2.5 Shipping Terms

When you buy merchandise online, shipping charges are usually one of the negotiated terms of the sale. As a consumer, anytime the business pays for shipping, it is welcomed. For businesses, shipping charges bring both benefits and challenges, and the terms negotiated can have a significant impact on inventory operations.

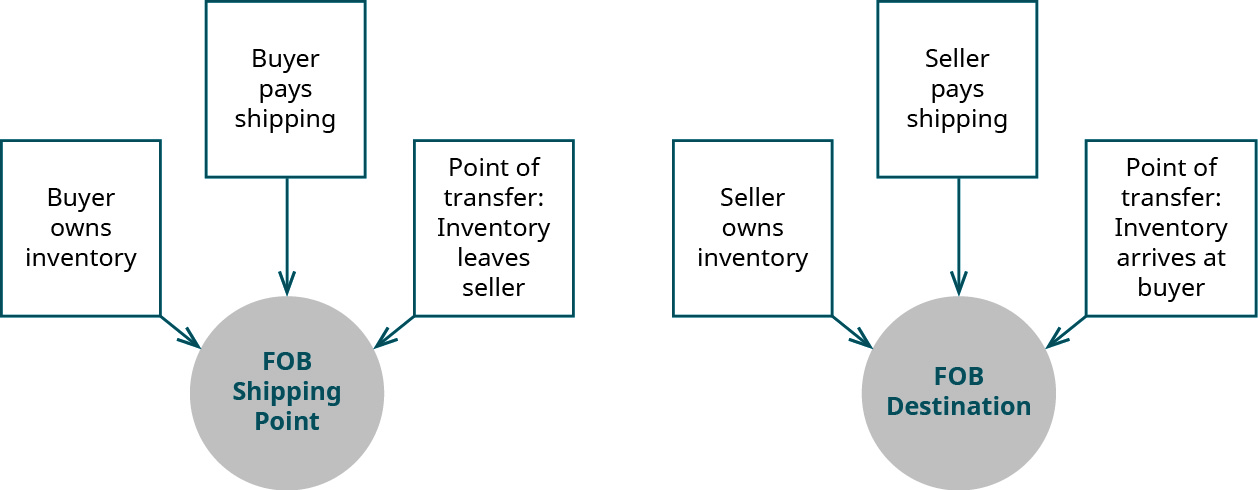

Shipping is determined by contract terms between a buyer and seller. There are several key factors to consider when determining who pays for shipping, and how it is recognized in merchandising transactions. The establishment of a transfer point and ownership indicates who pays the shipping charges, who is responsible for the merchandise, on whose balance sheet the assets would be recorded, and how to record the transaction for the buyer and seller.

Ownership of inventory refers to which party owns the inventory at a particular point in time—the buyer or the seller. One particularly important point in time is the point of transfer, when the responsibility for the inventory transfers from the seller to the buyer. Establishing ownership of inventory is important to determine who pays the shipping charges when the goods are in transit as well as the responsibility of each party when the goods are in their possession. Goods in transit refers to the time in which the merchandise is transported from the seller to the buyer (by way of delivery truck, for example). One party is responsible for the goods in transit and the costs associated with transportation. Determining whether this responsibility lies with the buyer or seller is critical to determining the reporting requirements of the retailer or merchandiser.

Freight-in refers to the shipping costs for which the buyer is responsible when receiving shipment from a seller, such as delivery and insurance expenses. When the buyer is responsible for shipping costs, they recognize this as part of the purchase cost. This means that the shipping costs stay with the inventory until it is sold. The cost principle requires this expense to stay with the merchandise as it is part of getting the item ready for sale from the buyer’s perspective. The shipping expenses are held in inventory until sold, which means these costs are reported on the balance sheet in Merchandise Inventory. When the merchandise is sold, the shipping charges are transferred with all other inventory costs to Cost of Goods Sold on the income statement.

