim Periods

An interim period is any reporting period shorter than a full year (fiscal or calendar). This can encompass monthly, quarterly, or half-year statements. The information contained on these statements is timelier than waiting for a yearly accounting period to end. The most common interim period is three months, or a quarter. For companies whose common stock is traded on a major stock exchange, meaning these are publicly traded companies, quarterly statements must be filed with the SEC on a Form 10-Q. The companies must file a Form 10-K for their annual statements. As you’ve learned, the SEC is an independent agency of the federal government that provides oversight of public companies to maintain fair representation of company financial activities for investors to make informed decisions.

In order for information to be useful to the user, it must be timely—that is, the user has to get it quickly enough so it is relevant to decision-making. You may recall that this is the basis of the time period assumption in accounting. For example, a potential or existing investor wants timely information by which to measure the performance of the company, and to help decide whether to invest, to stay invested, or to sell their stockholdings and invest elsewhere. This requires companies to organize their information and break it down into shorter periods. Internal and external users can then rely on the information that is both timely and relevant to decision-making.

The accounting period a company chooses to use for financial reporting will impact the types of adjustments they may have to make to certain accounts.

Why Some Accounts Have Incorrect Balances on the Trial Balance

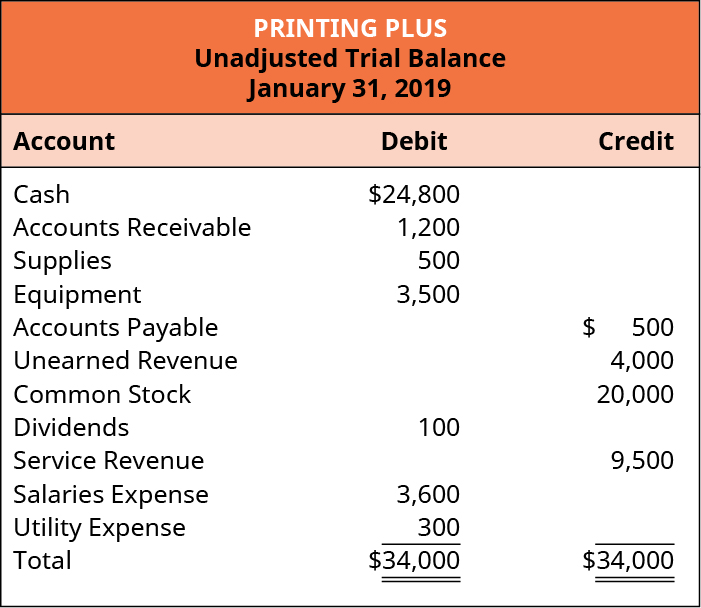

The unadjusted trial balance may have incorrect balances in some accounts. Recall the trial balance from Analyzing and Recording Transactions for the example company, Printing Plus.

The trial balance for Printing Plus shows Supplies of $500, which were purchased on January 30. Since this is a new company, Printing Plus would more than likely use some of their supplies right away, before the end of the month on January 31. Supplies are only an asset when they are unused. If Printing Plus used some of its supplies immediately on January 30, then why is the full $500 still in the supply account on January 31? How do we fix this incorrect balance?

Similarly, what about Unearned Revenue? On January 9, the company received $4,000 from a customer for printing services to be performed. The company recorded this as a liability because it received payment without providing the service. To clear this liability, the company must perform the service. Assume that as of January 31 some of the printing services have been provided. Is the full $4,000 still a liability? Since a portion of the service was provided, a change to unearned revenue should occur. The company needs to correct this balance in the Unearned Revenue account.

Having incorrect balances in Supplies and in Unearned Revenue on the company’s January 31 trial balance is not due to any error on the company’s part. The company followed all of the correct steps of the accounting cycle up to this point. So why are the balances still incorrect?

Journal entries are recorded when an activity or event occurs that triggers the entry. Usually the trigger is from an original source. Recall that an original source can be a formal document substantiating a transaction, such as an invoice, purchase order, cancelled check, or employee time sheet. Not every transaction produces an original source document that will alert the bookkeeper that it is time to make an entry.

When a company purchases supplies, the original order, receipt of the supplies, and receipt of the invoice from the vendor will all trigger journal entries. This trigger does not occur when using supplies from the supply closet. Similarly, for unearned revenue, when the company receives an advance payment from the customer for services yet provided, the cash received will trigger a journal entry. When the company provides the printing services for the customer, the customer will not send the company a reminder that revenue has now been earned. Situations such as these are why businesses need to make adjusting entries.

Long Description

A large circle labeled, in the center, The Accounting Cycle. The large circle consists of 10 smaller circles with arrows pointing from one smaller circle to the next one. Circles 5, 6 and 7 are highlighted. The smaller circles are labeled, in clockwise order: 1 Identify and Analyze Transactions; 2 Record Transactions to Journal; 3 Post Journal Information to Ledger; 4 Prepare Unadjusted Trial Balance; 5 Adjusting Entries; 6 Prepare Adjusted Trial Balance; 7 Prepare Financial Statements; 8 Closing Entries; 9 Prepare Post-Closing Trial Balance; 10 Reversing Entries (optional). Return

Printing Plus, Unadjusted Trial Balance, January 31, 2019. Debit accounts: Cash, $24,800; Accounts Receivable, 1,200; Supplies, 500; Equipment, 3,500; Dividends, 100; Salaries Expense, 3,600; Utility Expense, 300; Total Debits, $34,000. Credit accounts: Accounts Payable, 500; Unearned Revenue, 4,000; Common Stock, 20,000; Service Revenue, 9,500; Total Credits, $34,000. Return

Media Attributions

- Adjustment Process © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Unadjusted Trial Balance for Printing Plus © Rice Unversity is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license