7.4 Operating Leverage

In much the same way that managers control the risk of incurring a net loss by watching their margin of safety, being aware of the company’s operating leverage is critical to the financial well-being of the firm. Operating leverage is a measurement of how sensitive net operating income is to a percentage change in sales dollars. Typically, the higher the level of fixed costs, the higher the level of risk. However, as sales volumes increase, the payoff is typically greater with higher fixed costs than with higher variable costs. In other words, the higher the risk the greater the payoff.

First, let’s look at this from a general example to understand payoff. Suppose you had $10,000 to invest and you were debating between putting that money in low risk bonds earning 3% or taking a chance and buying stock in a new company that currently is not profitable but has an innovative product that many analysts predict will take off and be the next “big thing.” Obviously, there is more risk with buying the stock than with buying the bonds. If the company remains unprofitable, or fails, you stand to lose all or a portion of your investment ,whereas the bonds are less risky and will continue to pay 3% interest. However, the risk associated with the stock investment could result in a much higher payoff if the company is successful.

So how does this relate to fixed costs and companies? Companies have many types of fixed costs including salaries, insurance, and depreciation. These costs are present regardless of our production or sales levels. This makes fixed costs riskier than variable costs, which only occur if we produce and sell items or services. As we sell items, we have learned that the contribution margin first goes to meeting fixed costs and then to profits. Here is an example of how changes in fixed costs affects profitability.

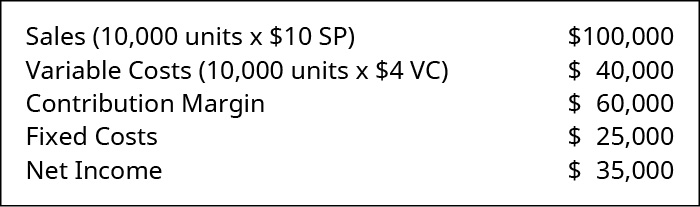

Gray Co. has the following income statement:

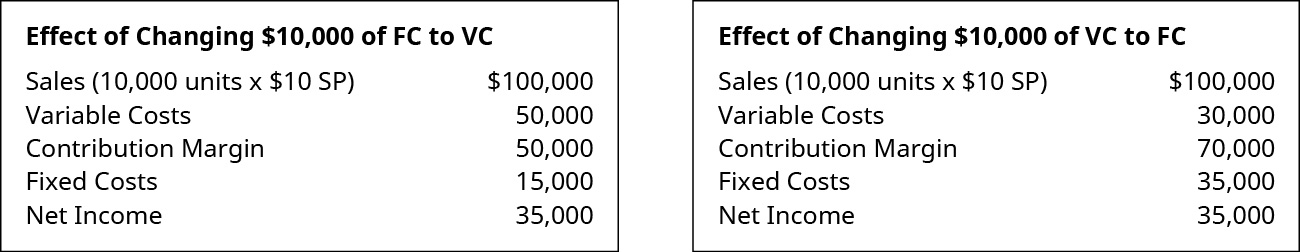

What is the effect of switching $10,000 of fixed costs to variable costs? What is the effect of switching $10,000 of variable costs to fixed costs?

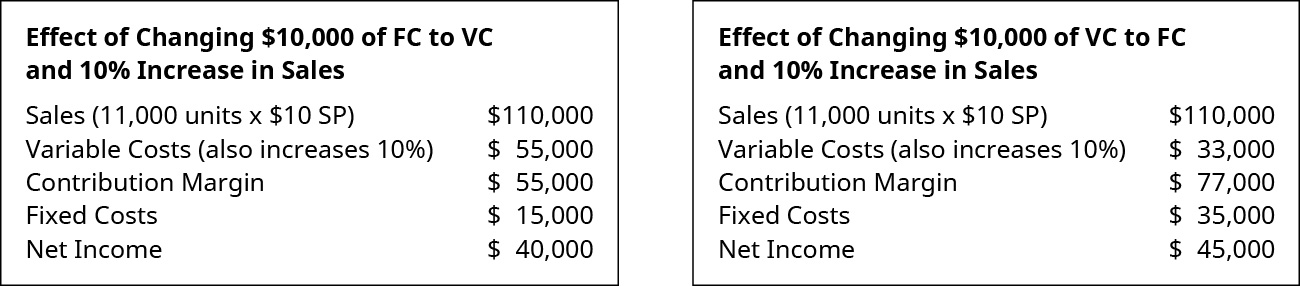

Notice that in this instance, the company’s net income stayed the same. Now, look at the effect on net income of changing fixed to variable costs or variable costs to fixed costs as sales volume increases. Assume sales volume increase by 10%.

As you can see from this example, moving variable costs to fixed costs, such as making hourly employees salaried, is riskier in that fixed costs are higher. However, the payoff, or resulting net income, is higher as sales volume increases.

