3.7 Recording the Initial Purchase of an Asset

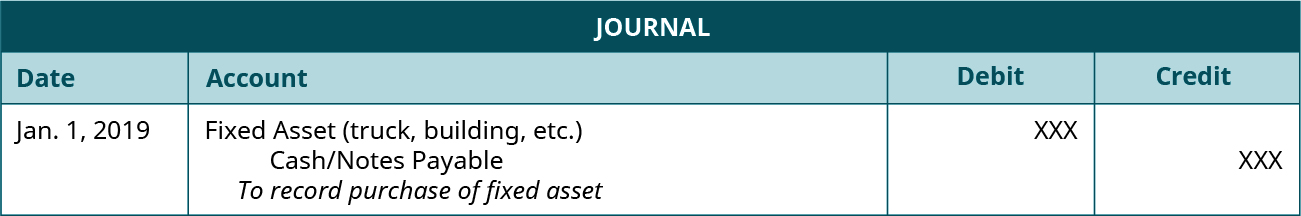

Assets are recorded on the balance sheet at cost, meaning that all costs to purchase the asset and to prepare the asset for operation should be included. Costs outside of the purchase price may include shipping, taxes, installation, and modifications to the asset.

The journal entry to record the purchase of a fixed asset (assuming that a note payable is used for financing and not a short-term account payable) is shown here.

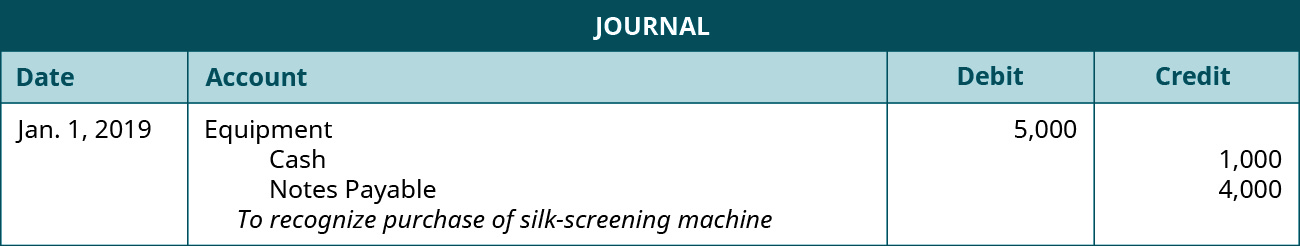

Applying this to Liam’s silk-screening business, we learn that he purchased his silk-screening machine for $5,000 by paying $1,000 cash and the remainder in a note payable over five years. The journal entry to record the purchase is shown here.