1.15 Closing Entries

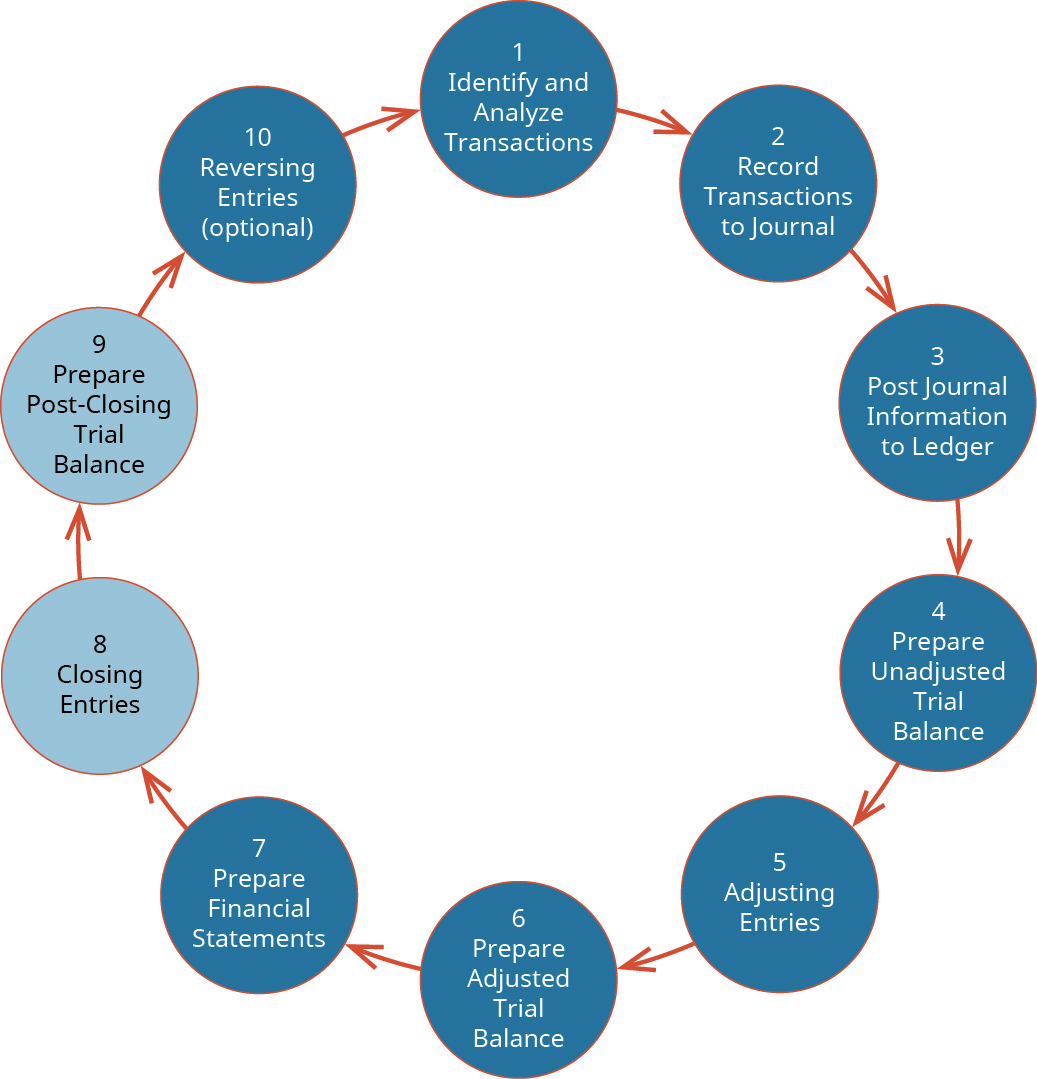

In this segment, we complete the final steps (steps 8 and 9) of the accounting cycle, the closing process. You will notice that we do not cover step 10, reversing entries. This is an optional step in the accounting cycle that you will learn about in future courses.

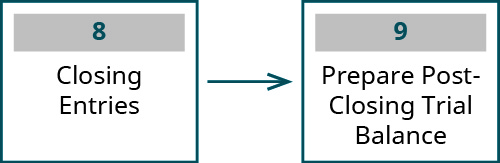

Our discussion here begins with journalizing and posting the closing entries (Figure 1.26). These posted entries will then translate into a post-closing trial balance, which is a trial balance that is prepared after all of the closing entries have been recorded.

Introduction to the Closing Entries

Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns. However, most companies prepare monthly financial statements and close their books annually, so they have a clear picture of company performance during the year, and give users timely information to make decisions.

Closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period. Closing, or clearing the balances, means returning the account to a zero balance. Having a zero balance in these accounts is important so a company can compare performance across periods, particularly with income. It also helps the company keep thorough records of account balances affecting retained earnings. Revenue, expense, and dividend accounts affect retained earnings and are closed so they can accumulate new balances in the next period, which is an application of the time period assumption.

