1.2 Transaction Analysis- accounting equation format

Now that you’ve gained a basic understanding of both the basic and expanded accounting equations, let’s consider some of the transactions a business may encounter. We’ll review how each transaction affects the basic accounting equation.

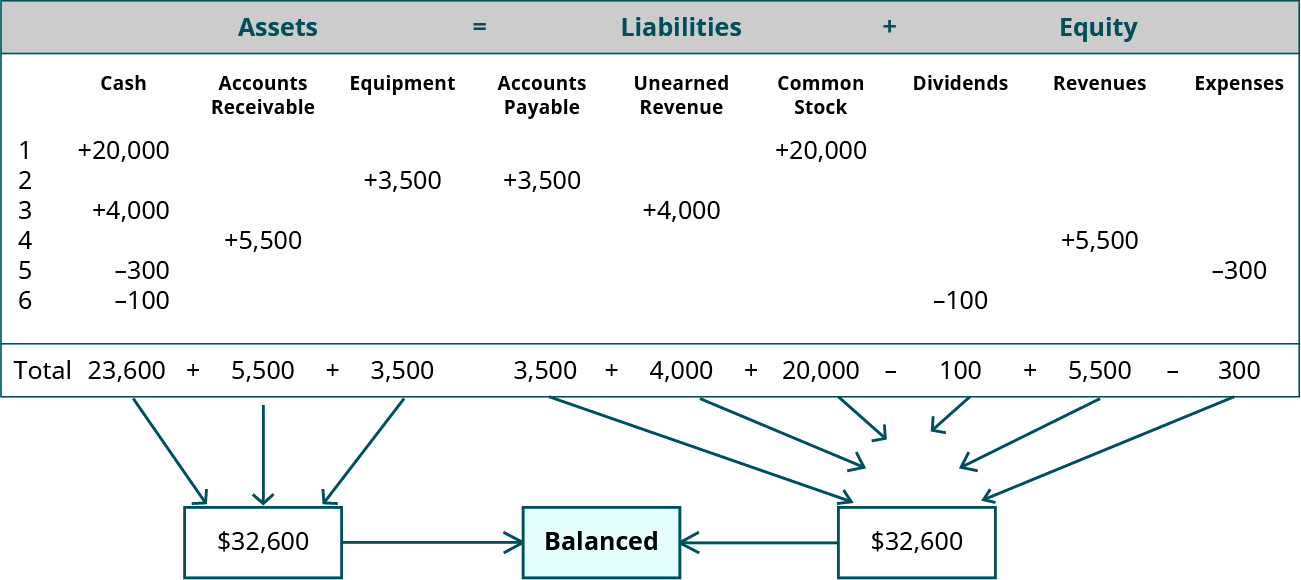

Reviewing and Analyzing Transactions

Let us assume our business is a service-based company. We use Lynn Sanders’ small printing company, Printing Plus, as our example. Please notice that since Printing Plus is a corporation, we are using the Common Stock account, instead of Owner’s Equity. The following are several transactions from this business’s current month:

- Issues $20,000 shares of common stock for cash.

- Purchases equipment on account for $3,500, payment due within the month.

- Receives $4,000 cash in advance from a customer for services not yet rendered.

- Provides $5,500 in services to a customer who asks to be billed for the services.

- Pays a $300 utility bill with cash.

- Distributed $100 cash in dividends to stockholders.

We now analyze each of these transactions, paying attention to how they impact the accounting equation and corresponding financial statements.

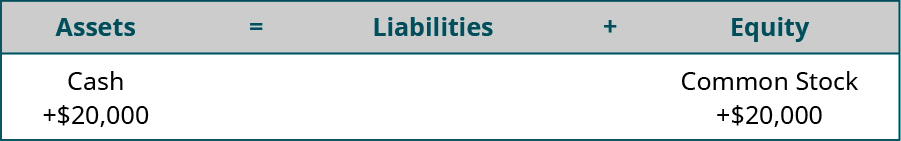

Transaction 1: Issues $20,000 shares of common stock for cash.

Analysis: Looking at the accounting equation, we know cash is an asset and common stock is stockholder’s equity. When a company collects cash, this will increase assets because cash is coming into the business. When a company issues common stock, this will increase a stockholder’s equity because he or she is receiving investments from owners.

Remember that the accounting equation must remain balanced, and assets need to equal liabilities plus equity. On the asset side of the equation, we show an increase of $20,000. On the liabilities and equity side of the equation, there is also an increase of $20,000, keeping the equation balanced. Changes to assets, specifically cash, will increase assets on the balance sheet and increase cash on the statement of cash flows. Changes to stockholder’s equity, specifically common stock, will increase stockholder’s equity on the balance sheet.

Transaction 2: Purchases equipment on account for $3,500, payment due within the month.

Analysis: We know that the company purchased equipment, which is an asset. We also know that the company purchased the equipment on account, meaning it did not pay for the equipment immediately and asked for payment to be billed instead and paid later. Since the company owes money and has not yet paid, this is a liability, specifically labeled as accounts payable. There is an increase to assets because the company has equipment it did not have before. There is also an increase to liabilities because the company now owes money. The more money the company owes, the more that liability will increase.

The accounting equation remains balanced because there is a $3,500 increase on the asset side, and a $3,500 increase on the liability and equity side. This change to assets will increase assets on the balance sheet. The change to liabilities will increase liabilities on the balance sheet.

