5.9 Treasury Stock

Sometimes a corporation decides to purchase its own stock in the market. These shares are referred to as treasury stock. A company might purchase its own outstanding stock for a number of possible reasons. It can be a strategic maneuver to prevent another company from acquiring a majority interest or preventing a hostile takeover. A purchase can also create demand for the stock, which in turn raises the market price of the stock. Sometimes companies buy back shares to be used for employee stock options or profit-sharing plans.

Acquiring Treasury Stock

When a company purchases treasury stock, it is reflected on the balance sheet in a contra equity account. As a contra equity account, Treasury Stock has a debit balance, rather than the normal credit balances of other equity accounts. The total cost of treasury stock reduces total equity. In substance, treasury stock implies that a company owns shares of itself. However, owning a portion of one’s self is not possible. Treasury shares do not carry the basic common shareholder rights because they are not outstanding. Dividends are not paid on treasury shares, they provide no voting rights, and they do not receive a share of assets upon liquidation of the company. There are two methods possible to account for treasury stock—the cost method, which is discussed here, and the par value method, which is a more advanced accounting topic. The cost method is so named because the amount in the Treasury Stock account at any point in time represents the number of shares held in treasury times the original cost paid to acquire each treasury share.

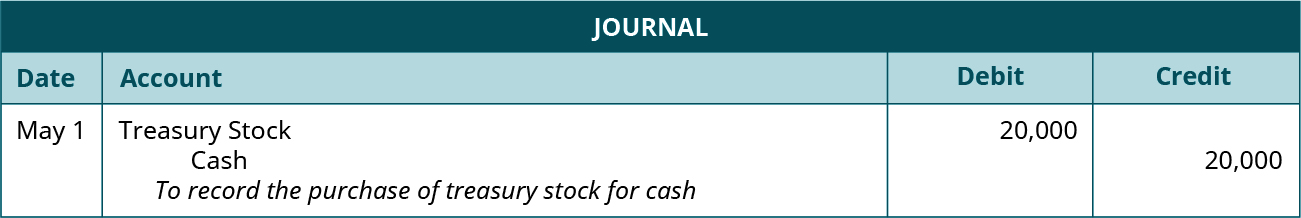

Assume Duratech’s net income for the first year was $3,100,000, and that the company has 12,500 shares of common stock issued. During May, the company’s board of directors authorizes the repurchase of 800 shares of the company’s own common stock as treasury stock. Each share of the company’s common stock is selling for $25 on the open market on May 1, the date that Duratech purchases the stock. Duratech will pay the market price of the stock at $25 per share times the 800 shares it purchased, for a total cost of $20,000. The following journal entry is recorded for the purchase of the treasury stock under the cost method.

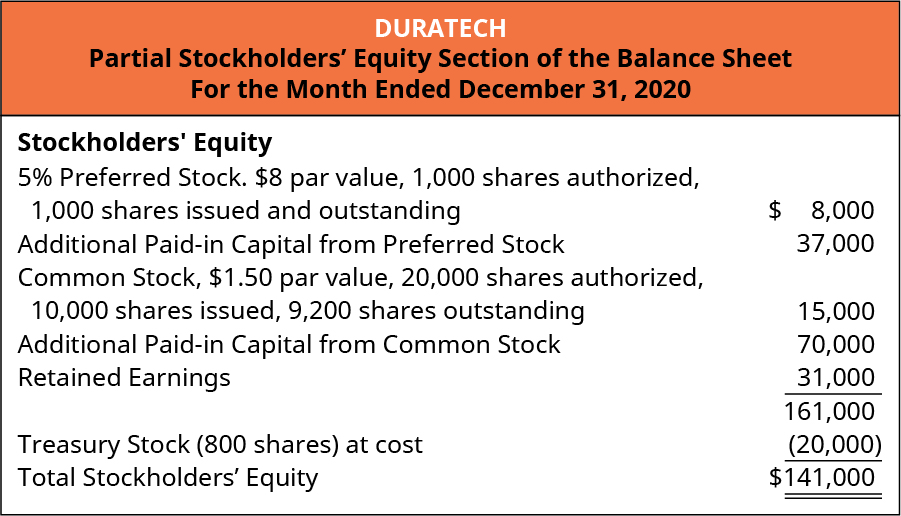

Even though the company is purchasing stock, there is no asset recognized for the purchase. An entity cannot own part of itself, so no asset is acquired. Immediately after the purchase, the equity section of the balance sheet (Figure 5.62) will show the total cost of the treasury shares as a deduction from total stockholders’ equity.