To further clarify this concept, balances are closed to assure all revenues and expenses are recorded in the proper period and then start over the following period. The revenue and expense accounts should start at zero each period, because we are measuring how much revenue is earned and expenses incurred during the period. However, the cash balances, as well as the other balance sheet accounts, are carried over from the end of a current period to the beginning of the next period.

For example, a store has an inventory account balance of $100,000. If the store closed at 11:59 p.m. on January 31, 2019, then the inventory balance when it reopened at 12:01 a.m. on February 1, 2019, would still be $100,000. The balance sheet accounts, such as inventory, would carry over into the next period, in this case February 2019.

The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, income, and any dividends from January 2019. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2019. Zeroing January 2019 would then enable the store to calculate the income (profit or loss) for the next month (February 2019), instead of merging it into January’s income and thus providing invalid information solely for the month of February.

However, if the company also wanted to keep year-to-date information from month to month, a separate set of records could be kept as the company progresses through the remaining months in the year. For our purposes, assume that we are closing the books at the end of each month unless otherwise noted.

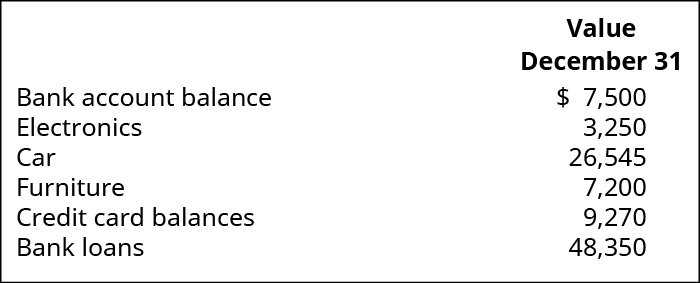

Let’s look at another example to illustrate the point. Assume you own a small landscaping business. It is the end of the year, December 31, 2018, and you are reviewing your financials for the entire year. You see that you earned $120,000 this year in revenue and had expenses for rent, electricity, cable, internet, gas, and food that totaled $70,000.

You also review the following information:

The next day, January 1, 2019, you get ready for work, but before you go to the office, you decide to review your financials for 2019. What are your year-to-date earnings? So far, you have not worked at all in the current year. What are your total expenses for rent, electricity, cable and internet, gas, and food for the current year? You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food. This means that the current balance of these accounts is zero, because they were closed on December 31, 2018, to complete the annual accounting period.

Next, you review your assets and liabilities. What is your current bank account balance? What is the current book value of your electronics, car, and furniture? What about your credit card balances and bank loans? Are the value of your assets and liabilities now zero because of the start of a new year? Your car, electronics, and furniture did not suddenly lose all their value, and unfortunately, you still have outstanding debt. Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period.

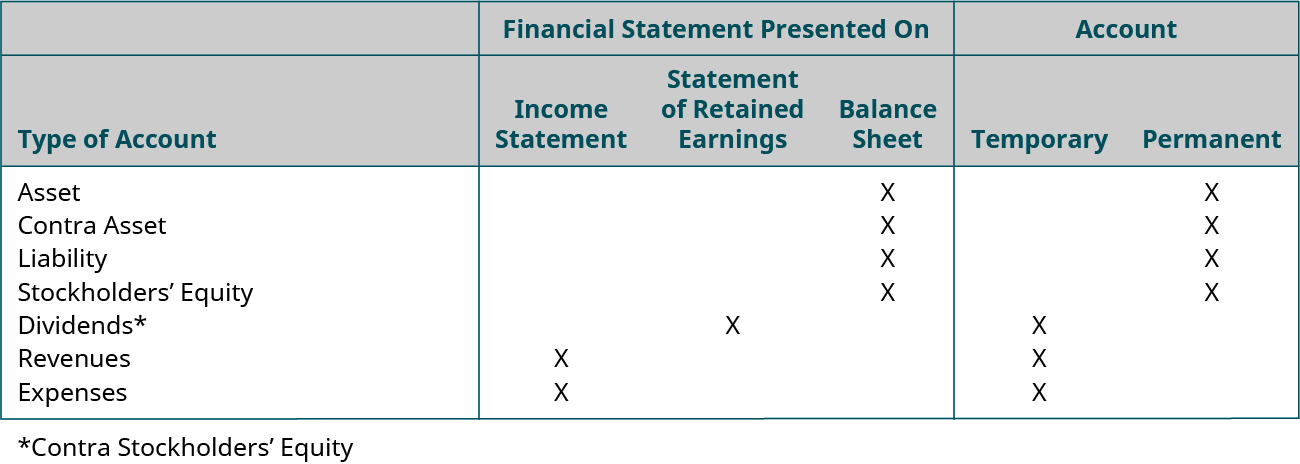

This is no different from what will happen to a company at the end of an accounting period. A company will see its revenue and expense accounts set back to zero, but its assets and liabilities will maintain a balance. Stockholders’ equity accounts will also maintain their balances. In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts.

