9.3 Activity-based Costing

As technology changes the ratio between direct labor and overhead, more overhead costs are linked to drivers other than direct labor and machine hours. This shift in costs gives companies the opportunity to stop using the traditional single predetermined overhead rate applied to all units of production and instead use an overhead allocation approach based on the actual activities that drive overhead. Making this change allows management to obtain more accurate product cost information, which leads to more informed decisions. Activity-based costing (ABC) is the process that assigns overhead to products based on the various activities that drive overhead costs.

Historical Perspective on Determination of Manufacturing Overhead Allocation

All products consist of material, labor, and overhead, and the major cost components have historically been materials and labor. Manufacturing overhead was not a large cost of the product, so an overhead allocation method based on labor or machine hours was logical. For example, as shown in Figure 9.3, Musicality determined the direct costs and direct labor for their three products: Solo, Band, and Orchestra. Under the traditional method of costing, the predetermined overhead rate of $2 per direct labor hour was computed by dividing the estimated overhead by the estimated direct labor hours. Based on the number of direct labor hours and the number of units produced for each product, the overhead per product is shown in Figure 9.4.

As technology costs decreased and production methods became more efficient, overhead costs changed and became a much larger component of product costs. For many companies, and in many cases, overhead costs are now significantly larger than labor costs. For example, in the last few years, many industries have increased technology, and the amount of overhead has doubled.4 Technology has changed the manufacturing labor force, and therefore, the type and cost of labor associated with those jobs have changed. In addition, technology has made it easier to track the various activities and their related overhead costs.

Costs can be gathered on a unit level, batch level, product level, or factory level. The idea behind these various levels is that at each level, there are additional costs that are encountered, so a company must decide at which level or levels it is best for the company to accumulate costs. A unit-level cost is incurred each time a unit of product is produced and includes costs such as materials and labor. A batch-level cost is incurred every time a batch of items is manufactured, for example, costs associated with purchasing and receiving materials. A product-level cost is incurred each time a product is produced and includes costs such as engineering costs, testing costs, or quality control costs. A factory-level cost is incurred because products are being produced and includes costs such as the plant supervisor’s salary and rent on the factory building. By definition, indirect labor is not traced to individual products. However, it is possible to track some indirect labor to several jobs or batches. A similar amount of information can be derived for indirect material. An example of an indirect material in some manufacturing processes is cleaning solution. For example, one type of cleaning solution is used in the manufacturing of pop sockets. It is not practical to measure every ounce of cleaning solution used in the manufacture of an individual pop socket; rather, it makes sense to allocate to a particular batch of pop sockets the cost of the cleaning solution needed to make that batch. Likewise, a manufacturer of frozen french fries uses a different type of solution to clean potatoes prior to making the french fries and would allocate the cost of the solution based on how much is used to make each batch of fries.

Establishing an Activity-Based Costing System

ABC is a five-stage process that allocates overhead more precisely than traditional allocation does by applying it to the products that use those activities. ABC works best in complex processes where the expenses are not driven by a single cost driver. Instead, several cost drivers are used as the overhead costs are analyzed and grouped into activities, and each activity is allocated based on each group’s cost driver. The five stages of the ABC process are:

- Identify the activities performed in the organization

- Determine activity cost pools

- Calculate activity rates for each cost pool

- Allocate activity rates to products (or services)

- Calculate unit product costs

The first step is to identify activities needed for production. An activity is an action or process involved in the production of inventory. There can be many activities that consume resources, and management will need to narrow down the activities to those that have the biggest impact on overhead costs. Examples of these activities include:

- Taking orders

- Setting up machines

- Purchasing material

- Assembling products

- Inspecting products

- Providing customer service

The second step is assigning overhead costs to the identified activities. In this step, overhead costs are assigned to each of the activities to become a cost pool. A cost pool is a list of costs incurred when related activities are performed. Table 9.2 illustrates the various cost pools along with their activities and related costs.