Notice on the partial balance sheet that the number of common shares outstanding changes when treasury stock transactions occur. Initially, the company had 10,000 common shares issued and outstanding. The 800 repurchased shares are no longer outstanding, reducing the total outstanding to 9,200 shares.

CONCEPTS IN PRACTICE

Reporting Treasury Stock for Nestlé Holdings Group

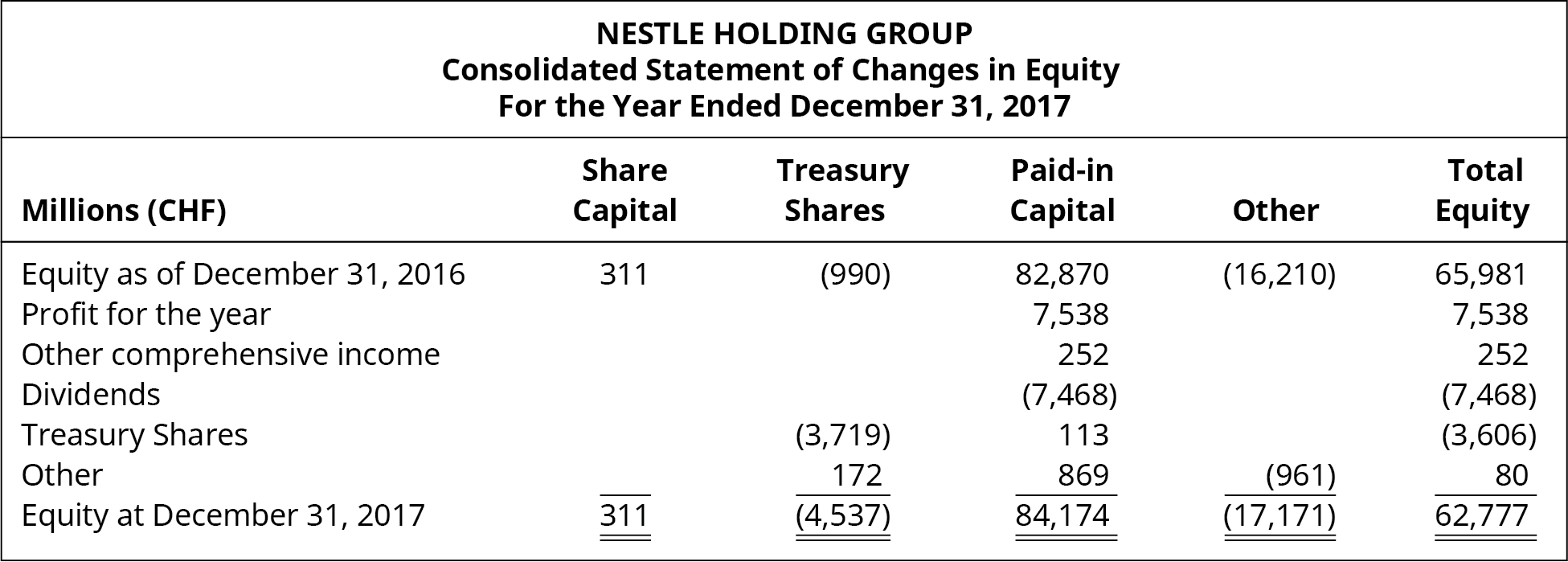

Nestlé Holdings Group sells a number of major brands of food and beverages including Gerber, Häagen-Dazs, Purina, and Lean Cuisine. The company’s statement of stockholders’ equity shows that it began with 990 million Swiss francs (CHF) in treasury stock at the beginning of 2016. In 2017, it acquired additional shares at a cost of 3,547 million CHF, raising its total treasury stock to 4,537 million CHF at the end of 2017, primarily due to a share buy-back program.15

