5.2 Types of Long-term Funding

Businesses have several ways to secure financing and, in practice, will use a combination of these methods to finance the business. As you’ve learned, net income does not necessarily mean cash. In some cases, in the long-run, profitable operations will provide businesses with sufficient cash to finance current operations and to invest in new opportunities. However, situations might arise where the cash flow generated is insufficient to cover future anticipated expenses or expansion, and the company might need to secure additional funding.

If the extra amount needed is somewhat temporary or small, a short-term source, such as a loan, might be appropriate. When additional long-term funding needs arise, a business can choose to sell stock in the company (equity-based financing) or obtain a long-term liability (debt-based financing), such as a loan that is spread over a period longer than a year.

Types of Long-Term Funding

If a company needs additional funding for a major expenditure, such as expansion, the source of funding would typically be repaid over several years, or in the case of equity-based financing, over an indefinite period of time. With equity-based financing, the company sells an interest in the company’s ownership by issuing shares of the company’s common stock. This financing option is equity financing, and it will be addressed in detail in the next chapter. Here, we will focus on two major long-term debt-based options: long-term loans and bonds.

Debt as an option for financing is an important source of funding for businesses. If a company chooses a debt-based option, the business can borrow money on an intermediate (typically two to four years) or long-term (longer than four years) basis from lenders. In the case of bonds, the funds would be provided by investors. While loans and bonds are similar in that they borrow money on which the borrower will pay interest and eventually repay the lenders, they have some important differences. First, a company can raise funds by borrowing from an individual, bank, or other lender, while a bond is typically sold to numerous investors. When a company chooses a loan, the business signs what is known as a note, and a legal relationship called a note payable is created between the borrower and the lender. The document lists the conditions of the financial arrangement, a fixed predetermined interest rate (or, if the agreement allows, a variable interest rate), the amount borrowed, the borrowing costs to be charged, and the timing of the payments. In some cases, companies will secure an interest-only loan, which means that for the life of the loan the organization pays only the interest expense that has accrued and upon maturity repays the original amount that it borrowed and still owes. For individuals a student loan, car loan, or a mortgage can all be types of notes payable.

If debt instruments are created with a variable interest rate that can fluctuate up or down, depending upon predetermined factors, an inflation measurement must also be included in the documentation. The Federal Funds Rate, for example, is a commonly used tool for potential adjustments in interest rates. To keep our discussion simple, we will use a fixed interest rate in our subsequent calculations.

Another difference between loans and bonds is that the note payable creates an obligation for the borrower to repay the lender on a specified date. To demonstrate the mechanics of a loan, with loans, a note payable is created for the borrower when the loan is initiated. This example assumes the loan will be paid in full by the maturity or due date. Typically, over the life of the loan, payments will be composed of both principal and interest components. The principal component paid typically reduces the amount that the borrower owes the lender.

Typical long-term loans have other characteristics. For example, most long-term notes are held by one entity, meaning one party provides all of the financing. If a company bought heavy-duty equipment from Caterpillar, it would be common for the seller of the equipment to also have a division that would provide the financing for the transaction. An additional characteristic of a long-term loan is that in many, if not most, situations, the initial creator of the loan will hold it and receive and process payments until it matures.

Returning to the differences between long-term debt and bonds, another difference is that the process for issuing (selling) bonds can be very complicated, especially for companies that are subject to regulation. The bond issue must be approved by the appropriate regulatory agency, and then outside parties such as investment banks sell the bonds to, typically, a large audience of investors. It is not unusual for several months to pass between the time that the company’s board of directors approves the bond offering, gets regulatory approval, and then markets and issues the bonds. This additional time is often the reason that the market rate for similar bonds in the outside business environment is higher or lower than the stated interest rate that the company committed to pay when the bond process was first begun. This difference can lead to bonds being issued (sold) at a discount or premium.

Finally, while loans can normally be paid off before they are due, in most cases bonds must be held by an owner until they mature. Because of this last characteristic, a bond, such as a thirty-year bond, might have several owners over its lifetime, while most long-term notes payable will only have one owner.