| Cost Pool | Activities and Related Costs |

|---|---|

| Production |

|

| Purchasing material |

|

| Inspect products |

|

| Assemble products |

|

| Technological production |

|

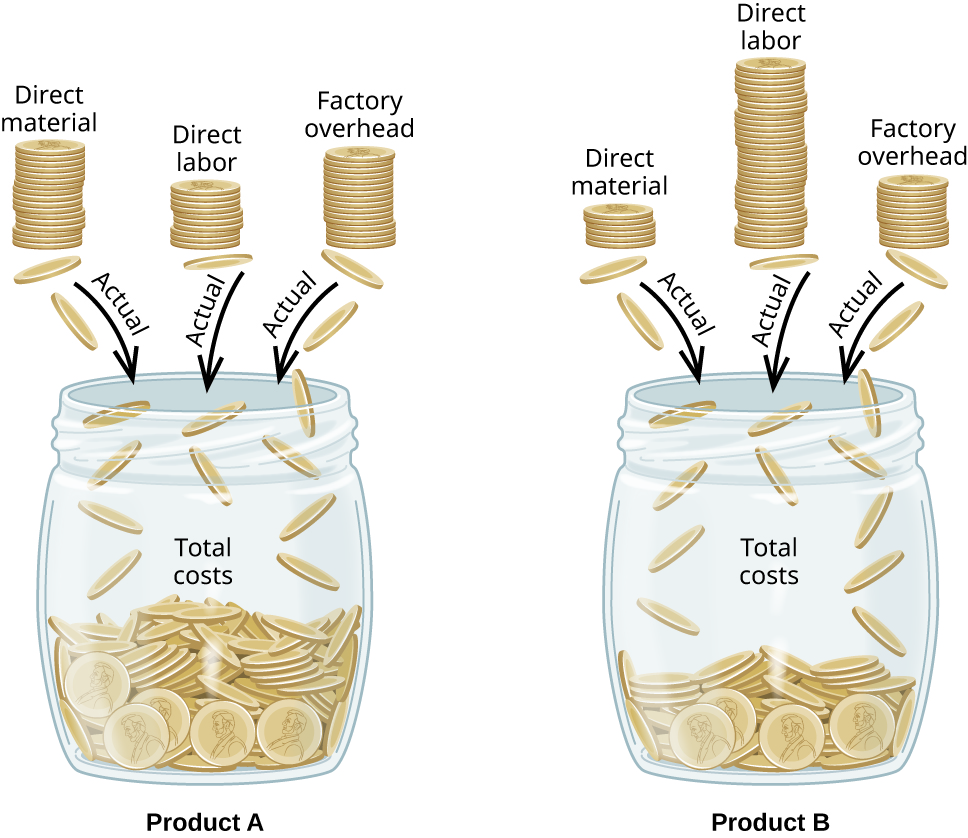

For example, the production cost pool consists of costs such as indirect labor for those accepting the order, verifying the customer has credit to pay for the order, maintenance and depreciation on the machines used to produce the orders, and utilities and rent for operating the machines. Figure 9.1 illustrates how the costs in each pool are allocated to each product in a different proportion.

Once the costs are grouped into similar cost pools, the activities in each pool are analyzed to determine which activity “drives” the costs in that pool, leading to the third step of ABC: identify the cost driver for each cost pool and estimate an annual level of activity for each cost driver. As you’ve learned, the cost driver is the specific activity that drives the costs in the cost pools. Table 9.3 shows some activities and cost drivers for those activities.

| Cost Pool | Cost Driver |

|---|---|

| Customer order | Number of orders |

| Production | Machine setups |

| Purchasing materials | Purchase requisitions |

| Assembling products | Direct labor hours |

| Inspecting products | Inspection hours |

| Customer service | Number of contacts with customer |

The fourth step is to compute the predetermined overhead rate for each of the cost drivers. This portion of the process is similar to finding the traditional predetermined overhead rate, where the overhead rate is divided by direct labor dollars, direct labor hours, or machine hours. Each cost driver will have its own overhead rate, which is why ABC is a more accurate method of allocating overhead.

Finally, step five is to allocate the overhead costs to each product. The predetermined overhead rate found in step four is applied to the actual level of the cost driver used by each product. As with the traditional overhead allocation method, the actual overhead costs are accumulated in an account called manufacturing overhead and then applied to each of the products in this step.

