3.4 Bad Debts & the Allowance- Comprehensive Example

The following comprehensive example will illustrate the bad debt estimation process from the sales transaction to adjusting entry reporting for all three bad debt estimation methods: income statement, balance sheet, and balance sheet aging of receivables.

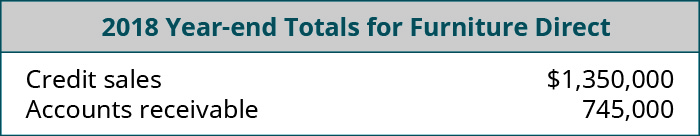

Furniture Direct sells office furniture to large scale businesses. Because the purchases are typically large, Furniture Direct allows customers to pay on credit using an in-house account. At the end of the year, Furniture Direct must estimate bad debt using one of the three estimation methods. It is currently using the income statement method and estimates bad debt at 5% of credit sales. If it were to switch to the balance sheet method, it would estimate bad debt at 8% of accounts receivable. If it were to use the balance sheet aging of receivables method, it would split its receivables into three categories: 0–30 days past due at 5%, 31–90 days past due at 10%, and over 90 days past due at 20%. There is currently a zero balance, transferred from the prior year’s Allowance for Doubtful Accounts. The following information is available from the year-end income statement and balance sheet.

There is also additional information regarding the distribution of accounts receivable by age.

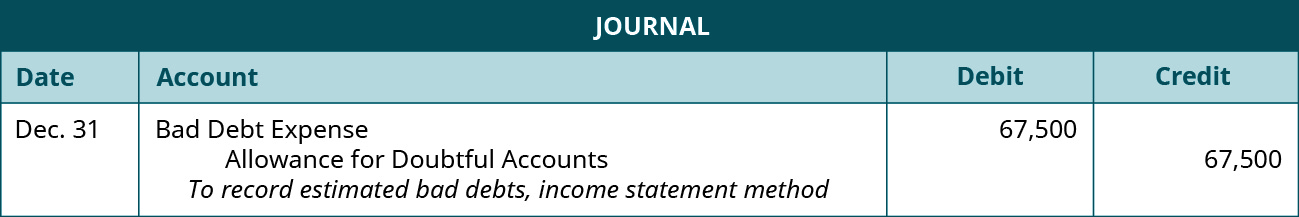

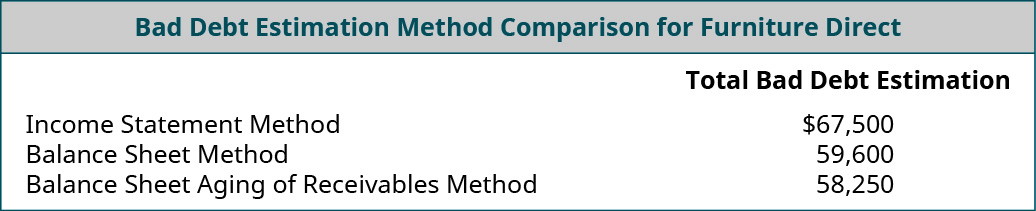

If the company were to maintain the income statement method, the total bad debt estimation would be $67,500 ($1,350,000 × 5%), and the following adjusting entry would occur.

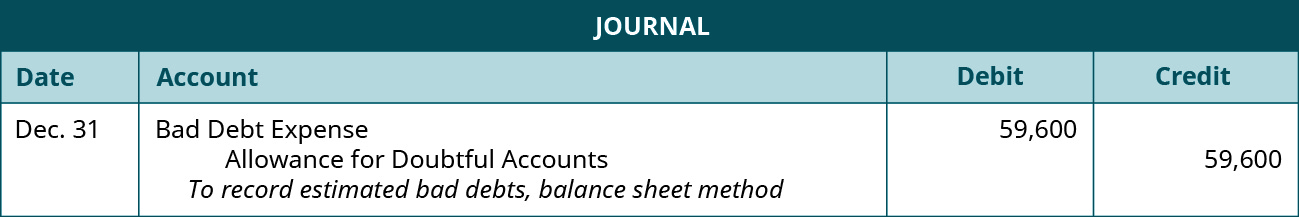

If the company were to use the balance sheet method, the total bad debt estimation would be $59,600 ($745,000 × 8%), and the following adjusting entry would occur.

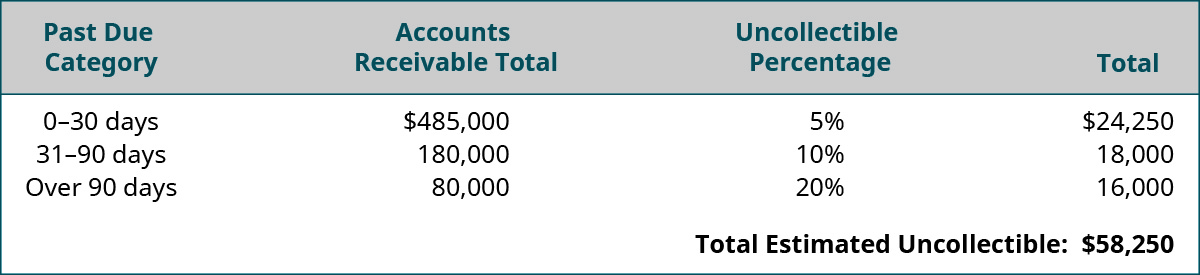

If the company were to use the balance sheet aging of receivables method, the total bad debt estimation would be $58,250, calculated as shown:

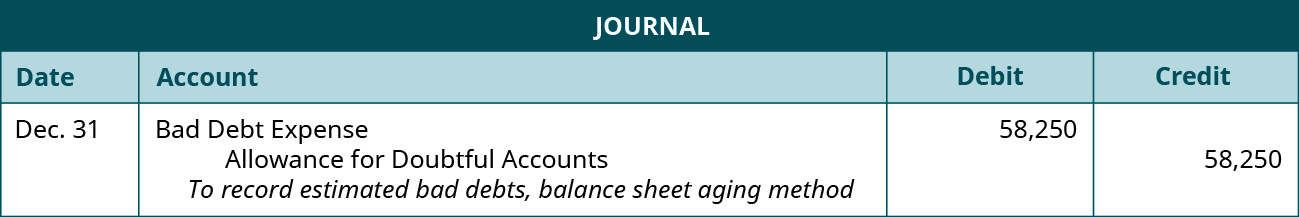

The adjusting entry recorded using the aging method is as follows.

As you can see, the methods provide different financial figures.

While it is up to the company to determine which method best describes its financial position, a company may manage these methods and figures to present the best financial position possible.