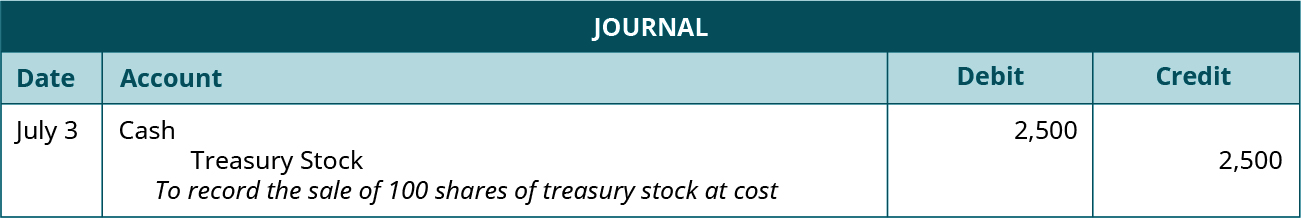

Reissuing Treasury Stock above Cost

Management typically does not hold treasury stock forever. The company can resell the treasury stock at cost, above cost, below cost, or retire it. If La Cantina reissues 100 of its treasury shares at cost ($25 per share) on July 3, a reversal of the original purchase for the 100 shares is recorded. This has the effect of increasing an asset, Cash, with a debit, and decreasing the Treasury Stock account with a credit. The original cost paid for each treasury share, $25, is multiplied by the 100 shares to be resold, or $2,500. The journal entry to record this sale of the treasury shares at cost is:

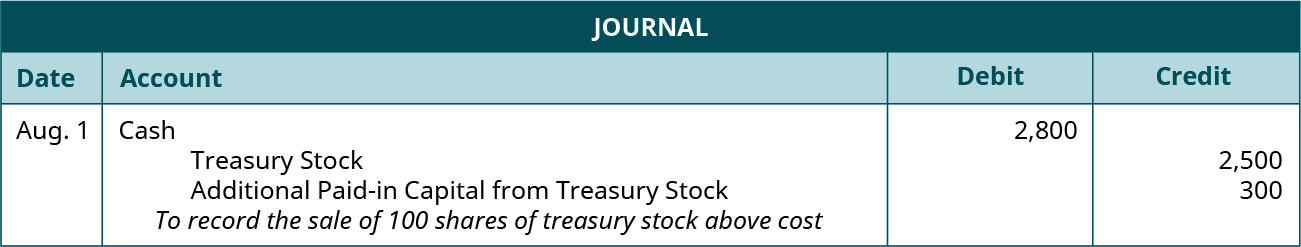

If the treasury stock is resold at a price higher than its original purchase price, the company debits the Cash account for the amount of cash proceeds, reduces the Treasury Stock account with a credit for the cost of the treasury shares being sold, and credits the Paid-in Capital from Treasury Stock account for the difference. Even though the difference—the selling price less the cost—looks like a gain, it is treated as additional capital because gains and losses only result from the disposition of economic resources (assets). Treasury Stock is not an asset. Assume that on August 1, La Cantina sells another 100 shares of its treasury stock, but this time the selling price is $28 per share. The Cash Account is increased by the selling price, $28 per share times the number of shares resold, 100, for a total debit to Cash of $2,800. The Treasury Stock account decreases by the cost of the 100 shares sold, 100 × $25 per share, for a total credit of $2,500, just as it did in the sale at cost. The difference is recorded as a credit of $300 to Additional Paid-in Capital from Treasury Stock.

Reissuing Treasury Stock Below Cost

If the treasury stock is reissued at a price below cost, the account used for the difference between the cash received from the resale and the original cost of the treasury stock depends on the balance in the Paid-in Capital from Treasury Stock account. Any balance that exists in this account will be a credit. The transaction will require a debit to the Paid-in Capital from Treasury Stock account to the extent of the balance. If the transaction requires a debit greater than the balance in the Paid-in Capital account, any additional difference between the cost of the treasury stock and its selling price is recorded as a reduction of the Retained Earnings account as a debit. If there is no balance in the Additional Paid-in Capital from Treasury Stock account, the entire debit will reduce retained earnings.

