1.1 Defining the Accounting Equation Components

[latex][/latex]

The Basic Accounting Equation

The basic accounting equation represents the idea that a company needs assets to operate, and there are two major sources that contribute to operations: liabilities and equity. The company borrows the funds, creating liabilities, or the company can take the funds provided by the profits generated in the current or past periods, creating retained earnings or some other form of stockholder’s equity. The accounting equation can also be thought of from a “sources and claims” perspective; that is, the assets (items owned by the organization) were obtained by incurring liabilities or were provided by owners. Stated differently, everything a company owns must equal everything the company owes to creditors (lenders) and owners (individuals for sole proprietors or stockholders for companies or corporations).

Assume a family purchases a home valued at $200,000. They make a down payment of $25,000 while financing the remaining balance with a $175,000 bank loan. This example demonstrates one of the most important concepts in the study of accounting: the accounting equation, which is:

In our example, the accounting equation would look like this:

\[\$200,000=\$175,000+\$25,000\]

As you continue your accounting studies and you consider the different major types of business entities available (sole proprietorships, partnerships, and corporations), there is another important concept for you to remember. This concept is that no matter which of the entity options that you choose, the accounting process for all of them will be predicated on the accounting equation.

YOUR TURN

The Accounting Equation

On a sheet of paper, use three columns to create your own accounting equation. In the first column, list all of the things you own (assets). In the second column, list any amounts owed (liabilities). In the third column, using the accounting equation, calculate, you guessed it, the net amount of the asset (equity). When finished, total the columns to determine your net worth. Hint: do not forget to subtract the liability from the value of the asset.

Here is something else to consider: is it possible to have negative equity? It sure is . . . ask any college student who has taken out loans. At first glance there is no asset directly associated with the amount of the loan. But is that, in fact, the case? You might ask yourself why make an investment in a college education—what is the benefit (asset) to going to college? The answer lies in the difference in lifetime earnings with a college degree versus without a college degree. This is influenced by many things, including the supply and demand of jobs and employees. It is also influenced by the earnings for the type of college degree pursued. (Where do you think accounting ranks?)

Solution

Answers will vary but may include vehicles, clothing, electronics (include cell phones and computer/gaming systems, and sports equipment). They may also include money owed on these assets, most likely vehicles and perhaps cell phones. In the case of a student loan, there may be a liability with no corresponding asset (yet). Responses should be able to evaluate the benefit of investing in college is the wage differential between earnings with and without a college degree.

Expanding the Accounting Equation

Let’s continue our exploration of the accounting equation, focusing on the equity component, in particular. Recall that we defined equity as the net worth of an organization. It is helpful to also think of net worth as the value of the organization. Recall, too, that revenues (inflows as a result of providing goods and services) increase the value of the organization. So, every dollar of revenue an organization generates increases the overall value of the organization.

Likewise, expenses (outflows as a result of generating revenue) decrease the value of the organization. So, each dollar of expenses an organization incurs decreases the overall value of the organization. The same approach can be taken with the other elements of the financial statements:

- Gains increase the value (equity) of the organization.

- Losses decrease the value (equity) of the organization.

- Investments by owners increase the value (equity) of the organization.

- Distributions to owners decrease the value (equity) of the organization.

- Changes in assets and liabilities can either increase or decrease the value (equity) of the organization depending on the net result of the transaction.