Notice that steps one through three represent the process of allocating overhead costs to activities, and steps four and five represent the process of allocating the overhead costs that have been assigned to activities to the products to which they pertain. Thus, the five steps of ABC involve two major processes: first, allocating overhead costs to the various activities to get a cost per activity, and then allocating the cost per activity to each product based on that product’s usage of the activities.

Now that the steps involved have been detailed, let’s demonstrate the calculations using the Musicality example.

YOUR TURN

Comparing Estimates to Actual Costs

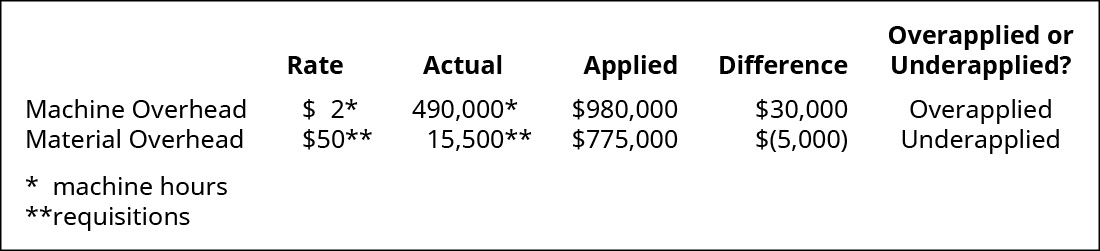

A company has determined that its estimated 500,000 machine hours is the optimal driver for its estimated $1,000,000 machine overhead cost pool. The $750,000 in the material overhead cost pool should be allocated using the estimated 15,000 material requisition requests. How much is over- or underapplied if there were actually 490,000 machine hours and 15,500 material requisitions that resulted in $950,000 in the machine overhead cost pool, and $780,000 in the material cost pool? What does this difference indicate?

Solution

The predetermined overhead rate is $2 per machine hour ($1,000,000 ÷ 500,000 machine hours) and $50 per material requisition ($750,000 ÷ 15,000 requisitions). The actual and applied overhead can then be calculated to determine whether it is over- or underapplied:

The difference is a combination of factors. There were fewer machine hours than estimated, but there was also less overhead than estimated. There were more requisitions than estimated, and there was also more overhead.

The Calculation of Product Costs Using the Activity-Based Costing Allocation Method

Musicality is considering switching to an activity-based costing approach for determining overhead and has collected data to help them decide which overhead allocation method they should use. Performing the analysis requires these steps:

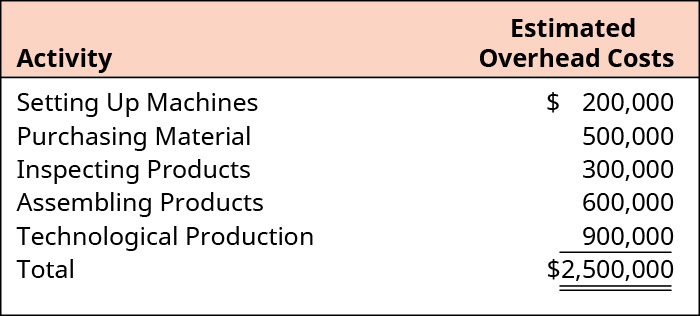

- Identify cost pools necessary to complete the product. Musicality determined its cost pools are:

- Setting up machines

- Purchasing material

- Inspecting products

- Assembling products

- Technological production

- Assign overhead cost to the cost pools. Musicality has estimated the overhead for each cost pool to be:

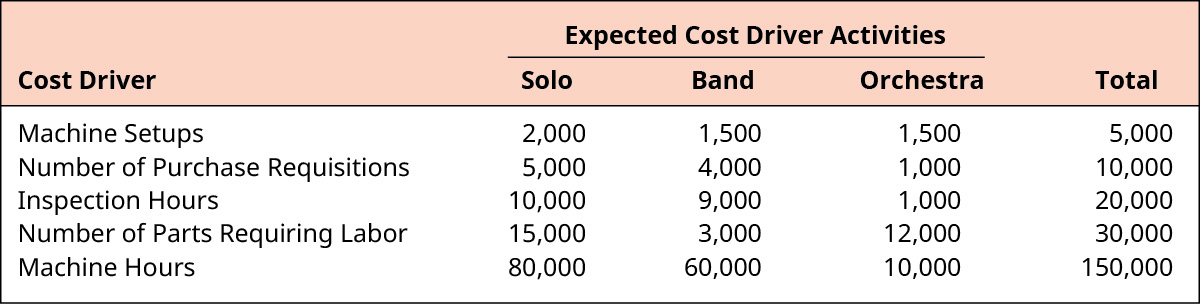

Figure 9.10 By: Rice University Openstax CC BY NC SA - Identify the cost driver for each activity, and estimate an annual activity for each driver. Musicality determined the driver and estimated activity for each product to be the following:

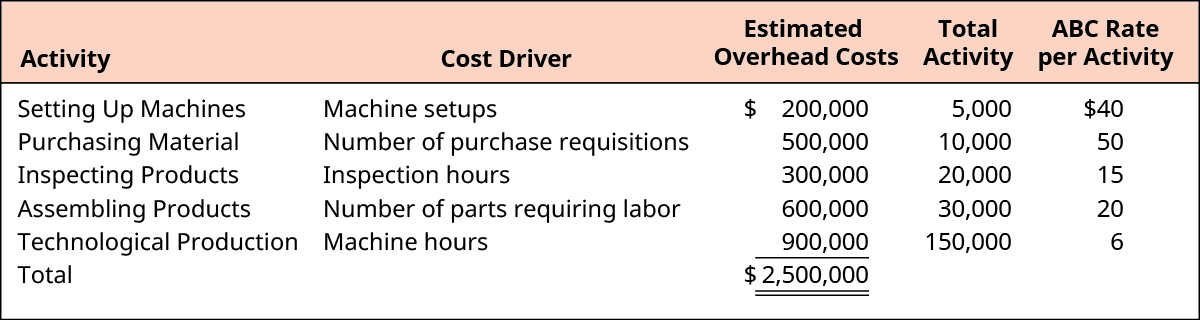

Figure 9.11 By: Rice University Openstax CC BY NC SA Long Description - Compute the predetermined overhead for each cost driver. Musicality determined this predetermined overhead rate for each driver:

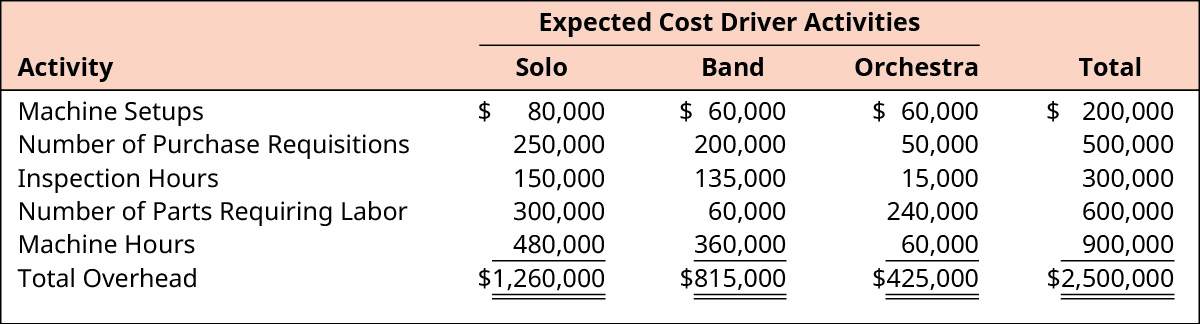

Figure 9.12 By: Rice University Openstax CC BY NC SA Long Description - Allocate overhead costs to products. Assuming Musicality’s activities were as estimated, the amount allocated to each product is:

