5.7 Owners’ Equity

Owners’ equity represents the business owners’ share of the company. It is often referred to as net worth or net assets in the financial world and as stockholders’ equity or shareholders’ equity when discussing businesses operations of corporations. From a practical perspective, it represents everything a company owns (the company’s assets) minus all the company owes (its liabilities). While “owners’ equity” is used for all three types of business organizations (corporations, partnerships, and sole proprietorships), only sole proprietorships name the balance sheet account “owner’s equity” as the entire equity of the company belongs to the sole owner. Partnerships often label this section of their balance sheet as “partners’ equity.” All three forms of business utilize different accounting for the respective equity transactions and use different equity accounts, but they all rely on the same relationship represented by the basic accounting equation (Figure 5.45).

Three Forms of Business Ownership

Businesses operate in one of three forms—sole proprietorships, partnerships, or corporations. Sole proprietorships utilize a single account in owners’ equity in which the owner’s investments and net income of the company are accumulated and distributions to the owner are withdrawn. Partnerships utilize a separate capital account for each partner, with each capital account holding the respective partner’s investments and the partner’s respective share of net income, with reductions for the distributions to the respective partners. Corporations differ from sole proprietorships and partnerships in that their operations are more complex, often due to size. Unlike these other entity forms, owners of a corporation usually change continuously.