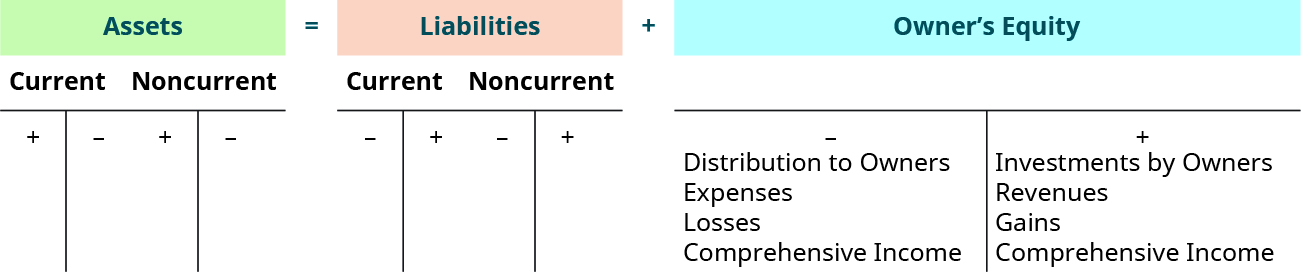

A graphical representation of this concept is shown in Figure 2.1.

Long Description

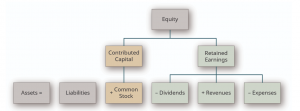

The expanded accounting equation breaks down Equity into four categories: common stock, dividends, revenues, and expenses. This considers each element of contributed capital and retained earnings individually to better illustrate each one’s impact on changes in equity.

This expansion of the equity section allows a company to see the impact to equity from changes to revenues and expenses, and to owner investments and payouts. It is important to have more detail in this equity category to understand the effect on financial statements from period to period. For example, an increase to revenue can increase net income on the income statement, increase retained earnings on the statement of retained earnings, and change the distribution of stockholder’s equity on the balance sheet. This may be difficult to understand where these changes have occurred without revenue recognized individually in this expanded equation.

A business can now use this equation to analyze transactions in more detail. But first, it may help to examine the many accounts that can fall under each of the main categories of Assets, Liabilities, and Equity, in terms of their relationship to the expanded accounting equation. We begin with the left side of the equation, the assets, and work toward the right side of the equation to liabilities and equity.

Long Description

Assets

On the left side of the equation are assets. Assets are resources a company owns that have an economic value. Assets are represented on the balance sheet financial statement. Some common examples of assets are cash, accounts receivable, inventory, supplies, prepaid expenses, notes receivable, equipment, buildings, machinery, and land.

Cash includes paper currency as well as coins, checks, bank accounts, and money orders. Anything that can be quickly liquidated into cash is considered cash. Cash activities are a large part of any business, and the flow of cash in and out of the company is reported on the statement of cash flows.

Accounts receivable is money that is owed to the company, usually from a customer. The customer has not yet paid with cash for the provided good or service but will do so in the future. Common phrasing to describe this situation is that a customer purchased something “on account,” meaning that the customer has asked to be billed and will pay at a later date: “Account” because a customer has not paid us yet but instead has asked to be billed; “Receivable” because we will receive the money in the future.

Inventory refers to the goods available for sale. Service companies do not have goods for sale and would thus not have inventory. Merchandising and manufacturing businesses do have inventory. Examples of supplies (office supplies) include pens, paper, and pencils. Supplies are considered assets until an employee uses them. At the point they are used, they no longer have an economic value to the organization, and their cost is now an expense to the business.

Prepaid expenses are items paid for in advance of their use. They are considered assets until used. Some examples can include insurance and rent. Insurance, for example, is usually purchased for more than one month at a time (six months typically). The company does not use all six months of the insurance at once, it uses it one month at a time. However, the company prepays for all of it up front. As each month passes, the company will adjust its records to reflect the cost of one month of insurance usage.

Notes receivable is similar to accounts receivable in that it is money owed to the company by a customer or other entity. The difference here is that a note typically includes interest and specific contract terms, and the amount may be due in more than one accounting period.

Equipment examples include desks, chairs, and computers; anything that has a long-term value to the company that is used in the office. Equipment is considered a long-term asset, meaning you can use it for more than one accounting period (a year for example). Buildings, machinery, and land are all considered long-term assets. Machinery is usually specific to a manufacturing company that has a factory producing goods. Machinery and buildings also depreciate. Unlike other long-term assets such as machinery, buildings, and equipment, land is not depreciated. The process to calculate the loss on land value could be very cumbersome, speculative, and unreliable; therefore, the treatment in accounting is for land to not be depreciated over time.

