1.14 Financial Statements

[latex][/latex]

One of the key factors for success for those beginning the study of accounting is to understand how the elements of the financial statements relate to each of the financial statements. That is, once the transactions are categorized into the elements, knowing what to do next is vital. This is the beginning of the process to create the financial statements. It is important to note that financial statements are discussed in the order in which the statements are presented.

Please watch the video.

Elements of the Financial Statements

When thinking of the relationship between the elements and the financial statements, we might think of a baking analogy: the elements represent the ingredients, and the financial statements represent the finished product. As with baking a cake, knowing the ingredients (elements) and how each ingredient relates to the final product (financial statements) is vital to the study of accounting.

To help accountants prepare and users better understand financial statements, the profession has outlined what is referred to as elements of the financial statements, which are those categories or accounts that accountants use to record transactions and prepare financial statements. There are ten elements of the financial statements, and we have already discussed most of them.

- Revenue—value of goods and services the organization sold or provided.

- Expenses—costs of providing the goods or services for which the organization earns revenue.

- Gains—gains are similar to revenue but relate to “incidental or peripheral” activities of the organization.

- Losses—losses are similar to expenses but related to “incidental or peripheral” activities of the organization.

- Assets—items the organization owns, controls, or has a claim to.

- Liabilities—amounts the organization owes to others (also called creditors).

- Equity—the net worth (or net assets) of the organization.

- Investment by owners—cash or other assets provided to the organization in exchange for an ownership interest.

- Distribution to owners—cash, other assets, or ownership interest (equity) provided to owners.

- Comprehensive income—defined as the “change in equity of a business enterprise during a period from transactions and other events and circumstances from nonowner sources” (SFAC No. 6, p. 21). While further discussion of comprehensive income is reserved for intermediate and advanced studies in accounting, it is worth noting that comprehensive income has four components, focusing on activities related to foreign currency, derivatives, investments, and pensions.

Financial Statements for a Sample Company

In this example using a fictitious company, Cheesy Chuck’s, we began with the account balances and demonstrated how to prepare the financial statements for the month of June, the first month of operations for the business. It will be helpful to revisit the process by summarizing the information we started with and how that information was used to create the four financial statements: income statement, statement of owner’s equity, balance sheet, and statement of cash flows.

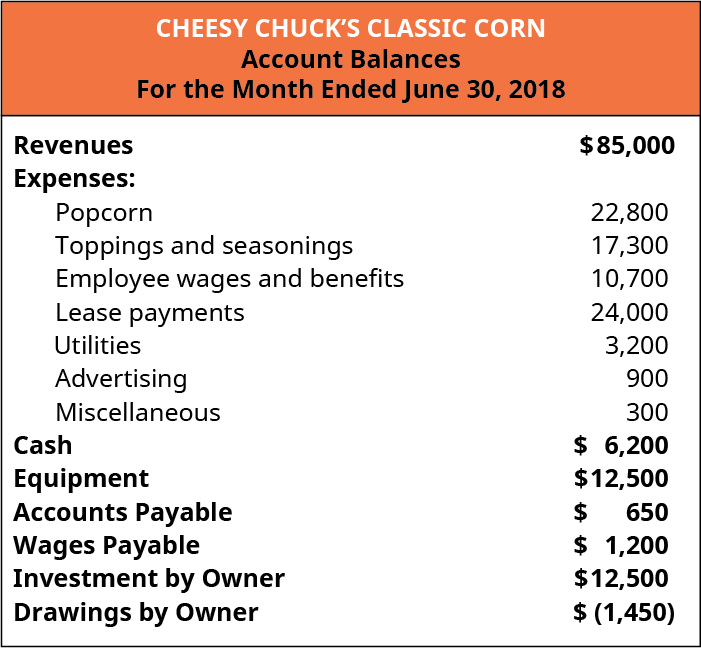

We started with the account balances shown in Figure 1.21.