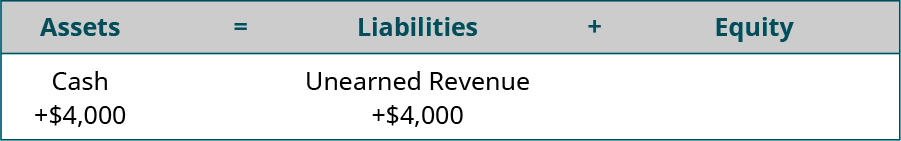

Transaction 3: Receives $4,000 cash in advance from a customer for services not yet rendered.

Analysis: We know that the company collected cash, which is an asset. This collection of $4,000 increases assets because money is coming into the business.

The company has yet to provide the service. According to the revenue recognition principle, the company cannot recognize that revenue until it provides the service. Therefore, the company has a liability to the customer to provide the service and must record the liability as unearned revenue. The liability of $4,000 worth of services increases because the company has more unearned revenue than previously.

The equation remains balanced, as assets and liabilities increase. The balance sheet would experience an increase in assets and an increase in liabilities.

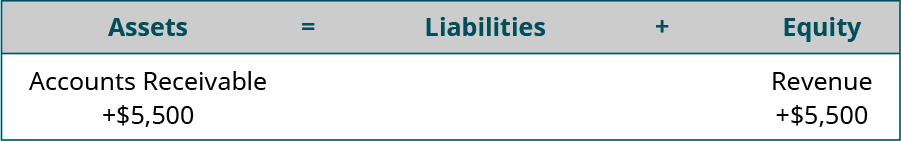

Transaction 4: Provides $5,500 in services to a customer who asks to be billed for the services.

Analysis: The customer asked to be billed for the service, meaning the customer did not pay with cash immediately. The customer owes money and has not yet paid, signaling an accounts receivable. Accounts receivable is an asset that is increasing in this case. This customer obligation of $5,500 adds to the balance in accounts receivable.

The company did provide the services. As a result, the revenue recognition principle requires recognition as revenue, which increases equity for $5,500. The increase to assets would be reflected on the balance sheet. The increase to equity would affect three statements. The income statement would see an increase to revenues, changing net income (loss). Net income (loss) is computed into retained earnings on the statement of retained earnings. This change to retained earnings is shown on the balance sheet under stockholder’s equity.

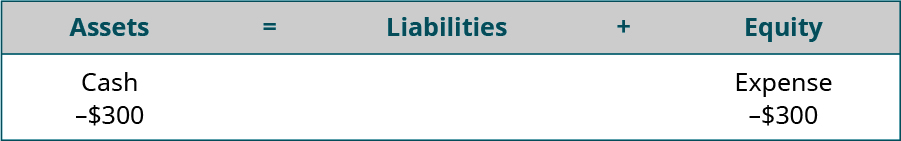

Transaction 5: Pays a $300 utility bill with cash.

Analysis: The company paid with cash, an asset. Assets are decreasing by $300 since cash was used to pay for this utility bill. The company no longer has that money.

Utility payments are generated from bills for services that were used and paid for within the accounting period, thus recognized as an expense. The expense decreases equity by $300. The decrease to assets, specifically cash, affects the balance sheet and statement of cash flows. The decrease to equity as a result of the expense affects three statements. The income statement would see a change to expenses, changing net income (loss). Net income (loss) is computed into retained earnings on the statement of retained earnings. This change to retained earnings is shown on the balance sheet under stockholder’s equity.

As you can see, assets total $32,600, while liabilities added to equity also equal $32,600. Our accounting equation remains balanced.

The following screencast walks you through the following similar examples:

- Owner invests $50,000 cash, receiving common stock in exchange for the investment.

- Owner invests $10,000 equipment, receiving common stock in exchange for the investment.

- Purchase equipment on account, $12,000.

- Paid $1,600 for monthly rent.

- Performed services for cash, $2000.

- Performed services on account, $7,000.

- Paid $8,000 to purchase equipment.

- Paid $2,400 salary to staff assistant.

- Collected $5,000 on account.

- Paid $12,000 on account.

- Paid $500 dividends.

YOUR TURN! For each scenario, click on the appropriate account category and its related effect (+ or -).

Long Description

Assets equal Liabilities plus Equity in a gray highlighted heading. Below the heading are nine columns, labeled left to right: Cash, Accounts Receivable, Equipment, Accounts Payable, Unearned Revenue, Common Stock, Dividends, Revenues, Expenses. Below the column headings are six lines. Line 1, plus 20,000 under Cash and plus 20,000 under Common Stock. Line 2, plus 3,500 under Equipment and plus 3,500 under Accounts Payable. Line 3, plus 4,000 under Cash and plus 4,000 under Unearned Revenue. Line 4, plus 5,500 under Accounts Receivable and plus 5,500 under Revenues. Line 5, minus 300 under Cash and minus 300 under Expenses. Line 6, minus 100 under Cash and minus 100 under Dividends. There is a Total line showing, for the first three columns: 23,600 plus 5,500 plus 3,500; below which are three arrows pointing to a box on the left containing $32,600. The Total line shows, for the remaining six columns: 3,500 plus 4,000 plus 20,000 minus 100 plus 5,500 minus 300; below which are six arrows pointing to a box on the right containing $32,600. The left and right boxes have arrows pointing to a middle box stating Balanced. Return