Temporary and Permanent Accounts

All accounts can be classified as either permanent (real) or temporary (nominal) the following Figure 1.27.

Permanent (real) accounts are accounts that transfer balances to the next period and include balance sheet accounts, such as assets, liabilities, and stockholders’ equity. These accounts will not be set back to zero at the beginning of the next period; they will keep their balances. Permanent accounts are not part of the closing process.

Temporary (nominal) accounts are accounts that are closed at the end of each accounting period, and include income statement, dividends, and income summary accounts. The new account, Income Summary, will be discussed shortly. These accounts are temporary because they keep their balances during the current accounting period and are set back to zero when the period ends. Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings.

The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account. It stores all of the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period. The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account.

Income summary is a nondefined account category. This means that it is not an asset, liability, stockholders’ equity, revenue, or expense account. The account has a zero balance throughout the entire accounting period until the closing entries are prepared. Therefore, it will not appear on any trial balances, including the adjusted trial balance, and will not appear on any of the financial statements.

You might be asking yourself, “is the Income Summary account even necessary?” Could we just close out revenues and expenses directly into retained earnings and not have this extra temporary account? We could do this, but by having the Income Summary account, you get a balance for net income a second time. This gives you the balance to compare to the income statement, and allows you to double check that all income statement accounts are closed and have correct amounts. If you put the revenues and expenses directly into retained earnings, you will not see that check figure. No matter which way you choose to close, the same final balance is in retained earnings.

Journalizing and Posting Closing Entries

The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger.

Four entries occur during the closing process. The first entry closes revenue accounts to the Income Summary account. The second entry closes expense accounts to the Income Summary account. The third entry closes the Income Summary account to Retained Earnings. The fourth entry closes the Dividends account to Retained Earnings. The information needed to prepare closing entries comes from the adjusted trial balance.

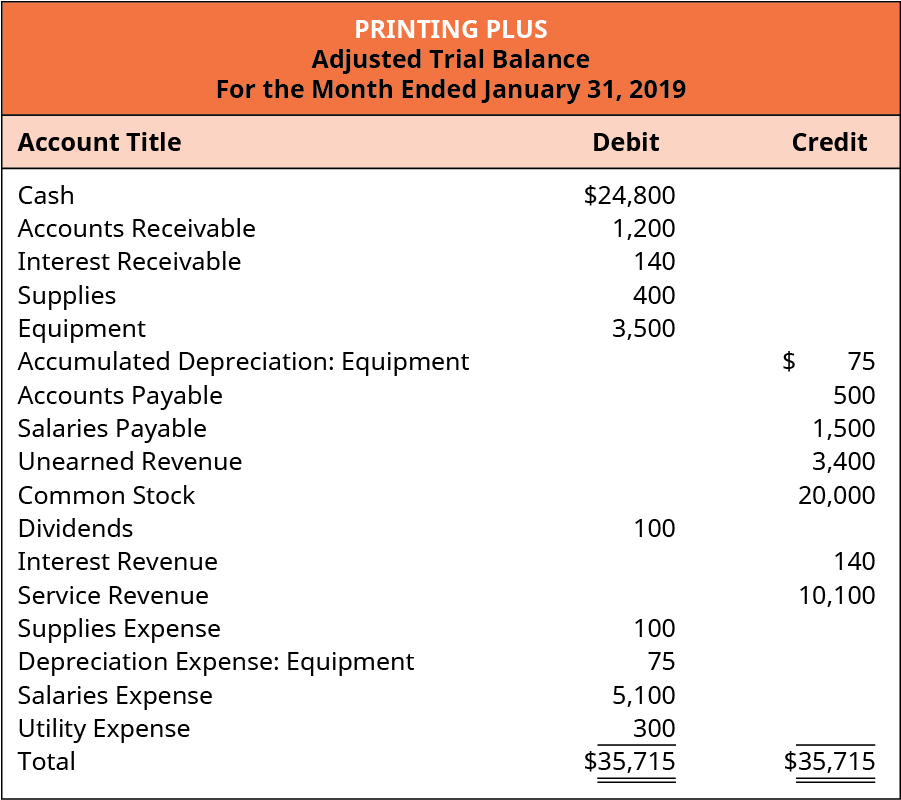

Let’s explore each entry in more detail using Printing Plus’s information from Analyzing and Recording Transactions and The Adjustment Process as our example. The Printing Plus adjusted trial balance for January 31, 2019, is presented in the following Figure 1.28.

