5.3 Bond Entries

Summary of Bond Principles

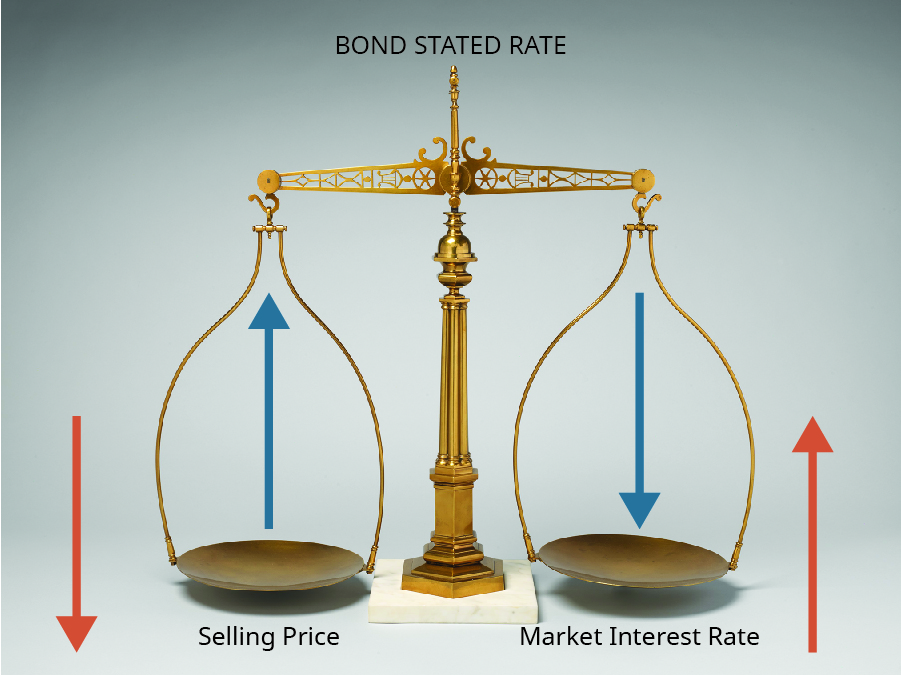

As we conclude our discussion of bonds, there are two principles that are worth noting. The first principle is there is an inverse relationship between the market rate of interest and the price of the bond. That is, when the market interest rate increases, the price of the bond decreases. This is due to the fact that the stated rate of the bond does not change.3 As we discussed, when the market interest rate is higher than the stated interest rate of the bond, the bond will sell at a discount to attract investors and to compensate for the interest rate earned between similar bonds. When, on the other hand, the market interest rate is lower than the stated interest rate, the bond will sell at a premium, which also compensates for the interest rate earned between similar bonds. It may be helpful to think of the inverse relationship between the market interest rate and the bond price in terms of analogies such as a teeter-totter in a park or a balance scale, as shown in Figure 5.40.

In reality, the market interest rate will be above or below the stated interest rate and is rarely equal to the stated rate. The point of this illustration is to help demonstrate the inverse relationship between the market interest rate and the bond selling price.

A second principle relating to bonds involves the relationship of the bond carrying value relative to its face value. By reviewing the amortization tables for bonds sold at a discount and bonds sold at a premium it is clear that the carrying value of bonds will always move toward the face value of the bond. This occurs because interest expense (using the effective-interest method) is calculated using the bond carrying value, which changes each period.

For example, earlier we explored a 5-year, $100,000 bond that sold for $104,460. Return to the amortization table in Figure 5.88 and notice the ending value on the bond is equal to the bond face value of $100,000 (ignoring the rounding difference). The same is true for bonds sold at a discount. In our example, the $100,000 bond sold at $91,800 and the carrying value in year five was $100,000. Understanding that the carrying value of bonds will always move toward the bond face value is one trick students can use to ensure the amortization table and related accounting are correct. If, on the maturity date, the bond carrying value does not equal the bond face value, something is incorrect.

Let’s summmarize bond characteristics, When businesses borrow money from banks or other investors, the terms of the arrangement, which include the frequency of the periodic interest payments, the interest rate, and the maturity value, are specified in the bond indentures or loan documents. Recall, too, that when the bonds are issued, the bond indenture only specifies how much the borrower will repay the lender on the maturity date. The amount of money received by the business (borrower) during the issue is called the bond proceeds. The bond proceeds can be impacted by the market interest rate at the time the bonds are sold. Also, because of the lag time between preparing a bond issuance and selling the bonds, the market dynamics may cause the stated interest rate to change. Rarely, the market rate is equal to the stated rate when the bonds are sold, and the bond proceeds will equal the face value of the bonds. More commonly, the market rate is not equal to the stated rate. If the market rate is higher than the stated rate when the bonds are sold, the bonds will be sold at a discount. If the market rate is lower than the stated rate when the bonds are sold, the bonds will be sold at a premium. Figure 5.40 illustrates this rule: that bond prices are inversely related to the market interest rate.

For fun…. here’s James Bond 007 treatment of bond entries:

Footnotes

3 Another reason for the inverse relationship between the market interest rate and bond prices is due to the time value of money.