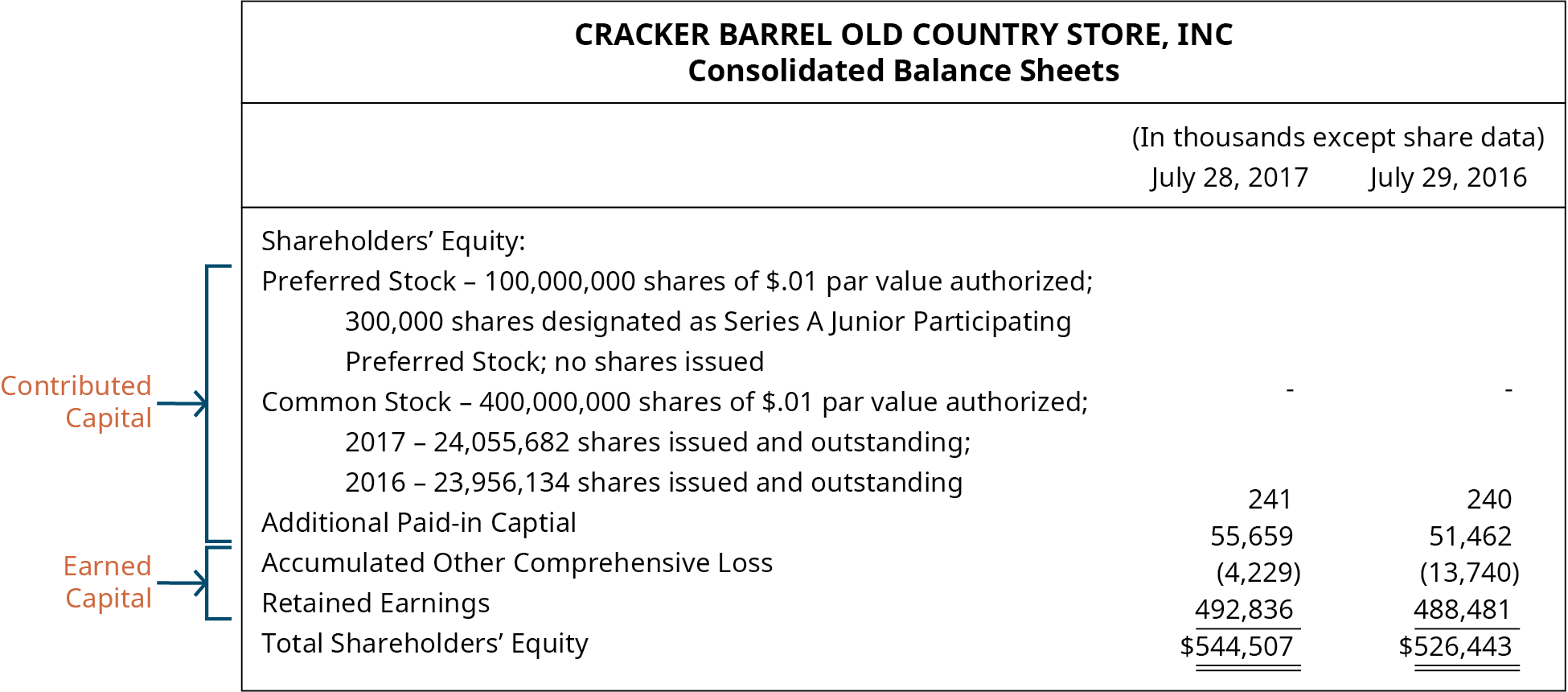

The stockholders’ equity section of the balance sheet for corporations contains two primary categories of accounts. The first is paid-in capital, or contributed capital—consisting of amounts paid in by owners. The second category is earned capital, consisting of amounts earned by the corporation as part of business operations. On the balance sheet, retained earnings is a key component of the earned capital section, while the stock accounts such as common stock, preferred stock, and additional paid-in capital are the primary components of the contributed capital section.

CONCEPTS IN PRACTICE

Contributed Capital and Earned Capital

The stockholders’ equity section of Cracker Barrel Old Country Store, Inc.’s consolidated balance sheet as of July 28, 2017, and July 29, 2016, shows the company’s contributed capital and the earned capital accounts.6

Characteristics and Functions of the Retained Earnings Account

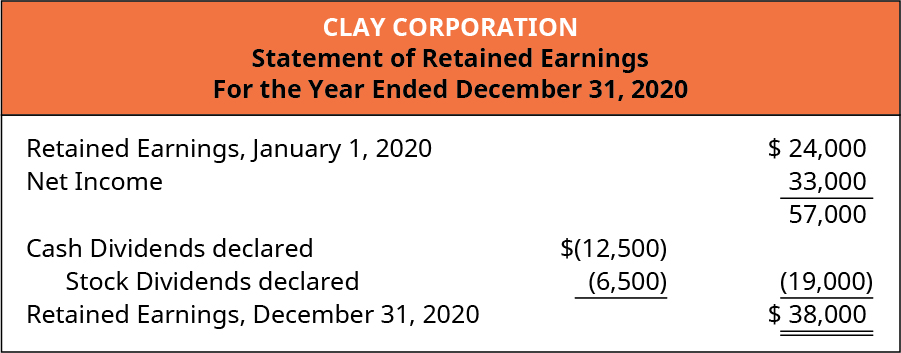

Retained earnings is the primary component of a company’s earned capital. It generally consists of the cumulative net income minus any cumulative losses less dividends declared. A basic statement of retained earnings is referred to as an analysis of retained earnings because it shows the changes in the retained earnings account during the period. A company preparing a full set of financial statements may choose between preparing a statement of retained earnings, if the activity in its stock accounts is negligible, or a statement of stockholders’ equity, for corporations with activity in their stock accounts. A statement of retained earnings for Clay Corporation for its second year of operations (Figure 5.47) shows the company generated more net income than the amount of dividends it declared.

When the retained earnings balance drops below zero, this negative or debit balance is referred to as a deficit in retained earnings.