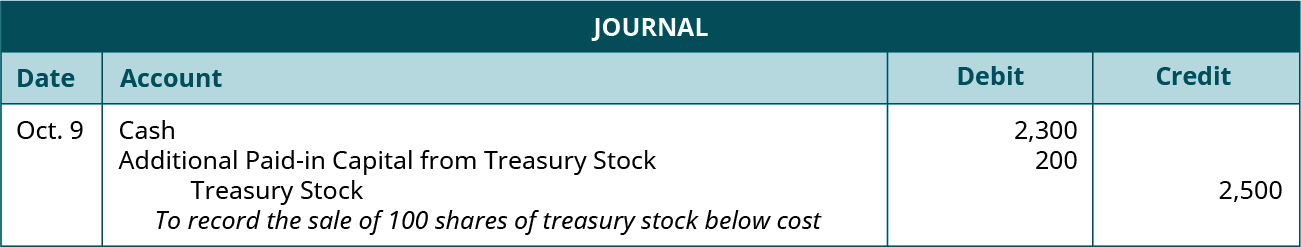

Assume that on October 9, La Cantina sells another 100 shares of its treasury stock, but this time at $23 per share. Cash is increased for the selling price, $23 per share times the number of shares resold, 100, for a total debit to Cash of $2,300. The Treasury Stock account decreases by the cost of the 100 shares sold, 100 × $25 per share, for a total credit of $2,500. The difference is recorded as a debit of $200 to the Additional Paid-in Capital from Treasury Stock account. Notice that the balance in this account from the August 1 transaction was $300, which was sufficient to offset the $200 debit. The transaction is recorded as:

Treasury stock transactions have no effect on the number of shares authorized or issued. Because shares held in treasury are not outstanding, each treasury stock transaction will impact the number of shares outstanding. A corporation may also purchase its own stock and retire it. Retired stock reduces the number of shares issued. When stock is repurchased for retirement, the stock must be removed from the accounts so that it is not reported on the balance sheet. The balance sheet will appear as if the stock was never issued in the first place.

