8.7 Job Order Journal Entries

Journal Entries to Move Direct Materials, Direct Labor, and Overhead into Work in Process

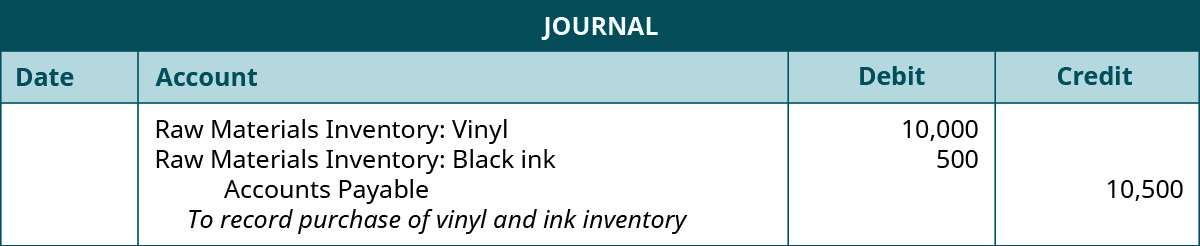

Dinosaur Vinyl keeps track of its inventory and orders additional inventory to have on hand when the production department requests it. This inventory is not associated with any particular job, and the purchases stay in raw materials inventory until assigned to a specific job. For example, Dinosaur Vinyl purchased an additional $10,000 of vinyl and $500 of black ink to complete Macs & Cheese’s billboard. If the purchase is made on account, the entry is as shown:

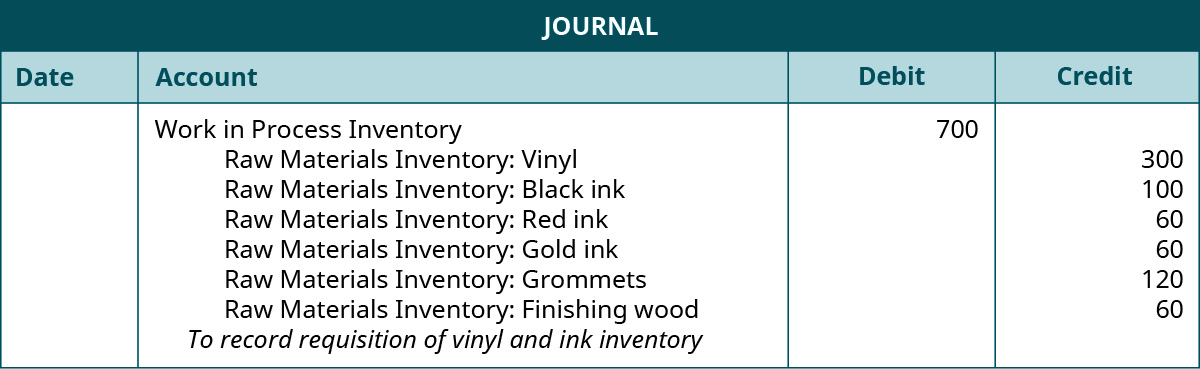

As shown in Figure 8.49, for the production process for job MAC001, the job supervisor submitted a materials requisition form for $300 in vinyl, $100 in black ink, $60 in red ink, and $60 in gold ink. For the finishing process for Job MAC001, $120 in grommets and $60 in finishing wood were requisitioned. The entry to reflect these actions is:

The production department employees work on the sign and send it over to the finishing/assembly department when they have completed their portion of the job.

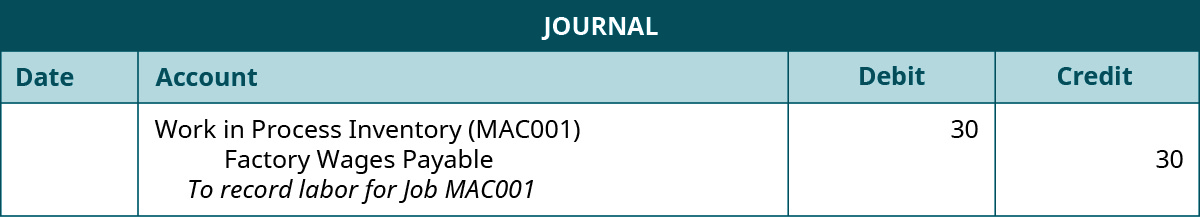

The direct cost of factory labor includes the direct wages paid to the employees and all other payroll costs associated with that labor. Typically, this includes wages and the payroll taxes and fringe benefits directly tied to those wages. The accounting system needs to keep track of the labor and the other related expenses assigned to a particular job. These records are typically kept in a time ticket submitted by employees daily.

