8.5 Predetermined Overhead Rates & Overhead Application

Job order cost systems maintain the actual direct materials and direct labor for each individual job. Since production consists of overhead—indirect materials, indirect labor, and other overhead—we need a methodology for applying that overhead. Unfortunately, the nature of indirect material, indirect labor, and other overhead expenses makes it impossible to determine the exact amount of overhead for each specific job. For example, how do you know the cost of electricity and heat for manufacturing one job? And, if you did, is it fair to say products manufactured in January are more expensive than the same product manufactured in March because of heat expense?

Fundamental Characteristics of the Overhead Determination Environment

Added to these issues is the nature of establishing an overhead rate, which is often completed months before being applied to specific jobs. Establishing the overhead allocation rate first requires management to identify which expenses they consider manufacturing overhead and then to estimate the manufacturing overhead for the next year. Manufacturing overhead costs include all manufacturing costs except for direct materials and direct labor. Therefore, in order to estimate manufacturing overhead, management must estimate the future purchase prices of dozens, or sometimes hundreds, of individual components, such as utilities, raw materials, contract labor, or diesel fuel. Estimating overhead costs is difficult because many costs fluctuate significantly from when the overhead allocation rate is established to when its actual application occurs during the production process. You can envision the potential problems in creating an overhead allocation rate within these circumstances.

Before demonstrating the calculation of a predetermined overhead allocation rate, let’s review the basic principles of revenue recognition and expense. In accounting, there are three ways to recognize expenses:

- Direct relationship between the expense and the associated revenue. This method is used for many costs, and the expense is recognized when a direct relationship exists. For example, sales commission expenses can be directly traced to product sales, and a commission expense is recorded when a sale is made.

- Systematic and rational allocation of expenses. This approach is used when costs exist and there is an expected benefit, even though the costs cannot be directly traced to the benefit. The assigning of expenses to a product or time period must be done in an objective and consistent manner. Examples of such expenses would include equipment rental for a factory or property insurance for the factory.

Both of these expenses (direct relationship and systematic and rational) are also examples of the types of expenses that compose manufacturing overhead. An example of the current revenue recognition principle is a company paying $4,800 a year for property insurance. Since production rates can vary month to month, most producers would allocate $400 each month for property insurance, and this cost would be incorporated into the total overhead costs anticipated when estimating a manufacturing overhead allocation rate.

The direct benefit is that the product will be sold and the revenue recognized. The overhead is associated but cannot be directly traced to an individual product, so the overhead expenses need to be assigned in a systematic and rational manner.

- Immediate recognition. This method is used when expenses exist but there is no direct expected benefit. In this case, the expense is recognized immediately. For example, research and development costs are necessary expenses but cannot be traced to a specific product, so they are expensed as incurred.

The allocation of overhead to the cost of the product is also recognized in a systematic and rational manner. The expected overhead is estimated, and an allocation system is determined. The actual costs are accumulated in a manufacturing overhead account. The overhead is then applied to the cost of the product from the manufacturing overhead account. The overhead used in the allocation is an estimate due to the timing considerations already discussed.

The application rate that will be used in a coming period, such as the next year, is often estimated months before the actual overhead costs are experienced. Often, the actual overhead costs experienced in the coming period are higher or lower than those budgeted when the estimated overhead rate or rates were determined. At this point, do not be concerned about the accuracy of the future financial statements that will be created using these estimated overhead allocation rates.

Despite improvements in technology and information flow, using the actual overhead to calculate the application rate is usually not possible because the actual overhead information is available too late for management to make decisions. Also, as you will learn, the results of the actual overhead costs, if they were available, could be misleading. Therefore, most manufacturing companies use predetermined overhead rates for these reasons:

- Overhead costs are not uniform throughout the year. An example is electricity costs that vary by weather and time of day.

- Some overhead costs are fixed, and the cost per unit varies with production. For example, rent may be $1,000 per month. If 500 units were made during one month, and 2,000 units were made the next month, the cost per unit would vary from $2 per unit to $0.50 per unit.

- The total number of units produced varies and is often known sooner than the cost of overhead. For example, a company may know it will have a contract to produce 100 custom units long before it knows the utility costs for the next year.

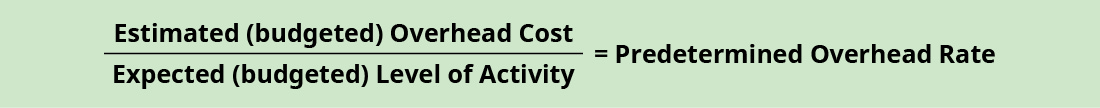

As previously described, a predetermined overhead rate is established prior to the beginning of the fiscal year and typically is not changed during the year. The predetermined rate is calculated as shown and is used to apply overhead costs to work in process:

CONCEPTS IN PRACTICE

Overhead in the Movie Industry

The movie industry uses job order costing, and studios need to allocate overhead to each movie. Their amount of allocated overhead is not publicly known because while publications share how much money a movie has produced in ticket sales, it is rare that the actual expenses are released to the public.

It has been speculated that Star Wars: The Force Awakens cost $201,000,000, with $30,000,000 considered overhead. Studios have estimated that the higher the movie expenses, the more studio overhead is required, and it has also been estimated that 10% of the total cost is assigned to studio overhead.

Determining Estimated Overhead Cost

The estimated or budgeted overhead is the amount of overhead determined during the budgeting process and consists of manufacturing costs but, as you have learned, excludes direct materials and direct labor. Examples of manufacturing overhead costs include indirect materials, indirect labor, manufacturing utilities, and manufacturing equipment depreciation. Another way to view it is overhead costs are those production costs that are not categorized as direct materials or direct labor.