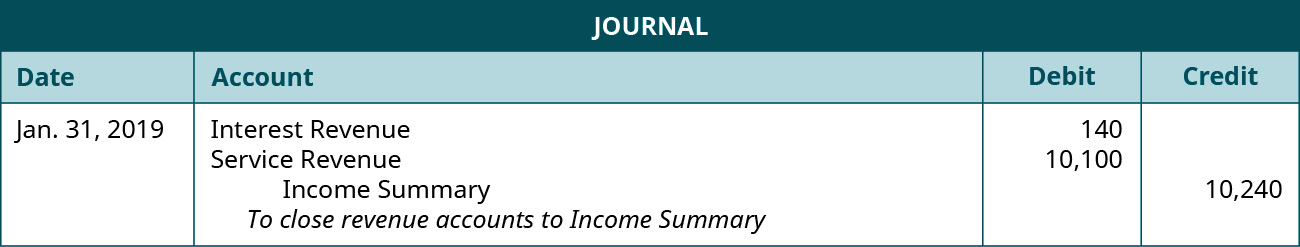

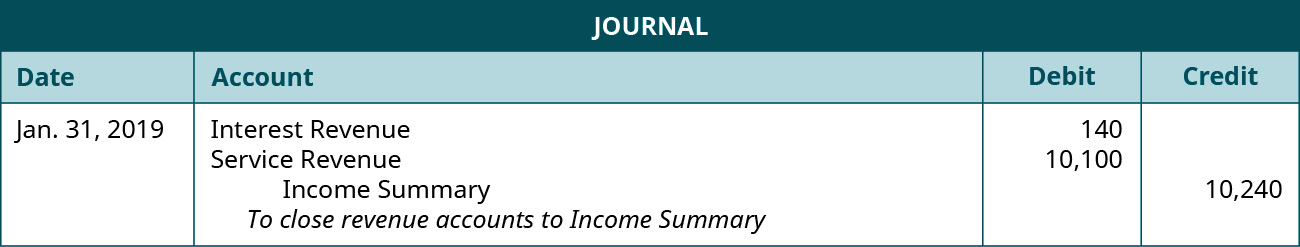

The first entry requires revenue accounts close to the Income Summary account. To get a zero balance in a revenue account, the entry will show a debit to revenues and a credit to Income Summary. Printing Plus has $140 of interest revenue and $10,100 of service revenue, each with a credit balance on the adjusted trial balance. The closing entry will debit both interest revenue and service revenue, and credit Income Summary.

The T-accounts after this closing entry would look like the following.

Notice that the balances in interest revenue and service revenue are now zero and are ready to accumulate revenues in the next period. The Income Summary account has a credit balance of $10,240 (the revenue sum).

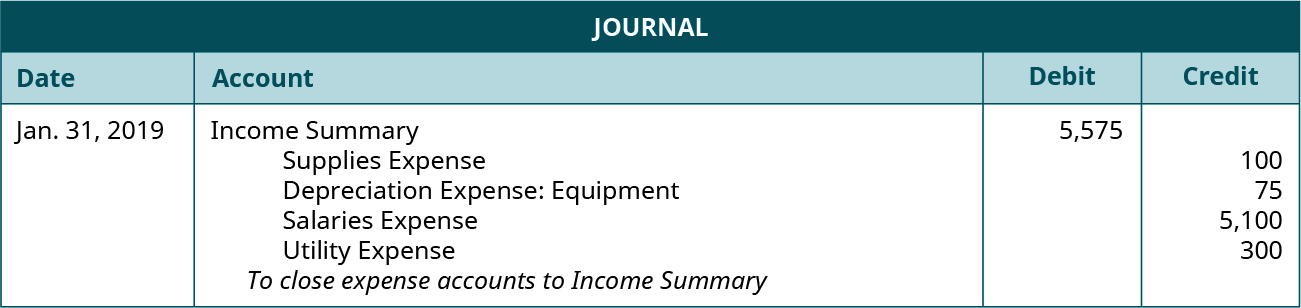

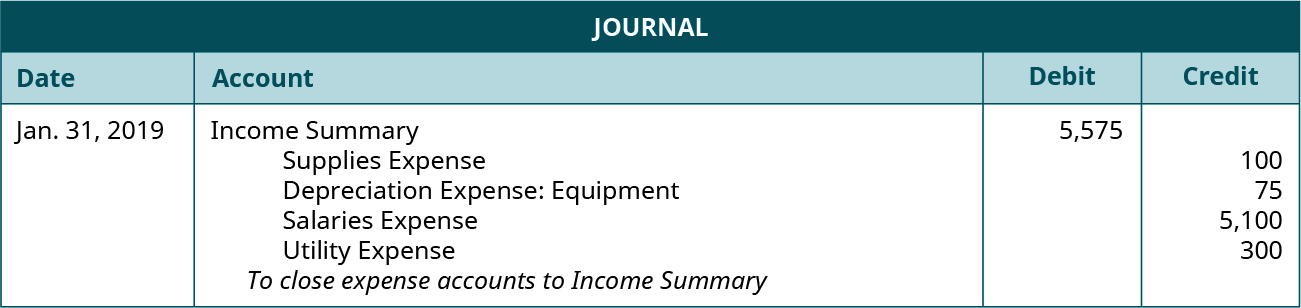

The second entry requires expense accounts close to the Income Summary account. To get a zero balance in an expense account, the entry will show a credit to expenses and a debit to Income Summary. Printing Plus has $100 of supplies expense, $75 of depreciation expense–equipment, $5,100 of salaries expense, and $300 of utility expense, each with a debit balance on the adjusted trial balance. The closing entry will credit Supplies Expense, Depreciation Expense–Equipment, Salaries Expense, and Utility Expense, and debit Income Summary.