Liabilities

The accounting equation emphasizes a basic idea in business; that is, businesses need assets in order to operate. There are two ways a business can finance the purchase of assets. First, it can sell shares of its stock to the public to raise money to purchase the assets, or it can use profits earned by the business to finance its activities. Second, it can borrow the money from a lender such as a financial institution. You will learn about other assets as you progress through the book. Let’s now take a look at the right side of the accounting equation.

Liabilities are obligations to pay an amount owed to a lender (creditor) based on a past transaction. Liabilities are reported on the balance sheet. It is important to understand that when we talk about liabilities, we are not just talking about loans. Money collected for gift cards, subscriptions, or as advance deposits from customers could also be liabilities. Essentially, anything a company owes and has yet to pay within a period is considered a liability, such as salaries, utilities, and taxes.

For example, a company uses $400 worth of utilities in May but is not billed for the usage, or asked to pay for the usage, until June. Even though the company does not have to pay the bill until June, the company owed money for the usage that occurred in May. Therefore, the company must record the usage of electricity, as well as the liability to pay the utility bill, in May.

Eventually that debt must be repaid by performing the service, fulfilling the subscription, or providing an asset such as merchandise or cash. Some common examples of liabilities include accounts payable, notes payable, and unearned revenue.

Accounts payable recognizes that the company owes money and has not paid. Remember, when a customer purchases something “on account” it means the customer has asked to be billed and will pay at a later date. In this case the purchasing company is the “customer.” The company will have to pay the money due in the future, so we use the word “payable.” The debt owed is usually paid off in less than one accounting period (less than a year typically) if it is classified as an account payable.

A notes payable is similar to accounts payable in that the company owes money and has not yet paid. Some key differences are that the contract terms are usually longer than one accounting period, interest is included, and there is typically a more formalized contract that dictates the terms of the transaction.

Unearned revenue represents a customer’s advanced payment for a product or service that has yet to be provided by the company. Since the company has not yet provided the product or service, it cannot recognize the customer’s payment as revenue, according to the revenue recognition principle. Thus, the account is called unearned revenue. The company owing the product or service creates the liability to the customer.

Equity

Stockholder’s equity refers to the owner’s (stockholders’) investments in the business and earnings. These two components are contributed capital and retained earnings.

The owner’s investments in the business typically come in the form of common stock and are called contributed capital. There is a hybrid owner’s investment labeled as preferred stock that is a combination of debt and equity (a concept covered in more advanced accounting courses). The company will issue shares of common stock to represent stockholder ownership.

Another component of stockholder’s equity is company earnings. These retained earnings are what the company holds onto at the end of a period to reinvest in the business, after any distributions to ownership occur. Stated more technically, retained earnings are a company’s cumulative earnings since the creation of the company minus any dividends that it has declared or paid since its creation. One tricky point to remember is that retained earnings are not classified as assets. Instead, they are a component of the stockholder’s equity account, placing it on the right side of the accounting equation.

Distribution of earnings to ownership is called a dividend. The dividend could be paid with cash or be a distribution of more company stock to current shareholders. Either way, dividends will decrease retained earnings.

Also affecting retained earnings are revenues and expenses, by way of net income or net loss. Revenues are earnings from the sale of goods and services. An increase in revenues will also contribute toward an increase in retained earnings. Expenses are the cost of resources associated with earning revenues. An increase to expenses will contribute toward a decrease in retained earnings. Recall that this concept of recognizing expenses associated with revenues is the expense recognition principle. Some examples of expenses include bill payments for utilities, employee salaries, and loan interest expense. A business does not have an expense until it is “incurred.” Incurred means the resource is used or consumed. For example, you will not recognize utilities as an expense until you have used the utilities. The difference between revenues earned and expenses incurred is called net income (loss) and can be found on the income statement.

