8.13 Journal Entries in Process Costing

Calculating the costs associated with the various processes within a process costing system is only a part of the accounting process. Journal entries are used to record and report the financial information relating to the transactions. The example that follows illustrates how the journal entries reflect the process costing system by recording the flow of goods and costs through the process costing environment.

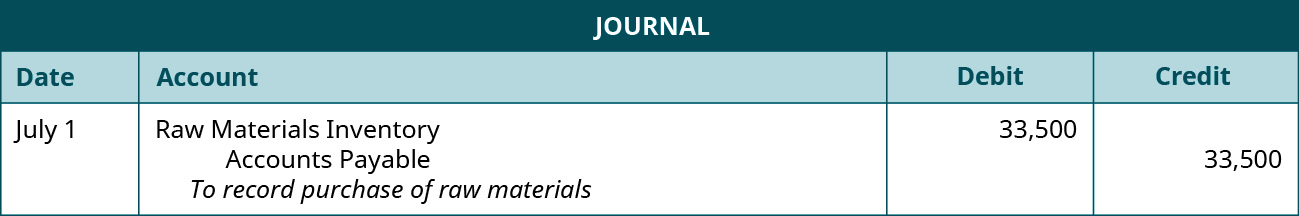

Purchased Materials for Multiple Departments

Each department within Rock City Percussion has a separate work in process inventory account. Raw materials totaling $33,500 were ordered prior to being requisitioned by each department: $25,000 for the shaping department and $8,500 for the packaging department. The July 1 journal entry to record the purchases on account is:

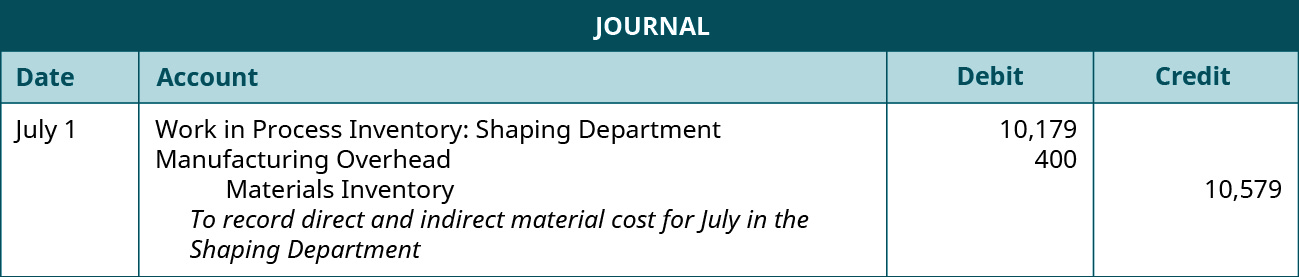

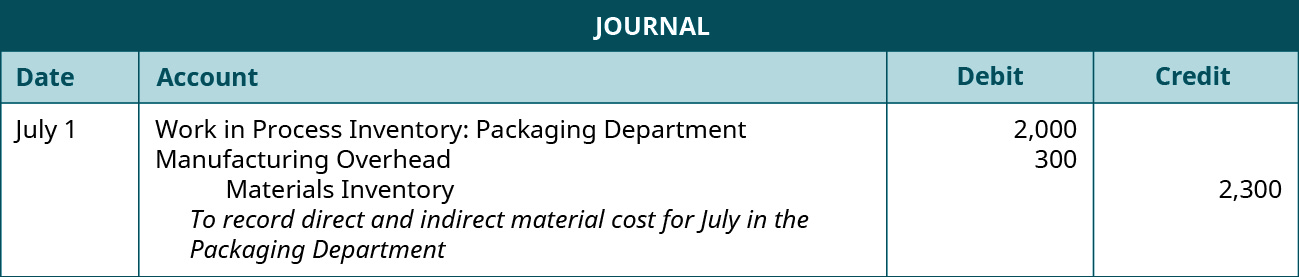

Direct Materials Requisitioned by the Shaping and Packaging Departments and Indirect Material Used

During July, the shaping department requisitioned $10,179 in direct material. Similar to job order costing, indirect material costs are accumulated in the manufacturing overhead account. The overhead costs are applied to each department based on a predetermined overhead rate. In the example, assume that there was an indirect material cost for water of $400 in July that will be recorded as manufacturing overhead. The journal entry to record the requisition and usage of direct materials and overhead is:

