5.8 Typical Stock Transactions

Chad and Rick have successfully incorporated La Cantina and are ready to issue common stock to themselves and the newly recruited investors. The proceeds will be used to open new locations. The corporate charter of the corporation indicates that the par value of its common stock is $1.50 per share. When stock is sold to investors, it is very rarely sold at par value. Most often, shares are issued at a value in excess of par. This is referred to as issuing stock at a premium. Stock with no par value that has been assigned a stated value is treated very similarly to stock with a par value.

Stock can be issued in exchange for cash, property, or services provided to the corporation. For example, an investor could give a delivery truck in exchange for a company’s stock. Another investor could provide legal fees in exchange for stock. The general rule is to recognize the assets received in exchange for stock at the asset’s fair market value.

Typical Common Stock Transactions

The company plans to issue most of the shares in exchange for cash, and other shares in exchange for kitchen equipment provided to the corporation by one of the new investors. Two common accounts in the equity section of the balance sheet are used when issuing stock—Common Stock and Additional Paid-in Capital from Common Stock. Common Stock consists of the par value of all shares of common stock issued. Additional paid-in capital from common stock consists of the excess of the proceeds received from the issuance of the stock over the stock’s par value. When a company has more than one class of stock, it usually keeps a separate additional paid-in capital account for each class.

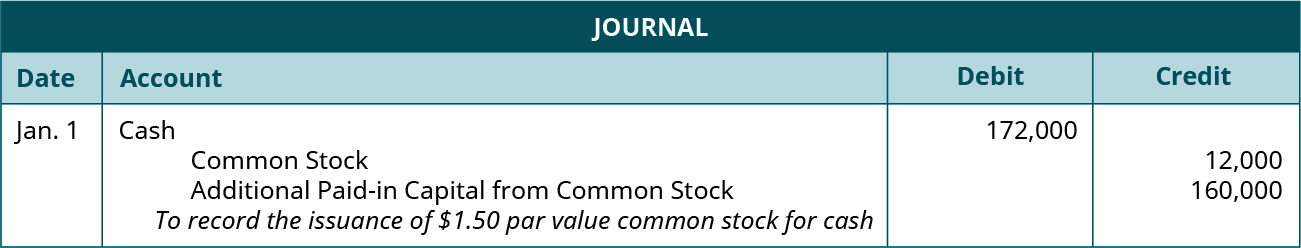

Issuing Common Stock with a Par Value in Exchange for Cash

When a company issues new stock for cash, assets increase with a debit, and equity accounts increase with a credit. To illustrate, assume that La Cantina issues 8,000 shares of common stock to investors on January 1 for cash, with the investors paying cash of $21.50 per share. The total cash to be received is $172,000.

The transaction causes Cash to increase (debit) for the total cash received. The Common Stock account increases (credit) with a credit for the par value of the 8,000 shares issued: 8,000 × $1.50, or $12,000. The excess received over the par value is reported in the Additional Paid-in Capital from Common Stock account. Since the shares were issued for $21.50 per share, the excess over par value per share of $20 ($21.50 − $1.50) is multiplied by the number of shares issued to arrive at the Additional Paid-in Capital from Common Stock credit.

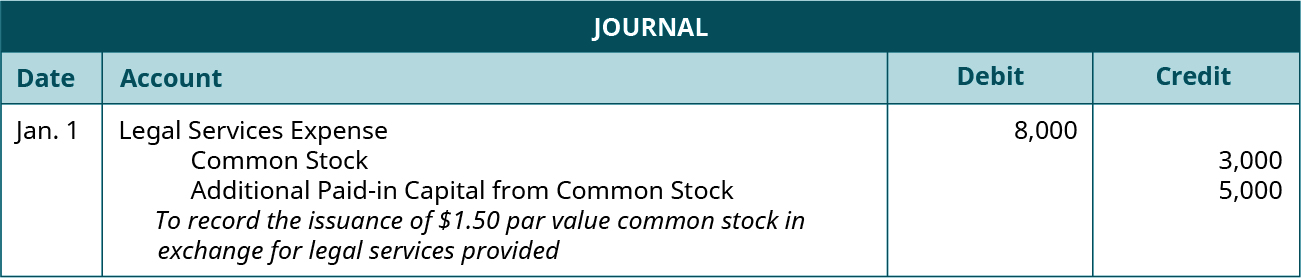

Issuing Common Stock with a Par Value in Exchange for Property or Services

When a company issues stock for property or services, the company increases the respective asset account with a debit and the respective equity accounts with credits. The asset received in the exchange—such as land, equipment, inventory, or any services provided to the corporation such as legal or accounting services—is recorded at the fair market value of the stock or the asset or services received, whichever is more clearly determinable.

