3.6 Tangible v Intangible Assets

Assets are items a business owns.3 For accounting purposes, assets are categorized as current versus long term, and tangible versus intangible. Assets that are expected to be used by the business for more than one year are considered long-term assets. They are not intended for resale and are anticipated to help generate revenue for the business in the future. Some common long-term assets are computers and other office machines, buildings, vehicles, software, computer code, and copyrights. Although these are all considered long-term assets, some are tangible and some are intangible.

Tangible Assets

An asset is considered a tangible asset when it is an economic resource that has physical substance—it can be seen and touched. Tangible assets can be either short term, such as inventory and supplies, or long term, such as land, buildings, and equipment. To be considered a long-term tangible asset, the item needs to be used in the normal operation of the business for more than one year, not be near the end of its useful life, and the company must have no plan to sell the item in the near future. The useful life is the time period over which an asset cost is allocated. Long-term tangible assets are known as fixed assets.

Businesses typically need many different types of these assets to meet their objectives. These assets differ from the company’s products. For example, the computers that Apple Inc. intends to sell are considered inventory (a short-term asset), whereas the computers Apple’s employees use for day-to-day operations are long-term assets. In Liam’s case, the new silk-screening machine would be considered a long-term tangible asset as he plans to use it over many years to help him generate revenue for his business. Long-term tangible assets are listed as noncurrent assets on a company’s balance sheet. Typically, these assets are listed under the category of Property, Plant, and Equipment (PP&E), but they may be referred to as fixed assets or plant assets.

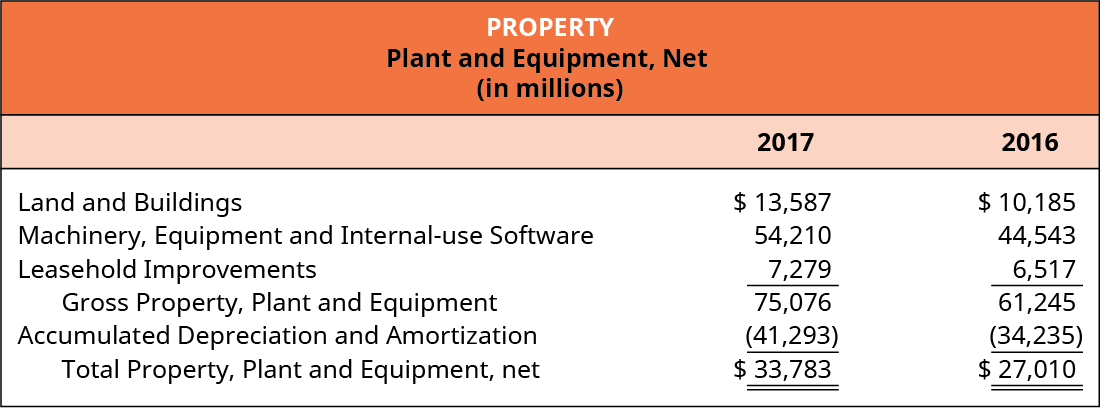

Apple Inc. lists a total of $33,783,000,000 in total Property, Plant and Equipment (net) on its 2017 consolidated balance sheet (see Figure 3.73).4 As shown in the figure, this net total includes land and buildings, machinery, equipment and internal-use software, and leasehold improvements, resulting in a gross PP&E of $75,076,000,000—less accumulated depreciation and amortization of $41,293,000,000—to arrive at the net amount of $33,783,000,000.

