3.10 Intangible Assets

Intangible assets can be difficult to understand and incorporate into the decision-making process. In this section we explain them in more detail and provide examples of how to amortize each type of intangible asset.

Fundamentals of Intangible Assets

Intangibles are recorded at their acquisition cost, as are tangible assets. The costs of internally generated intangible assets, such as a patent developed through research and development, are recorded as expenses when incurred. An exception is legal costs to register or defend an intangible asset. For example, if a company incurs legal costs to defend a patent it has developed internally, the costs associated with developing the patent are recorded as an expense, but the legal costs associated with defending the patent would be capitalized as a patent intangible asset.

Amortization of intangible assets is handled differently than depreciation of tangible assets. Intangible assets are typically amortized using the straight-line method; there is typically no salvage value, as the usefulness of the asset is used up over its lifetime, and no accumulated amortization account is needed. Additionally, based on regulations, certain intangible assets are restricted and given limited life spans, while others are infinite in their economic life and not amortized.

Copyrights

While copyrights have a finite life span of 70 years beyond the author’s death, they are amortized over their estimated useful life. Therefore, if a company acquired a copyright on a new graphic novel for $10,000 and estimated it would be able to sell that graphic novel for the next ten years, it would amortize $1,000 a year ($10,000 ÷ ten years), and the journal entry would be as shown. Assume that the novel began sales on January 1, 2019.

Patents

Patents are issued to the inventor of the product by the federal government and last twenty years. All costs associated with creating the product being patented (such as research and development costs) are expensed; however, direct costs to obtain the patent could be capitalized. Otherwise, patents are capitalized only when purchased. Like copyrights, patents are amortized over their useful life, which can be shorter than twenty years due to changing technology. Assume Mech Tech purchased the patent for a new pump system. The patent cost $20,000, and the company expects the pump to be a useful product for the next twenty years. Mech Tech will then amortize the $20,000 over the next twenty years, which is $1,000 a year.

Trademarks

Companies can register their trademarks with the federal government for ten years with the opportunity to renew the trademark every ten years. Trademarks are recorded as assets only when they are purchased from another company and are valued based on market price at the time of purchase. In this case, these trademarks are amortized over the expected useful life. In some cases, the trademark may be seen as having an indefinite life, in which case there would be no amortization.

Goodwill

From an accounting standpoint, goodwill is internally generated and is not recorded as an asset unless it is purchased during the acquisition of another company. The purchase of goodwill occurs when one company buys another company for an amount greater than the total value of the company’s net assets. The value difference between net assets and the purchase price is then recorded as goodwill on the purchaser’s financial statements. For example, say the London Hoops professional basketball team was sold for $10 million. The new owner received net assets of $7 million, so the goodwill (value of the London Hoops above its net assets) is $3 million. The following journal entry shows how the new owner would record this purchase.

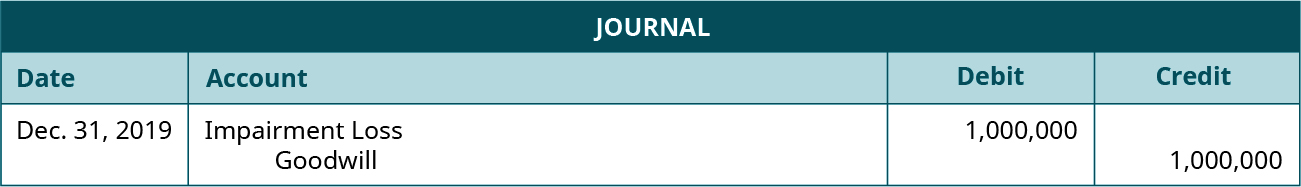

Goodwill does not have an expected life span and therefore is not amortized. However, a company is required to compare the book value of goodwill to its market value at least annually to determine if it needs to be adjusted. This comparison process is called testing for impairment. If the market value of goodwill is found to be lower than the book value, then goodwill needs to be reduced to its market value. If goodwill is impaired, it is reduced with a credit, and an impairment loss is debited. Goodwill is never increased beyond its original cost. For example, if the new owner of London Hoops assesses that London Hoops now has a fair value of $9,000,000 rather than the $10,000,000 of the original purchase, the owner would need to record the impairment as shown in the following journal entry.

CONCEPTS IN PRACTICE

Microsoft’s Goodwill

In 2016, Microsoft bought LinkedIn for $25 billion. Microsoft wanted the brand, website platform, and software, which are intangible assets of LinkedIn, and therefore Microsoft only received $4 billion in net assets. The overpayment by Microsoft is not necessarily a bad business decision, but rather the premium or value of those intangible assets that LinkedIn owned and Microsoft wanted. The $21 billion difference will be listed on Microsoft’s balance sheet as goodwill.