To illustrate, assume that La Cantina issues 2,000 shares of authorized common stock in exchange for legal services provided by an attorney. The legal services have a value of $8,000 based on the amount the attorney would charge. Because La Cantina’s stock is not actively traded, the asset will be valued at the more easily determinable market value of the legal services. La Cantina must recognize the market value of the legal services as an increase (debit) of $8,000 to its Legal Services Expense account. Similar to recording the stock issued for cash, the Common Stock account is increased by the par value of the issued stock, $1.50 × 2,000 shares, or $3,000. The excess of the value of the legal services over the par value of the stock appears as an increase (credit) to the Additional Paid-in Capital from Common Stock account:

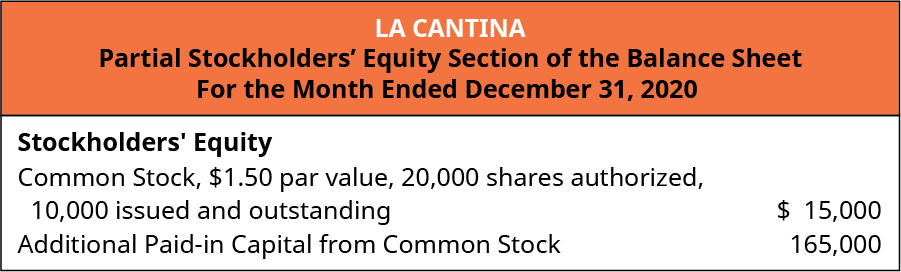

Just after the issuance of both investments, the stockholders’ equity account, Common Stock, reflects the total par value of the issued stock; in this case, $3,000 + $12,000, or a total of $15,000. The amounts received in excess of the par value are accumulated in the Additional Paid-in Capital from Common Stock account in the amount of $5,000 + $160,000, or $165,000. A portion of the equity section of the balance sheet just after the two stock issuances by La Cantina will reflect the Common Stock account stock issuances as shown in Figure 5.56.

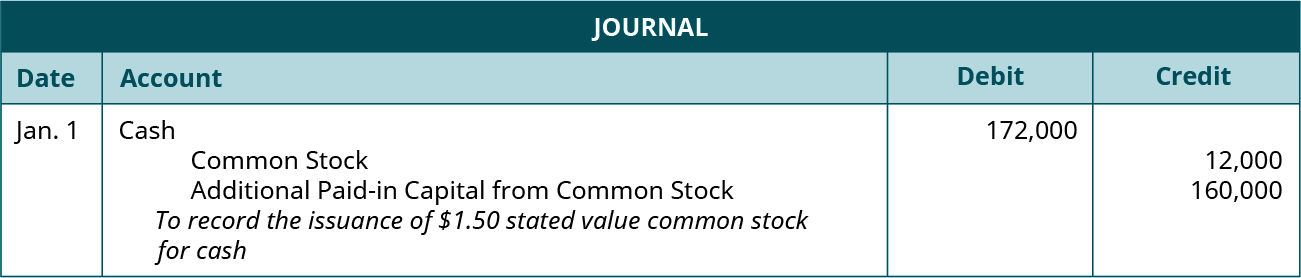

Issuing No-Par Common Stock with a Stated Value

Not all stock has a par value specified in the company’s charter. In most cases, no-par stock is assigned a stated value by the board of directors, which then becomes the legal capital value. Stock with a stated value is treated as if the stated value is a par value. Assume that La Cantina’s 8,000 shares of common stock issued on June 1 for $21.50 were issued at a stated value of $1.50 rather than at a par value. The total cash to be received remains $172,000 (8,000 shares × $21.50), which is recorded as an increase (debit) to Cash. The Common Stock account increases with a credit for the stated value of the 8,000 shares issued: 8,000 × $1.50, or $12,000. The excess received over the stated value is reported in the Additional Paid-in Capital from Common Stock account at $160,000, based on the issue price of $21.50 per share less the stated value of $1.50, or $20, times the 8,000 shares issued:

The transaction looks identical except for the explanation.