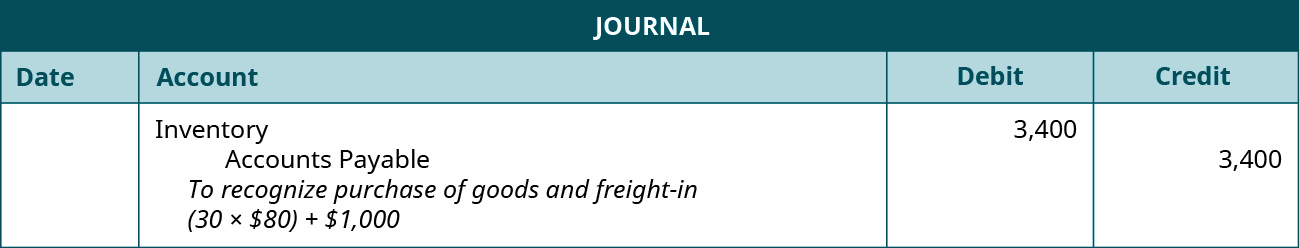

For example, California Business Solutions (CBS) may purchase 30 computers from a manufacturer for $80 and part of the agreement is that CBS (the buyer) pays the shipping costs of $1,000. CBS would record the following entry to recognize the purchase of the goods and the freight-in.

Merchandise Inventory increases (debit), and Cash decreases (credit), for the entire cost of the purchase, including shipping, insurance, and taxes. On the balance sheet, the shipping charges would remain a part of inventory.

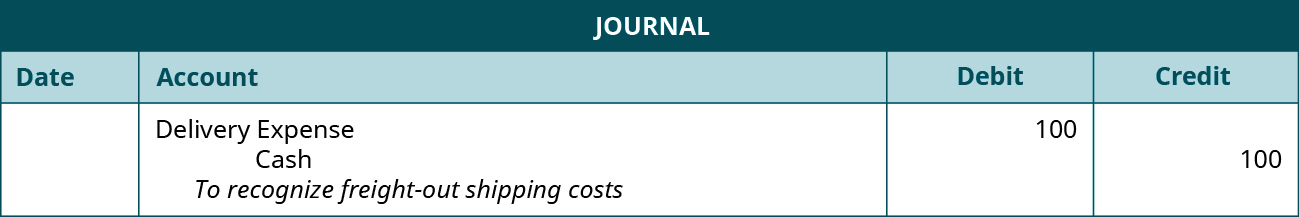

Freight-out refers to the costs for which the seller is responsible when shipping to a buyer, such as delivery and insurance expenses. When the seller is responsible for shipping costs, they recognize this as a delivery expense. The delivery expense is specifically associated with selling and not daily operations; thus, delivery expenses are typically recorded as a selling and administrative expense on the income statement in the current period.

For example, CBS may sell electronics packages to a customer and agree to cover the $100 cost associated with shipping and insurance. CBS would record the following entry to recognize freight-out.

Delivery Expense increases (debit) and Cash decreases (credit) for the shipping cost amount of $100. On the income statement, this $100 delivery expense will be grouped with Selling and Administrative expenses.

Free on Board (FOB) Shipping and Destination

Transportation costs are commonly assigned to either the buyer or the seller based on the free on board (FOB) terms, as the terms relate to the seller. Transportation costs are part of the responsibilities of the owner of the product, so determining the owner at the shipping point identifies who should pay for the shipping costs. The seller’s responsibility and ownership of the goods ends at the point that is listed after the FOB designation. Thus, FOB shipping point means that the seller transfers title and responsibility to the buyer at the shipping point, so the buyer would owe the shipping costs. The purchased goods would be recorded on the buyer’s balance sheet at this point.

Similarly, FOB destination means the seller transfers title and responsibility to the buyer at the destination, so the seller would owe the shipping costs. Ownership of the product is the trigger that mandates that the asset be included on the company’s balance sheet. In summary, the goods belong to the seller until they transition to the location following the term FOB, making the seller responsible for everything about the goods to that point, including recording purchased goods on the balance sheet . If something happens to damage or destroy the goods before they reach the FOB location, the seller would be required to replace the product or reverse the sales transaction.