Figure 9.13 By: Rice University Openstax CC BY NC SA Long Description

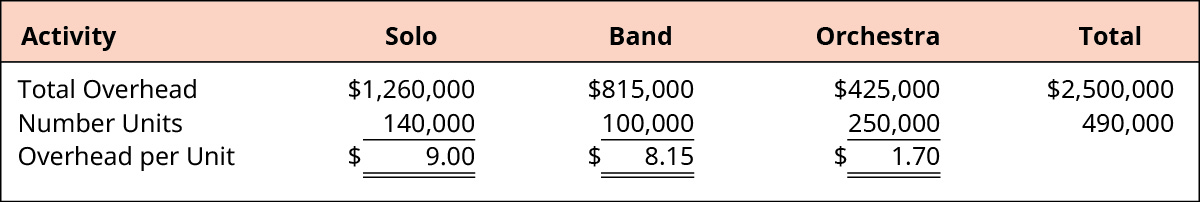

Now that Musicality has applied overhead to each product, they can calculate the cost per unit. Management can review its sales price and make necessary decisions regarding its products. The overhead cost per unit is the overhead for each product divided by the number of units of each product:

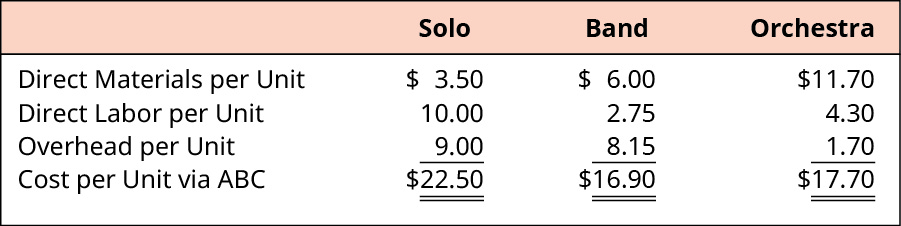

The overhead per unit can be added to the unit cost for direct material and direct labor to compute the total product cost per unit:

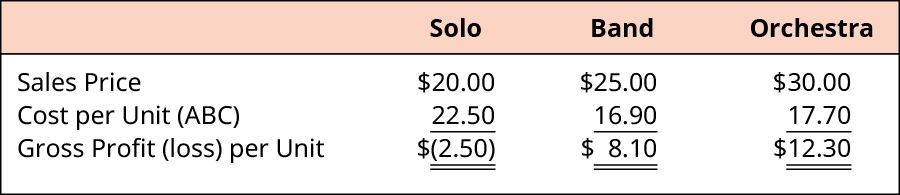

The sales price was set after management reviewed the product cost with traditional allocation along with other factors such as competition and product demand. The current sales price, cost of each product using ABC, and the resulting gross profit are shown in Figure 9.16.

The loss on each sale of the Solo product was not discovered until the company did the calculations for the ABC method, because the sales of the other products were strong enough for the company to retain a total gross profit.

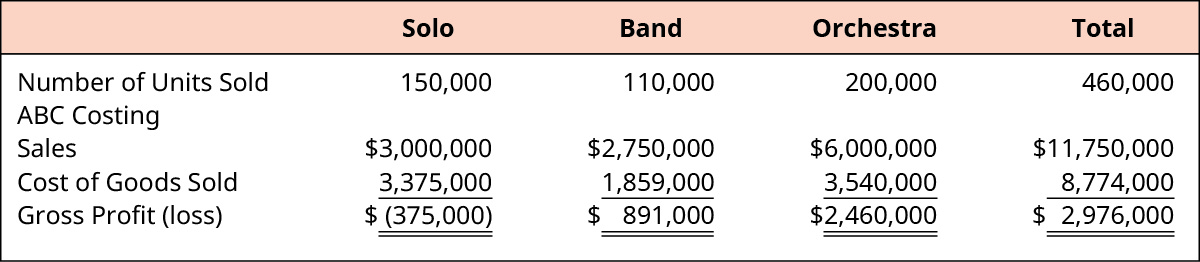

Additionally, the more accurate gross profit for each product calculated using ABC is shown in Figure 9.17:

The calculations Musicality did in order to switch to ABC revealed that the Solo product was generating a loss for every unit sold. Knowing this information will allow Musicality to consider whether they should make changes to generate a profit from the Solo product, such as increase the selling price or carefully analyze the costs to identify potential cost reductions. Musicality could also decide to continue selling Solo at a loss, because the other products are generating enough profit for the company to absorb the Solo product loss and still be profitable. Why would a company continue to sell a product that is generating a loss? Sometimes these products are ones for which the company is well known or that draw customers into the store. For example, companies will sometimes offer extreme sales, such as on Black Friday, to attract customers in the hope that the customers will purchase other products. This information shows how valuable ABC can be in many situations for providing a more accurate picture than traditional allocation.