On April 10, the labor time sheet totaling $30 is recorded for Job MAC001 through this entry:

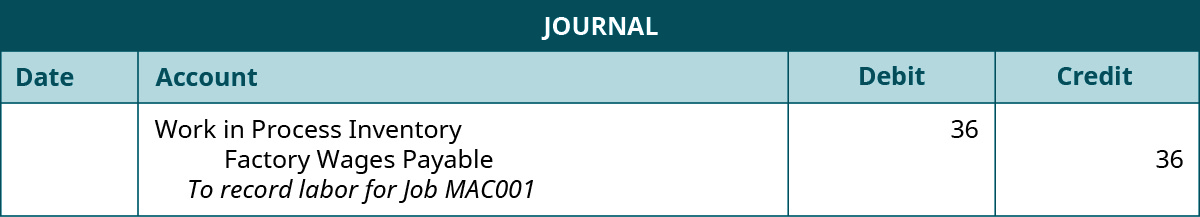

The assembly personnel in the finishing/assembly department complete Job MAC001 in two hours. The labor is recorded as shown:

Indirect materials also have a materials requisition form, but the costs are recorded differently. They are first transferred into manufacturing overhead and then allocated to work in process. The entry to record the indirect material is to debit manufacturing overhead and credit raw materials inventory.

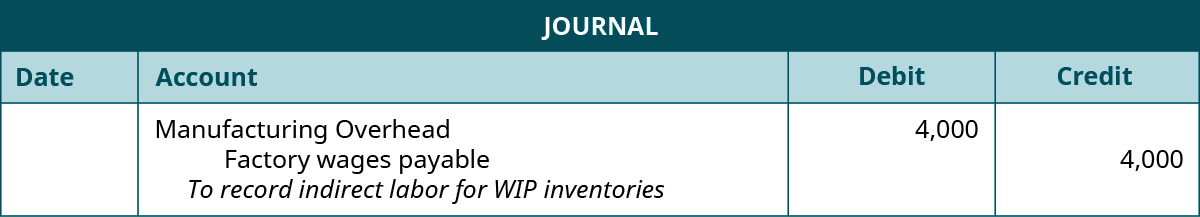

Indirect labor records are also maintained through time tickets, although such work is not directly traceable to a specific job. The difference between direct labor and indirect labor is that the indirect labor records the debit to manufacturing overhead while the credit is to factory wages payable.

Dinosaur Vinyl’s time tickets indicate that $4,000 in indirect labor costs were incurred during the period. The entry is:

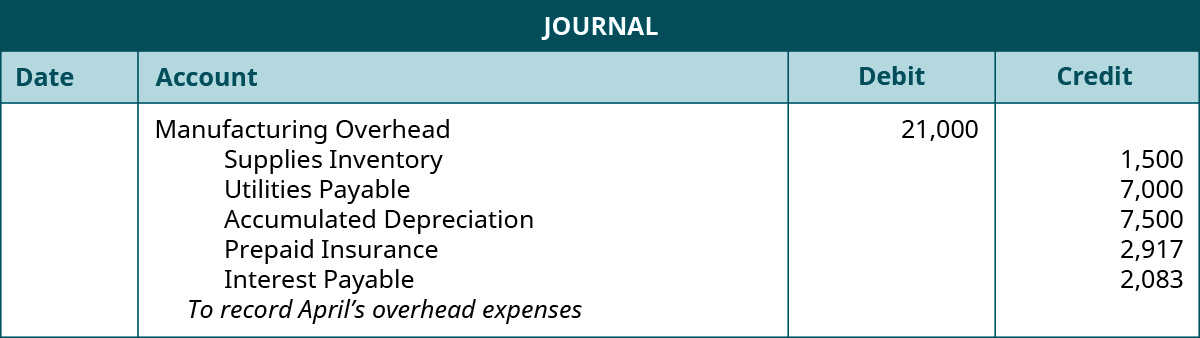

Dinosaur Vinyl also records the actual overhead incurred. As shown in Figure 8.55, manufacturing overhead costs of $21,000 were incurred. The entry to record these expenses increases the amount of overhead in the manufacturing overhead account. The entry is:

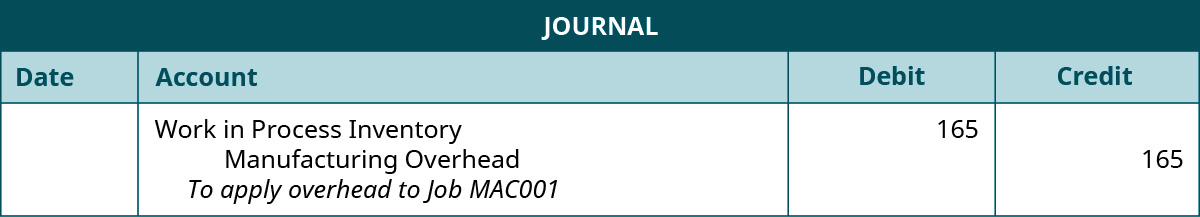

The amount of overhead applied to Job MAC001 is $165. The process of determining the manufacturing overhead calculation rate was explained and demonstrated in 8.3 Three Major Components of Product Costs in Job Order. The journal entry to record the manufacturing overhead for Job MAC001 is:

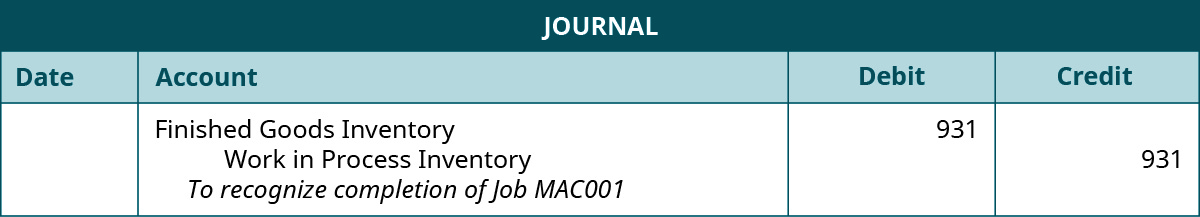

Journal Entry to Move Work in Process Costs into Finished Goods

When each job and job order cost sheet have been completed, an entry is made to transfer the total cost from the work in process inventory to the finished goods inventory. The total cost of the product for Job MAC001 is $931 and the entry is:

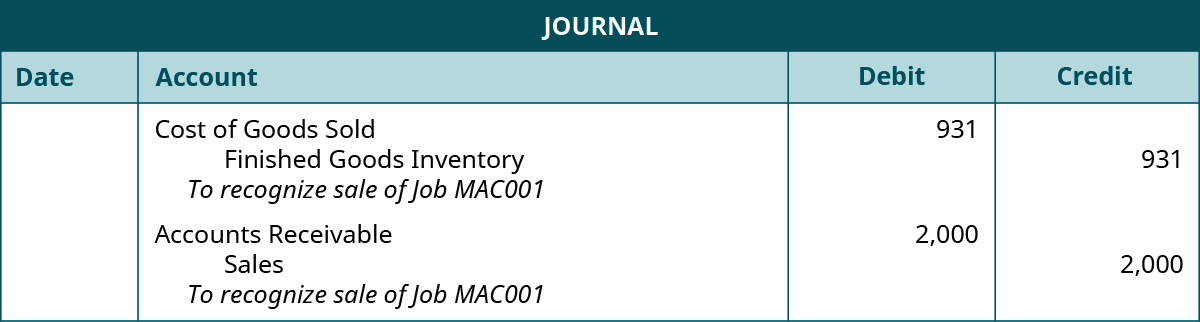

Journal Entries to Move Finished Goods into Cost of Goods Sold

When the sale has occurred, the goods are transferred to the buyer. The product is transferred from the finished goods inventory to cost of goods sold. A corresponding entry is also made to record the sale. The sign for Job MAC001 had a sales price of $2,000 and a cost of $931. These are the entries to record the transfer of goods and sale to the buyer:

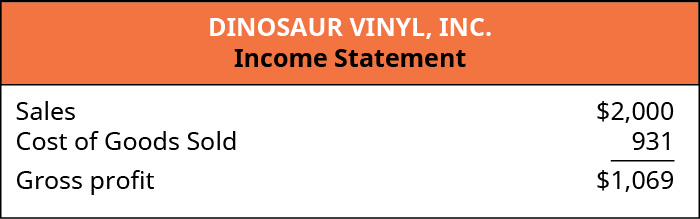

The resulting accounting is shown on the company’s income statement:

Long Description

A journal entry lists Work in Process Inventory with a debit of 700, Raw Materials Inventory: Vinyl with a credit of 300, Raw Materials Inventory: Black ink with a credit of 100, Raw Materials Inventory: Red ink with a credit of 60, Raw Materials Inventory: Gold ink with a credit of 60, Raw Materials Inventory: Grommets with a credit of 120, Raw Materials Inventory: Finishing wood with a credit of 60, and the note “To record requisition of vinyl and ink inventory”. Return