The T-accounts after this closing entry would look like the following.

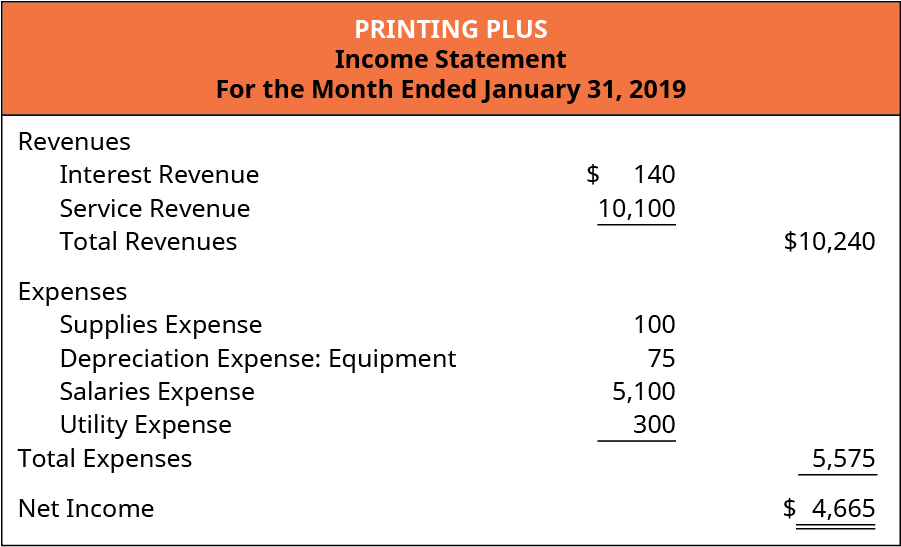

Notice that the balances in the expense accounts are now zero and are ready to accumulate expenses in the next period. The Income Summary account has a new credit balance of $4,665, which is the difference between revenues and expenses in Figure 1.29. The balance in Income Summary is the same figure as what is reported on Printing Plus’s Income Statement.

Why are these two figures the same? The income statement summarizes your income, as does income summary. If both summarize your income in the same period, then they must be equal. If they do not match, then you have an error.

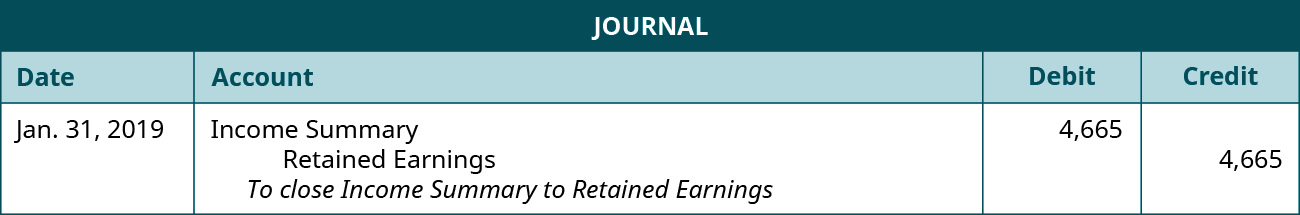

The third entry requires Income Summary to close to the Retained Earnings account. To get a zero balance in the Income Summary account, there are guidelines to consider.

- If the balance in Income Summary before closing is a credit balance, you will debit Income Summary and credit Retained Earnings in the closing entry. This situation occurs when a company has a net income.

- If the balance in Income Summary before closing is a debit balance, you will credit Income Summary and debit Retained Earnings in the closing entry. This situation occurs when a company has a net loss.

Remember that net income will increase retained earnings, and a net loss will decrease retained earnings. The Retained Earnings account increases on the credit side and decreases on the debit side.

Printing Plus has a $4,665 credit balance in its Income Summary account before closing, so it will debit Income Summary and credit Retained Earnings.

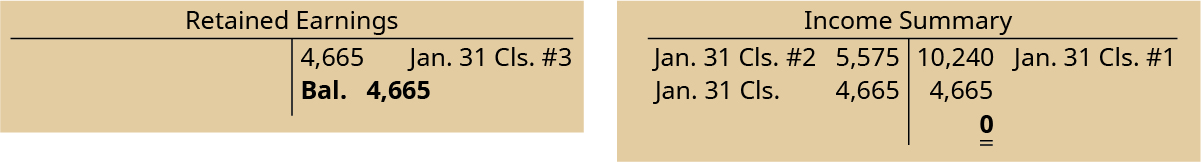

The T-accounts after this closing entry would look like the following.

Notice that the Income Summary account is now zero and is ready for use in the next period. The Retained Earnings account balance is currently a credit of $4,665.