During July, the packaging department requisitioned $2,000 in direct material and overhead costs for indirect material totaled $300 for the month of July. The journal entry to record the requisition and usage of materials is:

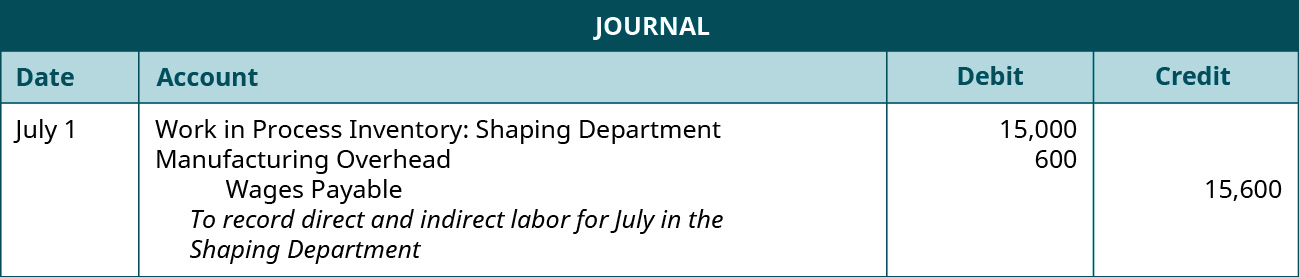

Direct Labor Paid by All Production Departments

During July, the shaping department incurred $15,000 in direct labor costs and $600 in indirect labor. The journal entry to record the labor costs is:

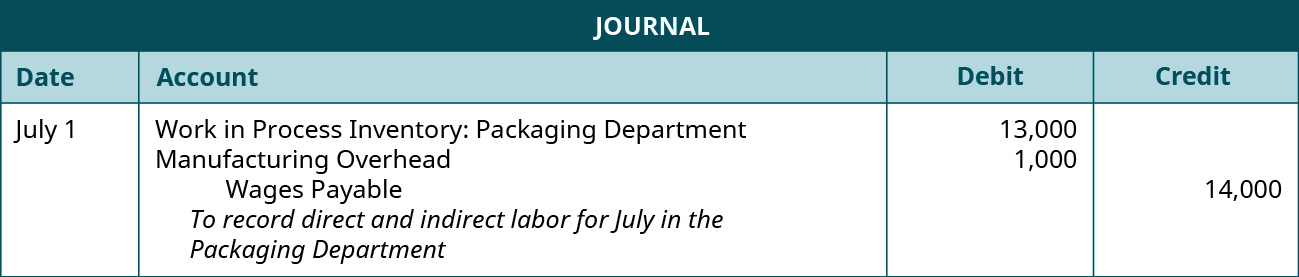

During July, the packaging department incurred $13,000 of direct labor costs and indirect labor of $1,000. The journal entry to record the labor costs is:

Applied Manufacturing Overhead to All Production Departments

Manufacturing overhead includes indirect material, indirect labor, and other types of manufacturing overhead. It is difficult, if not impossible, to trace manufacturing overhead to a specific product, and yet, the total cost per unit needs to include overhead in order to make management decisions.

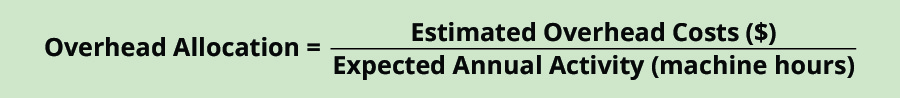

Overhead costs are accumulated in a manufacturing overhead account and applied to each department on the basis of a predetermined overhead rate. Properly allocating overhead to each department depends on finding an activity that provides a fair basis for the allocation. It needs to be an activity common to each department and influential in driving the cost of manufacturing overhead. In traditional costing systems, the most common activities used are machine hours, direct labor in dollars, or direct labor in hours. If the number of machine hours can be related to the manufacturing overhead, the overhead can be applied to each department based on the machine hours. The formula for overhead allocation is:

Rock City Percussion determined that machine hours is the appropriate base to use when allocating overhead. The estimated annual overhead cost is $340,000 per year. It was also estimated that the total machine hours will be 34,000 hours, so the allocation rate is computed as:

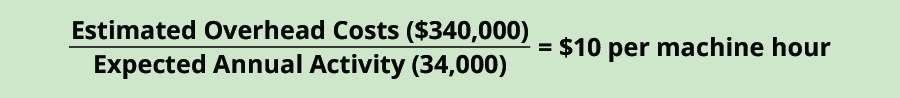

The shaping department used 700 machine hours, and with an overhead application rate of $10 per direct labor hour, the journal entry to record the overhead allocation is:

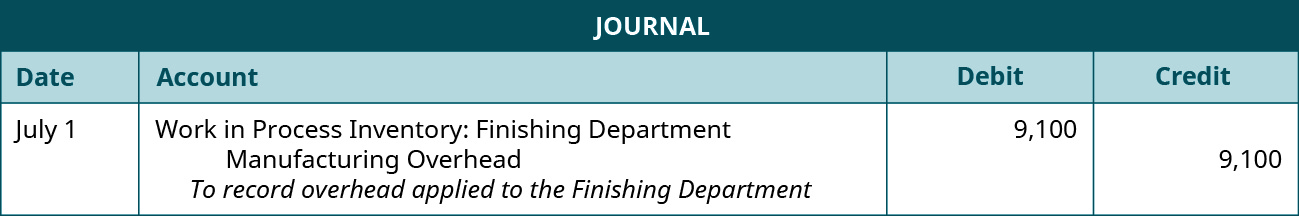

The finishing department used 910 machine hours, and with an overhead application rate of $10 per direct labor hour, the journal entry to record the overhead allocation is:

Transferred Costs of Finished Goods from the Shaping Department to the Packaging Department

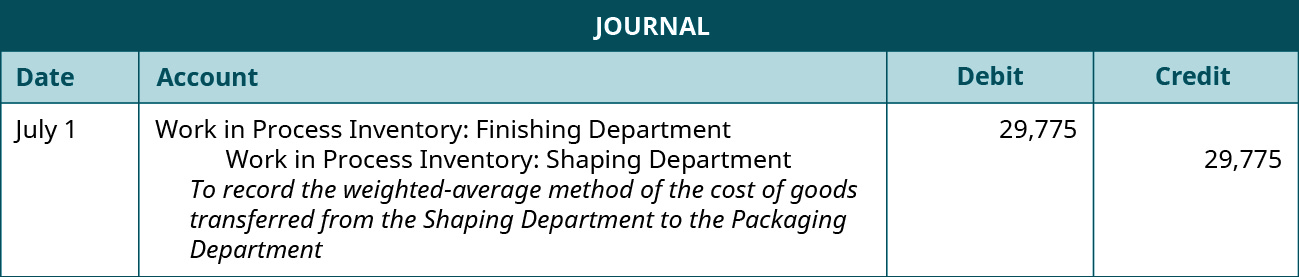

When the units are transferred from the shaping department to the packaging department, they are transferred at $3.97 per unit, as calculated previously. The amount transferred from the shaping department is the same amount listed on the production cost report in Figure 8.88. The journal entry is:

Transferred Goods from the Packaging Department to Finished Goods

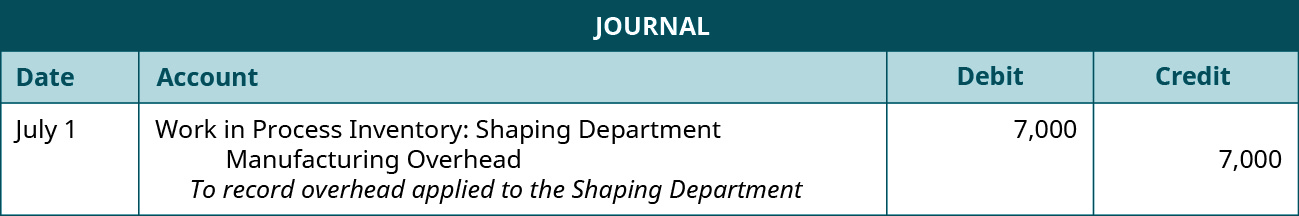

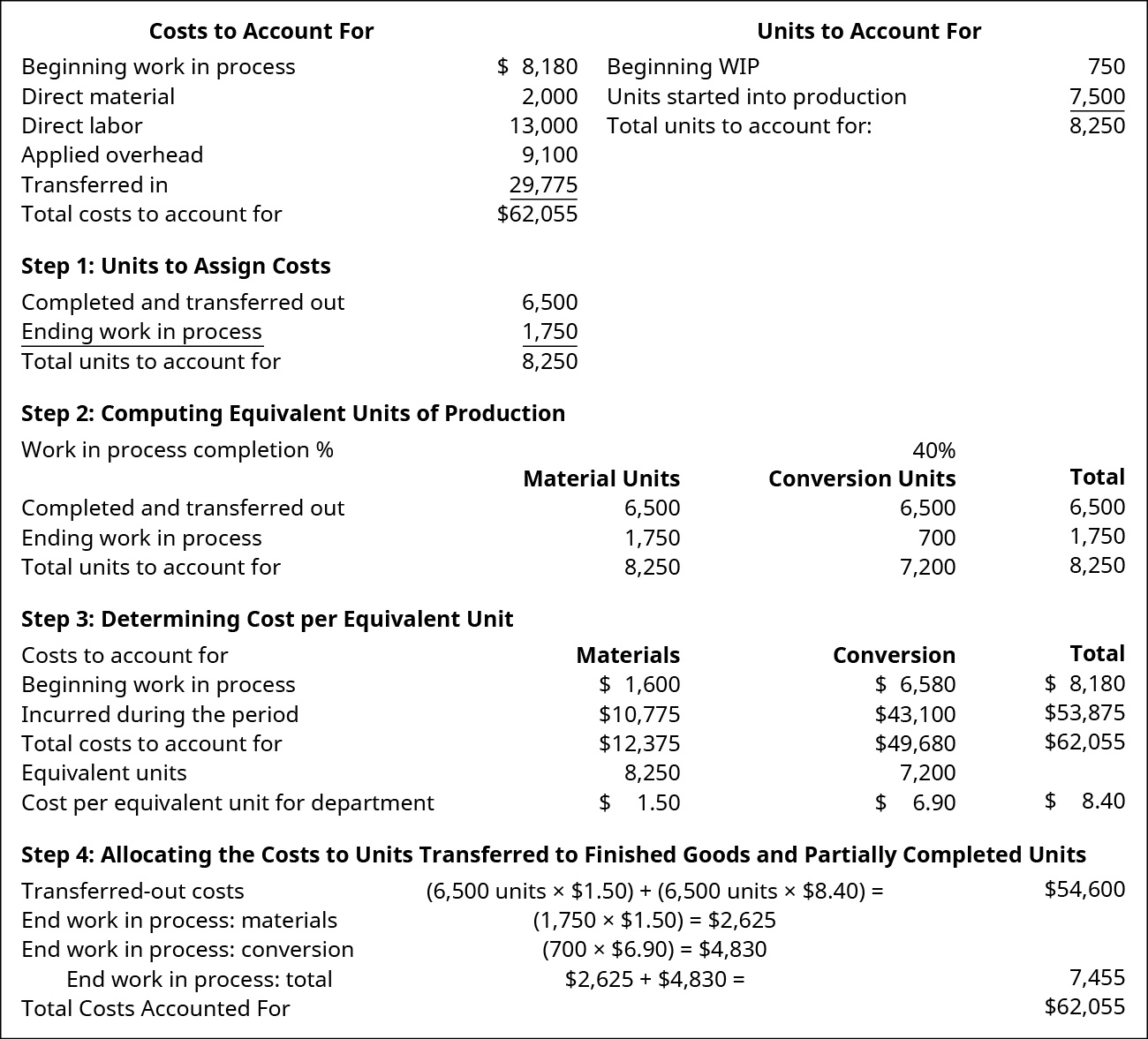

The computation of inventory for the packaging department is shown in Figure 8.89.