YOUR TURN

Current versus Long-Term Liabilities

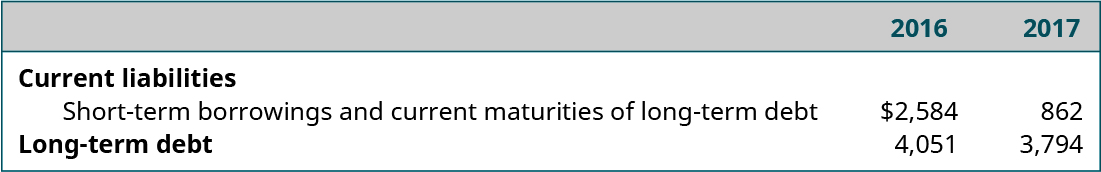

Below is a portion of the 2017 Balance Sheet of Emerson, Inc. (shown in millions of dollars).2 There are several observations we can make from this information.

Notice the company lists separately the Current Liabilities (listed as “Short-term borrowings and current maturities of long-term debt”) and Long-term Liabilities (listed as “Long-term debt”). Also, under the “Current liabilities” heading, notice the “Short-term borrowings and current maturities of long-term debt” decreased significantly from 2016 to 2017. In 2016, Emerson held $2.584 billion in short-term borrowings and current maturities of long-term debt. This amount decreased by $1.722 billion in 2017, which is a 67% decrease. During the same timeframe, long-term debt decreased $257 million, going from $4.051 billion to $3.794 billion, which is a 6.3% decrease.

Thinking about the primary purpose of accounting, why do you think accountants separate liabilities into current liabilities and long-term liabilities?

Solution

The primary purpose of accounting is to provide stakeholders with financial information that is useful for decision making. It is important for stakeholders to understand how much cash will be required to satisfy liabilities within the next year (liquidity) as well as how much will be required to satisfy long-term liabilities (solvency). Stakeholders, especially lenders and owners, are concerned with both liquidity and solvency of the business.