This is why companies are so concerned with managing their fixed and variable costs and will sometimes move costs from one category to another to manage this risk. Some examples include, as previously mentioned, moving hourly employees (variable) to salaried employees (fixed), or replacing an employee (variable) with a machine (fixed). Keep in mind that managing this type of risk not only affects operating leverage but can have an effect on morale and corporate climate as well.

CONCEPTS IN PRACTICE

Fluctuating Operating Leverage: Why Do Stores Add Self-Service Checkout Lanes?

Operating leverage fluctuations result from changes in a company’s cost structure. While any change in either variable or fixed costs will change operating leverage, the fluctuations most often result from management’s decision to shift costs from one category to another. As the next example shows, the advantage can be great when there is economic growth (increasing sales); however, the disadvantage can be just as great when there is economic decline (decreasing sales). This is the risk that must be managed when deciding how and when to cause operating leverage to fluctuate.

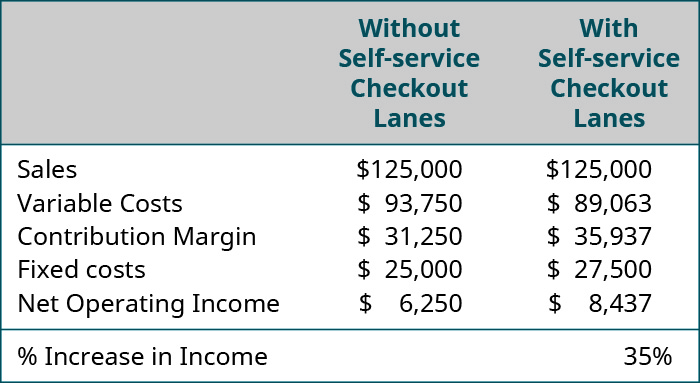

Consider the impact of reducing variable costs (fewer employee staffed checkout lanes) and increasing fixed costs (more self-service checkout lanes). A store with $125,000,000 per year in sales installs some self-service checkout lanes. This increases its fixed costs by 10% but reduces its variable costs by 5%. As Figure 7.48 shows, at the current sales level, this could produce a whopping 35% increase in net operating income. And, if the change results in higher sales, the increase in net operating income would be even more dramatic. Do the math and you will see that each 1% increase in sales would produce a 6% increase in net operating income: well worth the change, indeed.

(in 000s) Without Selfservice Checkout Lanes, With Selfservice Checkout Lanes (respectively): Sales $125,000, 125,000; Variable Costs 93,750, 89,063; Contribution Margin 31,250, 35,938; Fixed Costs 25,000, 27,500; Net Operating Income 6,250 8,438; Percent Increase in Income 35 percent.

The company in this example also faces a downside risk, however. If customers disliked the change enough that sales decreased by more than 6%, net operating income would drop below the original level of $6,250 and could even become a loss.

Operating leverage has a multiplier effect. A multiplier effect is one in which a change in an input (such as variable cost per unit) by a certain percentage has a greater effect (a higher percentage effect) on the output (such as net income). To explain the concept of a multiplier effect, think of having to open a very large, heavy wooden crate. You could pull and pull with your hands all day and still not exert enough force to get it open. But, what if you used a lever in the form of a pry bar to multiply your effort and strength? For every additional amount of force you apply to the pry bar, a much larger amount of force is applied to the crate. Before you know it, you have the crate open. Operating leverage works much like that pry bar: if operating leverage is high, then a very small increase in sales can result in a large increase in net operating income.

How does a company increase its operating leverage? Operating leverage is a function of cost structure, and companies that have a high proportion of fixed costs in their cost structure have higher operating leverage. There is, however, a cautionary side to operating leverage. Since high operating leverage is the result of high fixed costs, if the market for the company’s products, goods, or services shrinks, or if demand for the company’s products, goods, or services declines, the company may find itself obligated to pay for fixed costs with little or no sales revenue to spare. Managers who have made the decision to chase large increases in net operating income through the use of operating leverage have found that, when market demand falls, their only recourse is to close their doors. In fact, many large companies are making the decision to shift costs away from fixed costs to protect them from this very problem.

Long Descriptions

Effect of Changing $10,000 of FC to VC: Sales (1,000 units times $10 SP) $100,000 less Variable Costs 50,000 equals Contribution Margin 50,000. Subtract Fixed Costs 15,000 to get Net Income of $35,000. Effect of Changing $10,000 of VC to FC: Sales (1,000 units times $10 SP) $100,000 less Variable Costs 30,000 equals Contribution Margin 70,000. Subtract Fixed Costs 35,000 to get Net Income of $35,000. Return

Effect of Changing $10,000 of FC to VC and 10 percent Increase in Sales: Sales (1,100 units times $10 SP) $110,000 less Variable Costs 55,000 equals Contribution Margin 55,000. Subtract Fixed Costs 15,000 to get Net Income of $40,000. Effect of Changing $10,000 of VC to FC and 10 percent Increase in Sales: Sales (1,100 units times $10 SP) $110,000 less Variable Costs 33,000 equals Contribution Margin 77,000. Subtract Fixed Costs 35,000 to get Net Income of $45,000. Return