5.6 How Stocks Work

The Securities and Exchange Commission (SEC) (www.sec.gov) is a government agency that regulates large and small public corporations. Its mission is “to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.”8 The SEC identifies these as its five primary responsibilities:

- Inform and protect investors

- Facilitate capital information

- Enforce federal securities laws

- Regulate securities markets

- Provide data

Under the Securities Act of 1933,9 all corporations that make their shares available for sale publicly in the United States are expected to register with the SEC. The SEC’s registration requirement covers all securities—not simply shares of stock—including most tradable financial instruments. The Securities Act of 1933, also known as the “truth in securities law,” aims to provide investors with the financial data they need to make informed decisions. While some companies are exempt from filing documents with the SEC, those that offer securities for sale in the U.S. and that are not exempt must file a number of forms along with financial statements audited by certified public accountants.

Private versus Public Corporations

Both private and public corporations become incorporated in the same manner through the state governmental agencies that handles incorporation. The journal entries and financial reporting are the same whether a company is a public or a private corporation. A private corporation is usually owned by a relatively small number of investors. Its shares are not publicly traded, and the ownership of the stock is restricted to only those allowed by the board of directors.

The SEC defines a publicly traded company as a company that “discloses certain business and financial information regularly to the public” and whose “securities trade on public markets.”10 A company can initially operate as private and later decide to “go public,” while other companies go public at the point of incorporation. The process of going public refers to a company undertaking an initial public offering (IPO) by issuing shares of its stock to the public for the first time. After its IPO, the corporation becomes subject to public reporting requirements and its shares are frequently listed on a stock exchange.11

CONCEPTS IN PRACTICE

Spreading the Risk

The East India Company became the world’s first publicly traded company as the result of a single factor—risk. During the 1600s, single companies felt it was too risky to sail from the European mainland to the East Indies. These islands held vast resources and trade opportunities, enticing explorers to cross the Atlantic Ocean in search of fortunes. In 1600, several shipping companies joined forces and formed “Governor and Company of Merchants of London trading with the East Indies,” which was referred to as the East India Company. This arrangement allowed the shipping companies—the investors—to purchase shares in multiple companies rather than investing in a single voyage. If a single ship out of a fleet was lost at sea, investors could still generate a profit from ships that successfully completely their voyages.12

The Secondary Market

A corporation’s shares continue to be bought and sold by the public after the initial public offering. Investors interested in purchasing shares of a corporation’s stock have several options. One option is to buy stock on the secondary market, an organized market where previously issued stocks and bonds can be traded after they are issued. Many investors purchase through stock exchanges like the New York Stock Exchange or NASDAQ using a brokerage firm. A full-service brokerage firm provides investment advice as well as a variety of financial planning services, whereas a discount brokerage offers a reduced commission and often does not provide investment advice. Most of the stock trading—buying and selling of shares by investors—takes place through brokers, registered members of the stock exchange who buy and sell stock on behalf of others. Online access to trading has broadened the secondary market significantly over the past few decades. Alternatively, stocks can be purchased from investment bankers, who provide advice to companies wishing to issue new stock, purchase the stock from the company issuing the stock, and then resell the securities to the public.13

Marketing a Company’s Stock

Once a corporation has completed the incorporation process, it can issue stock. Each share of stock sold entitles the shareholder (the investor) to a percentage of ownership in the company. Private corporations are usually owned by a small number of investors and are not traded on a public exchange. Regardless of whether the corporation is public or private, the steps to finding investors are similar:

- Have a trusted and reliable management team. These should be experienced professionals who can guide the corporation.

- Have a financial reporting system in place. Accurate financial reporting is key to providing potential investors with reliable information.

- Choose an investment banker to provide advice and to assist in raising capital. Investment bankers are individuals who work in a financial institution that is primarily in the business of raising capital for corporations.

- Write the company’s story. This adds personality to the corporation. What is the mission, why it will be successful, and what sets the corporation apart?

- Approach potential investors. Selecting the right investment bankers will be extremely helpful with this step.

Capital Stock

A company’s corporate charter specifies the classes of shares and the number of shares of each class that a company can issue. There are two classes of capital stock—common stock and preferred stock. The two classes of stock enable a company to attract capital from investors with different risk preferences. Both classes of stock can be sold by either public or non-public companies; however, if a company issues only one class, it must be common stock. Companies report both common and preferred stock in the stockholders’ equity section of the balance sheet.

Common Stock

A company’s primary class of stock issued is common stock, and each share represents a partial claim to ownership or a share of the company’s business. For many companies, this is the only class of stock they have authorized. Common stockholders have four basic rights.