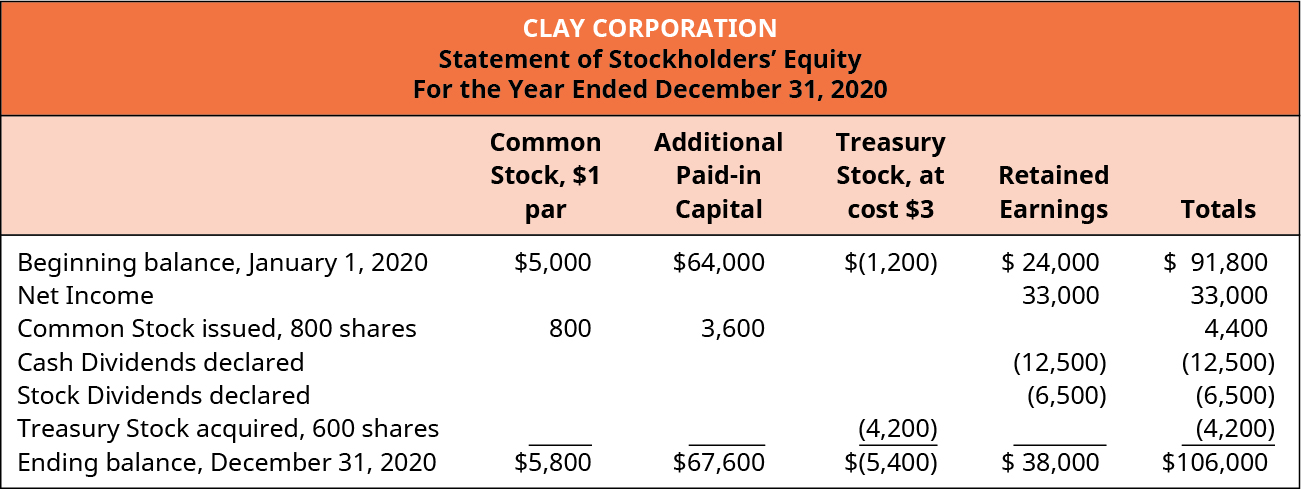

Statement of Stockholders’ Equity

The statement of retained earnings is a subsection of the statement of stockholders’ equity. While the retained earnings statement shows the changes between the beginning and ending balances of the retained earnings account during the period, the statement of stockholders’ equity provides the changes between the beginning and ending balances of each of the stockholders’ equity accounts, including retained earnings. The format typically displays a separate column for each stockholders’ equity account, as shown for Clay Corporation in Figure 5.49. The key events that occurred during the year—including net income, stock issuances, and dividends—are listed vertically. The stockholders’ equity section of the company’s balance sheet displays only the ending balances of the accounts and does not provide the activity or changes during the period.

Nearly all public companies report a statement of stockholders’ equity rather than a statement of retained earnings because GAAP requires disclosure of the changes in stockholders’ equity accounts during each accounting period. It is significantly easier to see the changes in the accounts on a statement of stockholders’ equity rather than as a paragraph note to the financial statements.

Long Descriptions

Cracker Barrel Old Country Store, Inc, Consolidated Balance Sheets. (In thousands except share data) July 28, 2017 and July 29, 2016, respectively: Shareholders’ Equity: Preferred Stock – 100,000,000 shares of $.01 par value authorized; 300,000 shares designated as Series A Junior Participating Preferred Stock; no shares issued. Common stock – 400,000,000 shares of $.01 par value authorized; 2017 – 24,055,682 shares issued and outstanding; 2016 – 23,956,134 shares issued and outstanding 241, 240. Additional paid-in capital 55,659, 51,462. Accumulated other comprehensive loss (4,220), (13,740). Retained earnings 492,836, 488,481. Total shareholders’ equity 544,507, 526,443. A bracket around the Preferred stock, Common stock, and Additional paid-in capital indicates that they make up the contributed capital. A bracket around the Accumulated other comprehensive loss and the Retained earnings indicates that they make up the earned capital. Return

Clay Corporation, Statement of Stockholders’ Equity, For the Year Ended December 31, 2020. Common Stock, $1 par; Additional Paid-in Capital; Treasury Stock, at cost $3; Retained Earnings; Totals (respectively): Beginning balance, January 1, 2020: $5,000, 64,000, (1,200), 24,000, 91,800. Net Income: -, -, -, 33,000, 33,000. Common stock issued, 800 shares: 800, 3,600, -, -, 4,400. Cash dividends declared: -, -, -, (12,500), (12,500). Stock dividends declared: -, -, -, (6,500), (6,500). Treasury stock acquired, 600 shares: -, -, (4,200), -, (4,200). Ending balance, December 31, 2020: $5,800, 67,600, (5,400), 38,000, 106,000. Return

Clay Corporation, Statement of Retained Earnings, For the Year Ended December 31, 2020 Retained earnings, January 1, 2020 $24,000. Prior Period adjustment, net of income taxes (700). Adjusted Retained earnings, January 1, 2020 24,700. Net Income 33,000. Less Cash dividend declared of (12,500) and Stock dividend declared of (6,500), totaling 19,000. Retained Earnings, December 31, 2020 $38,700. Return

Footnotes

- 6 Cracker Barrel. Cracker Barrel Old Country Store Annual Report 2017. September 22, 2017. http://investor.crackerbarrel.com/static-files/c05f90b8-1214-4f50-8508-d9a70301f51f

- 7 Kevin M. LaCroix. “Financial Statements Continue to Decline for U.S. Reporting Companies.” The D & O Diary. June 12, 2017. https://www.dandodiary.com/2017/06/articles/sox-generally/financial-restatements-continue-decline-u-s-reporting-companies/