YOUR TURN

Understanding Stockholders’ Equity

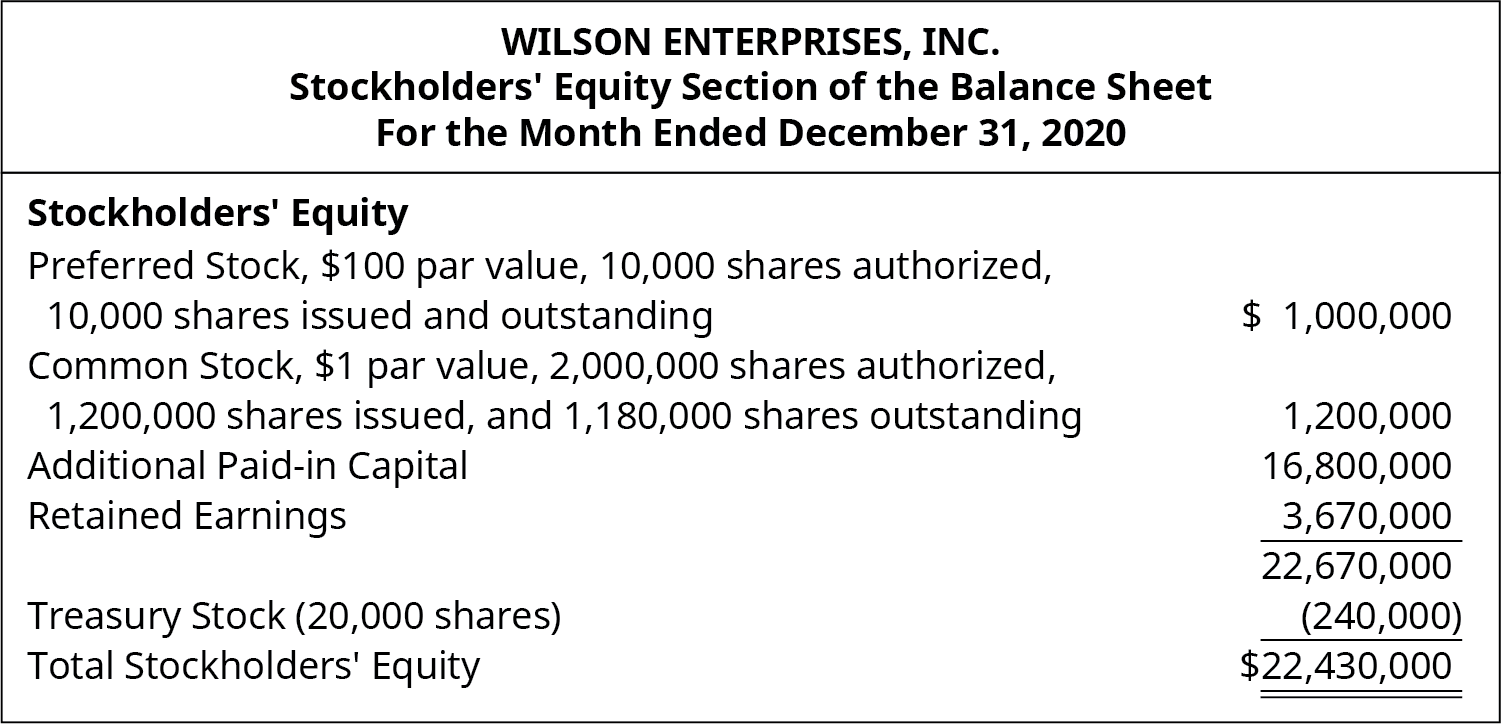

Wilson Enterprises reports the following stockholders’ equity:

Based on the partial balance sheet presented, answer the following questions:

- At what price was each share of treasury stock purchased?

- What is reflected in the additional paid-in capital account?

- Why is there a difference between the common stock shares issued and the shares outstanding?

Solution

A. $240,000 ÷ 20,000 = $12 per share. B. The difference between the market price and the par value when the stock was issued. C. Treasury stock.

Long Descriptions

La Cantina, Partial Stockholders’ Equity Section of the Balance Sheet, For the Month Ended December 31, 2020. Stockholders’ Equity: 5 percent Preferred stock, $8 par value, 1,000 shares authorized, 1,000 shares issued and outstanding $8,000. Additional paid-in capital from preferred stock 37,000. Common Stock, $1.50 par value, 20,000 shares authorized, 10,000 issued and outstanding $15,000. Additional Paid-in capital from common 70,000. Retained Earnings 31,000. Total 161,000. Treasury stock (800 shares) at cost 20,000. Total stockholders’ equity $141,000. Return

Nestle Holding Group, Consolidated Statement of Changes in Equity, For the Year Ended December 31, 2017. Millions (CHF), Share Capital, Treasury Shares, Paid-in Capital, Other, Total Equity (respectively): Equity as of December 31, 2016, 311, (990), 82,870, (16,210) 65,981. Profit for the year, -, -, 7,538, -, 7,538. Other comprehensive income, -, -, 252, -, 252. Dividends, -, -, (7,468), -, (7,468). Treasury shares, -, (3,719), 113, -, (3,606). Other, -, 172, 869, (961), 80. Equity at December 31, 2017, 311, (4,537), 84,174, (17,171), 62,777. Return

Preferred stock, $100 par value, 10,000 shares authorized, 10,000 shares issued and outstanding $1,000,000. Common Stock, $1 par value, 2,000,000 shares authorized, 1,200,000 issued and 1,180,000 outstanding $1,200,000. Additional Paid-in capital 16,800,000. Retained Earnings 3,670,000. Total 22,670,000. Treasury stock (20,000 shares) (240,000). Total Stockholders’ Equity $22,430,000. Return

Footnotes

- 15 Nestlé. “Annual Report 2017.” 2017. https://www.nestle.com/investors/annual-report