1.5 Transaction Analysis- from accounting equation to journal entries

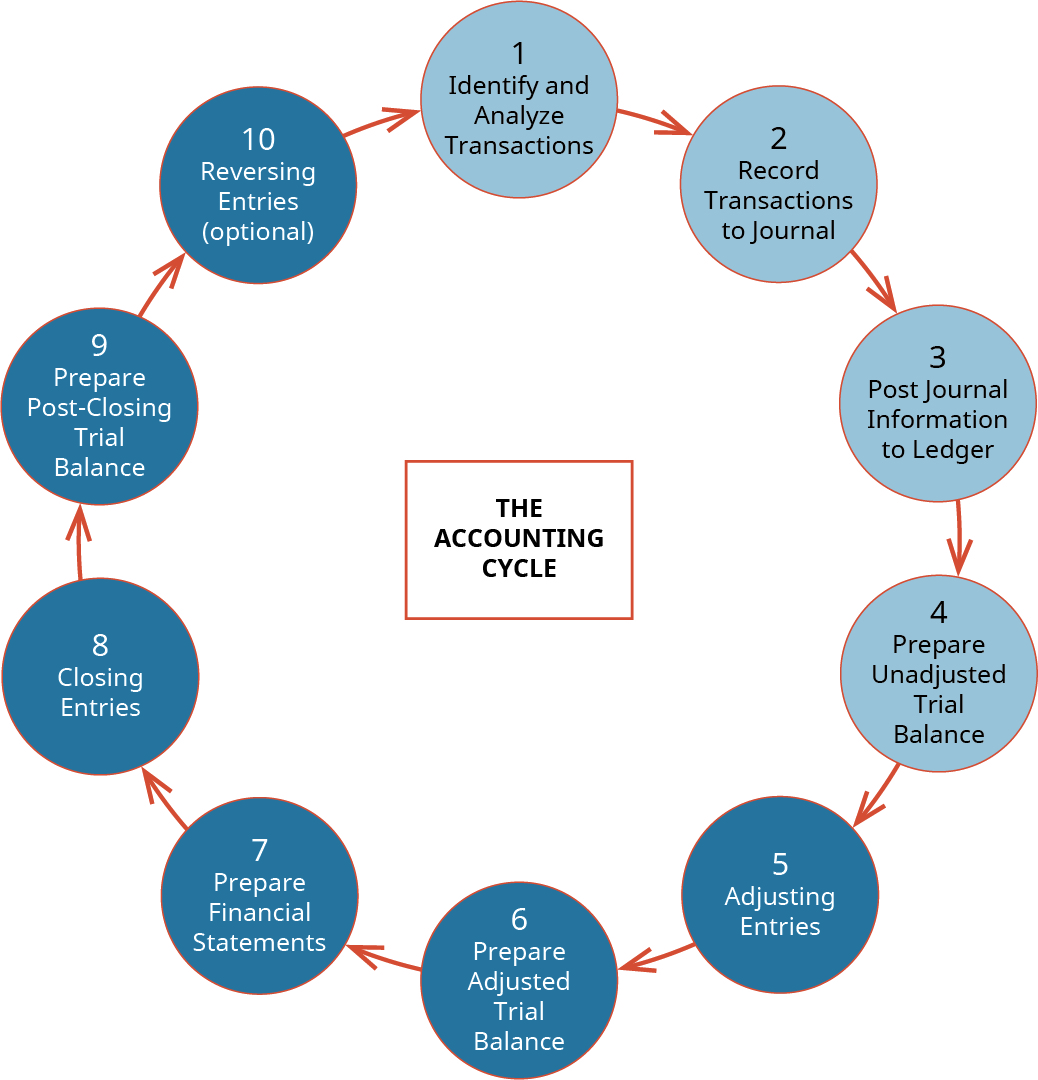

Analyzing and recording transactions represent the first steps in one continuous process known as the accounting cycle. The accounting cycle is a step-by-step process to record business activities and events to keep financial records up to date. The process occurs over one accounting period and will begin the cycle again in the following period. A period is one operating cycle of a business, which could be a month, quarter, or year. Review the accounting cycle in Figure 2.4.

As you can see, the cycle begins with identifying and analyzing transactions. The entire cycle is meant to keep financial data organized and easily accessible to both internal and external users of information.

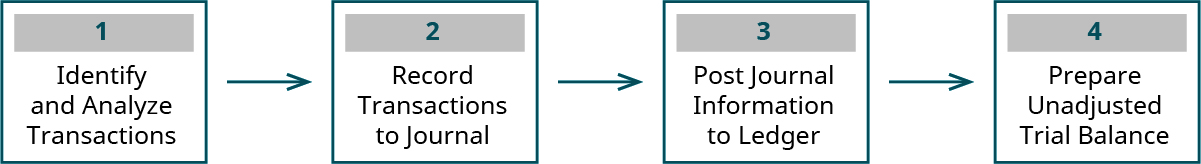

These first four steps set the foundation for the recording process.

