3.2 Petty Cash

As we have discussed, one of the hardest assets to control within any organization is cash. One way to control cash is for an organization to require that all payments be made by check. However, there are situations in which it is not practical to use a check. For example, imagine that the Galaxy’s Best Yogurt runs out of milk one evening. It is not possible to operate without milk, and the normal shipment does not come from the supplier for another 48 hours. To maintain operations, it becomes necessary to go to the grocery store across the street and purchase three gallons of milk. It is not efficient for time and cost to write a check for this small purchase, so companies set up a petty cash fund, which is a predetermined amount of cash held on hand to be used to make payments for small day-to-day purchases. A petty cash fund is a type of imprest account, which means that it contains a fixed amount of cash that is replaced as it is spent in order to maintain a set balance.

To maintain internal controls, managers can use a petty cash receipt (Figure 3.7), which tracks the use of the cash and requires a signature from the manager.

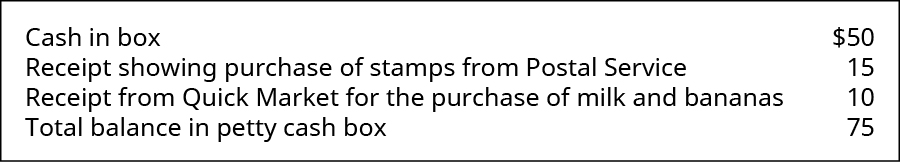

As cash is spent from a petty cash fund, it is replaced with a receipt of the purchase. At all times, the balance in the petty cash box should be equal to the cash in the box plus the receipts showing purchases.

For example, the Galaxy’s Best Yogurt maintains a petty cash box with a stated balance of $75 at all times. Upon review of the box, the balance is counted in the following way.

Because there may not always be a manager with check signing privileges available to sign a check for unexpected expenses, a petty cash account allows employees to make small and necessary purchases to support the function of a business when it is not practical to go through the formal expense process. In all cases, the amount of the purchase using petty cash would be considered to not be material in nature. Recall that materiality means that the dollar amount in question would have a significant impact in financial results or influence investor decisions.

Demonstration of Typical Petty Cash Journal Entries

Petty cash accounts are managed through a series of journal entries. Entries are needed to (1) establish the fund, (2) increase or decrease the balance of the fund (replenish the fund as cash is used), and (3) adjust for overages and shortages of cash. Consider the following example.

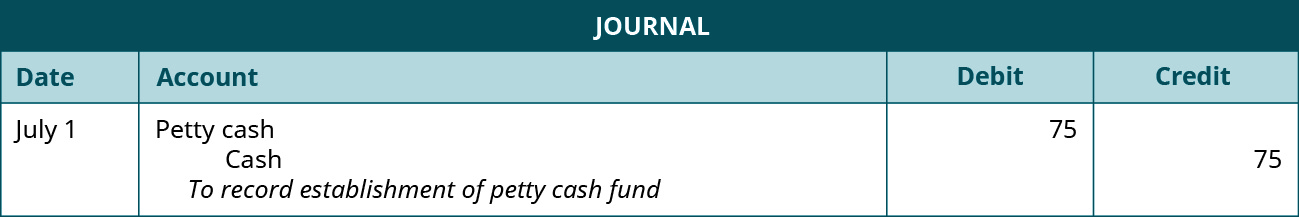

The Galaxy’s Best Yogurt establishes a petty cash fund on July 1 by cashing a check for $75 from its checking account and placing cash in the petty cash box. At this point, the petty cash box has $75 to be used for small expenses with the authorization of the responsible manager. The journal entry to establish the petty cash fund would be as follows.

As this petty cash fund is established, the account titled “Petty Cash” is created; this is an asset on the balance sheet of many small businesses. In this case, the cash account, which includes checking accounts, is decreased, while the funds are moved to the petty cash account. One asset is increasing, while another asset is decreasing by the same account. Since the petty cash account is an imprest account, this balance will never change and will remain on the balance sheet at $75, unless management elects to change the petty cash balance.

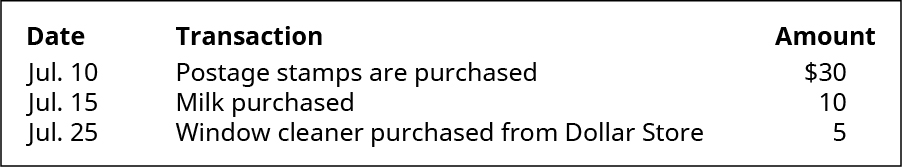

Throughout the month, several payments are made from the petty cash account of the Galaxy’s Best Yogurt. Assume the following activities.

