3.11 Sale of an Asset

When an asset is sold, the company must account for its depreciation up to the date of sale. This means companies may be required to record a depreciation entry before the sale of the asset to ensure it is current. After ensuring that the net book value of an asset is current, the company must determine if the asset has sold at a gain, at a loss, or at book value. We look at examples of each accounting alternative using the Kenzie Company data.

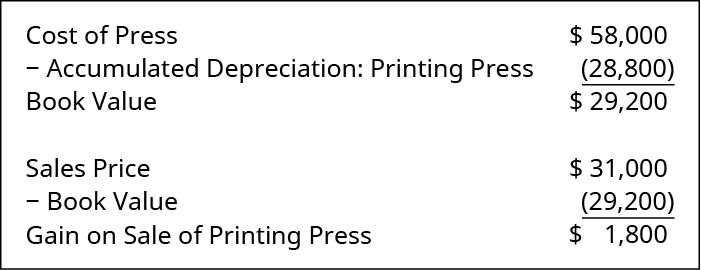

Recall that Kenzie’s press has a depreciable base of $48,000 and an economic life of five years. If Kenzie sells the press at the end of the third year, the company would have taken three years of depreciation amounting to $28,800 ($9,600 × 3 years). With an original cost of $58,000, and after subtracting the accumulated depreciation of $28,800, the press would have a book value of $29,200. If the company sells the press for $31,000, it would realize a gain of $1,800, as shown.

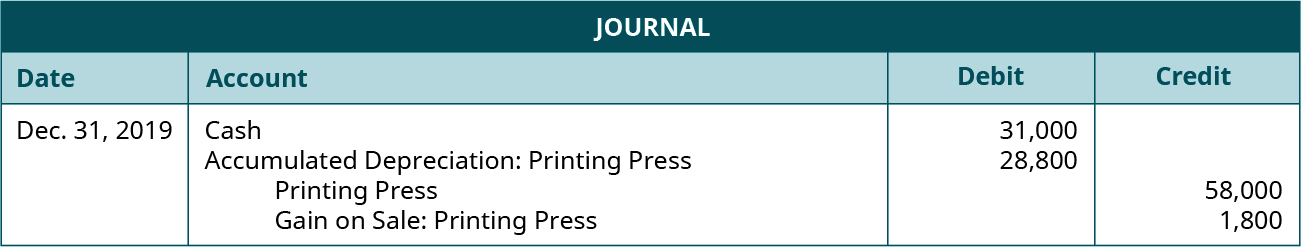

The journal entry to record the sale is shown here.

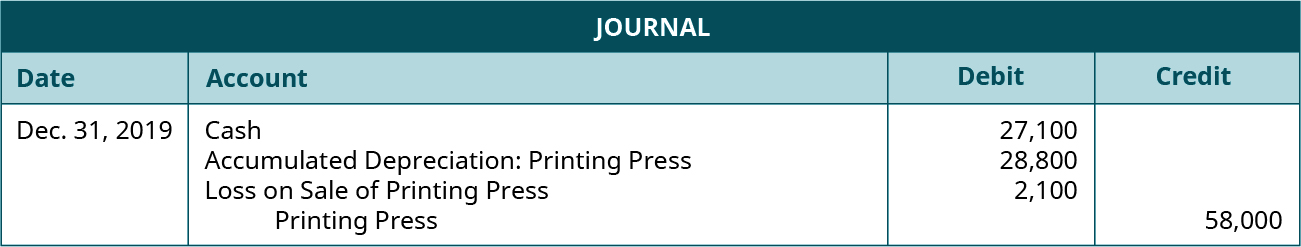

If Kenzie sells the printing press for $27,100, what would the journal entries be? The book value of the press is $29,200, so Kenzie would be selling the press at a loss. The journal entry to record the sale is shown here.

What if Kenzie sells the press at exactly book value? In this case, the company will realize neither a gain nor a loss. Here is the journal entry to record the sale.

While it would be ideal to estimate a salvage value that provides neither a gain nor a loss upon the retirement and sale of a long-term asset, this type of accuracy is virtually impossible to reach, unless you negotiate a fixed future sales price. For example, you might buy a truck for $80,000 and lock in a five-year life with 100,000 or fewer miles driven. Under these conditions, the dealer might agree to pay you $20,000 for the truck in five years.

Under these conditions, you could justify calculating your depreciation over a five-year period, using a depreciable base of $60,000. Under the straight-line method, this would provide an annual depreciation amount of $12,000. Also, when you sell the truck to the dealer after five years, the sales price will be $20,000, and the book value will be $20,000, so there would be neither a gain nor a loss on the sale.

In the Kenzie example where the asset was sold for $31,000 after three years, Kenzie should have recorded a total of $27,000 in depreciation (cost of $58,000 less the sales value of $31,000). However, the company recorded $28,800 in depreciation over the three-year period. Subtracting the gain of $1,800 from the total depreciation expense of $28,800 shows the true cost of using the asset as $27,000, and not the depreciation amount of $28,800.

When the asset was sold for $27,100, the accounting records would show $30,900 in depreciation (cost of $58,000 less the sales price of $27,100). However, depreciation is listed as $28,800 over the three-year period. Adding the loss of $2,100 to the total depreciation expense of $28,800 results in a cost of $30,900 for use of the asset rather than the $28,800 depreciation.

If the asset sells for exactly the book value, its depreciation expense was estimated perfectly, and there is no gain or loss. If it sells for $29,200 and had a book value of $29,200, its depreciation expense of $28,800 matches the original estimate.