Intangible Assets

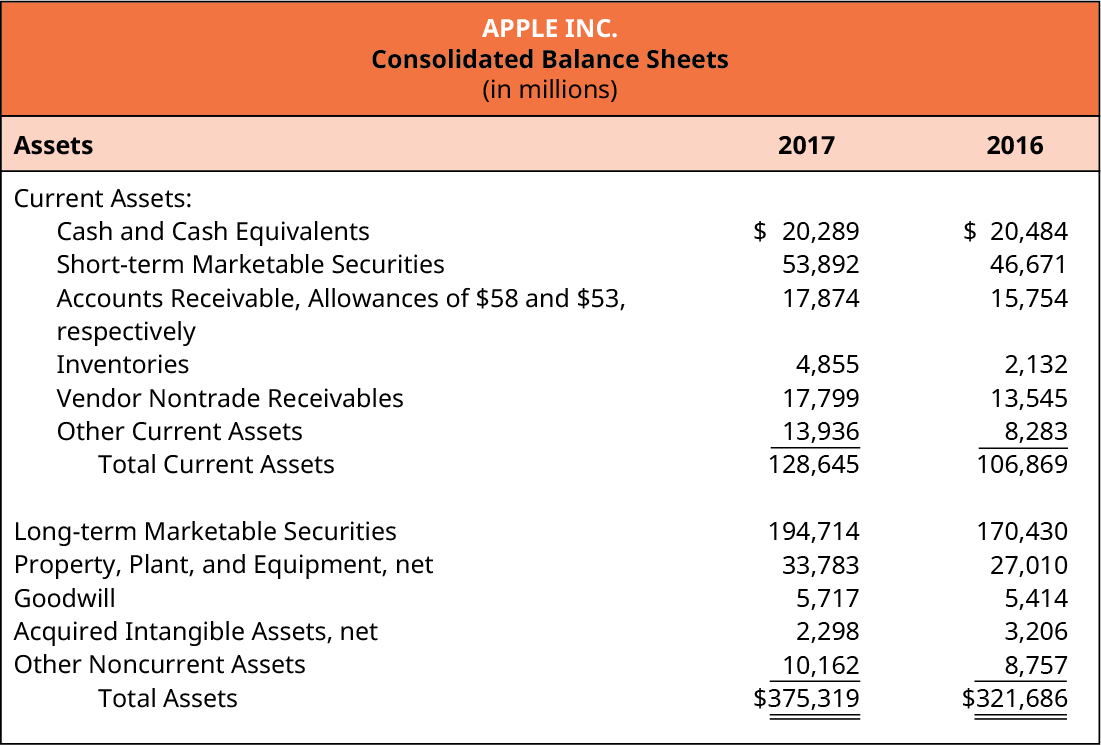

Companies may have other long-term assets used in the operations of the business that they do not intend to sell, but that do not have physical substance; these assets still provide specific rights to the owner and are called intangible assets. These assets typically appear on the balance sheet following long-term tangible assets (see Figure 3.74.)5 Examples of intangible assets are patents, copyrights, franchises, licenses, goodwill, sometimes software, and trademarks (Table 3.2). Because the value of intangible assets is very subjective, it is usually not shown on the balance sheet until there is an event that indicates value objectively, such as the purchase of an intangible asset.

A company often records the costs of developing an intangible asset internally as expenses, not assets, especially if there is ambiguity in the expense amounts or economic life of the asset. However, there are also conditions under which the costs can be allocated over the anticipated life of the asset. (The treatment of intangible asset costs can be quite complex and is taught in advanced accounting courses.)

| Asset | Useful Life |

|---|---|

| Patents | Twenty years |

| Trademarks | Renewable every ten years |

| Copyrights | Seventy years beyond death of creator |

| Goodwill | Indefinite |

Patents

A patent is a contract that provides a company exclusive rights to produce and sell a unique product. The rights are granted to the inventor by the federal government and provide exclusivity from competition for twenty years. Patents are common within the pharmaceutical industry as they provide an opportunity for drug companies to recoup the significant financial investment on research and development of a new drug. Once the new drug is produced, the company can sell it for twenty years with no direct competition.

Trademarks and Copyrights

A company’s trademark is the exclusive right to the name, term, or symbol it uses to identify itself or its products. Federal law allows companies to register their trademarks to protect them from use by others. Trademark registration lasts for ten years with optional 10-year renewable periods. This protection helps prevent impersonators from selling a product similar to another or using its name. For example, a burger joint could not start selling the “Big Mac.” Although it has no physical substance, the exclusive right to a term or logo has value to a company and is therefore recorded as an asset.

A copyright provides the exclusive right to reproduce and sell artistic, literary, or musical compositions. Anyone who owns the copyright to a specific piece of work has exclusive rights to that work. Copyrights in the United States last seventy years beyond the death of the original author. While you might not be overly interested in what seems to be an obscure law, it actually directly affects you and your fellow students. It is one of the primary reasons that your copy of the Collected Works of William Shakespeare costs about $40 in your bookstore or online, while a textbook, such as Principles of Biology or Principles of Accounting, can run in the hundreds of dollars.

Goodwill

Goodwill is a unique intangible asset. Goodwill refers to the value of certain favorable factors that a business possesses that allows it to generate a greater rate of return or profit. Such factors include superior management, a skilled workforce, quality products or service, great geographic location, and overall reputation. Companies typically record goodwill when they acquire another business in which the purchase price is in excess of the fair value of the identifiable net assets. The difference is recorded as goodwill on the purchaser’s balance sheet. For example, the goodwill of $5,717,000,000 that we see on Apple’s consolidated balance sheets for 2017 (see Figure 3.74) was created when Apple purchased another business for a purchase price exceeding the book value of its net assets.

YOUR TURN

Classifying Long-Term Assets as Tangible or Intangible

Long Descriptions

Property. Plant and Equipment, Net (in millions). For 2017 and 2016, respectively. Land and Buildings $13,587, $10,185; Machinery, Equipment, and Internal-use Software 54,210, 44,543; Leasehold Improvements 7,279, 6,517; Gross Property, Plant and Equipment 75,076, 61,245; Accumulated Depreciation and Amortization (41,293), (34,235); Total Property, Plant and Equipment, net $33,783, $27,010. Return

Apple Inc. Consolidated Balance Sheets (in millions). Assets for 2017 and 2016, respectively. Current Assets: Cash and Cash Equivalents $20,289, $20,484; Short-term Marketable Securities 53,892, 46,671; Accounts Receivable, Allowances of $58 and $53, respectively 17,874, 15,754; Inventories 4,855, 2,132; Vendor Nontrade Receivables 17,799, 13,545; Other Current Assets 13,936, 8,283; Total Current Assets 128,645, 106,869; Long-term Marketable Securities 194,714, 170,430; Property, Plant and Equipment, net 33,783, 27,010; Goodwill 5,717, 5,414; Acquired Intangible Assets, net 2,298, 3,206; Other Noncurrent Assets 10,162, 8,757; Total Assets $375,319, $321,686. Return

Footnotes

- 3 The Financial Accounting Standards Board (FASB) defines assets as “probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events” (SFAC No. 6, p. 12).

- 4 Apple, Inc. U.S. Securities and Exchange Commission 10-K Filing. November 3, 2017. http://pdf.secdatabase.com/2624/0000320193-17-000070.pdf

- 5 Apple, Inc. U.S. Securities and Exchange Commission 10-K Filing. November 3, 2017. http://pdf.secdatabase.com/2624/0000320193-17-000070.pdf