Income Statement

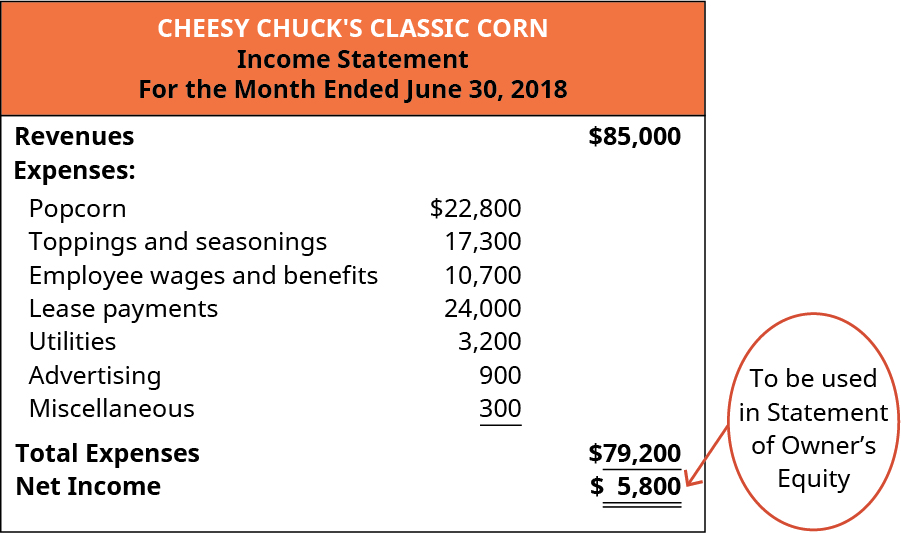

Let’s prepare the income statement so we can inform how a service business, Cheesy Chuck’s, performed for the month of June (note, an income statement is for a period of time). Our first step is to determine the value of goods and services that the organization sold or provided for a given period of time. These are the inflows to the business, and because the inflows relate to the primary purpose of the business (making and selling popcorn), we classify those items as Revenues, Sales, or Fees Earned. For this example, we use Revenue. The revenue for Cheesy Chuck’s for the month of June is $85,000.

Next, we need to show the total expenses for Cheesy Chuck’s. Because Cheesy Chuck’s tracks different types of expenses, we need to add these amounts to calculate total expenses. The final step to create the income statement is to determine the amount of net income or net loss for Cheesy Chuck’s. Since revenues ($85,000) are greater than expenses ($79,200), Cheesy Chuck’s has a net income of $5,800 for the month of June.

Figure 1.22 displays the June income statement for Cheesy Chuck’s Classic Corn.

Financial statements are created using numerous standard conventions or practices. The standard conventions provide consistency and help assure financial statement users the information is presented in a similar manner, regardless of the organization issuing the financial statement. Let’s look at the standard conventions shown in the Cheesy Chuck’s income statement:

- The heading of the income statement includes three lines.

- The first line lists the business name.

- The middle line indicates the financial statement that is being presented.

- The last line indicates the time frame of the financial statement. Do not forget the income statement is for a period of time (the month of June in our example).

- There are three columns.

- Going from left to right, the first column is the category heading or account.

- The second column is used when there are numerous accounts in a particular category (Expenses, in our example).

- The third column is a total column. In this illustration, it is the column where subtotals are listed and net income is determined (subtracting Expenses from Revenues).

- Subtotals are indicated by a single underline, while totals are indicated by a double underline. Notice the amount of Miscellaneous Expense ($300) is formatted with a single underline to indicate that a subtotal will follow. Similarly, the amount of “Net Income” ($5,800) is formatted with a double underline to indicate that it is the final value/total of the financial statement.

- There are no gains or losses for Cheesy Chuck’s. Gains and losses are not unusual transactions for businesses, but gains and losses may be infrequent for some, especially small, businesses.

Statement of Owner’s Equity (Retained Earnings)