The fourth entry requires Dividends to close to the Retained Earnings account. Remember from your past studies that dividends are not expenses, such as salaries paid to your employees or staff. Instead, declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the company—in this case, its shareholders.

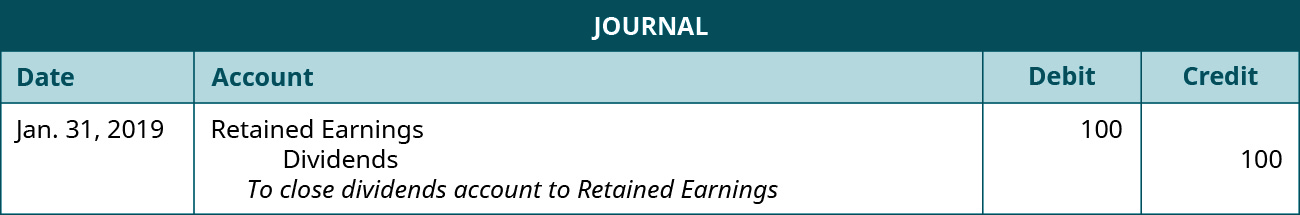

If dividends were not declared, closing entries would cease at this point. If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to the declaration and payment of dividends. The first part is the date of declaration, which creates the obligation or liability to pay the dividend. The second part is the date of record that determines who receives the dividends, and the third part is the date of payment, which is the date that payments are made. Printing Plus has $100 of dividends with a debit balance on the adjusted trial balance. The closing entry will credit Dividends and debit Retained Earnings.

The T-accounts after this closing entry would look like the following.

Why was income summary not used in the dividends closing entry? Dividends are not an income statement account. Only income statement accounts help us summarize income, so only income statement accounts should go into income summary.

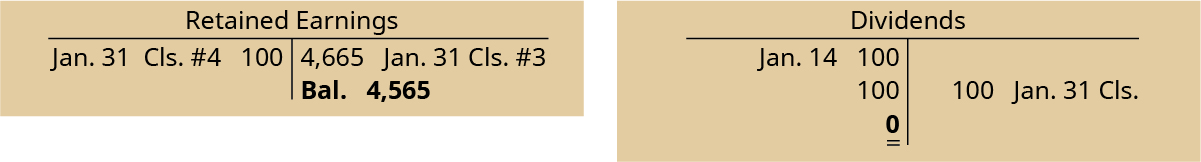

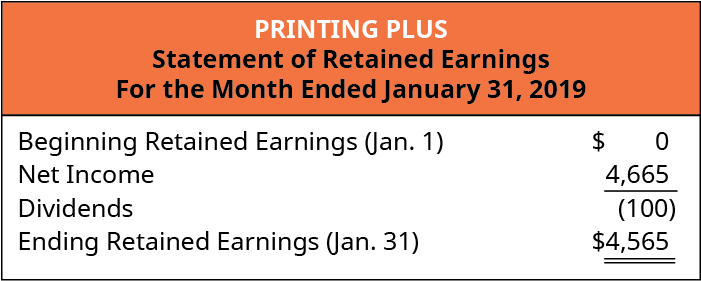

Remember, dividends are a contra stockholders’ equity account. It is contra to retained earnings. If we pay out dividends, it means retained earnings decreases. Retained earnings decreases on the debit side. The remaining balance in Retained Earnings is $4,565 the following Figure 5.6. This is the same figure found on the statement of retained earnings.

The statement of retained earnings shows the period-ending retained earnings after the closing entries have been posted. When you compare the retained earnings ledger (T-account) to the statement of retained earnings, the figures must match. It is important to understand retained earnings is not closed out, it is only updated. Retained Earnings is the only account that appears in the closing entries that does not close. You should recall from your previous material that retained earnings are the earnings retained by the company over time—not cash flow but earnings. Now that we have closed the temporary accounts, let’s review what the post-closing ledger (T-accounts) looks like for Printing Plus.