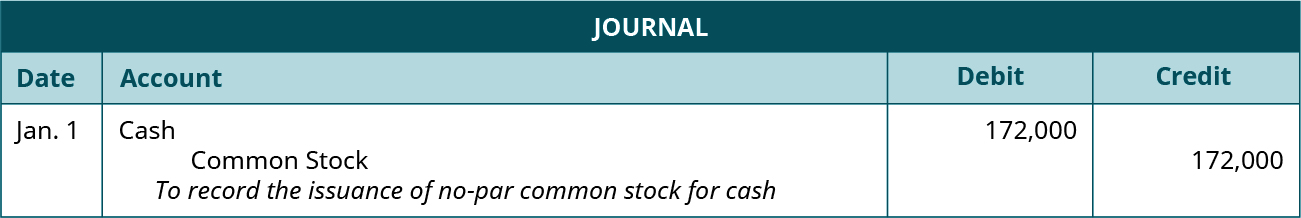

If the 8,000 shares of La Cantina’s common stock had been no-par, and no stated value had been assigned, the $172,000 would be debited to Cash, with a corresponding increase in the Common Stock account as a credit of $172,000. No entry would be made to Additional Paid-in Capital account as it is reserved for stock issue amounts above par or stated value. The entry would appear as:

Issuing Preferred Stock

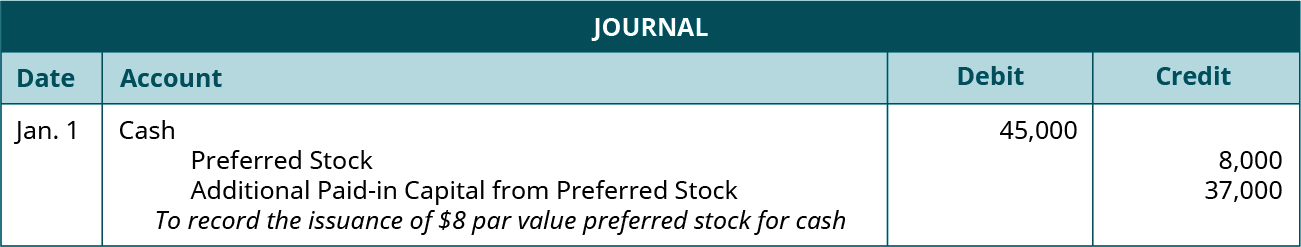

A few months later, Chad and Rick need additional capital to develop a website to add an online presence and decide to issue all 1,000 of the company’s authorized preferred shares. The 5%, $8 par value, preferred shares are sold at $45 each. The Cash account increases with a debit for $45 times 1,000 shares, or $45,000. The Preferred Stock account increases for the par value of the preferred stock, $8 times 1,000 shares, or $8,000. The excess of the issue price of $45 per share over the $8 par value, times the 1,000 shares, is credited as an increase to Additional Paid-in Capital from Preferred Stock, resulting in a credit of $37,000.

The journal entry is:

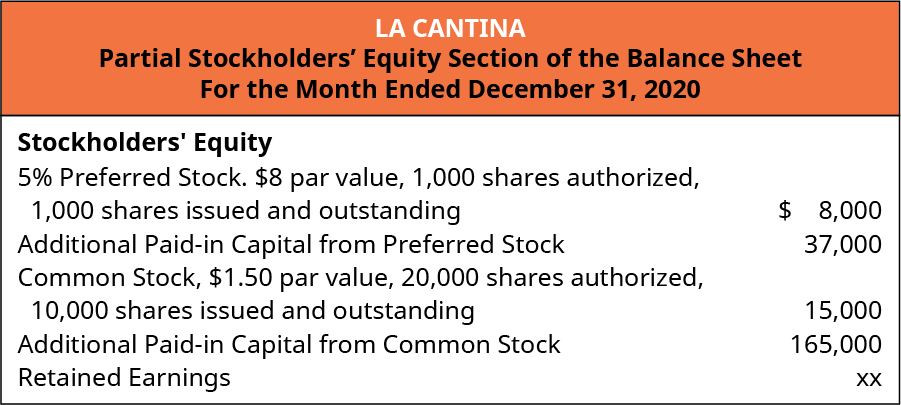

Figure 5.60 shows what the equity section of the balance sheet will reflect after the preferred stock is issued.

Notice that the corporation presents preferred stock before common stock in the Stockholders’ Equity section of the balance sheet because preferred stock has preference over common stock in the case of liquidation. GAAP requires that each class of stock displayed in this section of the balance sheet includes several items that must be disclosed along with the respective account names. The required items to be disclosed are:

- Par or stated value

- Number of shares authorized

- Number of shares issued

- Number of shares outstanding

- If preferred stock, the dividend rate

Long Description

La Cantina, Partial Stockholders’ Equity Section of the Balance Sheet, For the Month Ended December 31, 2020. Stockholders’ Equity: 5% percent Preferred stock, $8 par value, 1,000 shares authorized, 1,000 shares issued and outstanding $8,000. Additional paid-in capital from preferred stock 37,000. Common Stock, $1.50 par value, 20,000 shares authorized, 10,000 issued and outstanding $15,000. Additional Paid-in capital from common 165,000. Retained Earnings xx. Return