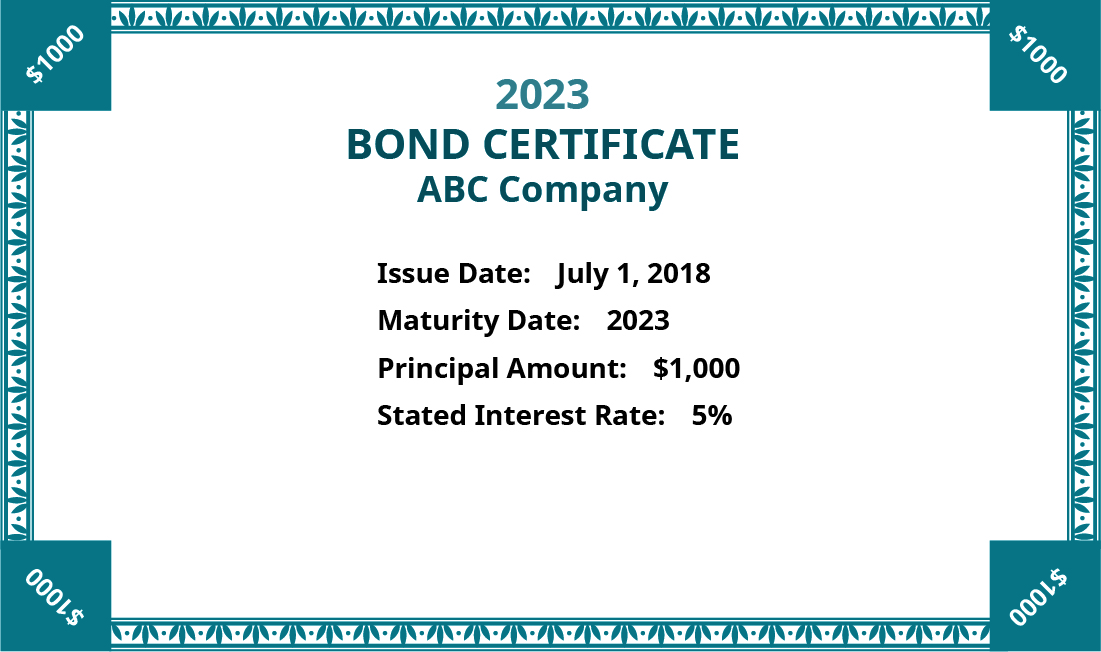

Fundamentals of Bonds

Now let us look at bonds in more depth. A bond is a type of financial instrument that a company issues directly to investors, bypassing banks or other lending institutions, with a promise to pay the investor a specified rate of interest over a specified period of time. When a company borrows money by selling bonds, it is said the company is “issuing” bonds. This means the company exchanges cash for a promise to repay the cash, along with interest, over a set period of time. As you’ve learned, bonds are formal legal documents that contain specific information related to the bond. In short, it is a legal contract—called a bond certificate (as shown in Figure 5.37) or an indenture—between the issuer (the business borrowing the money) and the lender (the investor lending the money). Bonds are typically issued in relatively small denominations, such as $1,000 so they can be placed in the market and are accessible to a greater market of investors compared to notes. The bond indenture is a contract that lists the features of the bond, such as the amount of money that will be repaid in the future, called the principal (also called face value or maturity value); the maturity date, the day the bond holder will receive the principal amount; and the stated interest rate, which is the rate of interest the issuer agrees to pay the bondholder throughout the term of the bond.

For a typical bond, the issuer commits to paying a stated interest rate either once a year (annually) or twice a year (semiannually). It is important to understand that the stated rate will not go up or down over the life of the bond. This means the borrower will pay the same semiannual or annual interest payment on the same dates for the life of the bond. In other words, when an investor buys a typical bond, the investor will receive, in the future, two major cash flows: periodic interest payments paid either annually or semiannually based on the stated rate of the bond, and the maturity value, which is the total amount paid to the owner of the bond on the maturity date.

The process of preparing a bond issuance for sale and then selling on the primary market is lengthy, complex, and is usually performed by underwriters—finance professionals who specialize in issuing bonds and other financial instruments. Here, we will only examine transactions concerning issuance, interest payments, and the sale of existing bonds.

There are two other important characteristics of bonds to discuss. First, for most companies, the total value of bonds issued can often range from hundreds of thousands to several million dollars. The primary reason for this is that bonds are typically used to help finance significant long-term projects or activities, such as the purchase of equipment, land, buildings, or another company.

CONCEPTS IN PRACTICE

Apple Inc. Issues Bonds

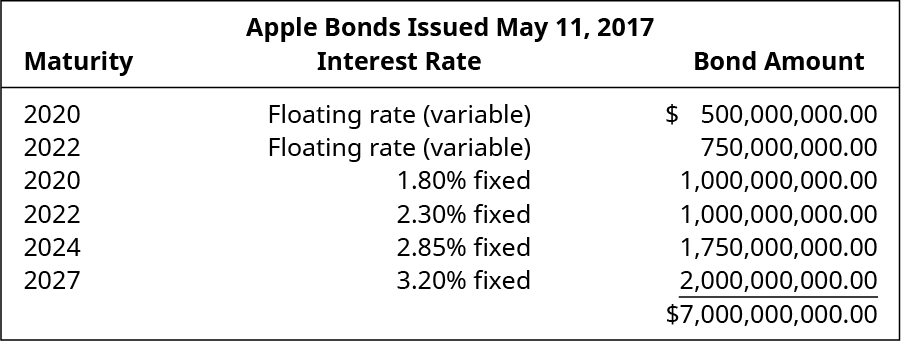

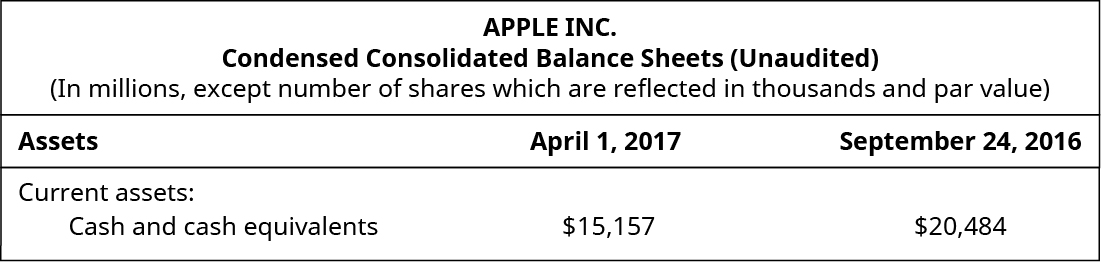

On May 11, 2017, Apple Inc. issued bonds to get cash. Apple Inc. submitted a form to the Securities and Exchange Commission (www.sec.gov) to announce their intentions.

On May 3 of the same year, Apple Inc. had issued their 10-Q (quarterly report) that showed the following assets.

