5.4 Debt v. Equity

Let’s consider Maria, who wants to buy a business. The venture is for sale for $1 million, but she only has $200,000. What are her options? In this situation, a business owner can use debt financing by borrowing money or equity financing by selling part of the company, or she can use a combination of both.

Debt financing means borrowing money that will be repaid on a specific date in the future. Many companies have started by incurring debt. To decide whether this is a viable option, the owners need to determine whether they can afford the monthly payments to repay the debt. One positive to this scenario is that interest paid on the debt is tax deductible and can lower the company’s tax liability. On the other hand, businesses can struggle to make these payments every month, especially as they are starting out.

With equity financing, a business owner sells part of the business to obtain money to finance business operations. With this type of financing, the original owner gives up some portion of ownership in the company in return for cash. In Maria’s case, partners would supplement her $200,000 and would then own a share of the business. Each partner’s share is based on their financial or other contributions.

If a business owner forms a corporation, each owner will receive shares of stock. Typically, those making the largest financial investment have the largest say in decisions about business operations. The issuance of dividends should also be considered in this set-up. Paying dividends to shareholders is not tax deductible, but dividend payments are also not required. Additionally, a company does not have to buy back any stock it sells.

Equity Financing

For a corporation, equity financing involves trading or selling shares of stock in the business to raise funds to run the business. For a sole proprietorship, selling part of the business means it is no longer a sole proprietorship: the subsequent transaction could create either a corporation or partnership. The owners would choose which of the two to create. Equity means ownership. However, business owners can be creative in selling interest in their venture. For example, Maria might sell interest in the building housing her candy store and retain all revenues for herself, or she may decide to share interest in the operations (sales revenues) and retain sole ownership of the building.

The main benefit of financing with equity is that the business owner is not required to pay back the invested funds, so revenue can be re-invested in the company’s growth. Companies funded this way are also more likely to succeed through their initial years. The Small Business Administration suggests a new business should have access to enough cash to operate for six months without having to borrow. The disadvantages of this funding method are that someone else owns part of the business and, depending on the arrangement, may have ideas that conflict with the original owner’s ideas but that cannot be disregarded.

The following characteristics are specific to equity financing:

- No required payment to owners or shareholders; dividends or other distributions are optional. Stock owners typically invest in stocks for two reasons: the dividends that many stocks pay or the appreciation in the market value of the stocks. For example, a stock holder might buy Walmart stock for $100 per share with the expectation of selling it for much more than $100 per share at some point in the future.

- Ownership interest held by the original or current owners can be diluted by issuing additional new shares of common stock.

- Unlike bonds that mature, common stocks do not have a definite life. To convert the stock to cash, some of the shares must be sold.

- In the past, common stocks were typically sold in even 100-share lots at a given market price per share. However, with Internet brokerages today, investors can buy any particular quantity they want.

Debt Financing

As you have learned, debt is an obligation to pay back an amount of money at some point in the future. Generally, a term of less than one year is considered short-term, and a term of one year or longer is considered long-term. Borrowing money for college or a car with a promise to pay back the amount to the lender generates debt. Formal debt involves a signed written document with a due date, an interest rate, and the amount of the loan. A student loan is an example of a formal debt.

The following characteristics are specific to debt financing:

- The company is required to make timely interest payments to the holders of the bonds or notes payable.

- The interest in cash that is to be paid by the company is generally locked in at the agreed-upon rate, and thus the same dollar payments will be made over the life of the bond. Virtually all bonds will have a maturity point. When the bond matures, the maturity value, which was the same as the contract or issuance value, is paid to whoever owns the bond.

- The interest paid is deductible on the company’s income tax return.

- Bonds or notes payable do not dilute the company’s ownership interest. The holders of the long-term liabilities do not have an ownership interest.

- Bonds are typically sold in $1,000 increments.

CONCEPTS IN PRACTICE

Short-Term Debt

Businesses sometimes offer lines of credit (short-term debt) to their customers. For example, Wilson Sporting Goods offers open credit to tennis clubs around the country. When the club needs more tennis balls, a club manager calls Wilson and says, “I’d like to order some tennis balls.” The person at Wilson says, “What’s your account number,” and takes the order. Wilson does not ask the manager to sign a note but does expect to be paid back. If the club does not pay within 120 days, Wilson will not let them order more items until the bill is paid. Ordering on open credit makes transactions simpler for the club and for Wilson, since there is not a need to formalize every order. But collecting on the amount might be difficult for Wilson if the club delays payment. For this reason, typically customers must fill out applications, or have a history with the vendor to go on open credit.