Discussion and Application of FOB Destination

As you’ve learned, the seller and buyer will establish terms of purchase that include the purchase price, taxes, insurance, and shipping charges. So, who pays for shipping? On the purchase contract, shipping terms establish who owns inventory in transit, the point of transfer, and who pays for shipping. The shipping terms are known as “free on board,” or simply FOB. Some refer to FOB as the point of transfer, but really, it incorporates more than simply the point at which responsibility transfers. There are two FOB considerations: FOB Destination and FOB Shipping Point.

If FOB destination point is listed on the purchase contract, this means the seller pays the shipping charges (freight-out). This also means goods in transit belong to, and are the responsibility of, the seller. The point of transfer is when the goods reach the buyer’s place of business.

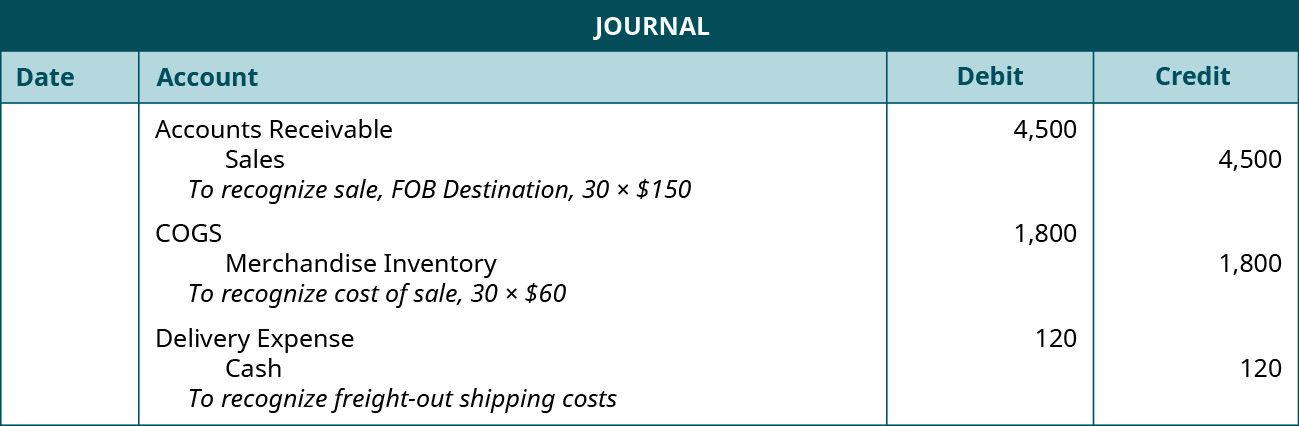

To illustrate, suppose CBS sells 30 landline telephones at $150 each on credit at a cost of $60 per phone. On the sales contract, FOB Destination is listed as the shipping terms, and shipping charges amount to $120, paid as cash directly to the delivery service. The following entries occur.

Accounts Receivable (debit) and Sales (credit) increases for the amount of the sale (30 × $150). Cost of Goods Sold increases (debit) and Merchandise Inventory decreases (credit) for the cost of sale (30 × $60). Delivery Expense increases (debit) and Cash decreases (credit) for the delivery charge of $120.

Discussion and Application of FOB Shipping Point

If FOB shipping point is listed on the purchase contract, this means the buyer pays the shipping charges (freight-in). This also means goods in transit belong to, and are the responsibility of, the buyer. The point of transfer is when the goods leave the seller’s place of business.

Suppose CBS buys 40 tablet computers at $60 each on credit. The purchase contract shipping terms list FOB Shipping Point. The shipping charges amount to an extra $5 per tablet computer. All other taxes, fees, and insurance are included in the purchase price of $60. The following entry occurs to recognize the purchase.

Merchandise Inventory increases (debit) and Accounts Payable increases (credit) by the amount of the purchase, including all shipping, insurance, taxes, and fees [(40 × $60) + (40 × $5)].

Figure 2.72 shows a comparison of shipping terms.