1.6 Unadjusted Trial Balance

Once all the monthly transactions have been analyzed, journalized, and posted on a continuous day-to-day basis over the accounting period (a month in our example), we are ready to start working on preparing a trial balance (unadjusted). Preparing an unadjusted trial balance is the fourth step in the accounting cycle. A trial balance is a list of all accounts in the general ledger that have nonzero balances. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

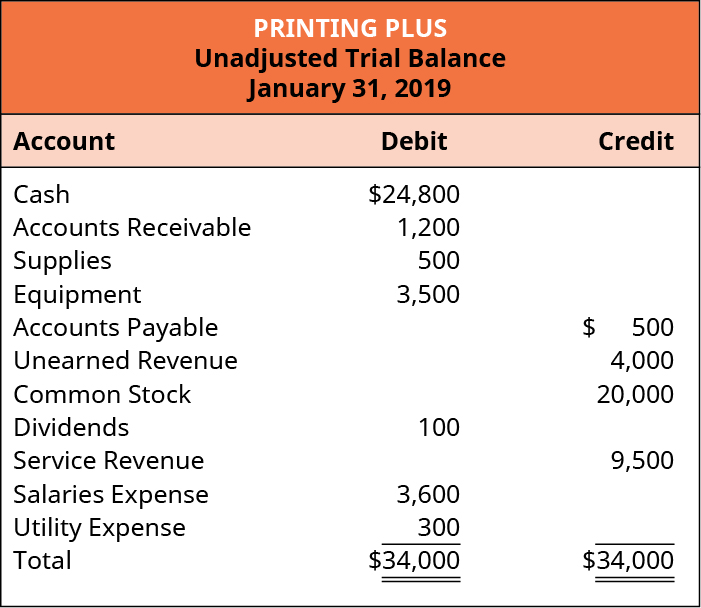

When constructing a trial balance, we must consider a few formatting rules, akin to those requirements for financial statements:

- The header must contain the name of the company, the label of a Trial Balance (Unadjusted), and the date.

- Accounts are listed in the accounting equation order with assets listed first followed by liabilities and finally equity.

- Amounts at the top of each debit and credit column should have a dollar sign.

- When amounts are added, the final figure in each column should be underscored.

- The totals at the end of the trial balance need to have dollar signs and be double-underscored.

Transferring information from T-accounts to the trial balance requires consideration of the final balance in each account. If the final balance in the ledger account (T-account) is a debit balance, you will record the total in the left column of the trial balance. If the final balance in the ledger account (T-account) is a credit balance, you will record the total in the right column.

Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. The final total in the debit column must be the same dollar amount that is determined in the final credit column. For example, if you determine that the final debit balance is $24,000 then the final credit balance in the trial balance must also be $24,000. If the two balances are not equal, there is a mistake in at least one of the columns.

Let’s now take a look at the T-accounts and unadjusted trial balance for Printing Plus to see how the information is transferred from the T-accounts to the unadjusted trial balance.

For example, Cash has a final balance of $24,800 on the debit side. This balance is transferred to the Cash account in the debit column on the unadjusted trial balance. Accounts Receivable ($1,200), Supplies ($500), Equipment ($3,500), Dividends ($100), Salaries Expense ($3,600), and Utility Expense ($300) also have debit final balances in their T-accounts, so this information will be transferred to the debit column on the unadjusted trial balance. Accounts Payable ($500), Unearned Revenue ($4,000), Common Stock ($20,000) and Service Revenue ($9,500) all have credit final balances in their T-accounts. These credit balances would transfer to the credit column on the unadjusted trial balance.

Once all balances are transferred to the unadjusted trial balance, we will sum each of the debit and credit columns. The debit and credit columns both total $34,000, which means they are equal and in balance. However, just because the column totals are equal and in balance, we are still not guaranteed that a mistake is not present.

Long Descriptions

Printing Plus, Unadjusted Trial Balance, January 31, 2019. Debit accounts: Cash $24,800; Accounts Receivable 1,200; Supplies 500; Equipment 3,500; Dividends 100; Salaries Expense 3,600; Utility Expense 300; Total Debits $34,000. Credit accounts: Accounts Payable 500; Unearned Revenue 4,000; Common Stock 20,000; Service Revenue 9,500; Total Credits $34,000. To the right of the unadjusted trial balance are eleven T-accounts with lines connecting the balances of the T-accounts to the account balances on the unadjusted trial balance. The eleven T-accounts, in order, are: Cash, with a debit entry dated January 3 for 20,000, a debit entry dated January 9 for 4,000, a debit entry dated January 17 for 2,800, a debit entry dated January 23 for 5,500, a credit entry dated January 12 for 300, a credit entry dated January 14 for 100, a credit entry dated January 18 for 3,500, a credit entry dated January 20 for 3,600, and a balance of 24,800. Accounts Receivable, with a debit entry dated January 10 for 5,500, a debit entry dated January 27 for 1,200, a credit entry dated January 23 for 5,500, and a balance of 1,200. Supplies, with a debit entry dated January 30 for 500, and a balance of 500. Equipment, with a debit entry dated January 5 for 3,500, and a balance of 3,500. Accounts Payable, with a debit entry dated January 18 for 3,500, a credit entry dated January 9 for 3,500, a credit entry dated January 30 for 500, and a balance of 500. Unearned Revenue, with a credit entry dated January 9 for 4,000, and a balance of 4,000. Common Stock, with a credit entry dated January 3 for 20,000, and a balance of 20,000. Dividends, with a debit entry dated January 14 for 100, and a balance of 100. Service Revenue, with a credit entry dated January 10 for 5,500, a credit entry dated January 17 for 2,800, a credit entry dated January 27 for 1,200, and a balance of 9,500. Salaries Expense, with a debit entry dated January 20 for 3,600, and a balance of 3,600. Utility Expense, with a debit entry dated January 12 for 300, and a balance of 300. Return

Printing Plus, Unadjusted Trial Balance, January 31, 2019. Debit accounts: Cash, $24,800; Accounts Receivable, 1,200; Supplies, 500; Equipment, 3,500; Dividends, 100; Salaries Expense, 3,600; Utility Expense, 300; Total Debits, $34,000. Credit accounts: Accounts Payable, 500; Unearned Revenue, 4,000; Common Stock, 20,000; Service Revenue, 9,500; Total Credits, $34,000. Return