Apple Inc. reported it had $15 billion dollars in cash and a total of $101 billion in Current Assets. Why did it need to issue bonds to raise $7 billion more?

Analysts suggested that Apple would use the cash to pay shareholder dividends. Even though Apple reported billions of dollars in cash, most of the cash was in foreign countries because that was where the products had been sold. Tax laws vary by country, but if Apple transferred the cash to a US bank account, they would have to pay US income tax on it, at a tax rate as high as 39%. So, Apple was much better off borrowing and paying 3.2% interest, which is tax deductible, than bringing the cash to the US and paying a 39% income tax.

However, it’s important to remember that in the United States, Congress can change tax laws at any time, so what was then current tax law when this transaction occurred could change in the future.

The second characteristic of bonds is that bonds are often sold to several investors instead of to one individual investor.

When establishing the stated rate of interest the business will pay on a bond, bond underwriters consider many factors, including the interest rates on government treasury bonds (which are assumed to be risk-free), rates on comparable bond offerings, and firm-specific factors related to the business’s risk (including its ability to repay the bond). The more likely the possibility that a company will default on the bond, meaning they either miss an interest payment or do not return the maturity amount to the bond’s owner when it matures, the higher the interest rate is on the bond. It is important to understand that the stated rate will not change over the life of any one bond once it is issued. However, the stated rate on future new bonds may change as economic circumstances and the company’s financial position changes.

Bonds themselves can have different characteristics. For example, a debenture is an unsecured bond issued based on the good name and reputation of the company. These companies are not pledging other assets to cover the amount in case they fail to pay the debt, or default. The opposite of a debenture is a secured bond, meaning the company is pledging a specific asset as collateral for the bond. With a secured bond, if the company goes under and cannot pay back the bond, the pledged asset would be sold, and the proceeds would be distributed to the bondholders.

There are term bonds, or single-payment bonds, meaning the entire bond will be repaid all at once, rather than in a series of payments. And there are serial bonds, or bonds that will mature over a period of time and will be repaid in a series of payments.

A callable bond (also known as a redeemable bond) is one that can be repurchased or “called” by the issuer of the bond. If a company sells callable bonds with an 8% interest rate and the interest rate the bank is offering subsequently drops to 5%, the company can borrow at that new rate of 5%, call the 8% bonds, and pay them off (even if the purchaser does not want to sell them back). In essence, the institution would be lowering its rate of interest to borrow money from 8% to 5% by calling the bond.

Putable bonds give the bondholder the right to decide whether to sell it back early or keep it until it matures. It is essentially the opposite of a callable bond.

A convertible bond can be converted to common stock in a one-way, one-time conversion. Under what conditions would it make sense to convert? Suppose the face-value interest rate of the bond is 8%. If the company is doing well this year, such that there is an expectation that shareholders will receive a significant dividend and the stock price will rise, the stock might appear to be more valuable than the return on the bond.

Long Description

Picture of a Promissory note, formatted with the following information: Loan Agreement Effective Date: [D D / M M / Y Y Y Y]; Borrower; Lender; Address Line 1 (street address); Address Line 1 (street Address); Address Line 2 (city, state, zip code); Address Line 2 (city, state, zip code); Promise to pay: a certain amount in U.S. Dollars within a set number of months from today, in equal continuous monthly payments of a certain amount each on a certain day of each month, with beginning and ending dates. Borrower promises to pay the Lender the principal listed above plus interest at a certain APR%. Value Received for Properety is described. If this note is not paid in full upon date due, the borrower agrees to pay all reasonable cost for collection, including all attorney fees. Return

Apple Bonds Issued May 11, 2017. Maturity, Interest Rate, Bond Amount (respectively): 2020, Floating rate (variable), $500,000,000.00; 2022, Floating rate (variable), $750,000,000.00; 2020, 1.80 percent fixed, $1,000,000,000.00; 2022, 2.30 percent fixed, $1,000,000,000.00; 2024, 2.85 percent fixed, $1,750,000,000.00; 2027, 3.20 percent fixed, $2,000,000,000.00; Total Bond Amount $7,000,000,000.00. Return

Footnotes

2 Emerson. 2017 Annual Report. Emerson Electric Company. 2017. https://www.emerson.com/documents/corporate/2017emersonannualreport-en-2883292.pdf