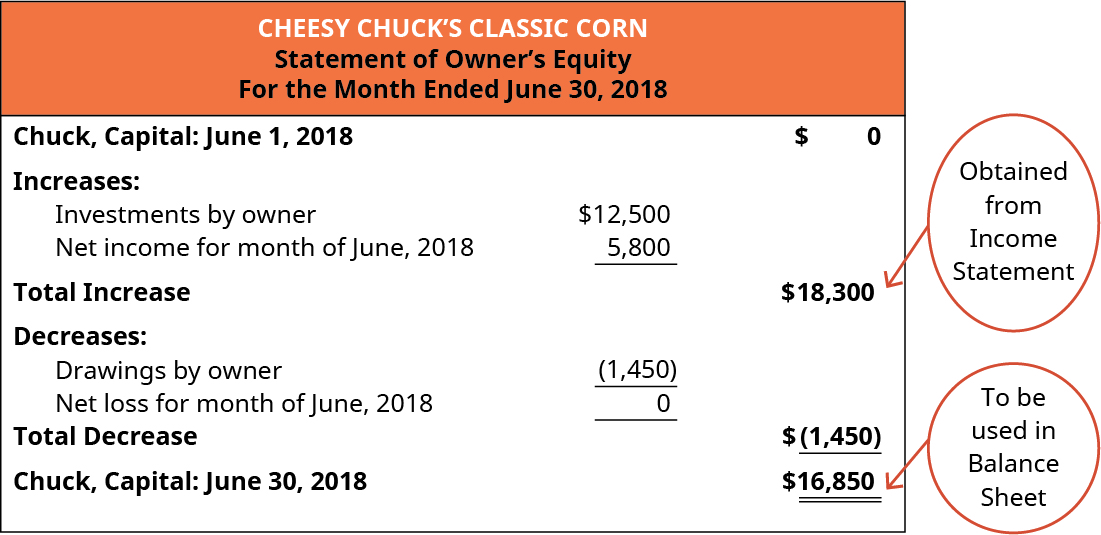

Let’s create the statement of owner’s equity for Cheesy Chuck’s for the month of June. Since Cheesy Chuck’s is a brand-new business, there is no beginning balance of Owner’s Equity. The first items to account for are the increases in value/equity, which are investments by owners and net income. As you look at the accounting information you were provided, you recognize the amount invested by the owner, Chuck, was $12,500. Next, we account for the increase in value as a result of net income, which was determined in the income statement to be $5,800. Next, we determine if there were any activities that decreased the value of the business. More specifically, we are accounting for the value of distributions to the owners and net loss, if any.

It is important to note that an organization will have either net income or net loss for the period, but not both. Also, small businesses in particular may have periods where there are no investments by, or distributions to, the owner(s). For the month of June, Chuck withdrew $1,450 from the business. This is a good time to recall the terminology used by accountants based on the legal structure of the particular business. Since the account was titled “Drawings by Owner” and because Chuck is the only owner, we can assume this is a sole proprietorship. If the business was structured as a corporation, this activity would be called something like “Dividends Paid to Owners.”

At this stage, remember that since we are working with a sole proprietorship to help simplify the examples, we have addressed the owner’s value in the firm as capital or owner’s equity. However, later we switch the structure of the business to a corporation, and instead of owner’s equity, we begin using such account titles as common stock and retained earnings to represent the owner’s interests. The corporate treatment is more complicated, because corporations may have a few owners up to potentially thousands of owners (stockholders). The details of accounting for the interests of corporations are covered in a subsequent chapter.

So how much did the value of Cheesy Chuck’s change during the month of June? You are correct if you answered $16,850. Since this is a brand-new store, the beginning value of the business is zero. During the month, the owner invested $12,500 and the business had profitable operations (net income) of $5,800. Also, during the month the owner withdrew $1,450, resulting in a net change (and ending balance) to owner’s equity of $16,850. Shown in a formula:

Beginning Balance + Investments by Owners ± Net Income (Net Loss) – Distributions, or

\[\$0+\$12,500+\$5,800-\$1,450=\$16,850\]

Figure 1.23 shows what the statement of owner’s equity for Cheesy Chuck’s Classic Corn would look like.

Notice the following about the statement of owner’s equity for Cheesy Chuck’s:

- The format is similar to the format of the income statement (three lines for the heading, three columns).

- The statement follows a chronological order, starting with the first day of the month, accounting for the changes that occurred throughout the month, and ending with the final day of the month.

The statement uses the final number from the financial statement previously completed. In this case, the statement of owner’s equity uses the net income (or net loss) amount from the income statement (Net Income, $5,800).

Balance Sheet

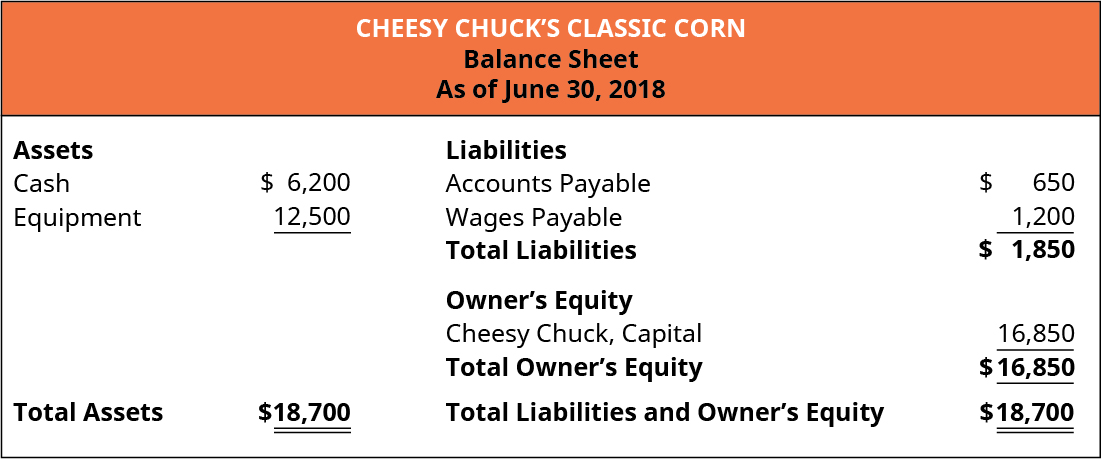

Let’s create a balance sheet for Cheesy Chuck’s for June 30. To begin, we look at the accounting records and determine what assets the business owns and the value of each. Cheesy Chuck’s has two assets: Cash ($6,200) and Equipment ($12,500). Adding the amount of assets gives a total asset value of $18,700. As discussed previously, the equipment that was recently purchased will be depreciated in the future, beginning with the next accounting period.