The Service Industries and Their Use of the Activity-Based Costing Allocation Method

ABC costing was developed to help management understand manufacturing costs and how they can be better managed. However, the service industry can apply the same principles to improve its cost management. Direct material and direct labor costs range from nonexistent to minimal in the service industry, which makes the overhead application even more important. The number and types of cost pools may be completely different in the service industry as compared to the manufacturing industry. For example, the health-care industry may have different overhead costs and cost drivers for the treatment of illnesses than they have for injuries. Some of the overhead related to monitoring a patient’s health status may overlap, but most of the overhead related to diagnosis and treatment differ from each other.

Long Description

Many manufacturing companies use MRP (material requirements planning) or ERP (enterprise resource planning) systems. MRP helps management organize the planning, scheduling, and tracking of materials while ERP systems help plan, organize, and track the materials as well as the accounting, marketing, supply chain, and other management functions. Return

Comparison of Actual and Applied Overhead for Machine Overhead and Material Overhead. Machine Overhead: $2 Rate per machine hour x 490,000 Actual machine hours = 980,000 Applied resulting in a $30,000 difference Overapplied. Material Overhead: $50 Rate per Requisition x 15,500 requisitions = 775,000 Applied, resulting in a $(5,000) difference Underapplied. Return

Expected Cost Driver Activities for Solo, Band, Orchestra, and Total, respectively. Machine Setups: 2,000, 1,500, 1,500, 5,000. Number of Purchase Requisitions: 5,000, 4,000, 1,000, 10,000. Inspection Hours: 10,000, 9,000, 1,000, 20,000 Number of Parts Requiring Labor: 15,000, 3,000, 12,000, 30,000 Machine Hours: 80,000, 60,000, 10,000, 150,000. Return

Activity, Cost Driver, Estimated Overhead Costs, Total Activity, and ABC Rate per Activity, respectively, for each activity is: Setting Up Machines, Machine setups, $200,000, 5,000, $40. Purchasing Material, Number of purchase requisitions, 500,000, 10,000, 50. Inspecting Products, Inspection hours, 300,000, 20,000, 15. Assembling Products, Number of parts requiring labor, 600,000, 30,000, 20. Technological Production, Machine hours, 900,000, 150,000, 6. Total Estimated Overhead Costs are $2,500,000. Return

Expected Cost Driver Activities for Solo, Band, Orchestra, and Total, respectively. Machine Setups: $80,000, $60,000, $60,000, $200,000. Inspection Hours: 150,000, 135,000, 15,000, 300,000. Number of Purchase Requisitions: 250,000, 200,000, 50,000, 500,000. Number of Parts Requiring Labor: 300,000, 60,000, 240,000, 600,000. Machine Hours: 480,000, 360,000, 60,000, 900,000. Total Overhead: $1,260,000, $815,000, $425,000, $2,500,000.

Return

Calculation of Total Gross Profit for Solo, Band, Orchestra, and Total, respectively. Number of Units Sold: 150,000, 110,000, 200,000, 460,000. ABC Costing Sales: $3,000,000, $2,750,000, $6,000,000, $11,750,000. Less Cost of Goods Sold: 3,375,000, 1,859,000, 3,540,000, 8,744,000. Equals Gross Profit (loss): $(375,000), $891,000, $2,460,000, $2,976,000. Return

Footnotes

- 4 Mary Ellen Biery. “A Sure-Fire Way to Boost the Bottom Line.” Forbes. January 12, 2014. https://www.forbes.com/sites/sageworks/2014/01/12/control-overhead-compare-industry-data/#47a9ea69d068