Net income reported on the income statement flows into the statement of retained earnings. If a business has net income (earnings) for the period, then this will increase its retained earnings for the period. This means that revenues exceeded expenses for the period, thus increasing retained earnings. If a business has net loss for the period, this decreases retained earnings for the period. This means that the expenses exceeded the revenues for the period, thus decreasing retained earnings.

You will notice that stockholder’s equity increases with common stock issuance and revenues, and decreases from dividend payouts and expenses. Stockholder’s equity is reported on the balance sheet in the form of contributed capital (common stock) and retained earnings. The statement of retained earnings computes the retained earnings balance at the beginning of the period, adds net income or subtracts net loss from the income statement, and subtracts dividends declared, to result in an ending retained earnings balance reported on the balance sheet.

Not All Transactions Affect Equity

As you continue to develop your understanding of accounting, you will encounter many types of transactions involving different elements of the financial statements. The previous examples highlighted elements that change the equity of an organization. Not all transactions, however, ultimately impact equity. For example, the following do not impact the equity or net worth of the organization:

- Exchanges of assets for assets

- Exchanges of liabilities for liabilities

- Acquisitions of assets by incurring liabilities

- Settlements of liabilities by transferring assets

Equity and Legal Structure

Recall that equity can also be referred to as net worth—the value of the organization. The concept of equity does not change depending on the legal structure of the business (sole proprietorship, partnership, and corporation). The terminology does, however, change slightly based on the type of entity. For example, investments by owners are considered “capital” transactions for sole proprietorships and partnerships but are considered “common stock” transactions for corporations. Likewise, distributions to owners are considered “drawing” transactions for sole proprietorships and partnerships but are considered “dividend” transactions for corporations.

As another example, in sole proprietorships and partnerships, the final amount of net income or net loss for the business becomes “Owner(s), Capital.” In a corporation, net income or net loss for the business becomes retained earnings, which is the cumulative, undistributed net income or net loss, less dividends paid for the business since its inception.

The essence of these transactions remains the same: organizations become more valuable when owners make investments in the business and the businesses earn a profit (net income), and organizations become less valuable when owners receive distributions (dividends) from the organization and the businesses incur a loss (net loss). Because accountants are providing information to stakeholders, it is important for accountants to fully understand the specific terminology associated with the various legal structures of organizations.

The following screencast provides an overview of the expanded accounting equation in a slightly rearranged format:

Now that you have a basic understanding of the accounting equation, and examples of assets, liabilities, and stockholder’s equity, you will be able to analyze the many transactions a business may encounter and determine how each transaction affects the accounting equation and corresponding financial statements.

Long Descriptions

Figure 2.1 Long Description: Assets (both current and noncurrent) equal Liabilities (both current and noncurrent) plus Owner’s Equity. Each of these has a big “T” below it. The current and non current assets each have the big “T” with a plus sign on the left side under the top line and a minus sign on the right side under the top line. The current and noncurrent liabilities each have a big “T” with a minus sign on the left side under the top line and a plus sign on the right side under the top line. The Owner’s Equity has a large “T” with a minus sign on the left side with Distribution to Owners, Expenses, Losses, and Comprehensive Income showing as the reasons. There is a plus sign on the right side with Investments by Owners, Revenues, Gains, and Comprehensive Income as the reasons. Return

Figure 2.2 Long Description: Hierarchical group of boxes representing the organizations that create generally accepted accounting principles (GAAP) and the principles, conventions, assumptions, and concepts that support GAAP. The top box is labeled SEC (enforces GAAP). The box below that is labeled FASB (sets GAAP). The box below that is labeled GAAP Accounting Standards. Below that are four boxes labeled left to right: Expense Recognition Principle; Full Disclosure Principle; Conservatism Convention; Going Concern Assumption. Below that are five boxes labeled left to right: Revenue Recognition Principle; Cost Principle; Separate Entity Concept; Monetary Measurement Concept; Time Period Assumption. Return

Media Attributions

- Graphical Representation of the Accounting Equation © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Expanded Accounting Equation © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license