Next, we determine the amount of money that Cheesy Chuck’s owes (liabilities). There are also two liabilities for Cheesy Chuck’s. The first account listed in the records is Accounts Payable for $650. Accounts Payable is the amount that Cheesy Chuck’s must pay in the future to vendors (also called suppliers) for the ingredients to make the gourmet popcorn. The other liability is Wages Payable for $1,200. This is the amount that Cheesy Chuck’s must pay in the future to employees for work that has been performed. Adding the two amounts gives us total liabilities of $1,850. (Here’s a hint as you develop your understanding of accounting: Liabilities often include the word “payable.” So, when you see “payable” in the account title, know these are amounts owed in the future—liabilities.)

Finally, we determine the amount of equity the owner, Cheesy Chuck, has in the business. The amount of owner’s equity was determined on the statement of owner’s equity in the previous step ($16,850). Can you think of another way to confirm the amount of owner’s equity? Recall that equity is also called net assets (assets minus liabilities). If you take the total assets of Cheesy Chuck’s of $18,700 and subtract the total liabilities of $1,850, you get owner’s equity of $16,850. Using the basic accounting equation, the balance sheet for Cheesy Chuck’s as of June 30 is shown in Figure 1.24.

Connecting the Income Statement and the Balance Sheet

Another way to think of the connection between the income statement and balance sheet (which is aided by the statement of owner’s equity) is by using a sports analogy. The income statement summarizes the financial performance of the business for a given period of time. The income statement reports how the business performed financially each month—the firm earned either net income or net loss. This is similar to the outcome of a particular game—the team either won or lost.

The balance sheet summarizes the financial position of the business on a given date. Meaning, because of the financial performance over the past twelve months, for example, this is the financial position of the business as of December 31. Think of the balance sheet as being similar to a team’s overall win/loss record—to a certain extent a team’s strength can be perceived by its win/loss record.

However, because different companies have different sizes, you do not necessarily want to compare the balance sheets of two different companies. For example, you would not want to compare a local retail store with Walmart. In most cases you want to compare a company with its past balance sheet information.

Statement of Cash Flows

This fourth and final financial statement lists the cash inflows and cash outflows for the business for a period of time. It was created to fill in some informational gaps that existed in the other three statements (income statement, owner’s equity/retained earnings statement, and the balance sheet).

Please watch the video and answer the question(s)!

Long Descriptions

Cheesy Chuck’s Classic Corn, Account Balances, For the Month Ended June 30, 2018. Revenues $85,000; Expenses: Popcorn 22,800, toppings and seasonings 17,300, Employee wages and benefits 10,700, Lease payments 24,000, Utilities 3,200, Advertising 900, Miscellaneous 300; Cash 6,200; Equipment 12,500; Accounts Payable 650; Wages Payable 1,200; Investment by Owner 12,500; Drawings by owner minus 1,450. Return

Cheesy Chuck’s Classic Corn, Income Statement, For the Month Ended June 30, 2018. Revenues $85,000, less Expenses: Popcorn 22,800, Toppings and seasonings 17,300, Employee wages and benefits 10,700, Lease payments 24,000, Utilities 3,200, Advertising 900, Miscellaneous 300 for Total Expenses 79,200 equaling Net Income $5,800. This Net Income figure will be used in the Statement of Owner’s Equity. Return

Cheesy Chuck’s Classic Corn, Statement of Owner’s Equity, For the month Ended June 30, 2018. Chuck, Capital: June 1, 2018 $0; Increases: Investments by owner $12,500, Net income for the month of june, 2018 [obtained from the income statement] 5,800. Total Increase 18,300. Decreases: Drawings by owner (1,450). Total Decrease (1,450); Chuck, Capital: June 30, 2018 $16,850 [To be used in Balance Sheet] Return

Cheesy Chuck’s Classic Corn, Balance Sheet, As of June 30, 2018. Assets: Cash 6,200, Equipment 12,500. Total Assets 18,700. Liabilities: Accounts Payable 650, Wages Payable 1,200. Total Liabilties 1,850; Owner’s Equity: Cheesy Chuck, Capital 16,800. Total Owner’s Equity 16,850; Total Liabilities and Owner’s Equity 18,700. Return

Media Attributions

- Account Balances © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Income Statement © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Statement of Owner’s Equity © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Balance Sheet © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license