Selecting an Estimated Activity Base

As you have learned, the overhead needs to be allocated to the manufactured product in a systematic and rational manner. This allocation process depends on the use of a cost driver, which drives the production activity’s cost. Examples can include labor hours incurred, labor costs paid, amounts of materials used in production, units produced, or any other activity that has a cause-and-effect relationship with incurred costs.

Direct labor hours, direct labor dollars, or machine hours are often chosen as the allocation base because those costs are associated with each product, and as the activity increases, so does the manufacturing overhead. In other words, the products that involve more direct labor hours, direct labor dollars, or machine hours also increase utility expenses, supervisor time (and thus indirect labor), equipment usage and the related depreciation expense, and so forth.

Traditionally, direct labor hours were used as the activity base, but technology continually decreases the amount of direct labor used in production, and machine hours or units produced have become more common activity bases. Management analyzes the costs and selects the activity as the estimated activity base because it drives the overhead costs of the unit.

Computing a Predetermined Overhead Rate

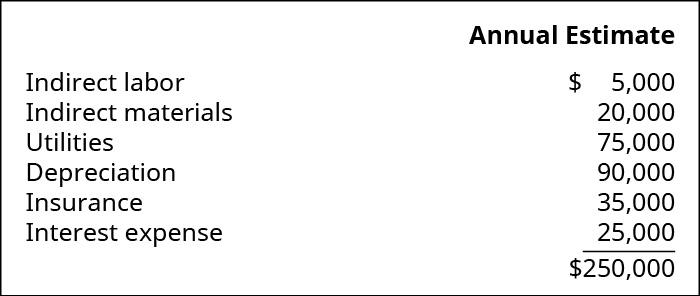

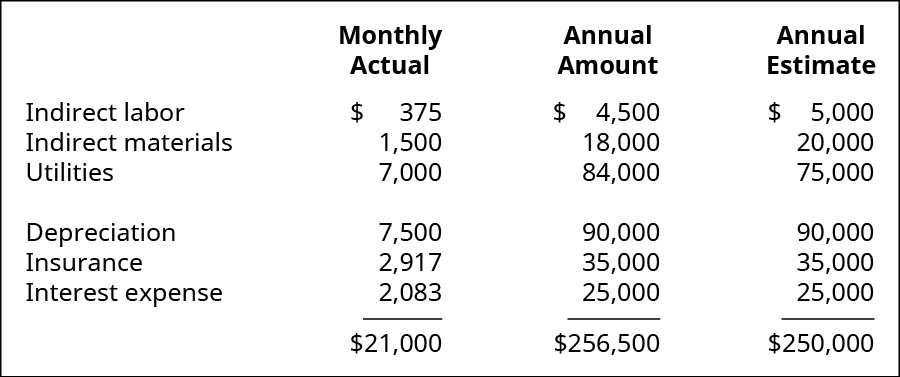

Dinosaur Vinyl uses the expenses from the prior two years to estimate the overhead for the upcoming year to be $250,000, as shown in Figure 8.38.

Dinosaur Vinyl also used its payroll records to estimate that it will spend $100,000 on direct labor. Using the predetermined overhead rate calculation, the overhead rate is $2.50 per direct labor dollar:

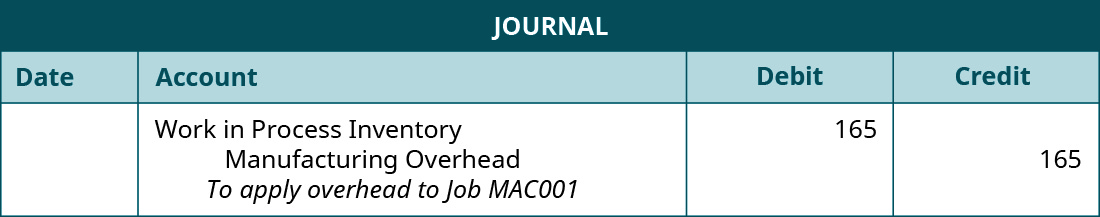

Over the fiscal year, the actual costs are recorded as debits into the account called manufacturing overhead. When the overhead is applied to the jobs, the amount is first calculated using the application rate. If the total labor paid for the job is $66, the overhead applied to the job is $2.50 times that amount, or $165. The entry to record the overhead for Job MAC001 is:

That amount is added to the cost of the job, and the amount in the manufacturing overhead account is reduced by the same amount. At the end of the year, the amount of overhead estimated and applied should be close, although it is rare for the applied amount to exactly equal the actual overhead. For example, Figure 8.41 shows the monthly costs, the annual actual cost, and the estimated overhead for Dinosaur Vinyl for the year. While the total amounts are close to each other, they are not exact.

Calculating Manufacturing Overhead Cost for an Individual Job

Figure 8.41 shows the monthly manufacturing actual overhead recorded by Dinosaur Vinyl. As explained previously, the overhead is allocated to the individual jobs at the predetermined overhead rate of $2.50 per direct labor dollar when the jobs are complete. When Job MAC001 is completed, overhead is $165, computed as $2.50 times the $66 of direct labor, with the total job cost of $931, which includes $700 for direct materials, $66 for direct labor, and $165 for manufacturing overhead.

Long Description

A three column chart showing the Monthly Actual, the Annual Amount, and the Annual Estimate of the overhead. The rows are: Indirect labor 375, 4,500, and 5,000; Indirect materials 1,500, 18,000, and 20,000; Utilities 7,000, 84,000, and 75,000; Depreciation 7,500, 90,000, and 90,000; Insurance 2,917, 35,000, and 35,000; Interest Expense 2,083, 25,000, and 25,000. The totals of the columns are $21,000, $256,500, and $250,000. Return