When deciding whether to raise capital by issuing debt or equity, a corporation needs to consider dilution of ownership, repayment of debt, cash obligations, budgeting impacts, administrative costs, and credit risks.

Dilution of Ownership

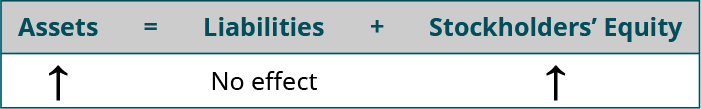

The most significant consideration of whether a company should seek funding using debt or equity financing is the effect on the company’s financial position. Issuance of debt does not dilute the company’s ownership as no additional ownership shares are issued. Issuing debt, or borrowing, creates an increase in cash, an asset, and an increase in a liability, such as notes payable or bonds payable. Because borrowing is independent of an owner’s ownership interest in the business, it has no effect on stockholders’ equity, and ownership of the corporation remains the same as illustrated in the accounting equation in Figure 5.41.

On the other hand, when a corporation issues stock, it is financing with equity. The same increase in cash occurs, but financing causes an increase in a capital stock account in stockholders’ equity as illustrated in the accounting equation in Figure 5.42.

This increase in stockholders’ equity implies that more shareholders will be allowed to vote and will participate in the distribution of profits and assets upon liquidation.

Repayment of Debt

A second concern when choosing between debt and equity financing relates to the repayment to the lender. A lender is a debt holder entitled to repayment of the original principal amount of the loan plus interest. Once the debt is paid, the corporation has no additional obligation to the lender. This allows owners of a corporation to claim a larger portion of the future earnings than would be possible if more stock were sold to investors. In addition, the interest component of the debt is an expense, which reduces the amount of income on which a company’s income tax liability is calculated, thereby lowering the corporation’s tax liability and the actual cost of the loan to the company.

Cash Obligations

The most obvious difference between debt and equity financing is that with debt, the principal and interest must be repaid, whereas with equity, there is no repayment requirement. The decision to declare dividends is solely up to the board of directors, so if a company has limitations on cash, it can skip or defer the declaration of dividends. When a company obtains capital through debt, it must have sufficient cash available to cover the repayment. This can put pressure on the company to meet debt obligations when cash is needed for other uses.

Budgeting

Except in the case of variable interest loans, loan and interest payments are easy to estimate for the purpose of budgeting cash payments. Loan payments do not tend to be flexible; instead the principal payment is required month after month. Moreover, interest costs incurred with debt are an additional fixed cost to the company, which raises the company’s break-even point (total revenue equals total costs) as well as its cash flow demands.

Cost Differences

Issuing debt rather than equity may reduce additional administration costs associated with having additional shareholders. These costs may include the costs for informational mailings, processing and direct-depositing dividend payments, and holding shareholder meetings. Issuing debt also saves the time associated with shareholder controversies, which can often defer certain management actions until a shareholder vote can be conducted.

Risk Assessment by Creditors

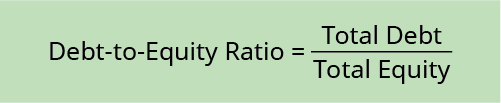

Borrowing commits the borrower to comply with debt covenants that can restrict both the financing options and the opportunities that extend beyond the main business function. This can limit a company’s vision or opportunities for change. For example, many debt covenants restrict a corporation’s debt-to-equity ratio, which measures the portion of debt used by a company relative to the amount of stockholders’ equity, calculated by dividing total debt by total equity.

When a company borrows additional funds, its total debt (the numerator) rises. Because there is no change in total equity, the denominator remains the same, causing the debt-to-equity ratio to increase. Because an increase in this ratio usually means that the company will have more difficulty in repaying the debt, lenders and investors consider this an added risk. Accordingly, a business is limited in the amount of debt it can carry. A debt agreement may also restrict the company from borrowing additional funds.

To increase the likelihood of debt repayment, a debt agreement often requires that a company’s assets serve as collateral, or for the company’s owners to guarantee repayment. Increased risks to the company from high-interest debt and high amounts of debt, particularly when the economy is unstable, include obstacles to growth and the potential for insolvency resulting from the costs of holding debt. These important considerations should be assessed prior to determining whether a company should choose debt or equity financing.