T-Account Summary

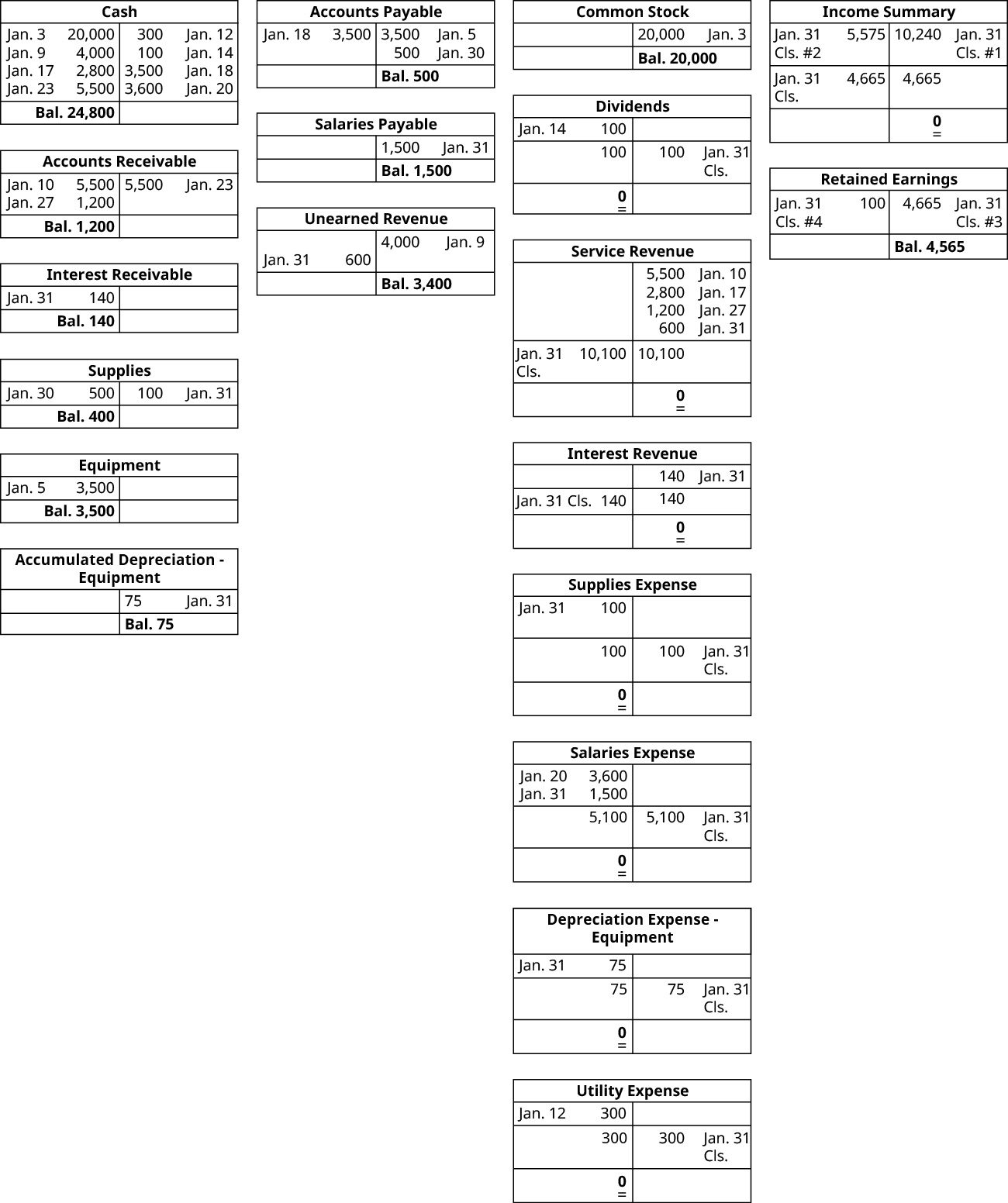

The T-account summary for Printing Plus after closing entries are journalized is presented in Figure 1.31.

Notice that revenues, expenses, dividends, and income summary all have zero balances. Retained earnings maintains a $4,565 credit balance. The post-closing T-accounts will be transferred to the post-closing trial balance, which is step 9 in the accounting cycle.

Here’s a short video summarizing the four closing entries.

Long Description

A large circle labeled, in the center, The Accounting Cycle. The large circle consists of 10 smaller circles with arrows pointing from one smaller circle to the next one. The smaller circles are labeled, in clockwise order: 1 Identify and Analyze Transactions; 2 Record Transactions to Journal; 3 Post Journal Information to Ledger; 4 Prepare Unadjusted Trial Balance; 5 Adjusting Entries; 6 Prepare Adjusted Trial Balance; 7 Prepare Financial Statements; 8 Closing Entries; 9 Prepare Post-Closing Trial Balance; 10 Reversing Entries (optional). The circles for 8 Closing Entries and 9 Prepare Post-Closing Trial Balance are shaded a slightly different color. Return

Financial Statement Presented On, Account, for the following accounts: Asset: Balance Sheet, Permanent; Contra Asset: Balance Sheet, Permanent; Liability: Balance Sheet, Permanent; Stockholders’ Equity: Balance Sheet, Permanent; Dividends*: Statement of Retained Earnings, Temporary; Revenues: Income Statement, Temporary; Expenses: Income Statement, Temporary. *Contra Stockholders’ Equity. Return

Printing Plus, Adjusted Trial Balance, January 31, 2019. Account Title, Debit or Credit. Cash $24,800 debit. Accounts Receivable 1,200 debit. Interest Receivable 140 debit. Supplies 400 debit. Equipment 3,500 debit. Accumulated Depreciation: Equipment $75 credit. Accounts Payable 500 credit. Salaries Payable 1,500 credit. Unearned Revenue 3,400 credit. Common Stock 20,000 credit. Dividends 100 debit. Interest Revenue 140 credit. Service Revenue 10,100 credit. Supplies Expense 100 debit. Depreciation Expense: Equipment 75 debit. Salaries Expense 5,100 debit. Utility Expense 300 debit. Totals: $35,715 debits, $35,715 credits.” Return