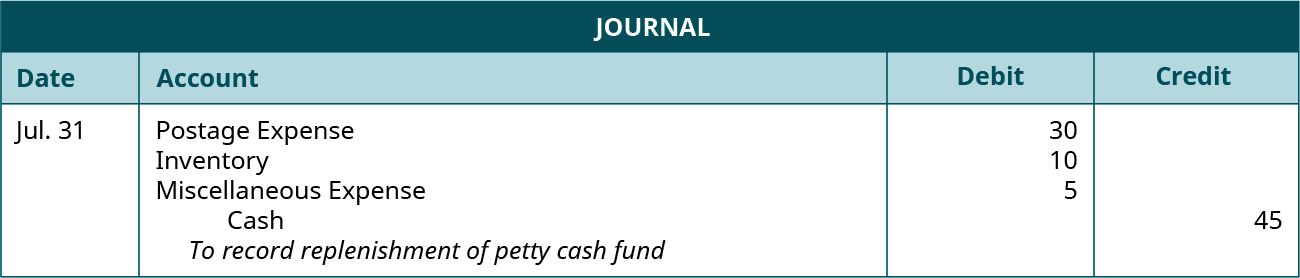

At the end of July, in the petty cash box there should be a receipt for the postage stamp purchase, a receipt for the milk, a receipt for the window cleaner, and the remaining cash. The employee in charge of the petty cash box should sign each receipt when the purchase is made. The total amount of purchases from the receipts ($45), plus the remaining cash in the box should total $75. As the receipts are reviewed, the box must be replenished for what was spent during the month. The journal entry to replenish the petty cash account will be as follows.

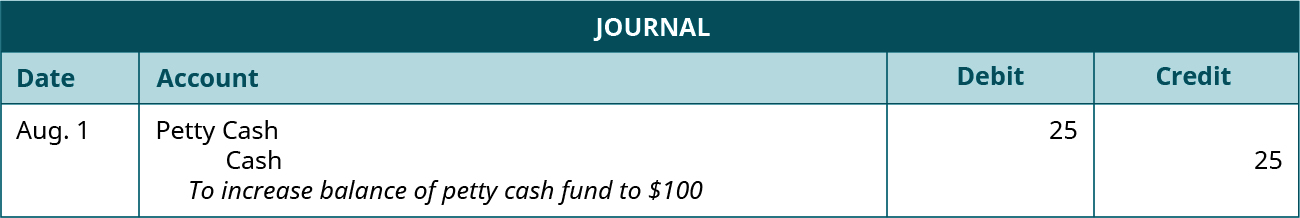

Typically, petty cash accounts are reimbursed at a fixed time period. Many small businesses will do this monthly, which ensures that the expenses are recognized within the proper accounting period. In the event that all of the cash in the account is used before the end of the established time period, it can be replenished in the same way at any time more cash is needed. If the petty cash account often needs to be replenished before the end of the accounting period, management may decide to increase the cash balance in the account. If, for example, management of the Galaxy’s Best Yogurt decides to increase the petty cash balance to $100 from the current balance of $75, the journal entry to do this on August 1 would be as follows.

If the management at a later date decides to decrease the balance in the petty cash account, the previous entry would be reversed, with cash being debited and petty cash being credited.

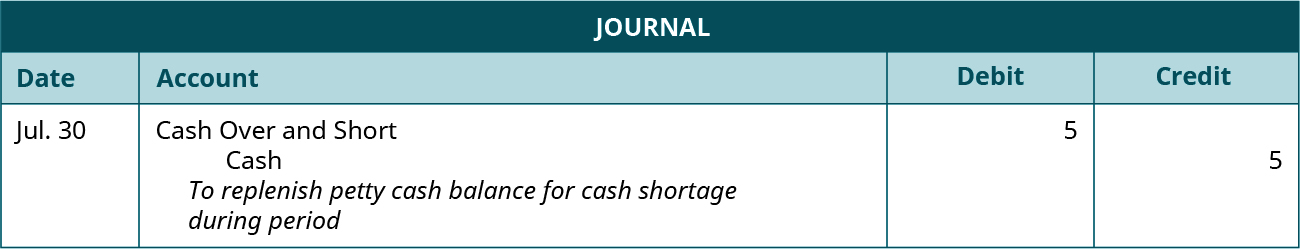

Occasionally, errors may occur that affect the balance of the petty cash account. This may be the result of an employee not getting a receipt or getting back incorrect change from the store where the purchase was made. In this case, an expense is created that creates a cash overage or shortage.

Consider Galaxy’s expenses for July. During the month, $45 was spent on expenses. If the balance in the petty cash account is supposed to be $75, then the petty cash box should contain $45 in signed receipts and $30 in cash. Assume that when the box is counted, there are $45 in receipts and $25 in cash. In this case, the petty cash balance is $70, when it should be $75. This creates a $5 shortage that needs to be replaced from the checking account. The entry to record a cash shortage is as follows.

When there is a shortage of cash, we record the shortage as a “debit” and this has the same effect as an expense. If we have an overage of cash, we record the overage as a credit, and this has the same impact as if we are recording revenue. If there were cash overage, the petty cash account would be debited and the cash over and short account would be credited. In this case, the expense balance decreases, and the year-end balance is the net balance from all overages and shortages during the year.

If a petty cash account is consistently short, this may be a warning sign that there is not a proper control of the account, and management may want to consider additional controls to better monitor petty cash.