- Common stockholders have the right to vote on corporate matters, including the selection of corporate directors and other issues requiring the approval of owners. Each share of stock owned by an investor generally grants the investor one vote.

- Common stockholders have the right to share in corporate net income proportionally through dividends.

- If the corporation should have to liquidate, common stockholders have the right to share in any distribution of assets after all creditors and any preferred stockholders have been paid.

- In some jurisdictions, common shareholders have a preemptive right, which allows shareholders the option to maintain their ownership percentage when new shares of stock are issued by the company. For example, suppose a company has 1,000 shares of stock issued and plans to issue 200 more shares. A shareholder who currently owns 50 shares will be given the right to buy a percentage of the new issue equal to his current percentage of ownership. His current percentage of ownership is 5%:

This shareholder will be given the right to buy 5% of the new issue, or 10 new shares.

Should the shareholder choose not to buy the shares, the company can offer the shares to other investors. The purpose of the preemptive right is to prevent new issuances of stock from reducing the ownership percentage of the current shareholders. If the shareholder in our example is not offered the opportunity to buy 5% of the additional shares (his current ownership percentage) and the new shares are sold to other investors, the shareholder’s ownership percentage will drop because the total shares issued will increase.

The shareholder would now own only 4.17% of the corporation, compared to the previous 5%.

Preferred Stock

A company’s charter may authorize more than one class of stock. Preferred stock has unique rights that are “preferred,” or more advantageous, to shareholders than common stock. The classification of preferred stock is often a controversial area in accounting as some researchers believe preferred stock has characteristics closer to that of a stock/bond hybrid security, with characteristics of debt rather than a true equity item. For example, unlike common stockholders, preferred shareholders typically do not have voting rights; in this way, they are similar to bondholders. In addition, preferred shares do not share in the common stock dividend distributions. Instead, the “preferred” classification entitles shareholders to a dividend that is fixed (assuming sufficient dividends are declared), similar to the fixed interest rate associated with bonds and other debt items. Preferred stock also mimics debt in that preferred shareholders have a priority of dividend payments over common stockholders. While there may be characteristics of both debt and equity, preferred stock is still reported as part of stockholders’ equity on the balance sheet.

Not every corporation authorizes and issues preferred stock, and there are some important characteristics that corporations should consider when deciding to issue preferred stock. The price of preferred stock typically has less volatility in the stock market. This makes it easier for companies to more reliably budget the amount of the expected capital contribution since the share price is not expected to fluctuate as freely as for common stock. For the investor, this means there is less chance of large gains or losses on the sale of preferred stock.

The Status of Shares of Stock

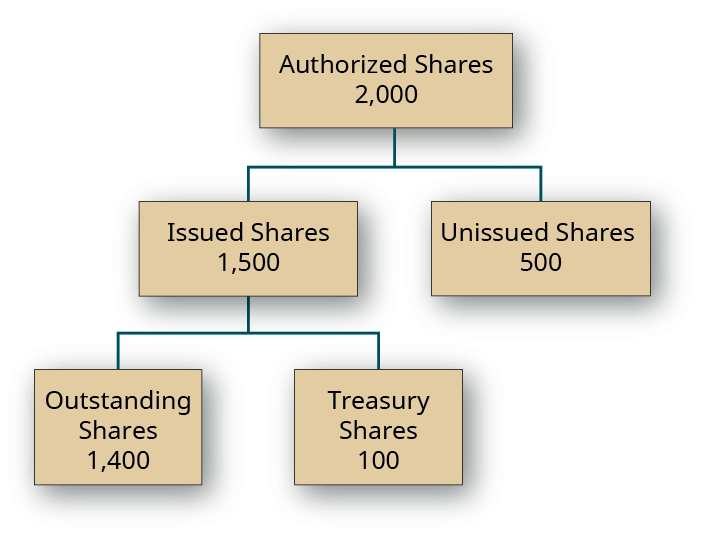

The corporate charter specifies the number of authorized shares, which is the maximum number of shares that a corporation can issue to its investors as approved by the state in which the company is incorporated. Once shares are sold to investors, they are considered issued shares. Shares that are issued and are currently held by investors are called outstanding shares because they are “out” in the hands of investors. Occasionally, a company repurchases shares from investors. While these shares are still issued, they are no longer considered to be outstanding. These repurchased shares are called treasury stock.