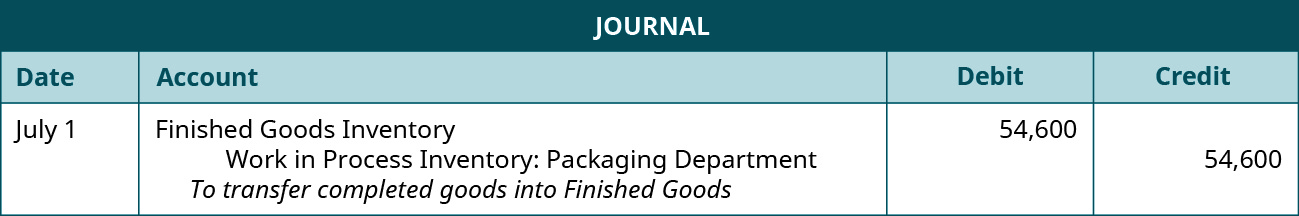

The value of the inventory transferred to finished goods in the production cost report is the same as in the journal entry:

Recording the Cost of Goods Sold Out of the Finished Goods Inventory

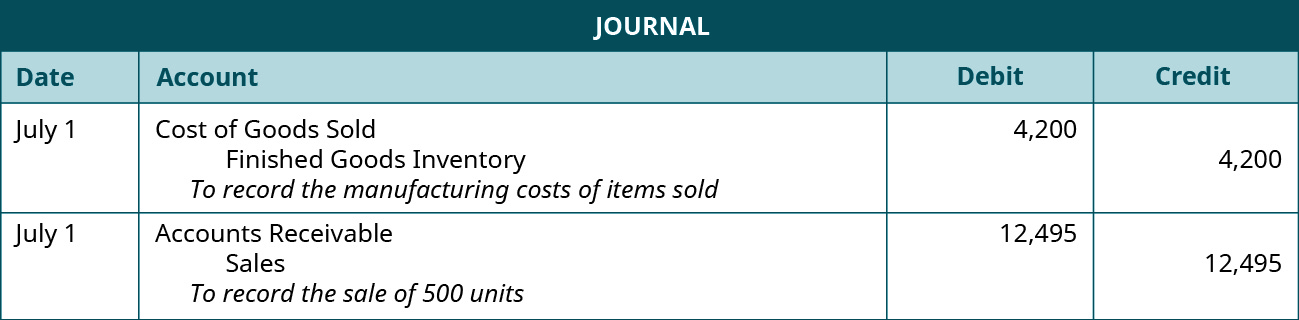

Each unit is a package of two drumsticks that cost $8.40 to make and sells for $24.99. There are two transactions when recording a sale. One entry is to transfer the inventory from finished goods inventory to cost of goods sold and is at the cost of the product. The second transaction is to record the sale at the sales price. The compound entry to record both transactions for the sale of 500 units on account is:

Long Description

Costs to account for: Beginning WIP materials 1,600, Beginning WIP Conversion 6,580 Direct Material $2,000, Direct Labor 13,000, Applied Overhead 9,100, Transferred In materials 8,775, Transferred in conversion 21,000 equals Total Costs to Account for $62,055 Units to account for: Beginning WIP 750, Units started into production 7,500, Total units to account for 8,250. Step 1: Units to Assign Costs: Completed and transferred out 6,500, Ending WIP 1,750, Total units to account for 8,250. Step 2: Computing Equivalent Units of Production (WIP completion 40%); Total units, 100 percent Materials Unit, 40 percent Conversion Units, respectively: Completed and transferred out 6,600, 6,500, 6,500; Ending WIP 1,750, 1,750, 700; Total units to account for 8,250, 8,250, 7,200. Step 3: Determining Cost per Equivalent Unit; Costs to account for: Beginning WIP $8,180, 1,600, 6,580; Incurred during the period $26,100, 2,000, 22,100; Transferred in $29,775, 8,775, 21,000; Total costs to account for 62,055, 12,375, 49,680 Equivalent units –, 8250, 7,200; Cost per equivalent unit for dep’t 8.40, 1.50, 6.90. Step 4: Allocating the Costs to Units Transferred to Finished Goods and Partially Completed Units; Transferred out costs (6,500 units times $1.50) plus (6,500 units times $6.90) equals 54,600; End. WIP: materials (1,750 times $1.50) equals $2,625; End. WIP: conversion (700 times $6.90) equals $4,830; End WIP total $2,625 plus 4,830 equals 7,455; Costs to account for $62,055. Return