Step 1. Identifying and analyzing transactions is the first step in the process. This takes information from original sources or activities and translates that information into usable financial data. An original source is a traceable record of information that contributes to the creation of a business transaction. For example, a sales invoice is considered an original source. Activities would include paying an employee, selling products, providing a service, collecting cash, borrowing money, and issuing stock to company owners. Once the original source has been identified, the company will analyze the information to see how it influences financial records.

Let’s say that Mark Summers of Supreme Cleaners provides cleaning services to a customer. He generates an invoice for $200, the amount the customer owes, so he can be paid for the service. This sales receipt contains information such as how much the customer owes, payment terms, and dates. This sales receipt is an original source containing financial information that creates a business transaction for the company.

Double-Entry Bookkeeping

The basic components of even the simplest accounting system are accounts and a general ledger. An account is a record showing increases and decreases to assets, liabilities, and equity—the basic components found in the accounting equation. Each of these categories, in turn, includes many individual accounts, all of which a company maintains in its general ledger. A general ledger is a comprehensive listing of all of a company’s accounts with their individual balances.

Accounting is based on what we call a double-entry accounting system, which requires the following:

- Each time we record a transaction, we must record a change in at least two different accounts. Having two or more accounts change will allow us to keep the accounting equation in balance.

- Not only will at least two accounts change, but there must also be at least one debit and one credit side impacted.

- The sum of the debits must equal the sum of the credits for each transaction.

Journals

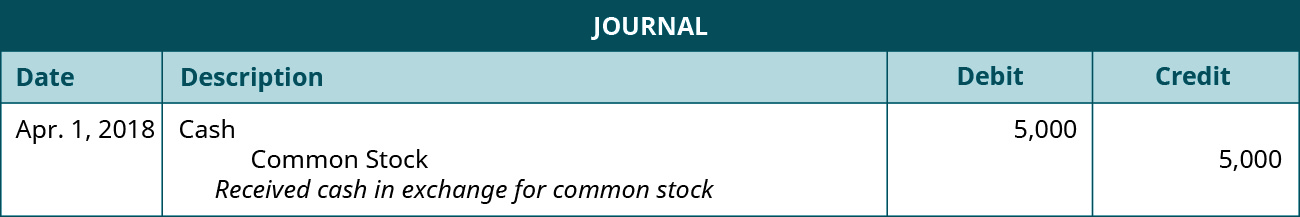

Accountants use special forms called journals to keep track of their business transactions. A journal is the first place information is entered into the accounting system. A journal is often referred to as the book of original entry because it is the place the information originally enters into the system. A journal keeps a historical account of all recordable transactions with which the company has engaged. In other words, a journal is similar to a diary for a business. When you enter information into a journal, we say you are journalizing the entry. Journaling the entry is the second step in the accounting cycle. Here is a picture of a journal.

You can see that a journal has columns labeled debit and credit. The debit is on the left side, and the credit is on the right. Let’s look at how we use a journal.

When filling in a journal, there are some rules you need to follow to improve journal entry organization.

Formatting When Recording Journal Entries

- Include a date of when the transaction occurred.

- The debit account title(s) always come first and on the left.

- The credit account title(s) always come after all debit titles are entered, and on the right.

- The titles of the credit accounts will be indented below the debit accounts.

- You will have at least one debit (possibly more).

- You will always have at least one credit (possibly more).

- The dollar value of the debits must equal the dollar value of the credits or else the equation will go out of balance.

- You will write a short description after each journal entry.

- Skip a space after the description before starting the next journal entry.

An example journal entry format is as follows. It is not taken from previous examples but is intended to stand alone.

Note that this example has only one debit account and one credit account, which is considered a simple entry. A compound entry is when there is more than one account listed under the debit and/or credit column of a journal entry (as seen in the following).

Notice that for this entry, the rules for recording journal entries have been followed. There is a date of April 1, 2018, the debit account titles are listed first with Cash and Supplies, the credit account title of Common Stock is indented after the debit account titles, there are at least one debit and one credit, the debit amounts equal the credit amount, and there is a short description of the transaction.

Let’s revisit the prior series of transactions commonly recorded by businesses:

- Owner invests $50,000 cash, receiving common stock in exchange for the investment.

- Owner invests $10,000 equipment, receiving common stock in exchange for the investment.

- Purchase equipment on account, $12,000.

- Paid $1,600 for monthly rent.

- Performed services for cash, $2000.

- Performed services on account, $7,000.

- Paid $8,000 to purchase equipment.

- Paid $2,400 salary to staff assistant.

- Collected $5,000 on account.

- Paid $12,000 on account.

- Paid $500 dividends.

Long Description

A large circle labeled, in the center, The Accounting Cycle. The large circle consists of 10 smaller circles with arrows pointing from one smaller circle to the next one. The smaller circles are labeled, in clockwise order: 1 Identify and Analyze Transactions; 2 Record Transactions to Journal; 3 Post Journal Information to Ledger; 4 Prepare Unadjusted Trial Balance; 5 Adjusting Entries; 6 Prepare Adjusted Trial Balance; 7 Prepare Financial Statements; 8 Closing Entries; 9 Prepare Post-Closing Trial Balance; 10 Reversing Entries (optional). Return

Media Attributions

- 1st 4 steps of Accounting Cycle © Rice University is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license