Service Revenue T-account has 4 entries on the credit side: January 10 5,500, January 17 2,800, January 27 1,200, January 31 600. The total on the credit side is then 10,100. There is a January 31 closing entry to the debit side of 10,100, leaving a 0 balance on the credit side. The Interest Revenue T-account has one credit entry on January 31 of 140, a credit balance of 140, a debit side closing entry on January 31 of 140, and a 0 balance on the credit side. The Income Summary T-Account has a debit of 10,240 on January 31 for Closing entry #1, leaving a credit side balance of 10,240. Return

Supplies Expense T-account has a January 31 debit side entry of 100, a debit balance of 100, a credit closing entry of 100, leaving a 0 debit side balance. Depreciation Expense: Equipment T-account has a January 31 debit side entry of 75, a debit balance of 75, a credit closing entry of 75, leaving a 0 debit side balance. Salaries Expense T-account has a January 20 debit side entry of 3,600, January 31 debit side entry of 1,500, a debit balance of 5,100, a credit closing entry of 5,100, leaving a 0 debit side balance. Utilities Expense T-account has a January 31 debit side entry of 300, a debit balance of 300, a credit closing entry of 300, leaving a 0 debit side balance. Income Summary T-account has a January 31 debit side closing entry #2 of 5,575, a January 31 credit side closing entry #1 of 10,240, leaving a credit balance of 4,665. Return

Retained Earnings T-account has credit closing entry #3 on January 31 of 4,665, leaving a balance on the credit side of 4,665. Income Summary T-account has a January 31 debit side closing entry #2 of 5,575, a January 31 credit side closing entry #1 of 10,240, leaving a credit balance of 4,665. It then has a January 31 closing entry on the credit side of 4,665, leaving a 0 balance on the credit side. Return

Cash has a January 3 debit entry of 20,000, a January 9 debit entry of 4,000, a January 12 credit entry of 300, a January 14 credit entry of 100, a January 17 debit entry of 2,800, a January 18 credit entry of 3,500, a January 20 credit entry of 3,600, a January 23 debit entry of 5,500, leaving a debit balance of 24,800. Accounts Receivable has a January 10 debit entry of 5,500, a January 23 credit entry of 5,500, a January 27 debit entry of 1,200 and a debit balance of 1,200. Interest Receivable has a January 31 debit entry of 140 and a debit balance of 140. Supplies has a January 30 debit entry of 500, a January 31 credit entry of 100 and a debit balance of 400. Equipment has a January 5 debit entry of 3,500 and a debit balance of 3,500. Accumulated Depreciation: Equipment has a January 31 credit entry of 75 and a credit balance of 75. Accounts Payable has a January 5 credit entry of 3,500, a January 13 debit entry of 3,500, a January 30 credit entry of 500, and a credit balance of 500. Salaries Payable has a January 31 credit entry of 1,500 and a credit balance of 1,500. Unearned Revenue has a January 9 credit entry of 4,000, a January 31 debit entry of 600, leaving a credit balance of 3,400. Common Stock has a January 3 credit entry of 20,000 and a credit balance of 20,000. Dividends has a January 14 debit entry of 100, a debit balance of 100, a credit January 31 closing entry for 100, leaving a debit side 0 balance. Service Revenue account has 4 entries on the credit side: January 10 5,500, January 17 2,800, January 27 1,200, January 31 600. The total on the credit side is then 10,100. There is a January 31 closing entry to the debit side of 10,100, leaving a 0 balance on the credit side. The Interest Revenue has one credit entry on January 31 of 140, a credit balance of 140, a debit side closing entry on January 31 of 140, and a 0 balance on the credit side. Supplies Expense has a January 31 debit side entry for 100, a debit side balance of 100, a credit side January 31 closing entry for 100, leaving a 0 debit side balance. Salaries Expense has a January 20 debit side entry for 3,600, a debit side entry on January 31 for 1,500, a debit side balance of 5,100, a credit side January 31 closing entry of 5,100, leaving a 0 debit side balance. Depreciation Expense: Equipment has a January 31 debit side entry for 75, a debit side balance of 375, a credit side January 31 closing entry of 75, leaving a 0 debit side balance. Utilities Expense has a January 12 debit side entry for 300, a debit side balance of 300, a credit side January 31 closing entry of 300, leaving a 0 debit side balance. Income Summary has a January 31 debit side closing entry #2 of 5,575, a January 31 credit side closing entry #1 of 10,240, leaving a credit balance of 4,665. It then has a January 31 closing entry on the credit side of 4,665, leaving a 0 balance on the credit side. Retained Earnings has a debit closing entry #4 on January 31 for 100, a credit closing entry #3 for 4,665, and a credit balance of 4,565. Return

Media Attributions

- Closing entries © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Final steps © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Location chart

- Adjusted Trial Balance © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Income Statement © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 1.16.14 © Rice Unviersity is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 1.16.15TacctSum © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license