Assume that Waystar Corporation has 2,000 shares of capital stock authorized in its corporate charter. During May, Waystar issues 1,500 of these shares to investors. These investors are now called stockholders because they “hold” shares of stock. Because the other 500 authorized shares have not been issued they are considered unissued shares. Now assume that Waystar buys back 100 shares of stock from the investors who own the 1,500 shares. Only 1,400 of the issued shares are considered outstanding, because 100 shares are now held by the company as treasury shares.

Stock Values

Two of the most important values associated with stock are market value and par value. The market value of stock is the price at which the stock of a public company trades on the stock market. This amount does not appear in the corporation’s accounting records, nor in the company’s financial statements.

Most corporate charters specify the par value assigned to each share of stock. This value is printed on the stock certificates and is often referred to as a face value because it is printed on the “face” of the certificate. Incorporators typically set the par value at a very small arbitrary amount because it is used internally for accounting purposes and has no economic significance. Because par value often has some legal significance, it is considered to be legal capital. In some states, par value is the minimum price at which the stock can be sold. If for some reason a share of stock with a par value of one dollar was issued for less than its par value of one dollar known as issuing at a stock discount, the shareholder could be held liable for the difference between the issue price and the par value if liquidation occurs and any creditors remain unpaid.

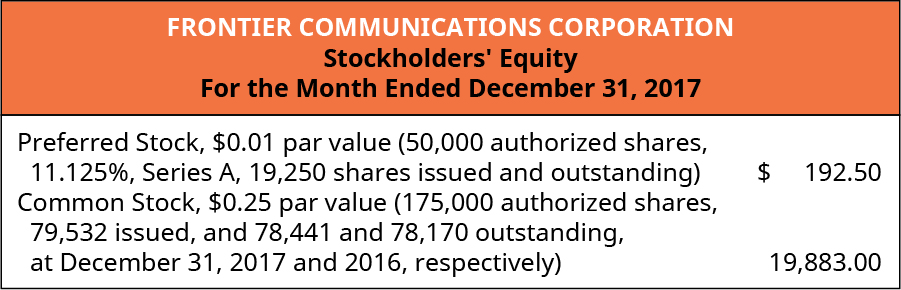

Under some state laws, corporations are sometimes allowed to issue no-par stock—a stock with no par value assigned. When this occurs, the company’s board of directors typically assigns a stated value to each share of stock, which serves as the company’s legal capital. Companies generally account for stated value in the accounting records in the same manner as par value. If the company’s board fails to assign a stated value to no-par stock, the entire proceeds of the stock sale are treated as legal capital. A portion of the stockholders’ equity section of Frontier Communications Corporation’s balance sheet as of December 31, 2017 displays the reported preferred and common stock. The par value of the preferred stock is $0.01 per share and $0.25 per share for common stock. The legal capital of the preferred stock is $192.50, while the legal capital of the common stock is $19,883.14

Long Description

Frontier Communications Corporation, Stockholders’ Equity, For the Month Ended December 31, 2017. Preferred Stock, $0.01 par value (50,000 authorized shares, 11.125%, Series A, 19,250 shares issued and outstanding) $192.50. Common stock, $0.25 par value (175,000 authorized shares, 79,532 issued, and 78,441 and 78,170 outstanding at December 31, 2017 and 2016, respectively) 19,883.00. Return

Footnotes

- 8 U.S. Securities and Exchange Commission. “What We Do.” June 10, 2013. https://www.sec.gov/Article/whatwedo.html

- 9 U.S. Securities and Exchange Commission. “Registration under the Securities Act of 1933.” https://www.investor.gov/additional-resources/general-resources/glossary/registration-under-securities-act-1933

- 10 U. S. Securities and Exchange Commission. “Public Companies.” https://www.investor.gov/introduction-investing/basics/how-market-works/public-companies

- 11 U.S. Securities and Exchange Commission. “Companies, Going Public.” October 14, 2014. https://www.sec.gov/fast-answers/answers-comppublichtm.html

- 12 Johnson Hur. “History of The Stock Market.” BeBusinessed.com. October 2016. https://bebusinessed.com/history/history-of-the-stock-market/

- 13 Dr. Econ. “Why Do Investment Banks Syndicate a New Securities Issue (and Related Questions).” Federal Reserve Bank of San Francisco. December 1999. https://www.frbsf.org/education/publications/doctor-econ/1999/december/investment-bank-securities-retirement-insurance/

- 14 Frontier Communications Corporation. 10-K Filing. February 28, 2018. https://www.sec.gov/Archives/edgar/data/20520/000002052018000007/ftr-20171231x10k.htm#Exhibits_and_Financial_Statement_Schedul